Question:

You work with the pricing actuary at Cash for Claims, a large Property/Casualty insurer.

The CEO has some questions based on the most recent pricing analysis and the pricing

actuary has asked you to assist w

...

Question:

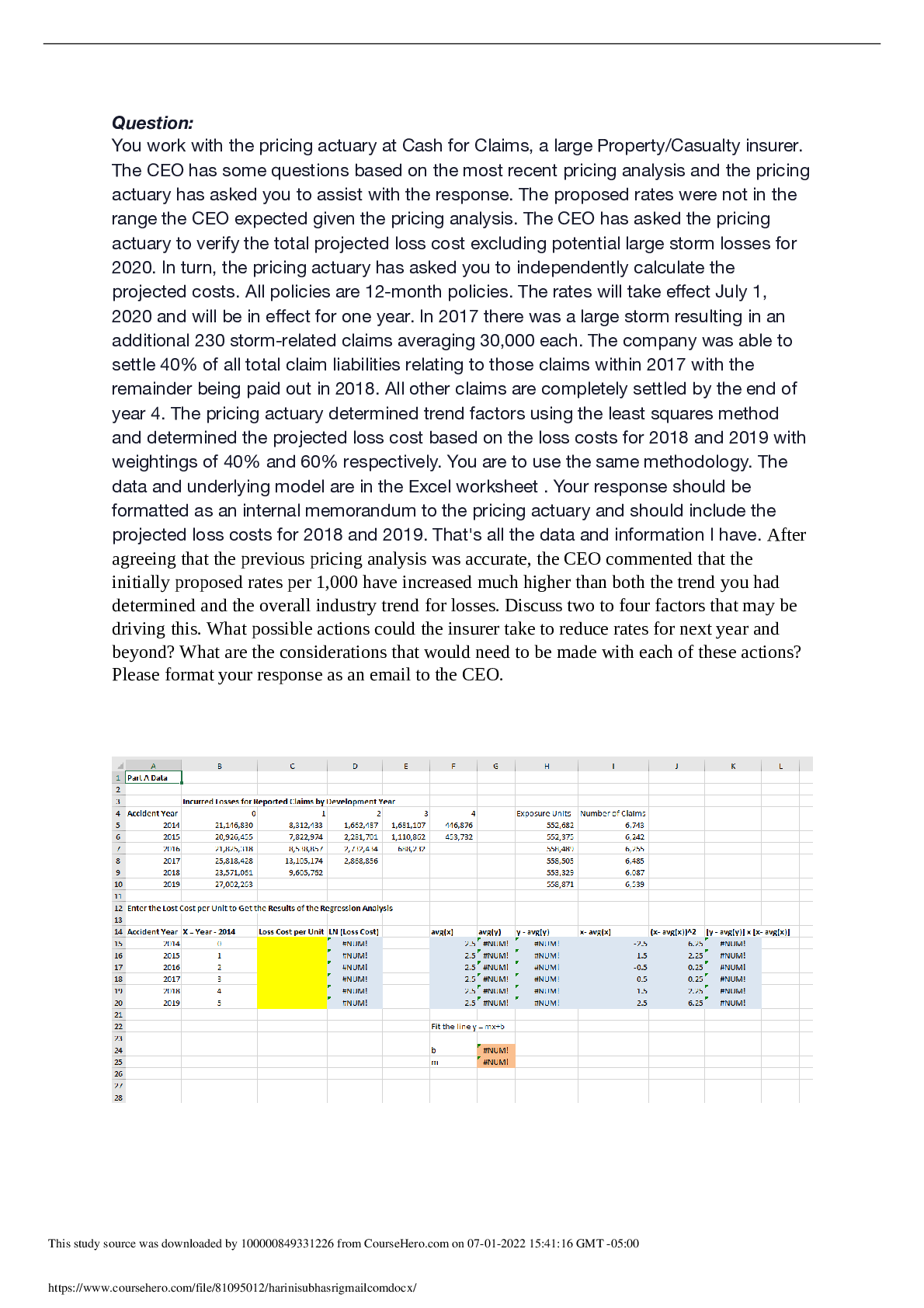

You work with the pricing actuary at Cash for Claims, a large Property/Casualty insurer.

The CEO has some questions based on the most recent pricing analysis and the pricing

actuary has asked you to assist with the response. The proposed rates were not in the

range the CEO expected given the pricing analysis. The CEO has asked the pricing

actuary to verify the total projected loss cost excluding potential large storm losses for

2020. In turn, the pricing actuary has asked you to independently calculate the

projected costs. All policies are 12-month policies. The rates will take effect July 1,

2020 and will be in effect for one year. In 2017 there was a large storm resulting in an

additional 230 storm-related claims averaging 30,000 each. The company was able to

settle 40% of all total claim liabilities relating to those claims within 2017 with the

remainder being paid out in 2018. All other claims are completely settled by the end of

year 4. The pricing actuary determined trend factors using the least squares method

and determined the projected loss cost based on the loss costs for 2018 and 2019 with

weightings of 40% and 60% respectively. You are to use the same methodology. The

data and underlying model are in the Excel worksheet. Your response should be

formatted as an internal memorandum to the pricing actuary and should include the

projected loss costs for 2018 and 2019. That's all the data and information I have. After

agreeing that the previous pricing analysis was accurate, the CEO commented that the

initially proposed rates per 1,000 have increased much higher than both the trend you had

determined and the overall industry trend for losses. Discuss two to four factors that may be

driving this. What possible actions could the insurer take to reduce rates for next year and

beyond? What are the considerations that would need to be made with each of these actions?

Please format your response as an email to the CEO.

[Show More]