[eTextBook] [PDF] DC-DC Converter Topologies 2024 By Moschopoulos

$ 25

- libgen.png)

McCance, Huether - Pathophysiology_ The Biological Basis for Disease in Adults and Children TEST BANK 8th(2018, Mosby) - libgen.lc

$ 8

RNRF DCF Study Guide Questions and Answers Graded A

$ 4

Research Methods, Concepts and Connections, 3e Michael Passer (Test Bank)

$ 25

Google IT- File and Text Manipulation - Intro to OS - Becoming a Power User-Week 1 - Set #2 Q&A

$ 8

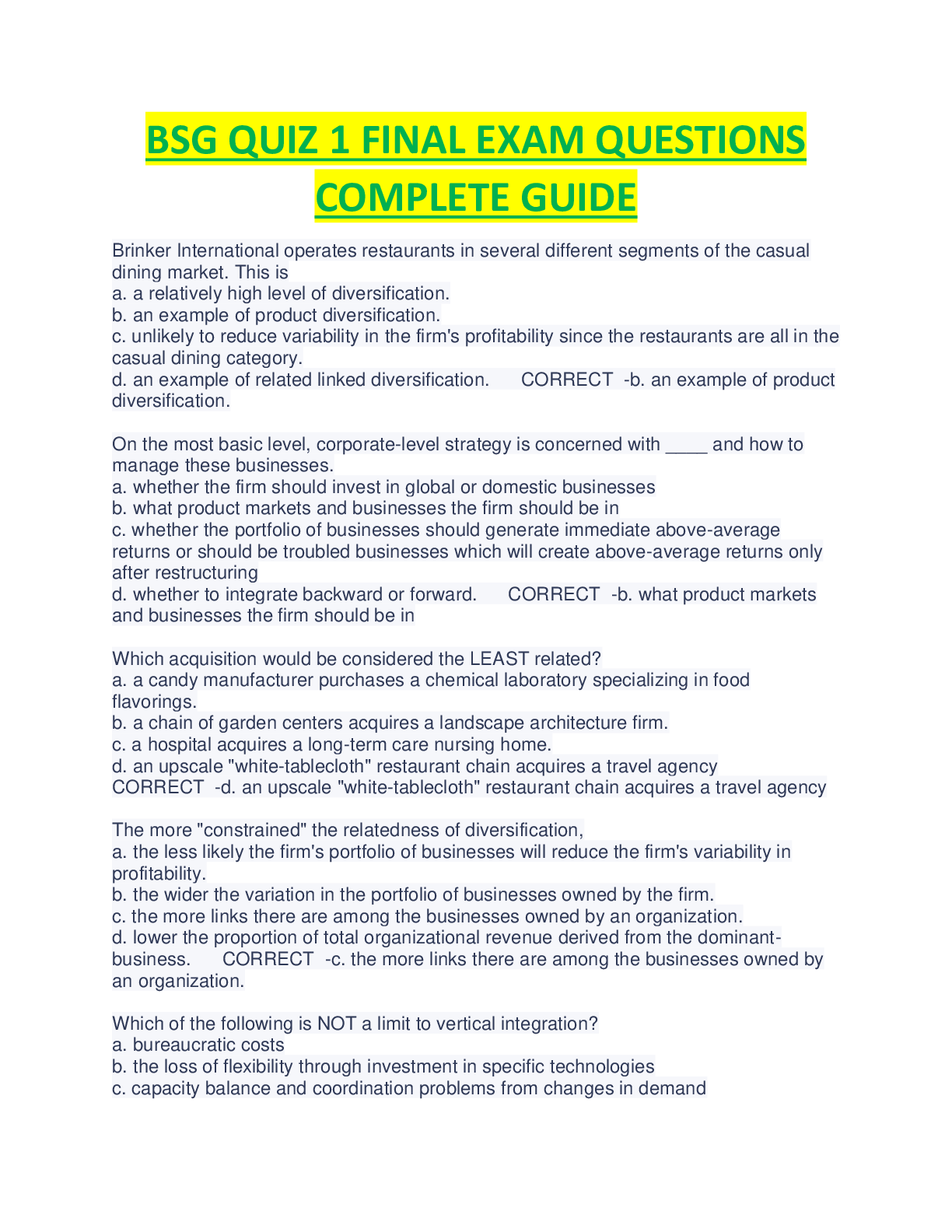

BSG QUIZ 1 FINAL EXAM QUESTIONS COMPLETE GUIDE 100% VERIFIED .

$ 16.5

AQA A-level PHYSICS 7408/3A Paper 3 Section A Mark scheme June 2020 Version 1.0 Final

$ 10

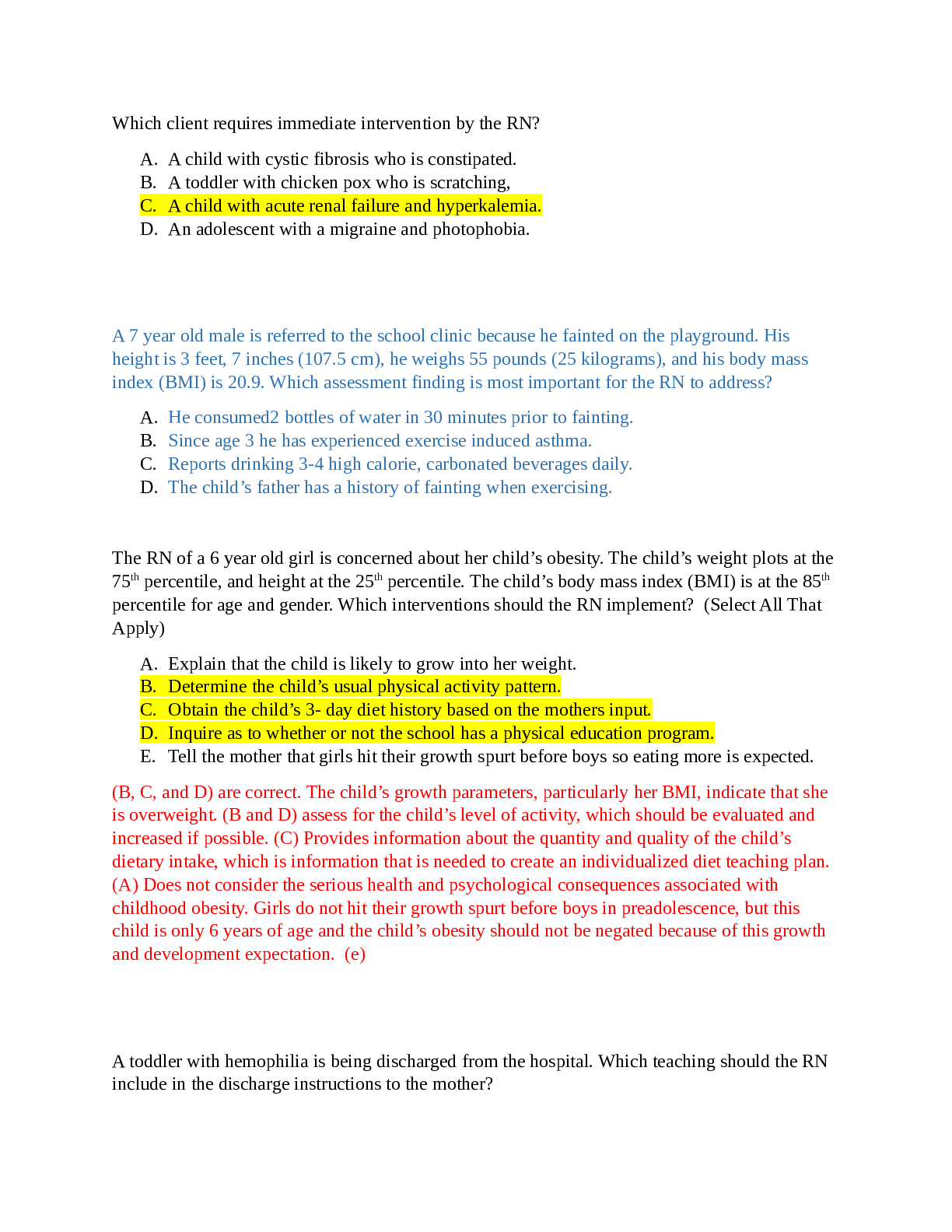

HESI RN PEDIATRIC EXAM STUDY GUIDE 2020/2021 (GRADED A+)

$ 14

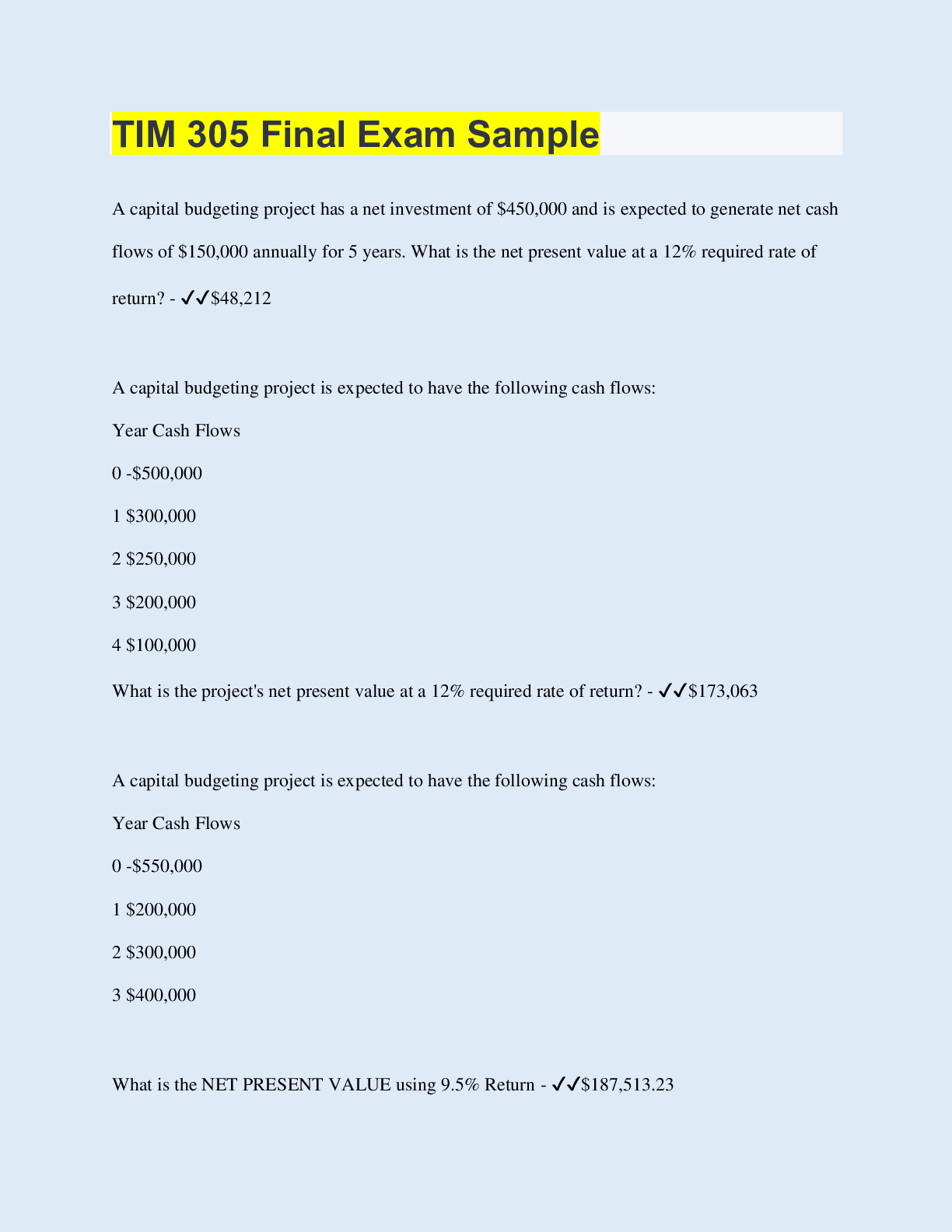

TIM 305 Final Exam Sample

$ 9

NETW-583 Week 6 Case Study 4: Google’s Attempt to Buy Into Wireless (GRADED A)

$ 9

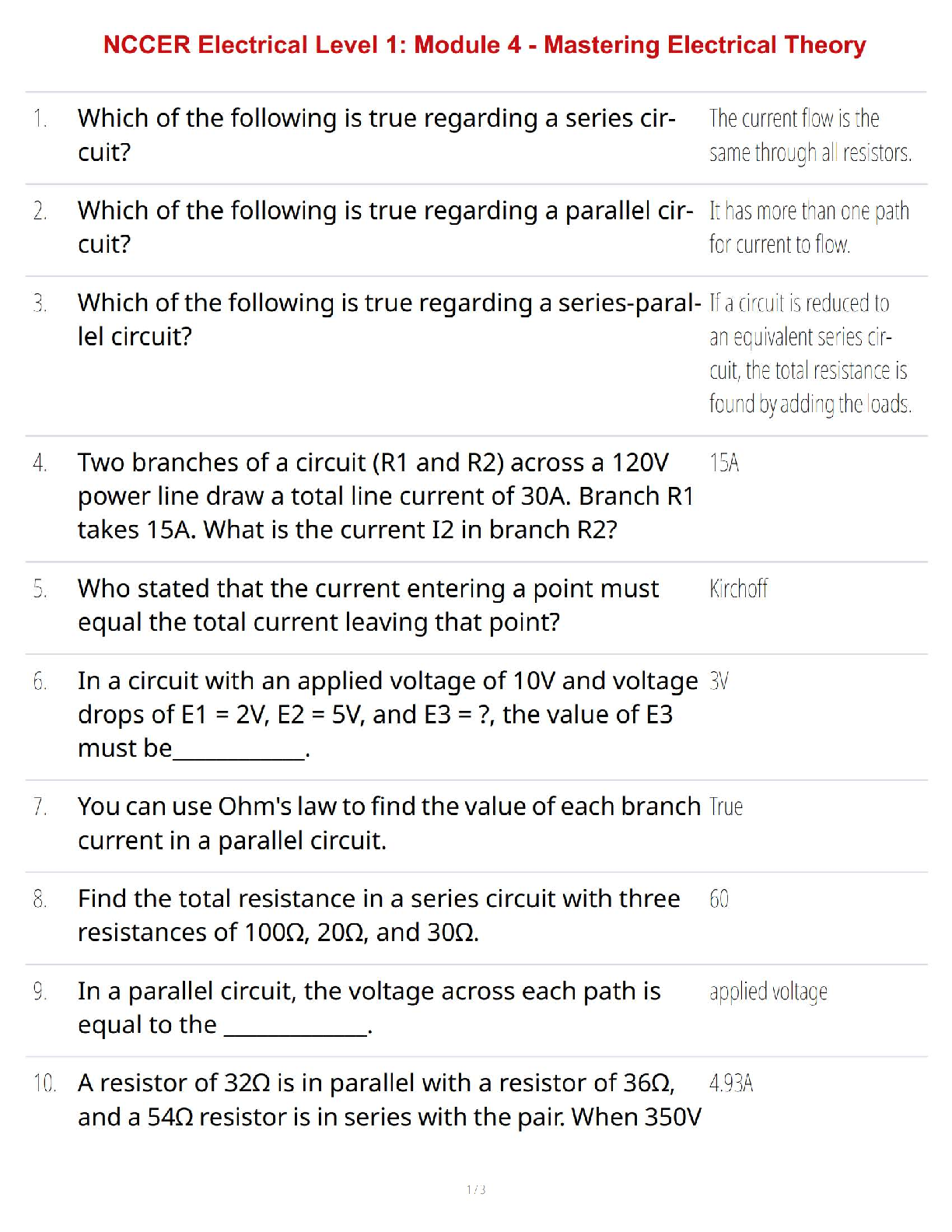

NCCER Electrical Level 1: Module 4 - Mastering Electrical Theory

$ 7.5

eBook The Machine Learning Simplified 1st Edition By Andrew Wolf

.png)