Financial Accounting > Quiz > ACCT 640 Accounting Concepts and Procedures I -15C - Quiz 3 - Key (Correct Answers Highlighted in Ye (All)

ACCT 640 Accounting Concepts and Procedures I -15C - Quiz 3 - Key (Correct Answers Highlighted in Yellow)

Document Content and Description Below

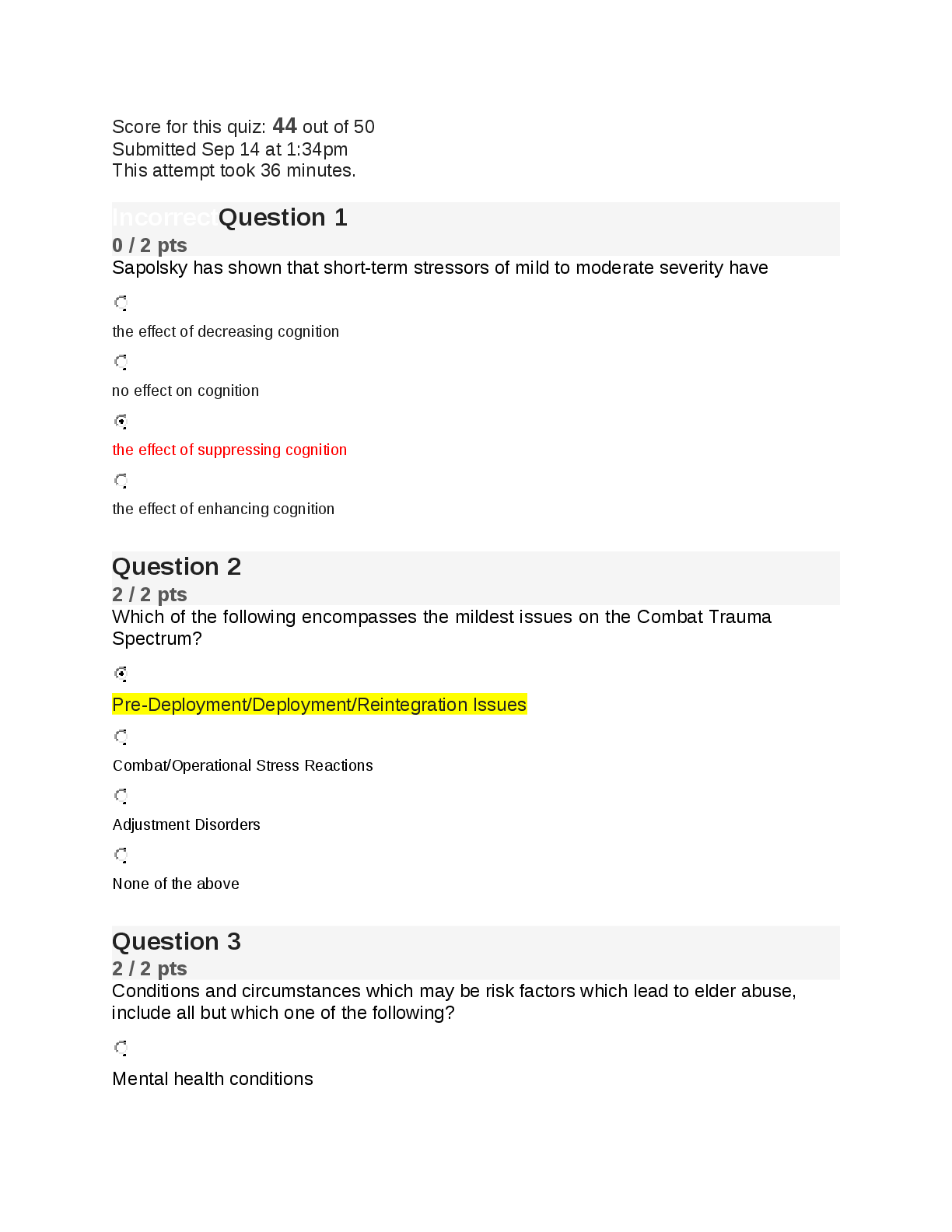

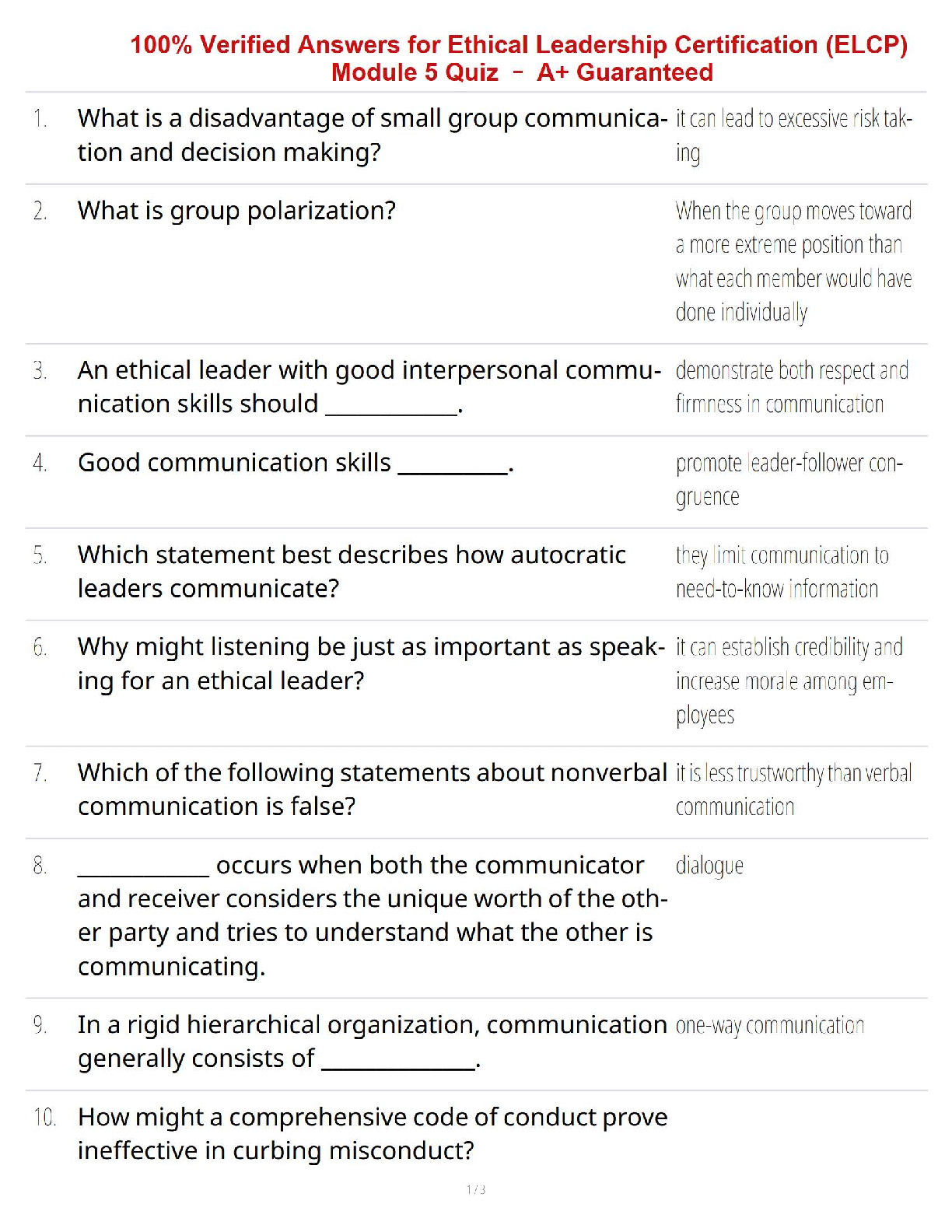

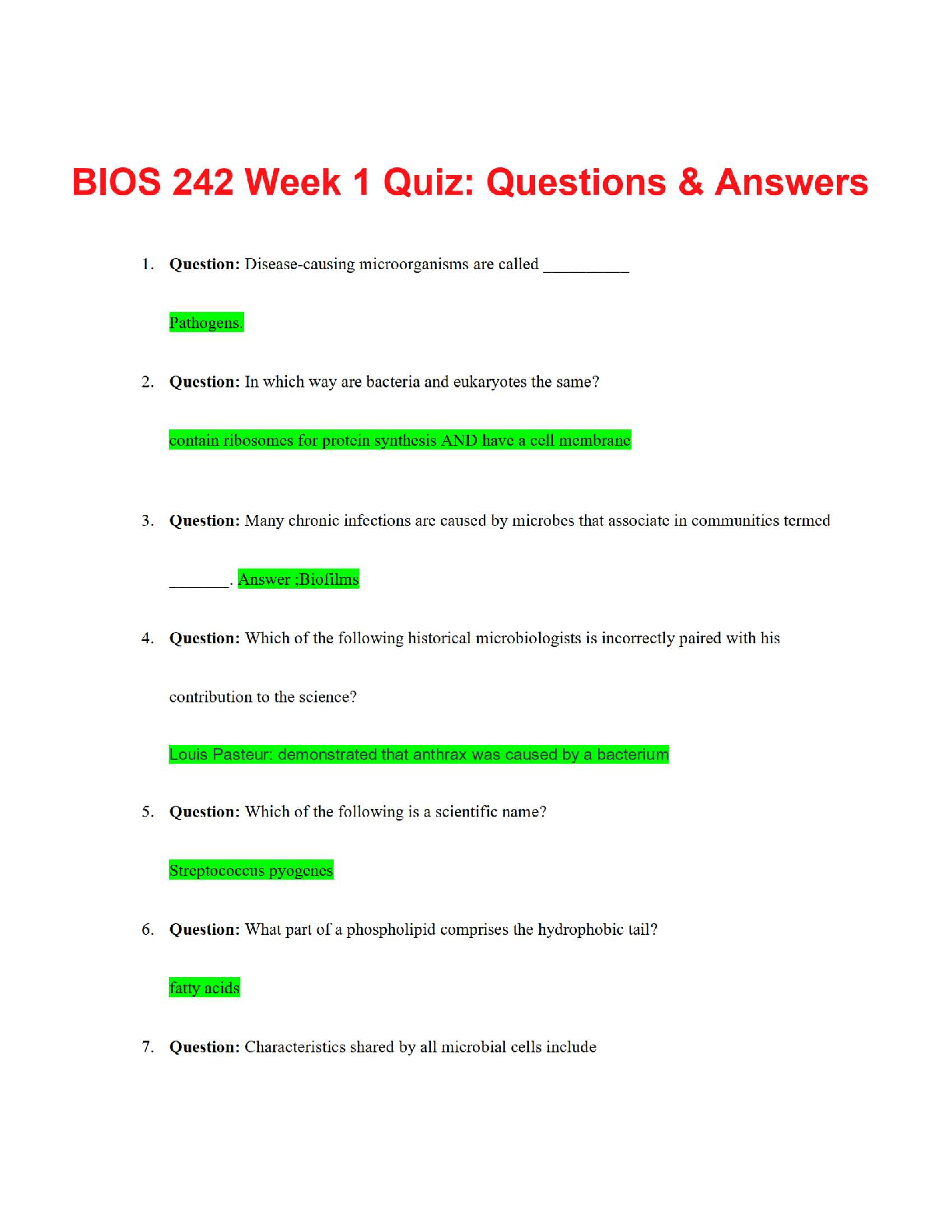

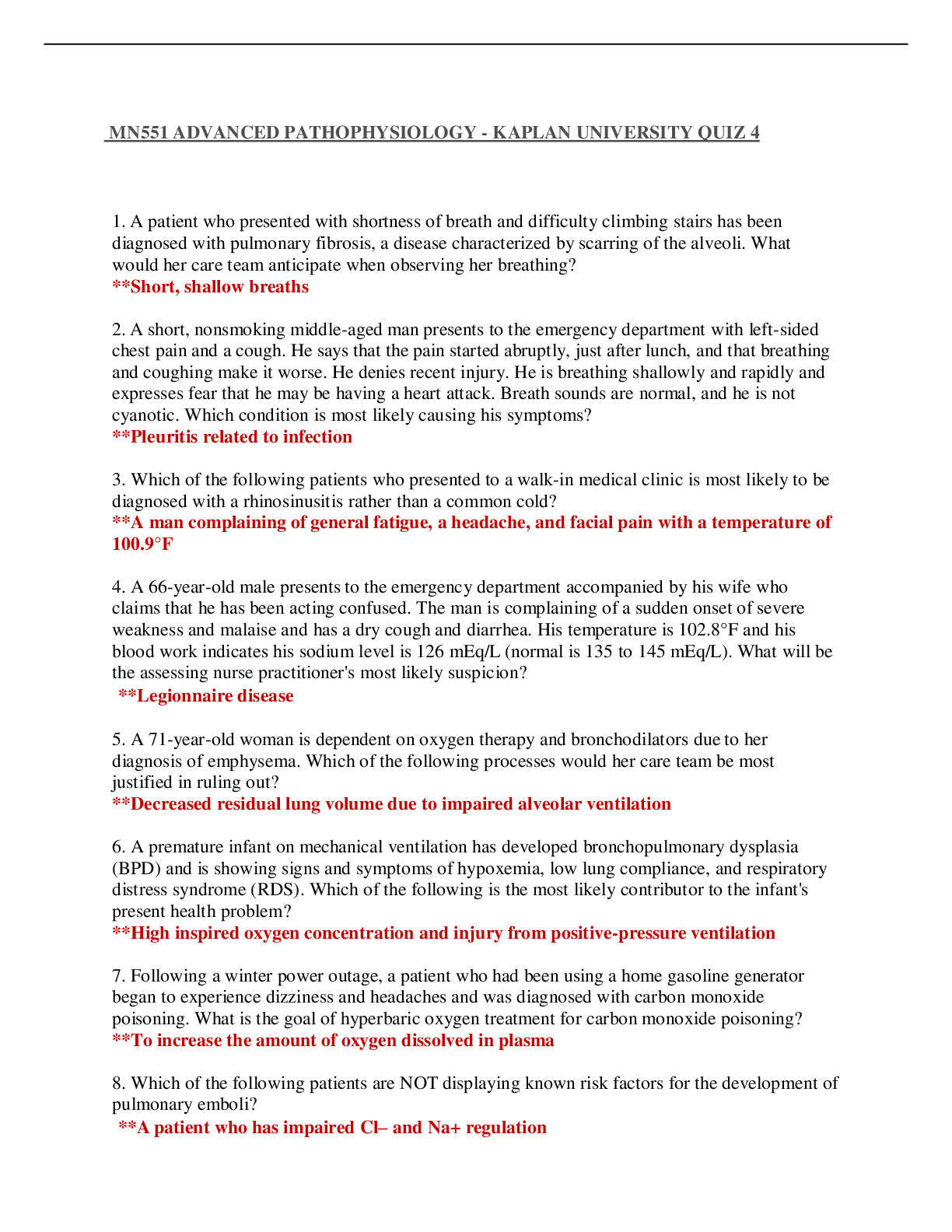

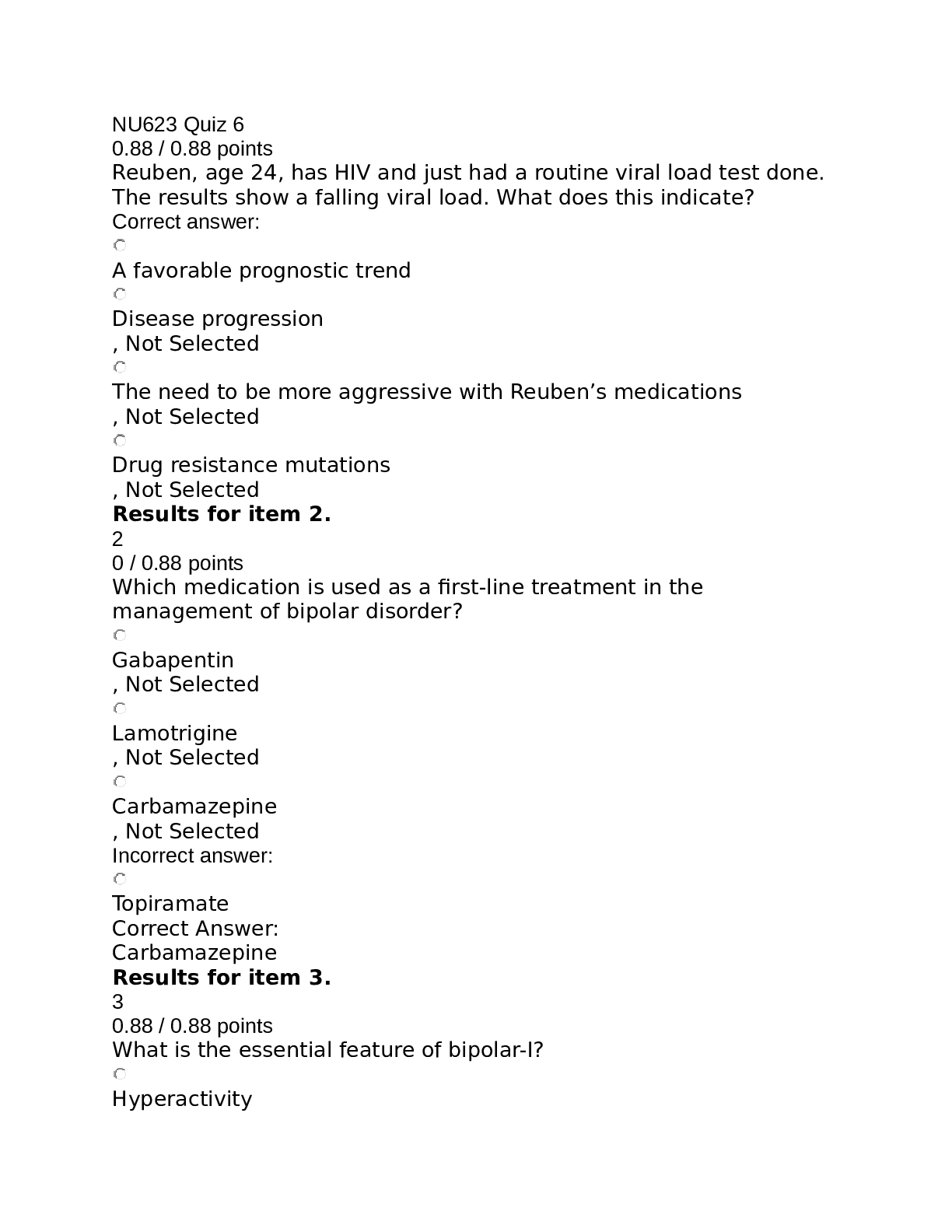

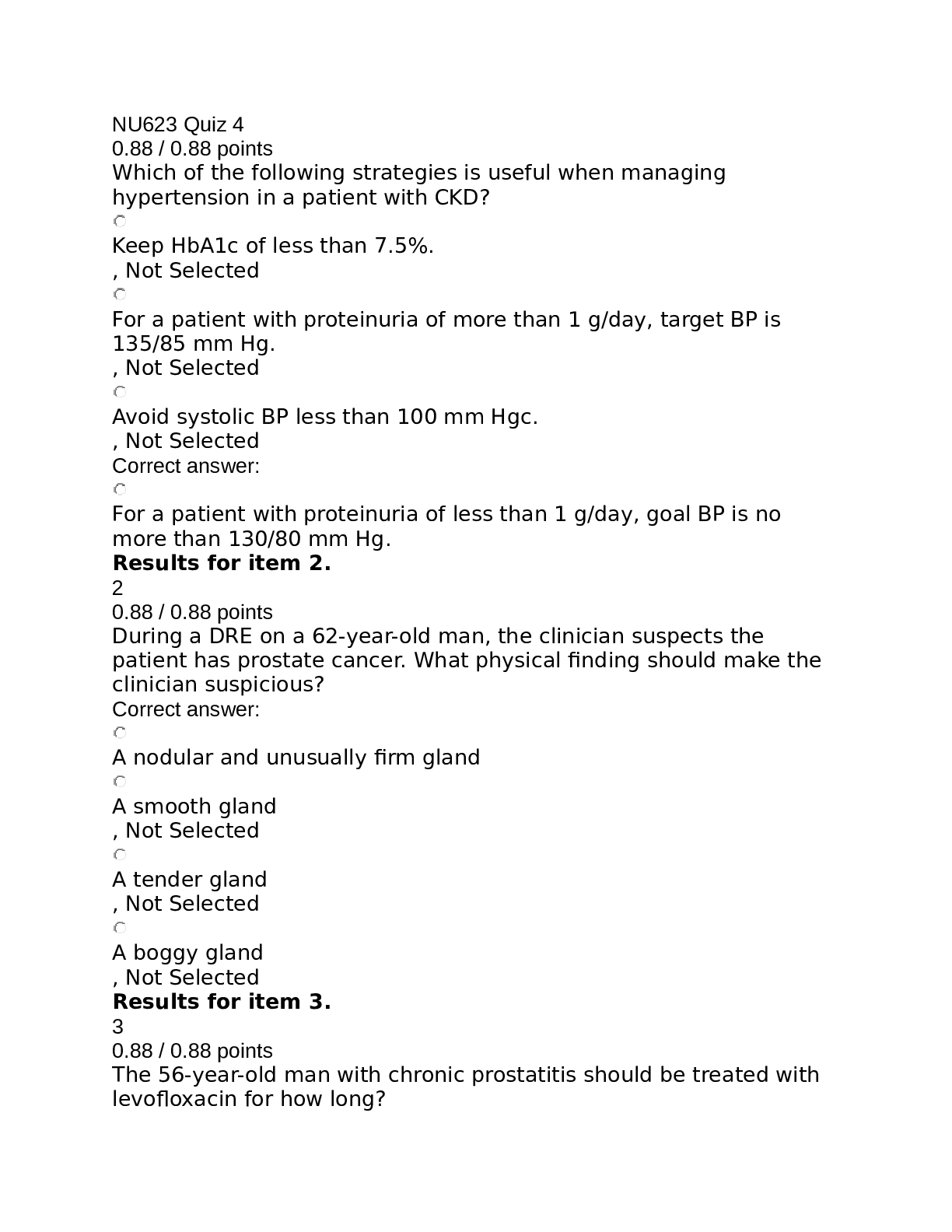

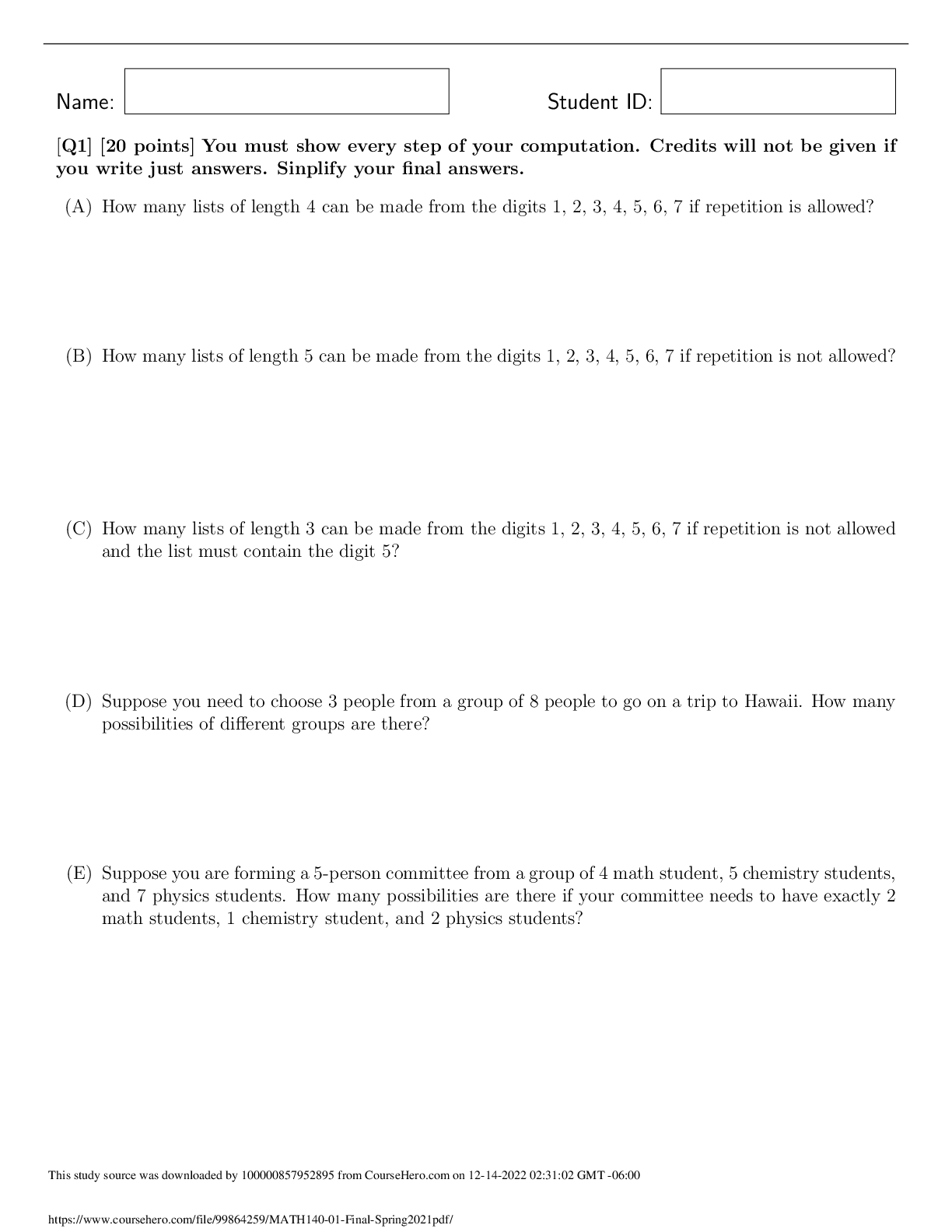

Quiz 3 – Ch. 3 Submit your answers on eCampus. Keep this to study for the Mid-Term Exam. 1. Indicate whether each of the following statements is True or False and then select the correct multiple ... choice answer. _____ The account “Cash” will be used in most adjusting journal entries. _____ After closing entries are made, the accounts Cost of Goods Sold, Prepaid Expense, and Dividends will all have a zero balance. A. True, True B. True, False C. False, True D. False, False 2. The following list of accounts appear in alphabetical order and were taken from ABC Corporation’s ledger as of December 31, 2015. The Accounts Payable records were missing. Accounts Payable ?? Accounts Receivable 3,000 Building 22,000 Cash 9,000 Common Stock 20,000 Cost of Goods Sold 2,000 Dividends 1,000 Equipment 10,000 Inventory 7,000 Land 5,000 Notes Payable 12,000 Retained Earnings 11,000 Revenue 8,000 Unearned Revenue 4,000 Wage Expense 9,000 Based on this information, determine the total dollar amount of credits that would appear in the company’s trial balance. A. $68,000 B. $66,000 C. $67,000 D. $72,000 E. $65,000 3. Match each of the following events with its related term by entering the appropriate letter in the space provided and then selecting the correct multiple choice answer? 1. Accrued Expense 2. Accrued Revenue 3. Deferred Expense 4. Deferred Revenue _____ Office supplies purchased with cash. _____ Customer prepays for a year magazine subscription, but no magazines have yet been delivered. _____ Interest has been earned on a note receivable, but the cash has not yet been received. _____ Utilities bill has been received, but will not be paid until next month. A. 1, 2, 3, 4 B. 3, 4, 2, 1 C. D. 2, 1, 4, 3 4, 3, 2, 1 E. 1, 2, 4, 3 4. The following is a partial list of accounts from a company’s December 31, 2015, unadjusted Trial Balance: Accounts Receivables $12,000 Unearned Revenue $ 16,350 Interest Revenue 20,270 Retained Earnings (1/1/15) 122,625 Utilities Expense 10,900 Prepaid Expenses 4,600 Dividends 6,400 Service Revenue 65,400 Salary Expense 23,450 Interest Expense 4,500 Accrued Expenses 9,250 Rent Expense 20,120 What is the balance in the Retained Earnings account on December 31, 2015, after closing? A. $133,675 B. $142,925 C. $159,275 D. $150,025 E. $149,325 5. A company fails to record the adjusting entry for supplies it has used during the period. It will have what effect on the financial statements? Assets Liabilities Net Income Stockholders’ Equity A. Understated No Effect Understated Understated B. Understated Overstated No Effect No Effect C. Overstated No Effect Overstated Overstated D. No Effect Understated Overstated Overstated Use the following information to answer the next 5 questions. The unadjusted trial balance for a company as of December 31, 2015 appears below. Debit Credit Cash $1,200 Accounts Receivable 900 Prepaid Insurance 900 Supplies 2,000 Land 10,000 Office Furniture 4,500 Accounts Payable 900 Unearned Revenue 1,500 Note Payable 5,500 Common Stock 3,000 Retained Earnings 7,400 Dividends 1,100 Service Revenues 4,100 Rent Expense 600 Salaries Expense 1,200 $22,400 $22,400 Additional Information: 1) The Company paid $900 for a one-year insurance policy on July 1, 2015. 2) The office furniture was purchased on January 1, 2015 and is expected to have a nine-year life and no salvage. Depreciation for 2015 has not been recorded. 3) The unearned revenue account was created when the Company was paid $1,500 for services to be rendered. Half of these services were rendered on December 31, 2015. 4) The note payable represents a 8 month, 8% loan obtained from The Bank & Trust on October 1, 2015. 5) The Company paid $600 on November 1, 2015 as annual rent for its warehouse. This amount was debited to rent expense. 6) The Company operates five days per week (M-F) with a weekly payroll of $500. The Company pays its employees every Friday. December 31, 2015 is a Wednesday. These wages have yet to be recorded. 7) Supplies on hand at December 31, 2015 had a cost of $600. 6. The correct adjusting entry for number “1” above includes a A. Debit to Insurance Expense for $900 B. Debit to Prepaid Insurance for $450 C. Debit to Insurance Expense for $450 D. Credit to Prepaid Insurance for $900 7. The correct adjusting entry for number “4” above includes a A. Credit to Interest Expense for $110 B. Debit to Interest Expense for $110 C. Debit to Interest Payable for $110 D. Credit to Interest Payable for $290 8. The correct adjusting entry for number “5” would be A. Debit to Prepaid Rent for $500 B. Debit to Rent Expense for $500 C. Credit to Rent Expense for $100 D. Debit to Prepaid Rent for $100 9. After adjustment, the balance in the Salary Expense account is A. $1,200 B. $300 C. $900 D. $1,500 E. $0 10. Net Income after Adjusting entries for the year-ending December 31, 2015 is A. $790 B. $40 C. $3,250 D. $590 E. $2,690 [Show More]

Last updated: 3 years ago

Preview 1 out of 3 pages

.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$5.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Sep 07, 2022

Number of pages

3

Written in

All

Additional information

This document has been written for:

Uploaded

Sep 07, 2022

Downloads

0

Views

152

.png)

.png)