LINGUISTICS: SEMANTICS

$ 9

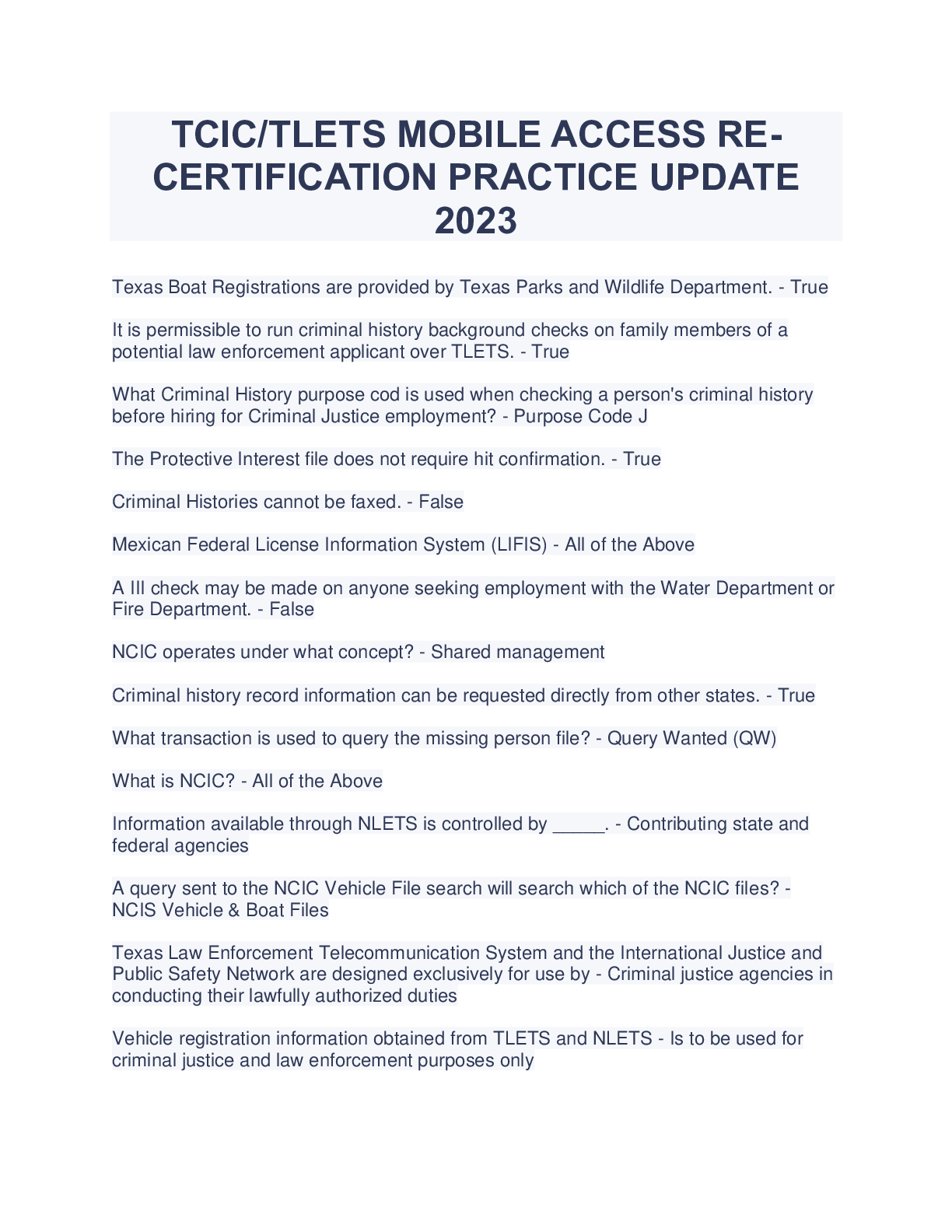

TCICTLETS MOBILE ACCESS RE-CERTIFICATION PRACTICE UPDATE2023

$ 12

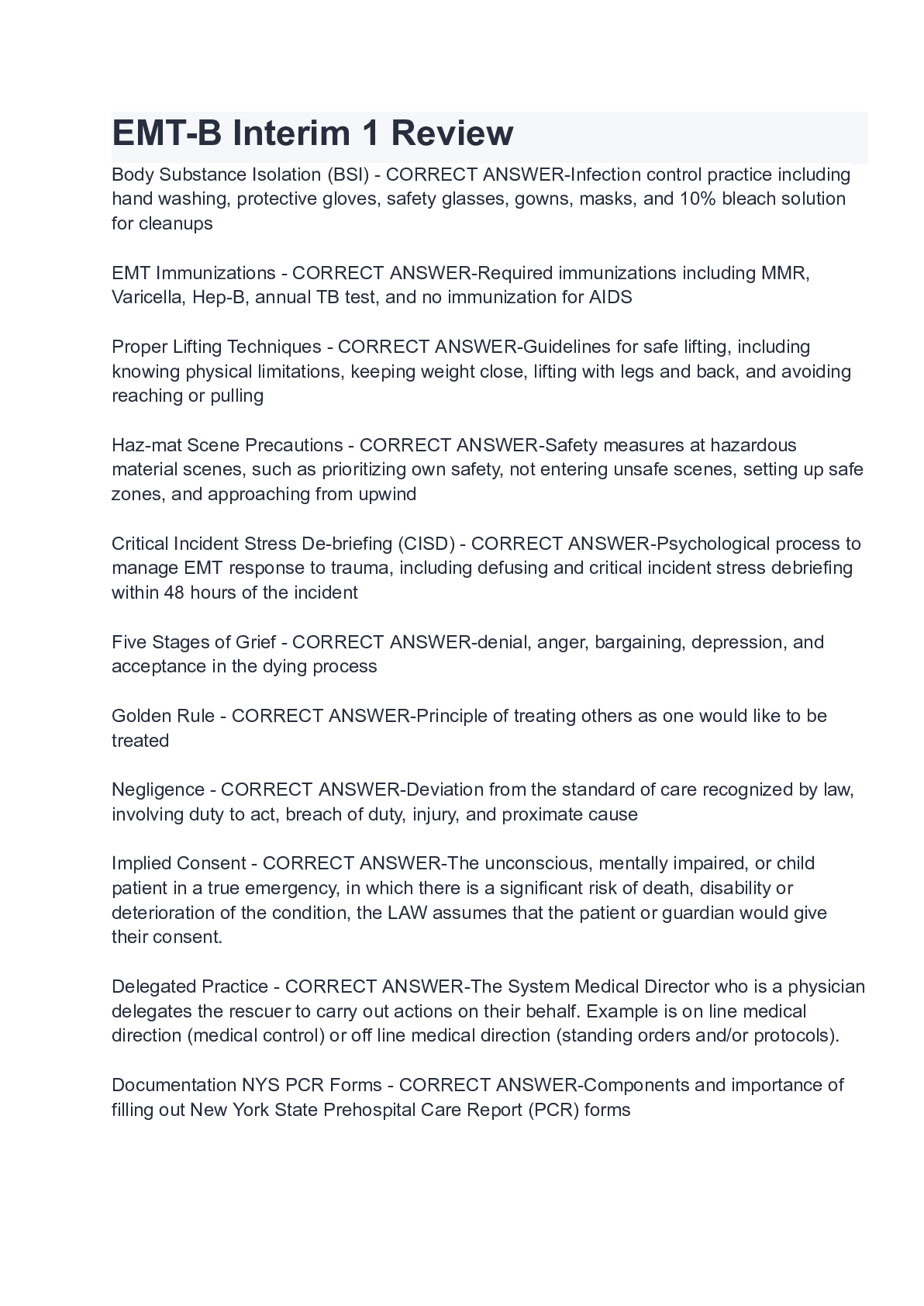

EMT-B Interim 1 Review

$ 7

ATI Comprehensive final

$ 10

RMA PRACTICE EXAMINATION (AMT WEBSITE)

$ 10

eBook Biotechnology of Microbial Enzymes Production, Biocatalysis, and Industrial Applications 2nd Edition By Goutam Brahmachari

$ 30

PN Comprehensive Predictor 2017 Remediation.

$ 15

Basic Orientation Plus Questions with 100% Correct Answers.pdf

$ 17

ATI COMPREHENSIVE EXIT FINAL 2020 FORM B

$ 13.5

RN Maternal Newborn 2019 Retake Study Guide

$ 12

As level ocr a chemistry 2021 breadth

$ 8

Intro_to_Infor_Technology_final_milestone

$ 7

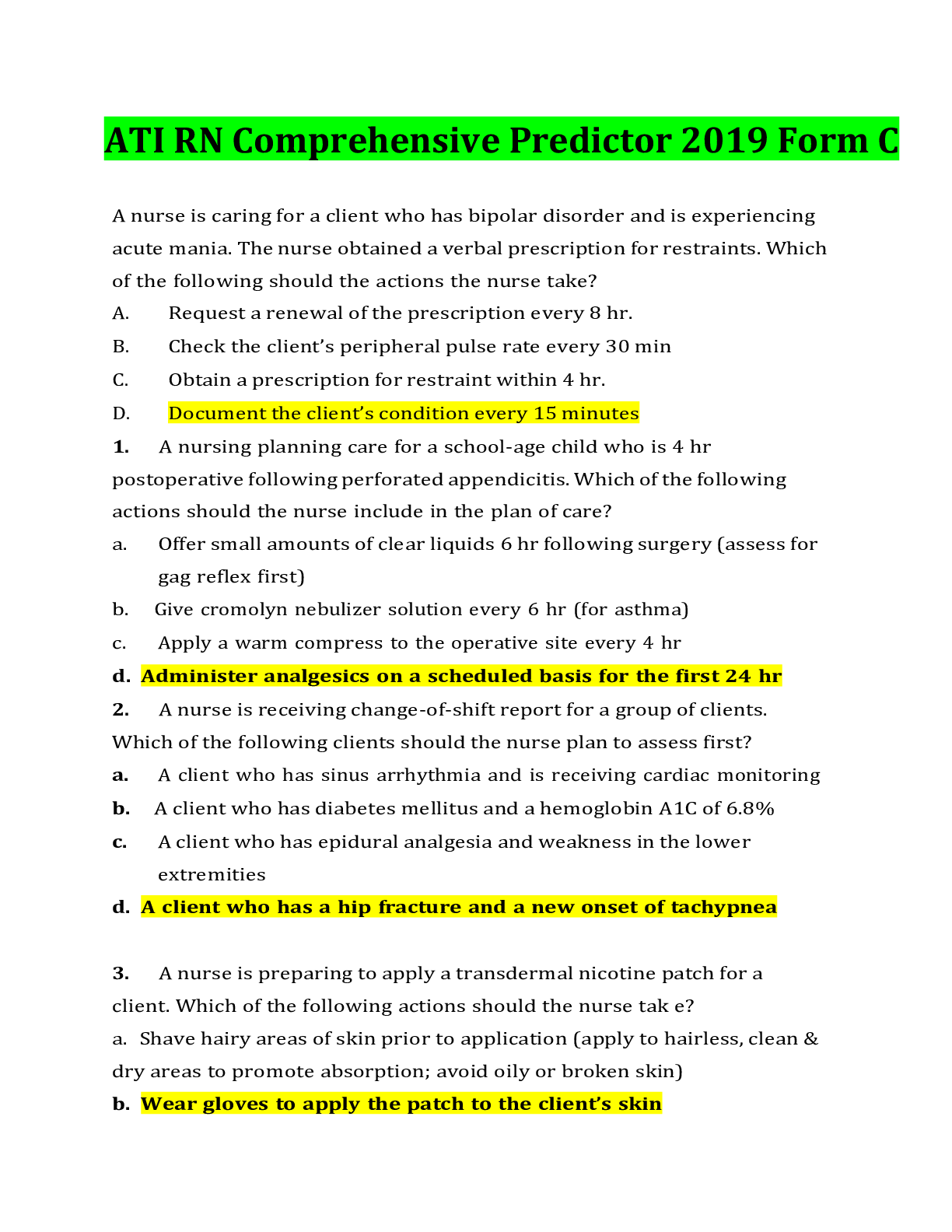

ATI RN Comprehensive Predictor 2019 Form C

$ 14

ebook PDF for Exploring Computational Pharmaceutics AI and Modeling in Pharma 4.0 1st Edition By Defang Ouyang

$ 29

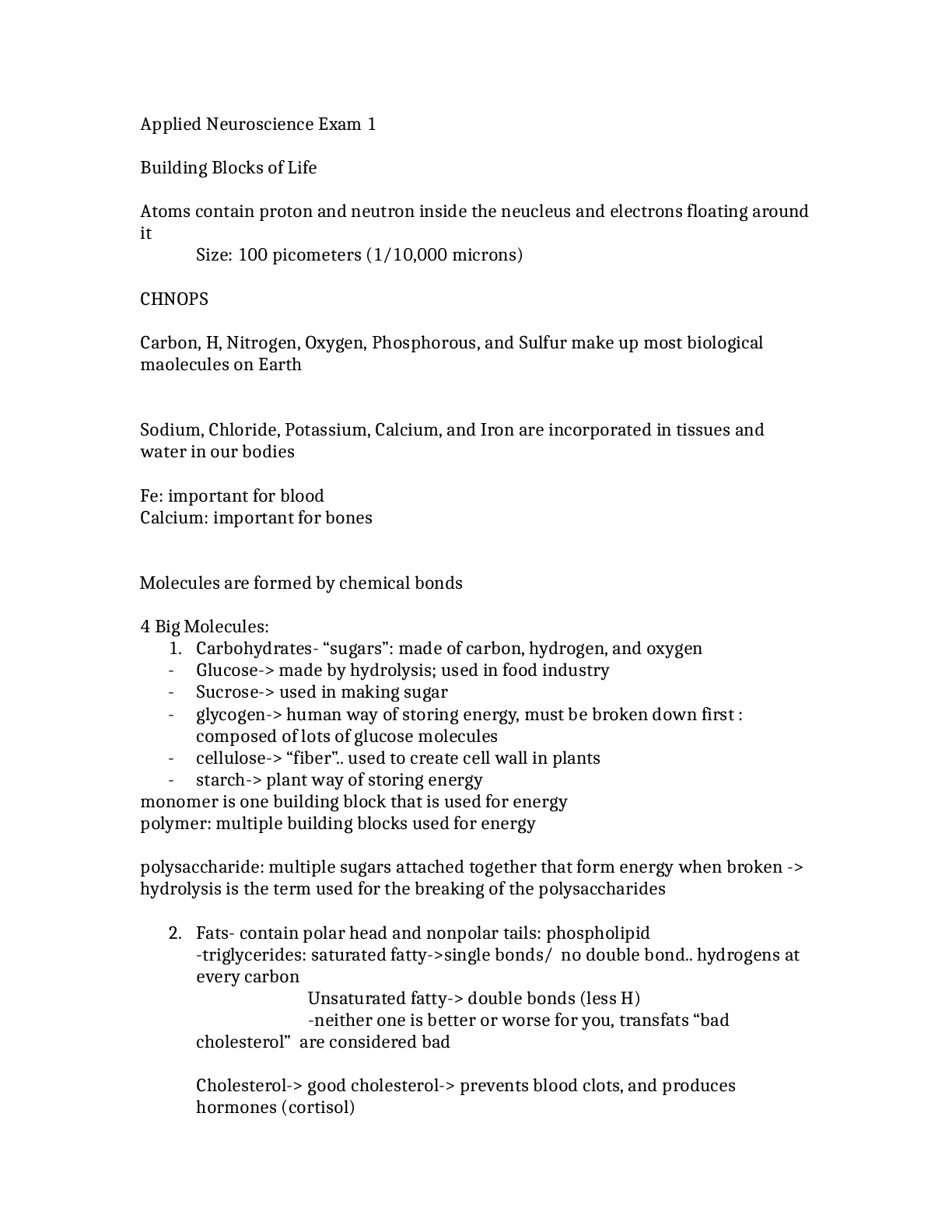

Applied Neuroscience Exam 1

$ 18.5

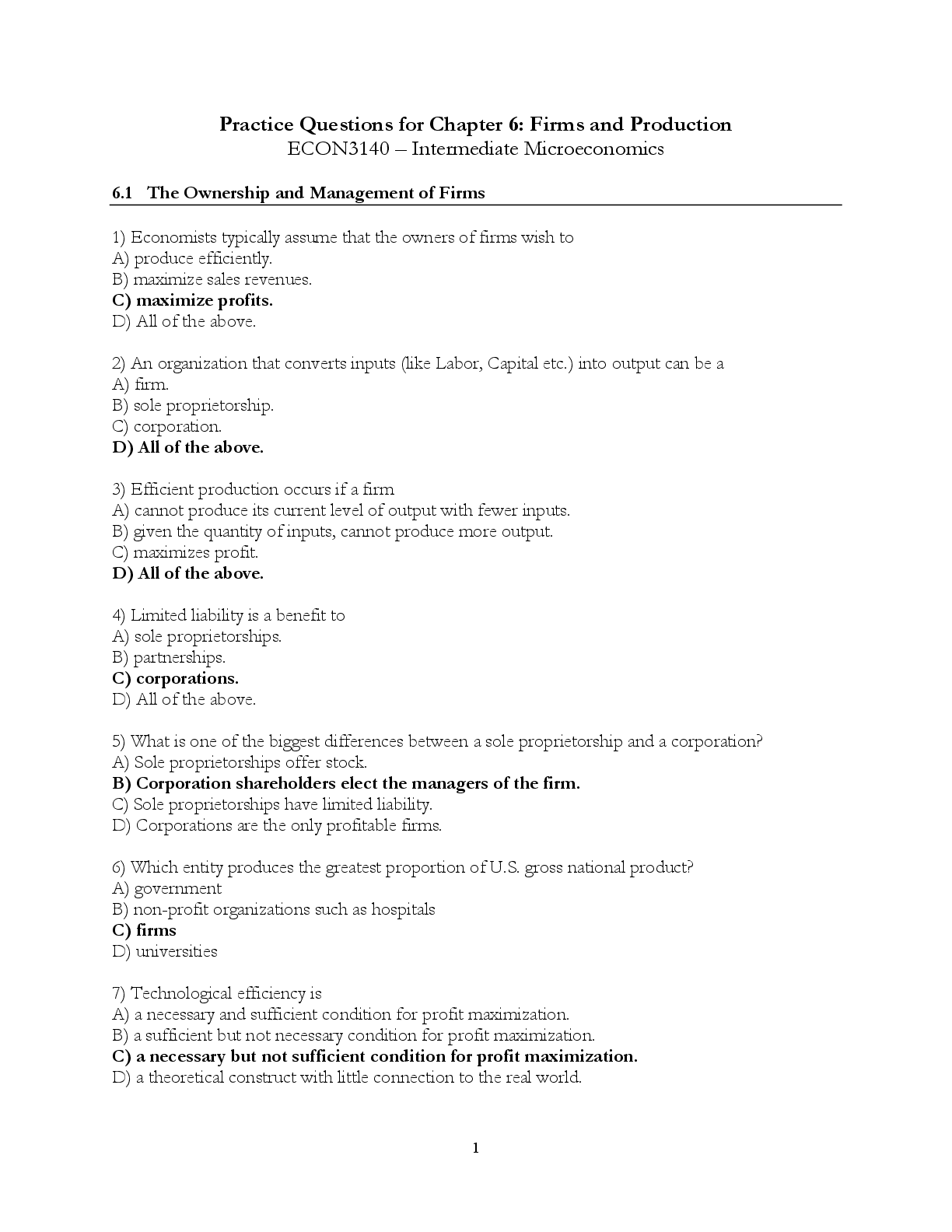

ECON3140 – Intermediate Microeconomics (1)

$ 18

ATI PN Comprehensive Predictor Form A 2019

$ 12

AQA A-LEVEL MATHEMATICS 7357/1 Paper 1 Mark scheme June 2019 Version: 1.0 Final

$ 7

BIOL 181 WEEK 8 QUIZ

$ 9

Nutrition Proctored GRADE A+

$ 13

F-60 Study Material 100% Correct

$ 12

NUR 2349 PN1 Final Exam Study Guide

$ 30

NR 503 Study Guide For Final Exam May,2018

$ 8.5

.png)

NR 601 Week 2 COPD Case Study Part 2 (Initial post, faculty, peer responses)

$ 9

ATI COMPREHENSIVE EXIT EXAM 2023

$ 10

Random CMCA Practice Test Questions (Under Construction) Already Passed

$ 15.5

eBook [PDF] Assessment for Counselors 1st Edition By Bradley Erford

$ 30

CSC 236 - Lab 2 (2 programs) ADTs implement vs extend

$ 11

[eBook][PDF] Quantitative Chemical Analysis 10e Daniel Harris, Charles Lucy (EPUB ORG PDF)

$ 14.5

.png)

ATI PN Fundamentals, nursing.

$ 10

ATI TEAS 7 TESTBANK 2

$ 30

WGU D293 2025 LATEST REAL EXAM WITH ACTUAL NGN QUESTIONS AND 100% CORRECT ANSWERS A+ GRADED

$ 7.5

AQA A-level PHYSICS 7408/1 Paper 1 Mark scheme June 2021 Version: 1.0 Final

$ 8

NURS_4465_quiz_1

$ 12.5

Acct 441 Exam 3 Practice Set Solutions

$ 8

ECONS 200 UOFA FINAL EXAM VERSION 1 2025

$ 19.5

AQA 2022 PHYSICS AS QUESTION PAPER 1

$ 6

Chapter 5: Diversity and Human Needs and Development Practice 2022

$ 10

NR_603_week_3_discussion

$ 18

ECET105 WEEK 7 DIGITAL CIRCUITS AND SYSTEMS ASSIGNMENT(WITH VERIFIED ANSWERS) 2023

$ 8

AQA PHYSICS A LEVEL 7408 PAPER 3A MARKSHEME JUNE 2022

$ 10

eBook [PDF] The Muse of Coding Computer Programming as Art 1st Edition By Richard Garfinkle

$ 20

AS PHYSICS 7407/1 Paper 1 Mark scheme June 2021 Version: 1.0 Final

$ 7

[eBook][PDF] Intro to Python for Computer Science and Data Science Learning to Program with AI, Big Data and The Cloud, 1st Edition By Paul Deitel, Harvey Deitel

$ 14.5

eBook Safety and Health for Engineers 4e Roger Brauer

$ 29

JMU SCOM Final Exam Study Guide

$ 10

GCE Further Mathematics B (MEI) Y410/01: Core Pure Advanced Subsidiary GCE Mark Scheme for November 2020

$ 6.5

.png)

Assignment Java Programming Documentation

$ 10

.png)

CARD BCAT EXAM LATEST 2022 ALREADY PASSED

$ 10

Shadow Health Tina Jones Comp Subjective Data Collection: 50 of 50 (100.0%) Latest Test

$ 20

WRITTEN INTERVIEW FOR ELECTRICIANS LICENCE CLASS C-1

$ 11

iHuman Case Study: Nancy Campbell

$ 22

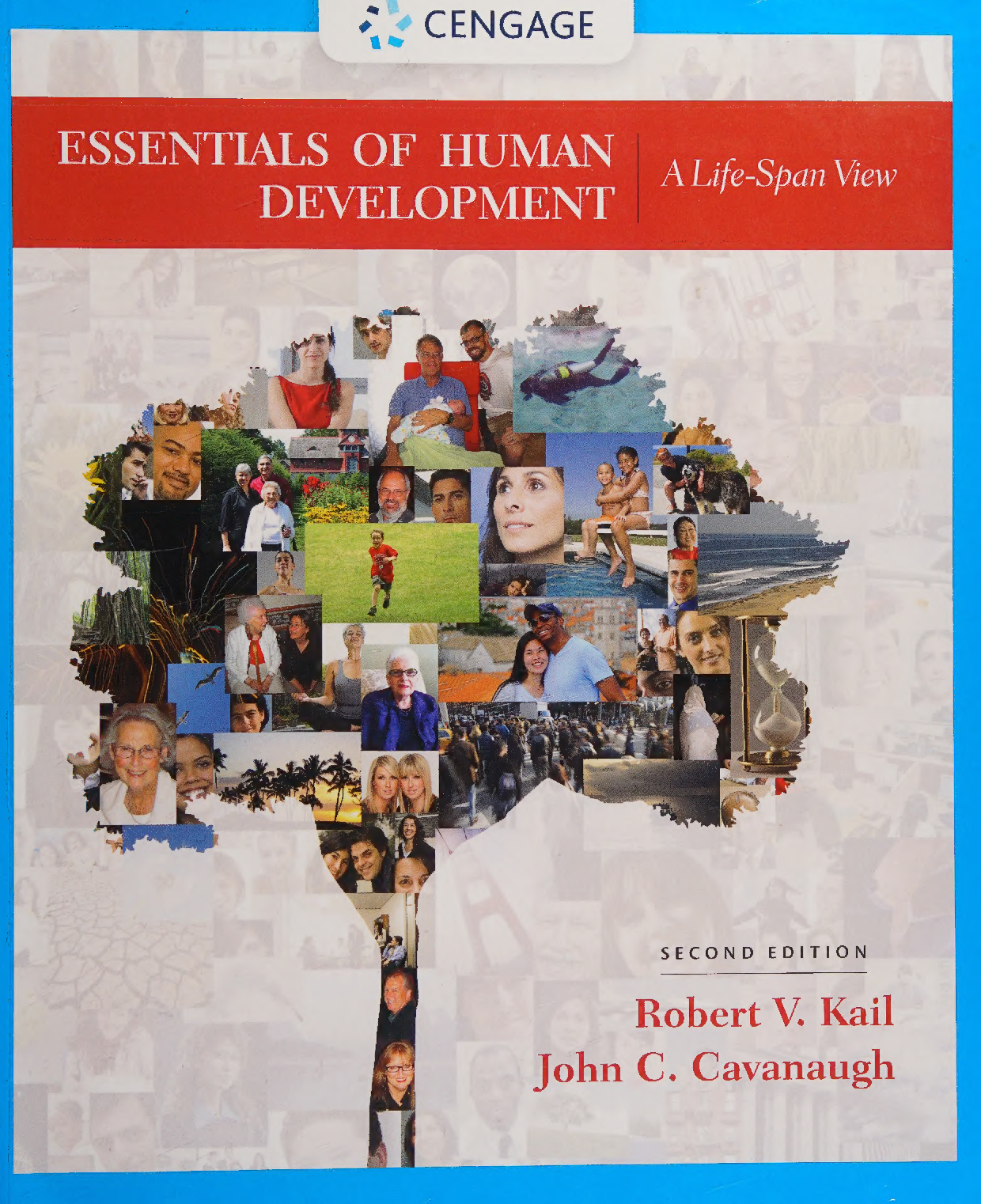

eBook (scan copy) Essentials of Human Development A Life-Span View 2nd Edition By Robert Kail , John Cavanaugh

$ 20

Ati comprehensive exit exam 2025

$ 32.5

APEA_3P_Exam_Pre5

$ 11

David Carter Part 1- Documentation Assignments

$ 12.5

Database Systems Design Implementation And Management 12th Edition By Carlos Coronel, Steven Morris Chapter 1_16 TEST BANK

$ 28

NJ Core Applicator Test | 190 Questions with complete solutions

$ 10

NR 466 Capstone A and B study guide

$ 15

RUA_Health_Promotion_Project

$ 18

Database Systems Design, Implementation,& Management 13th Edition-Carlos Coronel, Steven Morris-Test Bank

$ 15

Code HS Answers: Lessons 1-20 Complete Test Answered Correctly

$ 9

.png)

Teas math practice tests practice 7 already passed

$ 10

CCS CPT Coding Lesson 3 Assessment

$ 3

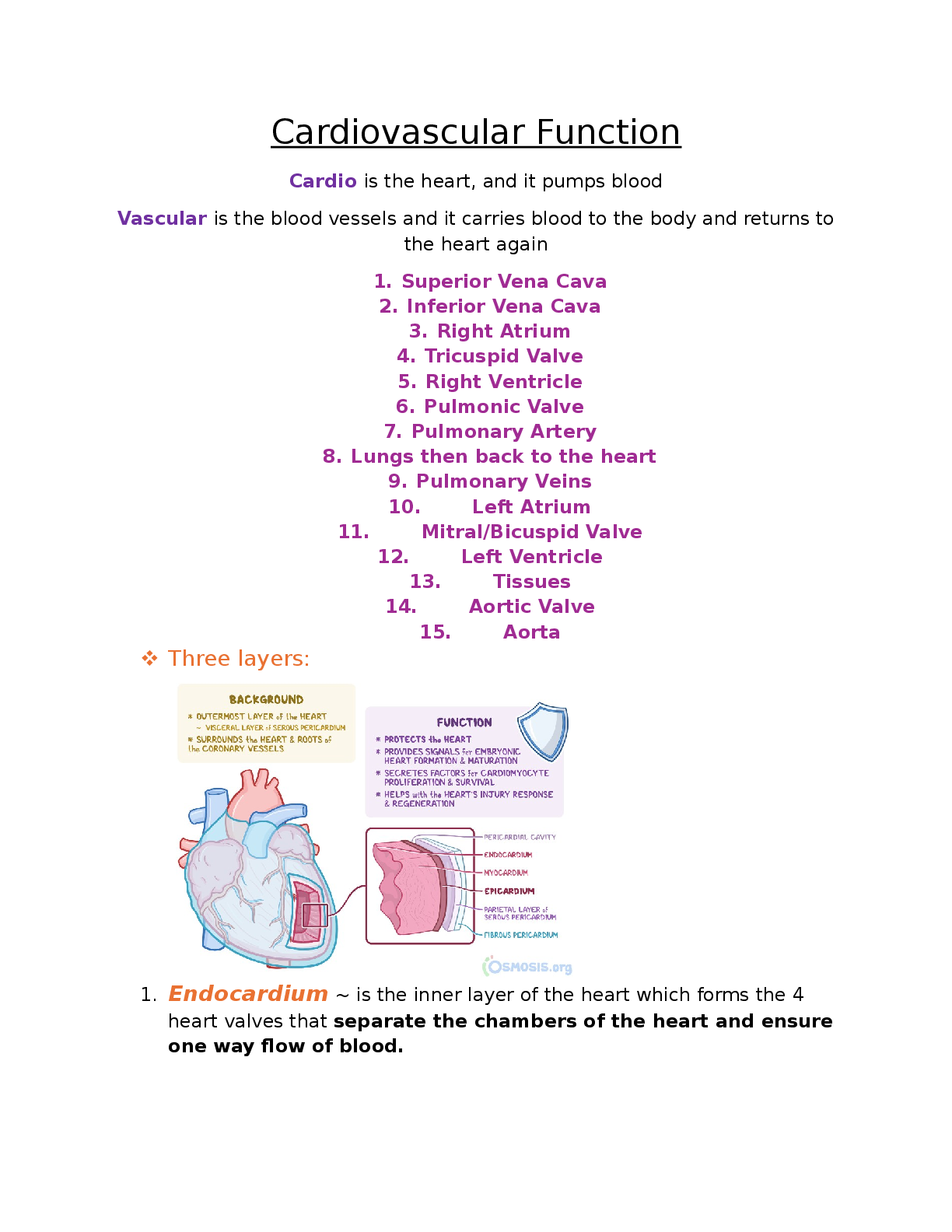

Cardiovascular Function

$ 15

201 mcqs q and a

$ 9

ATI TEAS MATHS 2023

$ 18

PUBH 8035 Module 6 final exam

$ 10

CCRP EXAM PREP.pdf

$ 16

- midterm 2-practice exam.png)

BIOL 235)- midterm 2-practice exam.pdf

$ 14

[eBook] [PDF] Python 3 Using ChatGPT GPT 4 By Oswald Campesato

$ 25

UN5Assgn1 Unit 5 Assignment 1

$ 10

ASNT Level 3 Basic Materials & Processes

$ 10

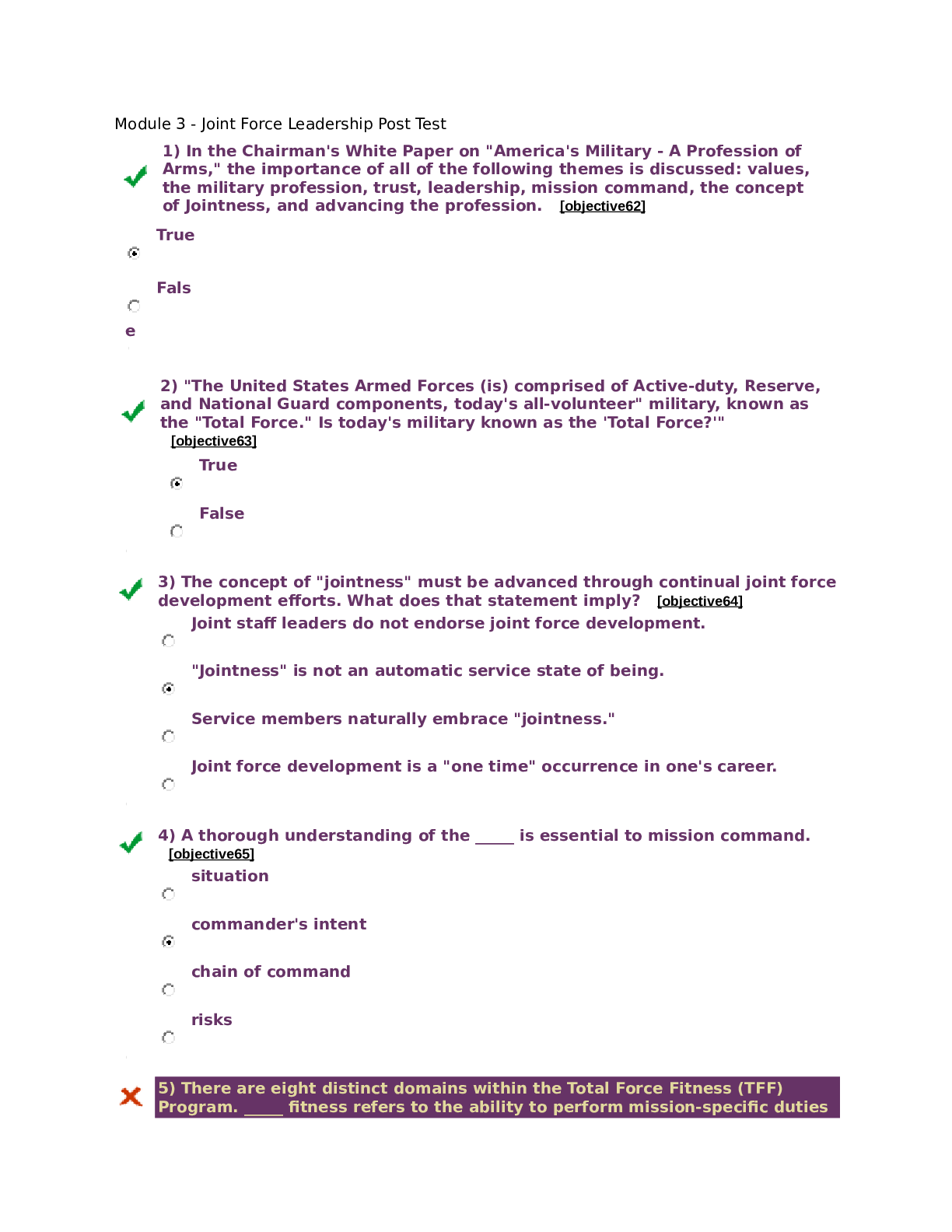

Module 3 - Joint Force Leadership Post Test Full

$ 13

3CX ACADEMY ADVANCED CERTIFICATION LATEST 2025/2026 FINAL STUDY QUESTIONS WITH CORRECT VERIFIED ANSWERS 100% GUARANTEED PASS | RATED A+

$ 9.5

OCR A LEVEL MATHEMATICS B PAPER 3 _ JUNE 2022 _INSERT

$ 6

Summary CSPSC 110 PSET 7 SOLUTION