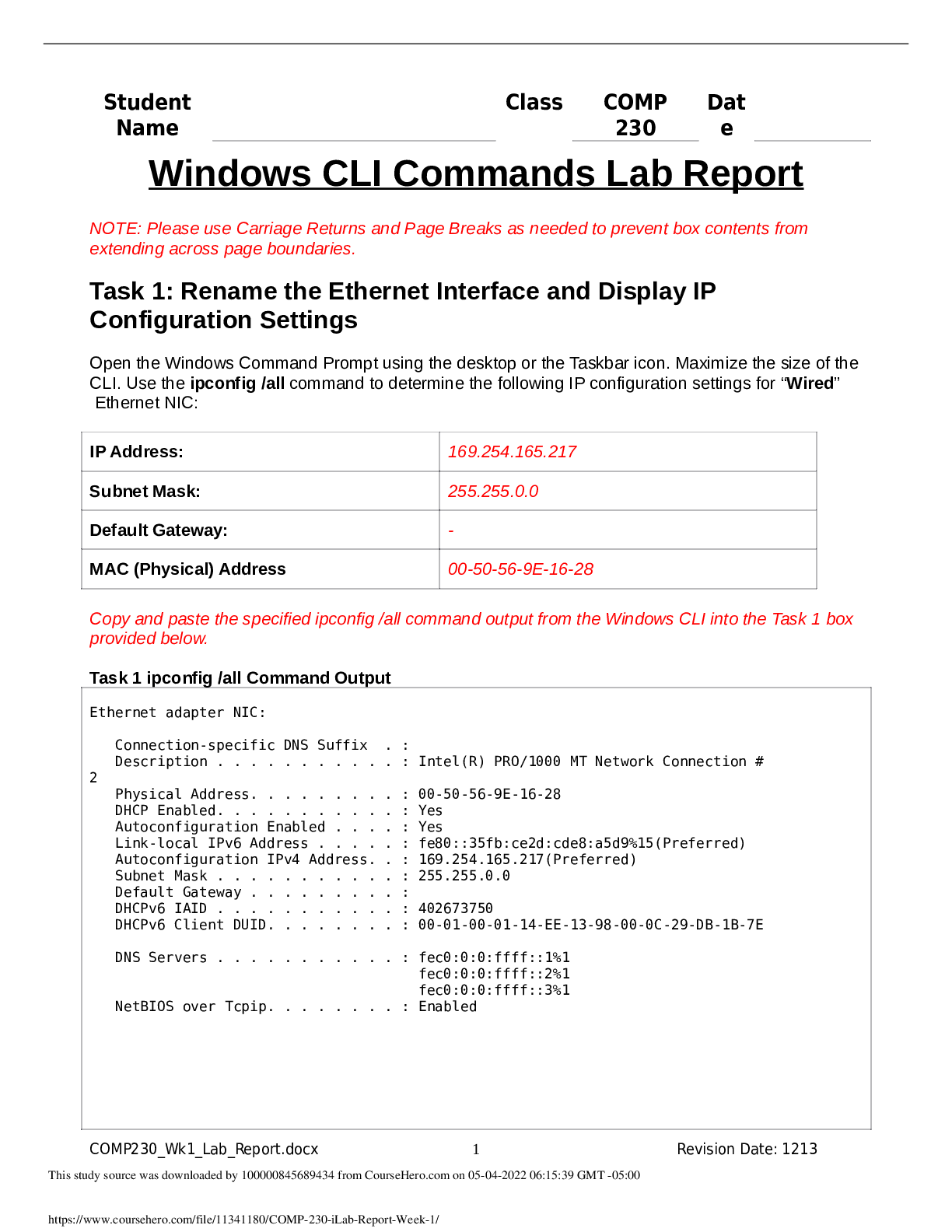

COMP 230 Week 1 Lab: Windows CLI Commands Lab Report (GRADED)

$ 8

PHARMACOLOGY PRE-ASSESSMENT QUIZ

$ 7

EMT Practice Test Questions with correctly solved solutions.

$ 16

GI/neuro quiz 4 practice questions Adult Health II (Chamberlain University)

$ 10

FDNY Probie School Week 1 Quiz Review | 40 Questions with 100% Correct Answers | Updated & Verified

$ 5

Extra Credit HESI Module 9 2022-2023

$ 14

.png)

WGU C224 Research Foundations Questions and Answers Already Passed

$ 15

2024 ACA 122 Final Exam Review Complete Questions & Answers (Solved) 100% Correct

$ 9

COMP 230 Week 3 Course Project: Automating Administrative Tasks [GRADED A]

$ 12.5

NURS 6512 FINAL EXAM

$ 16.5

Student Exploration: Nuclear Reactions

$ 10

eBook C# 13 and .NET 9 – Modern Cross-Platform Development Fundamentals 1st Edition By Mark J. Price

.png)