Law > QUESTIONS & ANSWERS > 997 NMLS Questions with Answers (All)

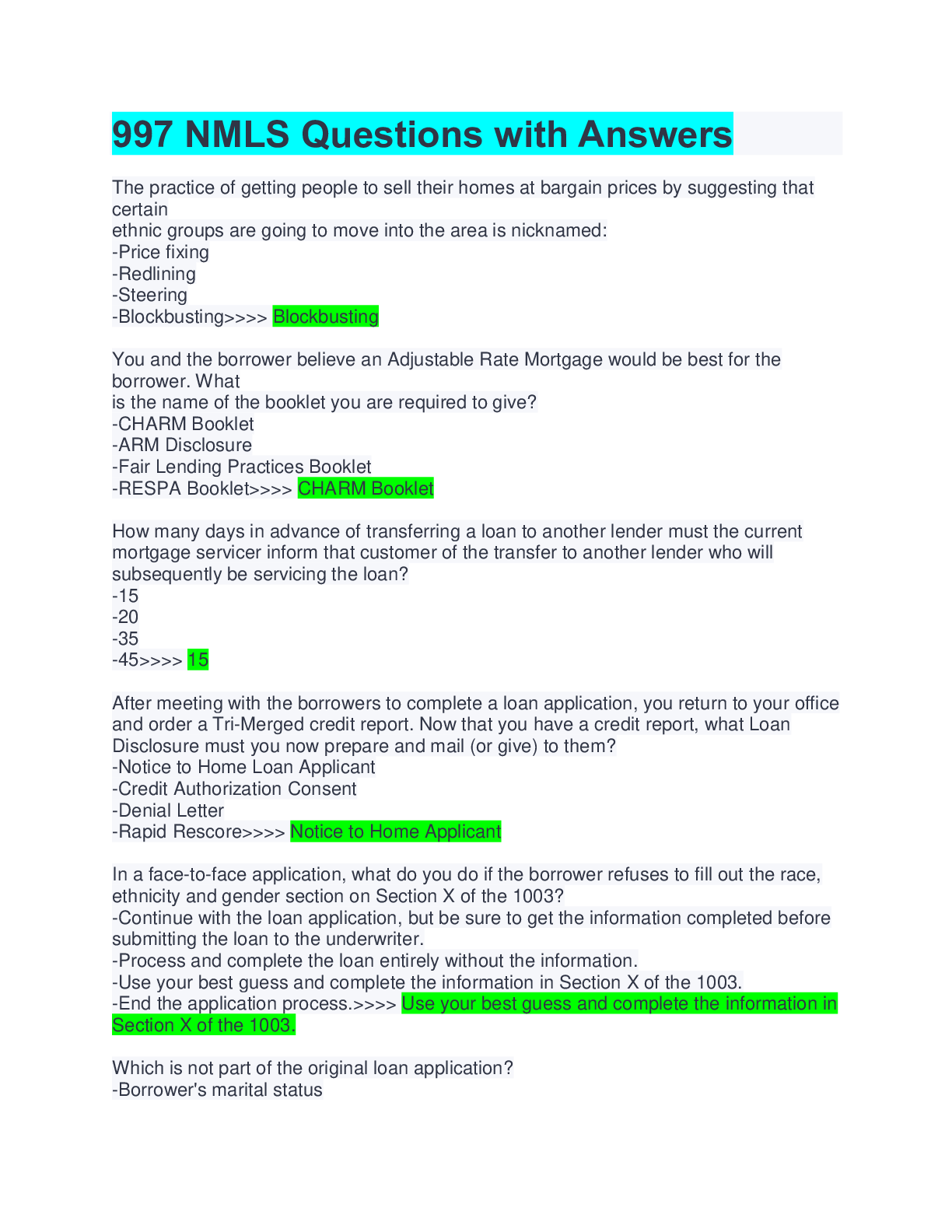

997 NMLS Questions with Answers

Document Content and Description Below

997 NMLS Questions with Answers The practice of getting people to sell their homes at bargain prices by suggesting that certain ethnic groups are going to move into the area is nicknamed: -Price f ... ixing -Redlining -Steering -Blockbusting>>>> Blockbusting You and the borrower believe an Adjustable Rate Mortgage would be best for the borrower. What is the name of the booklet you are required to give? -CHARM Booklet -ARM Disclosure -Fair Lending Practices Booklet -RESPA Booklet>>>> CHARM Booklet How many days in advance of transferring a loan to another lender must the current mortgage servicer inform that customer of the transfer to another lender who will subsequently be servicing the loan? -15 -20 -35 -45>>>> 15 After meeting with the borrowers to complete a loan application, you return to your office and order a Tri-Merged credit report. Now that you have a credit report, what Loan Disclosure must you now prepare and mail (or give) to them? -Notice to Home Loan Applicant -Credit Authorization Consent -Denial Letter -Rapid Rescore>>>> Notice to Home Applicant In a face-to-face application, what do you do if the borrower refuses to fill out the race, ethnicity and gender section on Section X of the 1003? -Continue with the loan application, but be sure to get the information completed before submitting the loan to the underwriter. -Process and complete the loan entirely without the information. -Use your best guess and complete the information in Section X of the 1003. -End the application process.>>>> Use your best guess and complete the information in Section X of the 1003. Which is not part of the original loan application? -Borrower's marital status-ECOA disclosure -Borrower provided ethnicity -Borrower provided birth date>>>> ECOA disclosure Which is not an application disclosure? -Servicing disclosure -Environmental hazard disclosure -Appraisal disclosure -APR disclosure>>>> Environmental hazard disclosure Regarding Mortgage Servicing Transfers, what are the number of days that the current mortgage servicer must inform that customer prior to transferring the loan to another lender - who will subsequently service that loan. How many days prior to this loan transfer does the current mortgage servicer have to inform the customer? -15 -20 -3 -45>>>> 15 What is not likely to happen if the lender/investor finds fraud? -A 1% interest rate increase on the loan -The lender and/or broker will be required to repurchase the loan -The entire loan can be called due and payable -The loan officer must pay back any premium made on the loan>>>> A 1% interest rate increase on the loan What is the maximum penalty for providing false information on a federally related loan? -$5,000 fine and one year jail time -$250,000 fine and 30 years jail time -Revoke license and $1,000 fine -Up to $1,000,000 fine and jail time>>>> Up to $1,000,000 fine and jail time What law requires the lender to collect borrower information for first mortgages and home improvement loans? -HOEPA -TILA -ECOA -HMDA>>>> HMDA HMDA requires the lenders to obtain which of the following information for each borrower? -Age and Race -Race and Sex -Marital status and Sex -Marital status and Age>>>> Race and SexProviding a referral fee to a realtor is? -An acceptable practice -An illegal practice -An acceptable practice as long as it is a fair price for services actually provided -Acceptable only if fully disclosed>>>> An illegal practice What are the penalties for giving a referral fee to a realtor?-There are no penalties. -$10,000 per incident and up to one year in jail -$100,000 plus up to 30 years in jail -$1,000,000 plus up to one year in jail>>>> $10,000 per incident and up to one year in jail What are the penalties for violating Section 8 of RESPA? -$5,000 per incident and up to one year in jail -$10,000 per incident plus one year jail time -$100,000 plus up to 30 years in jail -$1,000,000 plus up to one year in jail>>>> $10,000 per incident plus one year jail time Which of the following does RESPA require on a purchase? -Lead paint notice -A 1008 -APR disclosure -Settlement cost booklet>>>> Settlement cost booklet Aggregate escrow requires that the borrower have which of the following? -$0 in the account or no more than 2 months impounds in reserves -$0 in account, or no more than 1 month impound in reserves -No more than 1% of the principal balance of the loan maximum in the impound account -$100 and no impound reserves>>>> $0 in the account or no more than 2 months impounds in reserves What is the minimum amount of time that a lender has to inform the borrower that they are transferring servicing? -15 days -45 days -10 days -60 days>>>> 15 days A yield spread premium is disclosed on which document? -TIL disclosure -Good faith estimate -Servicing disclosure -Rescission disclosure>>>> Good faith estimate Which is the primary law that affects mortgage loan closings?-TILA -ECOA -RESPA -HMDA>>>> RESPA If a loan officer were to take a loan application Tuesday at 1:00 p.m., what is the last day that the good faith estimate must be mailed or disclosed? -The same day, Tuesday before end of business -The next day, Wednesday before 5pm -Friday before midnight -Within 3 days before 5pm>>>> Friday before midnight If you are a lender, it is acceptable to REQUIRE the services of a specific provider: -if you have no ownership interest in the provider. -if the other service provider is an affiliate. -as long as you provide the borrower with the appropriate disclosure within three business days of the loan application. -only if the service provider is licensed.>>>> if you have no ownership interest in the provider. RESPA imposes requirements about or prohibits all of the following except: -legal kickbacks and referral fees. -the loan origination fee. -the amount of prepaids. -information that must be disclosed to the borrower at the loan application or within 3 business days of the application.>>>> the loan origination fee. Regulation Z requires: -disclosure of the settlement costs to buyers and sellers. -disclosure of the impound accounts and the prepaids of the borrower(s). -computation and disclosure of the APR to the borrowers. -disclosure of servicing information on the loan.>>>> computation and disclosure of the APR to the borrowers [Show More]

Last updated: 3 years ago

Preview 1 out of 154 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$13.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Aug 13, 2022

Number of pages

154

Written in

All

Additional information

This document has been written for:

Uploaded

Aug 13, 2022

Downloads

0

Views

107