Financial Accounting > EXAM > ACCT 212 MIDTERM EXAM (100% ANSWERS) | DeVry University (All)

ACCT 212 MIDTERM EXAM (100% ANSWERS) | DeVry University

Document Content and Description Below

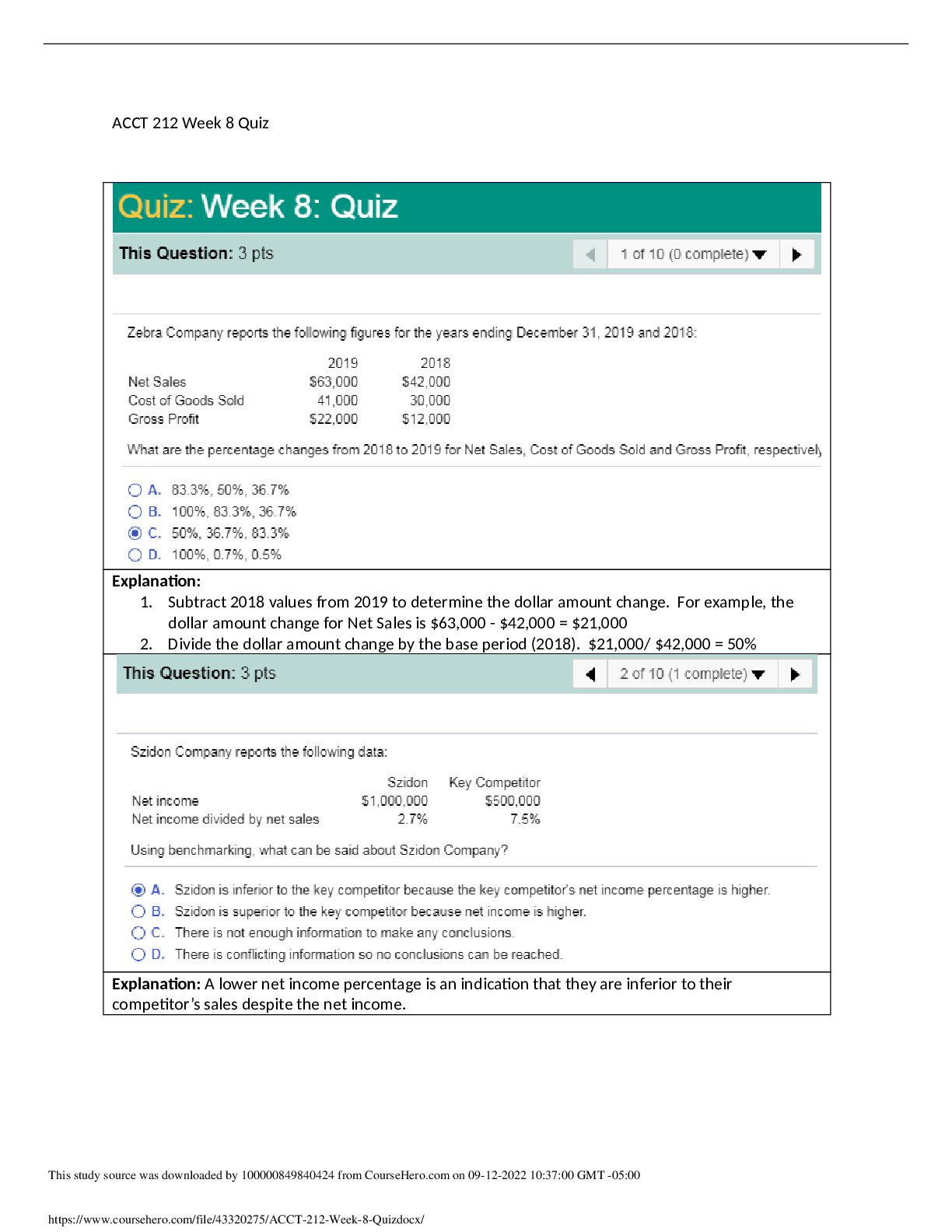

1. Question : (TCO 1) It is important that budgets be accepted by . Student Answer: division managers department heads supervisors All of the above Question 2 . Question : ... (TCO 2) The qualitative forecasting method that individually questions a panel of experts is . Student Answer: executive opinions sales force polling the Delphi method consumer surveys Question 3 . Question : (TCO 3) The regression statistic that measures how many standard errors the coefficient is from zero is the . Student Answer: correlation coefficient coefficient of determination standard error of the estimate t-statistic Question 4 . Question : (TCO 4) Marketing costs include . Student Answer: advertising packaging travel and entertainment All of the above Question 5 . Question : (TCO 5) Which of the following is not true when ranking proposals using zero-base budgeting? Student Answer: Due to changing circumstances, a low-priority item may later become a high-priority item. Decision packages are ranked in order of increasing benefit. Divisional and departmental managers submit initial recommendations, with top management making the final ranking. Nonfunded packages should also be ranked. Question 6 . Question : (TCO 6) The payback period is computed by dividing the cost of the capital investment by the . Student Answer: annual net income annual cash inflow present value of the cash inflow present value of the net income Question 7 . Question : (TCO 1) Budgeting can be an important management tool if implemented properly. Identify several positive results when budgets are used properly. Identify several negative results if budgets are not properly implemented. Student Answer: Budgeting is a crucial part of management tool, some of the positive when budgets are used properly. Once a budget is plan properly it help management to state specific goal for their department. It's providing an early warning system and alerting management of any arise problems before it's getting to an extreme level. It's can also motivate personnel by providing the objectives for performance evaluation. Employees are more motivate to work and meet their budget expectations with raises and bonuses determined by performance compared to budget. However, there are a downside once a budget is not properly implement. The budget can promote gamesmanship where mangers inflate their budget request knowing that they will be reduced. Also an unrealistic budget may lead to unethical employee conduct in order to meet the objectives. And employees who were not included in the budgeting process may perceived the budget to be unfair. Instructor Responses may vary. When budgets are used properly, positive results Explanation: can include the following: managers are required to plan ahead, there are definite objectives for performance evaluation, there is an early warning system for potential problems, there is coordination of activities within the business, there is greater management awareness of the entity's overall operations, and there are positive behavior patterns created by motivating personnel to meet planned objectives. However, if budgets are not implemented properly, negative results can include discouragement of additional effort to meet goals, poor morale of managers, lack of commitment to budget goals, and gamesmanship through significantly inflated requests. Question 8 . Question : (TCO 2) Budgeting and forecasting are both vital to a company’s success. Compare and contrast these two elements. Student Answer: Budgeting VS Forecasting: Budget is a formal written plan for the future that communicate management's goal throughout the organizations. Budget can cover any period of time with the amount of detail present in the budget varying in direct correlation to the length of the budget. Budget divided into 2 type short-term and long- term. Short-term budgets provide specific details, while long-terms are very broad and general in nature. Achieving the objectives detailed in the short-term budget will place an organization on the path to accomplishing its long-term budget goals. For budgets to be effective it must reflect the goals of each department as they related to the organization as a whole. It should predict the future as accurately as possible. Budgets communicate goals and objective, and the responsibility for achieving them. Effective budget must be based on accurate and reliable information generated by the accounting system, and supported by all levels of management. It also provides the flexibility to allow for unexpected contingencies. Forecasting is a quantifiable estimate of future demand. Forecasts are needed by various departments in the organization, with the purposed of forecast varying from one department to another. Each forecast is depending on the specific need and demand of managers. And each specific units provide information depends on what information that an employee is perform his or her job. For instance, production departments need units and finance and account department depends on the dollars. managers of human resources need to how many employees the firm requires. Even though they are two separate units but they work together hand in hand and a organization need both budgeting and forecasting. Instructor Explanation: Forecasting involves predicting future values with the objective of reducing risk in decision making, and budgeting involves planning for the future. Forecasts provide the starting point for planning and budgeting. For example, the budgeting process typically starts with sales, which must be forecasted using some quantitative or qualitative technique. The sales forecast is then used to create the sales budget. Question 9 . Question : (TCO 2) Use the table Manufacturing Capacity Utilization to answer the questions below. Capacity Utilization centages Part (a): What is the project manufacturing capacity utilization for Day 16 using a 3-day moving average? Part (b): What is the project manufacturing capacity utilization for Day 16 using a 6-day moving average? Part (c): Use the mean absolute deviation (MAD) and mean square error (MSE) to determine which average provides the better forecast. Student Answer: Part a) the project manufacturing capacity utilization for day 16 of 3 day moving average is 80.7 this is how the calculation is done by taking the sum of day 13 to day 15 or the sum of (80.7+80.7+80.8)/3 Part B) The project capacity utilization for day 16 using 6 day moving average is 79.88 =79.9 this is how the calculation is done taking the sum from day 10 to day 15 or the sum of (78.8+78.4+80.8+80.7+80.7+80.8)/6 The mean absolute deviation (MAD) of the business is 1.158333 or 1.16 and the average of mean square error is 1.3417 or 1.34. In this problem there is no better forecast because this a personal reference. MAD may have many small errors in the optimal forecast and the MSE is putting the high weight on the deviation of the forecast. The result is just showing the square root of the MAD. Instructor Explanation: Part (a): Using an Excel spreadsheet to calculate the 3-day moving average, the forecast of manufacturing capacity utilization for Day 16 is 80.73%. Part (b): Using an Excel spreadsheet to calculate the 6-day moving average, the forecast of manufacturing capacity utilization for Day 16 is 79.88%. Part (c): Using an Excel spreadsheet, the 3-day moving average has a MAD of 1.16 and a MSE of 2.53. The 6-day moving average has a MAD of 1.12 and a MSE of 1.59. Therefore, the 6-day moving average provides a better forecast of manufacturing capacity utilization. Question 10 . Question : (TCO 3) Use the table “Food and Beverage Sales for Jimmy’s Greek Restaurant” to answer the questions below. Food and Beverage Sales for Jimmy’s Greek Restaurant ($000s) Month First Year Second Year January 242 263 February 235 238 March 232 247 April 278 193 May 284 193 June 240 149 July 145 157 August 152 161 September 110 122 October 130 130 November 152 167 December 236 231 Part (a): Calculate the regression line and forecast sales for January of Year 3. Part (b): Calculate the seasonal forecast of sales for January of Year 3. Part (c): Which forecast do you think is most accurate and why? Student Answer: Part a) y=79.46+.532x Part b) Part c) I from my point of view the regression line forecast is more accurate because it stay to what the regular monthly sale would be. The seasonal forecast is less accurate Instructor Explanation: because the sale average does not stay constant and it did not show the actual sale average rather than the rise of sale within the season. Part (a): Using an Excel spreadsheet, the regression line is y = 235.22 - 3.18x. Based on this regression line, the sales forecast for January of Year 3 is $155.45 (in thousands). Part (b): Using an Excel spreadsheet, the seasonal forecast of sales for January of Year 3 is $187 (in thousands). Part (c): Responses will vary. Students should discuss whether they believe there is a trend in the data. Question 11 . Question : (TCO 6) Davis Company is considering two capital investment proposals. Estimates regarding each project are provided below. Project A Project B Initial Investment $800,000 $650,000 Annual Net Income $50,000 45,000 Annual Cash Inflow $220,000 $200,000 Salvage Value $0 $0 Estimated Useful Life 5 years 4 years The company requires a 10% rate of return on all new investments. Part (a): Calculate the payback period for each project. Part (b): Calculate the net present value for each project. Part (c): Which project should Jackson Company accept and why? Student Answer: Par a) The payback period is year 4 by taking the cash flow -the initial investment=the amount of payback each ear for example: 220,000- 800,000 =-580,000. by using the same example the positive number is 80,000 by year 4 of project a and the payback period for project b is year 3 using the same formula. The net present value Instructor Explanation: Part (a): Project A payback period = $800,000 ÷ $220,000 = 3.64 years Project B payback period = $650,000 ÷ $200,000 = 3.25 years Part (b): Project A NPV = ($220,000 x 3.7908) - $800,000 = $33,976 Project B NPV = ($200,000 x 3.1699) - $650,000 = ($16,020) Part (c): Based on the payback period, Project B appears to be the best option with a lower payback period. However, based on the net present value, Project A is the best option because it has a much greater NPV. Furthermore, Project B is unacceptable because it has a negative net present value. While the payback period is useful as an initial screening tool, it does not consider the time value of money nor expected profitability. Therefore, Davis Company should accept Project A. Question 12 . Question : (TCO 6) Corn Doggy Inc. produces and sells corn dogs. The corn dogs are dipped by hand. Austin Beagle, production manager, is considering purchasing a machine that will make the corn dogs. Austin has shopped for machines and found that the machine he wants will cost $262,000. In addition, Austin estimates that the new machine will increase the company’s annual net cash inflows by $40,300. The machine will have a 12-year useful life and no salvage value. Part (a): Calculate the payback period. Part (b): Calculate the machine’s internal rate of return. Part (c): Calculate the machine’s net present value using a discount rate of 10%. Part (d): Assuming Corn Doggy Inc.’s cost of capital is 10%, is the investment acceptable? Why or why not? Student Answer: Instructor Explanation: Part (a): Payback period: $262,000 ÷ $40,300 = 6.50 years Part (b): Internal rate of return: IRR factor = $262,000 ÷ $40,300 = 6.50124 Scanning the 12-year line, a factor of 6.50124 represents an internal rate of return of approximately 11%. Part (c): Net present value: Present Value of Cash flows = ($40,300 x 6.8137) - $262,000 = $12,592. Part (d): Yes, the investment is acceptable. Indications are that the investment will earn a greater return than 10%. The internal rate of return is estimated to be 11%, and the net present value is positive. [Show More]

Last updated: 3 years ago

Preview 1 out of 10 pages

.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Also available in bundle (1)

Click Below to Access Bundle(s)

ACCT 212 Financial Accounting Entire Course Week 1 – 8 BUNDLED (100% CORRECT ANSWERS)

Entire Course Week 1 – 8ACCT 212 Week 1 Homework (Collection) ACCT-212 Week 1 Quiz (Collection) ACCT 212 Week 2 Homework (Collection) ACCT-212 Week 2 Quiz (Collection) ACCT 212 Week 3 Homework...

By Prof. Goodluck 3 years ago

$15

24

Reviews( 0 )

$12.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Sep 09, 2022

Number of pages

10

Written in

All

Additional information

This document has been written for:

Uploaded

Sep 09, 2022

Downloads

0

Views

139

Questions and Answers 100% VERIFIED.png)

Questions and Answers 100% correct Solutions.png)