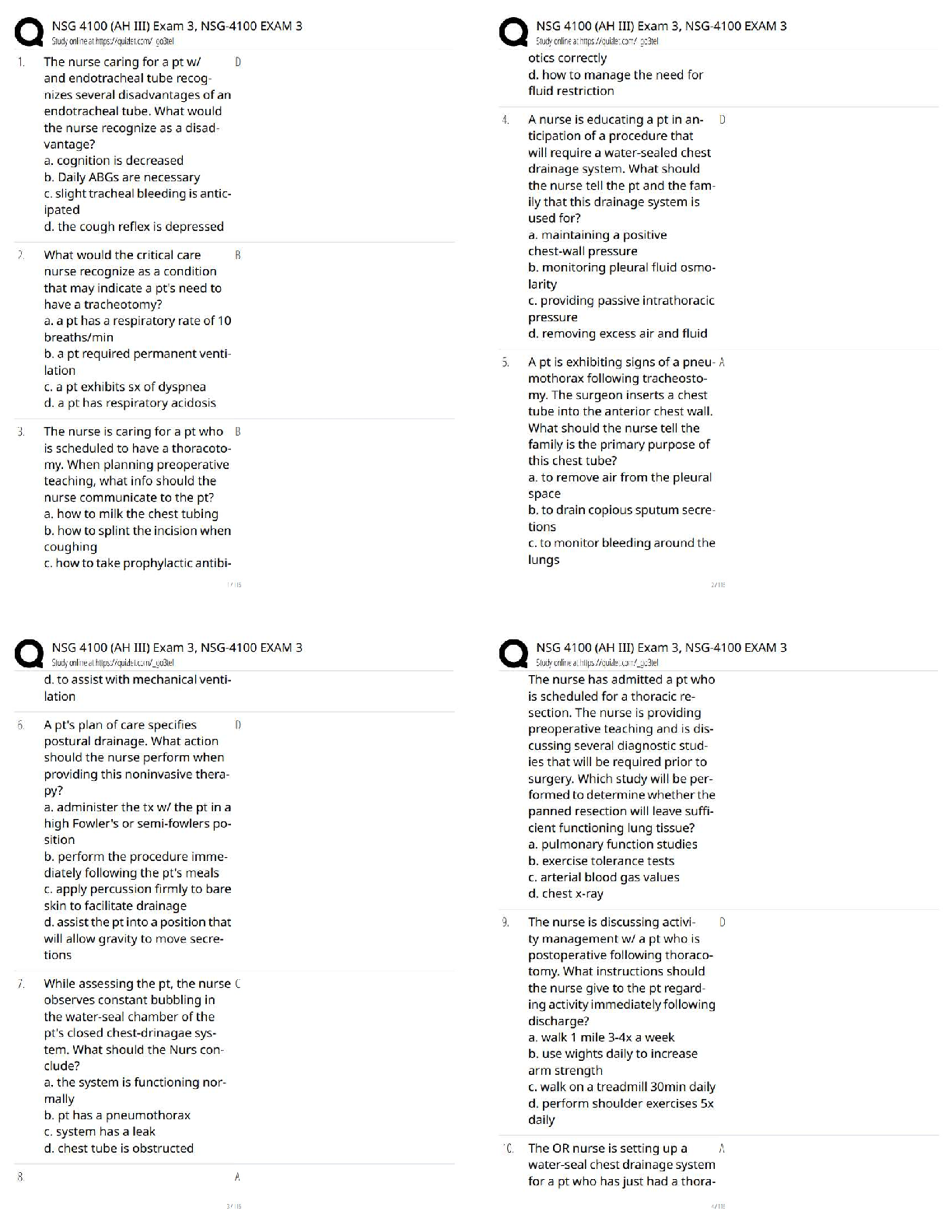

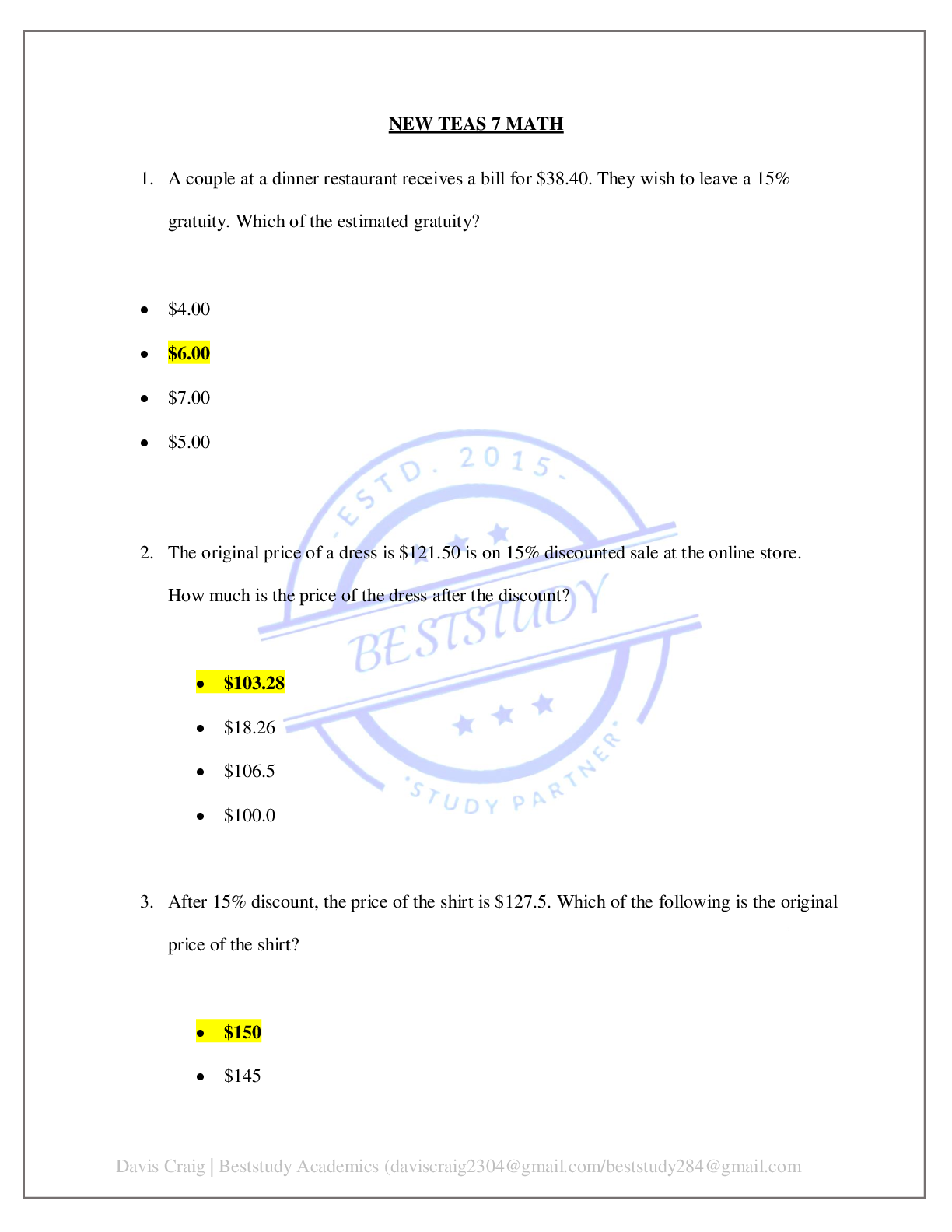

NEW TEAS 7 MATH V4

$ 50

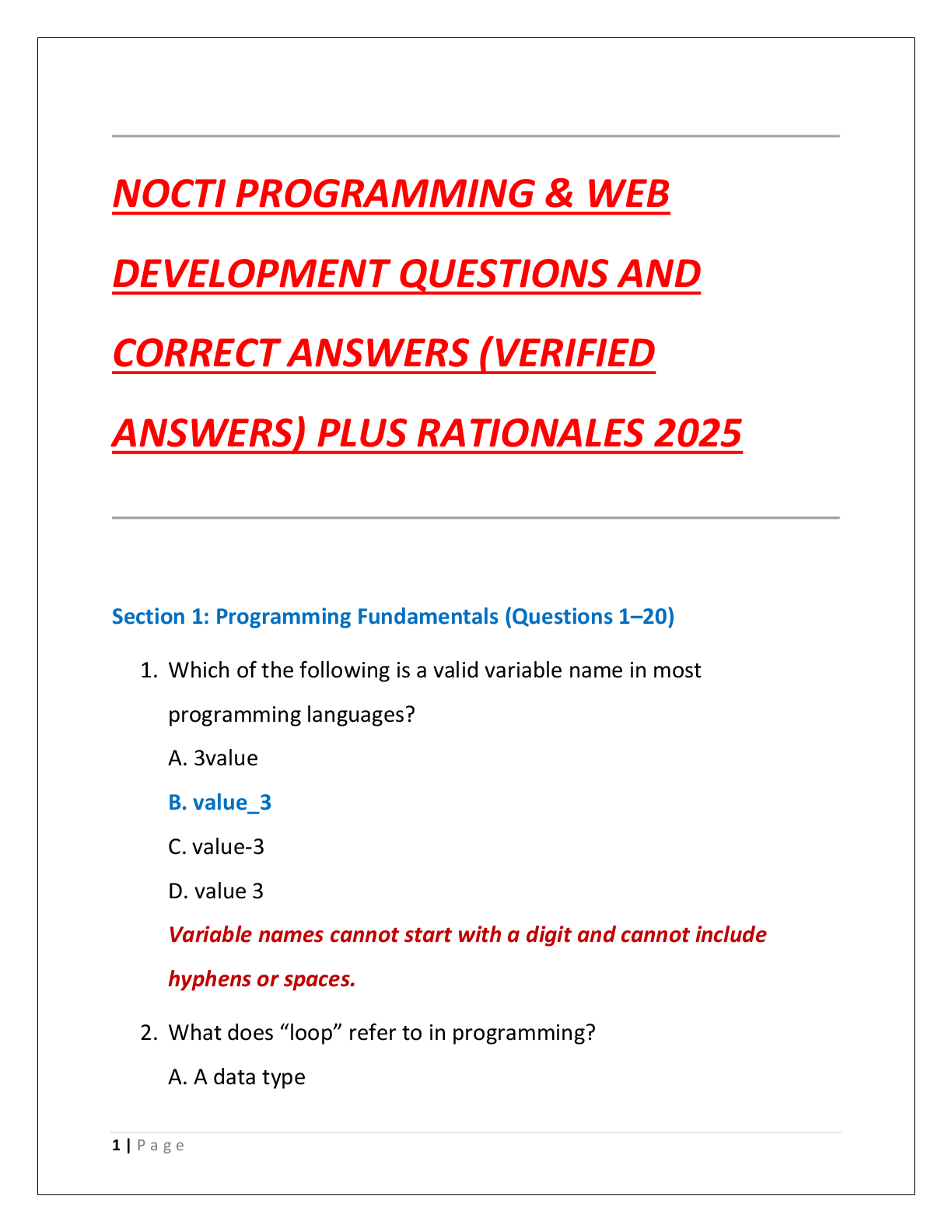

NOCTI PROGRAMMING & WEB DEVELOPMENT QUESTIONS AND CORRECT ANSWERS (VERIFIED ANSWERS) PLUS RATIONALES 2025

$ 15

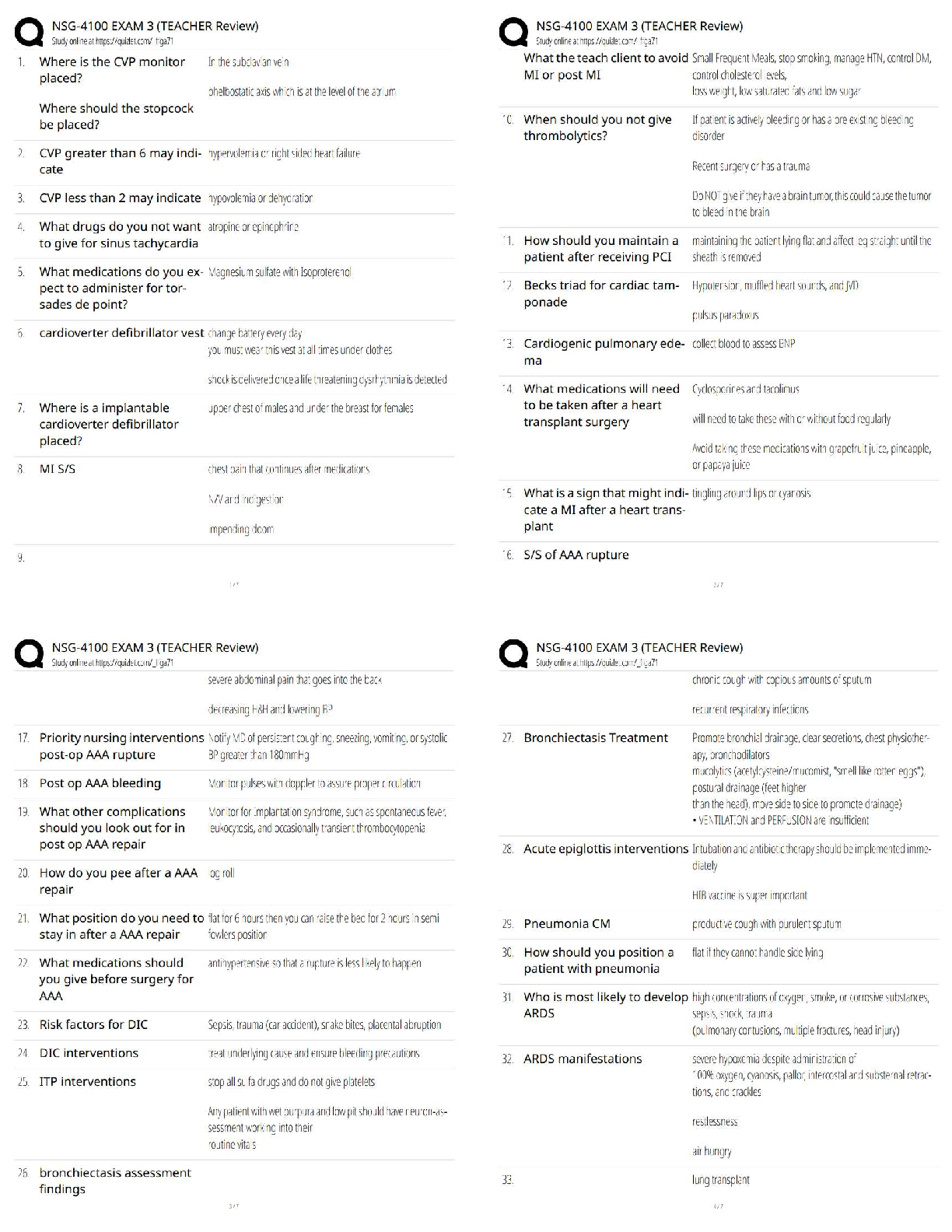

2024 HESI Cardiovascular Disorders Exam Guaranteed A+ Actual Questions and Answers, Complete 100%

$ 14

ASVAB Study Guide-2022-2023

$ 11

data and data management study guide

$ 8

eBook ioremediation and Phytoremediation Technologies in Sustainable Soil Management, Volume 4,1st Edition By Junaid Ahmad Malik, Megh R.Goyal, Khursheed Ahmad Wani

$ 30

eBook Urinalysis in the Dog and Cat Primera 1st Edition By Dennis J. Chew,Patricia A. Schenck

$ 30

Dalisay Edwards OBGYN

$ 12.5

INDR 372 Production Planning and Control _INDR 372 Review Exercises for the Midterm Exam.

$ 6.5

nur 150 test 3 guide

$ 15

Sampling Design and Analysis 2nd Edition Solution Manual

$ 24

IVY SOFTWARE BUSINESS MATH AND STATISTICS EXAM 2024 NEWEST COMPLETE 200 QUESTIONS AND CORRECT DETAILED ANSWERS (VERIFIED ANSWERS) ALREADY GRADED A+ BRAND NEW!!

$ 18

eBook Formal Methods, 26th International Symposium, FM 2024, Milan, Italy, September Proceedings, Part I: 14933, 1st edition by André Platzer, Kristin Yvonne Rozier, Matteo Pradella

$ 30

BIOD 171 EXAM MODULE 4

$ 11

[eBook][PDF] Modern Database Management, 12th Edition By Jeffrey Hoffer, Ramesh Venkataraman, Heikki Topi

$ 14.5

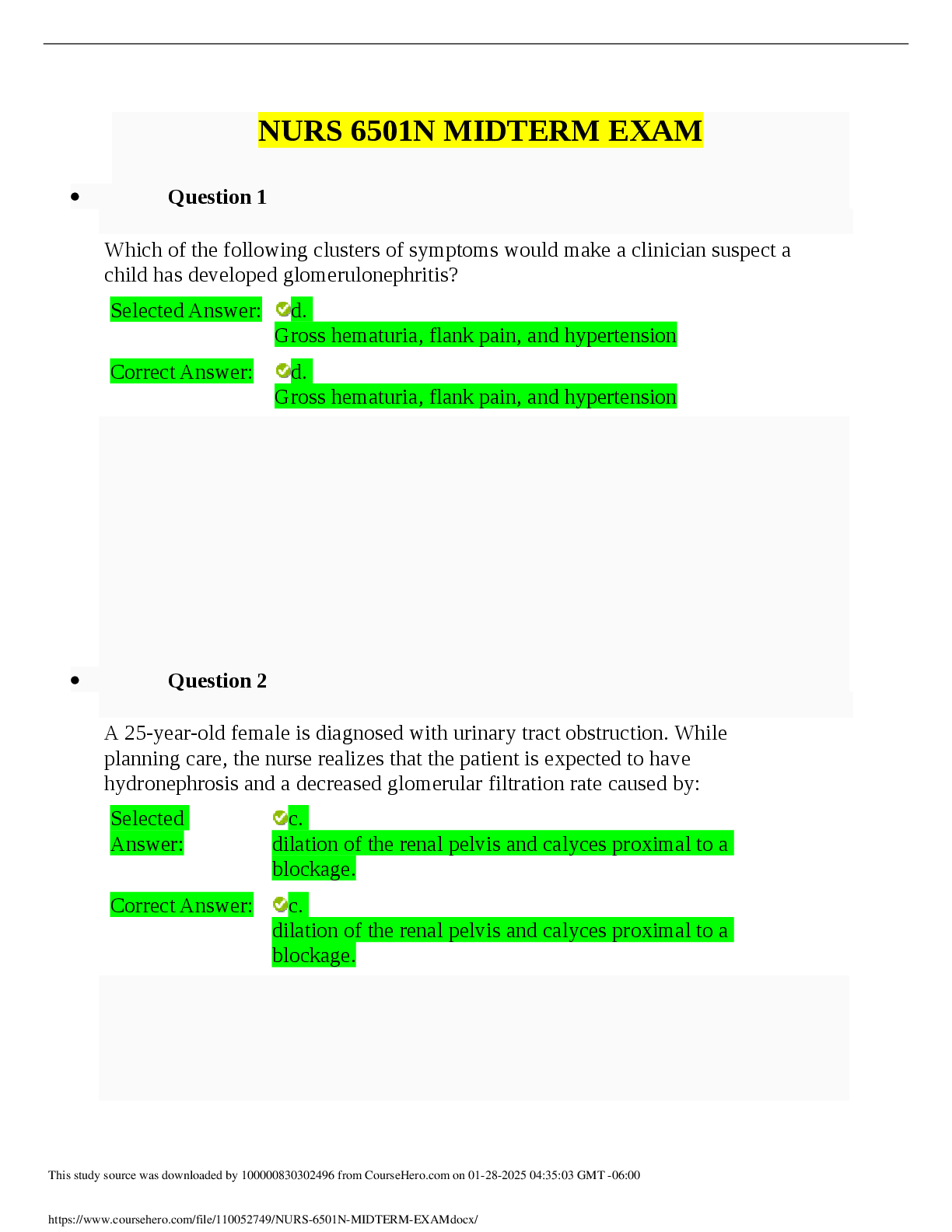

NURS 6501N MIDTERM EXAM

$ 15

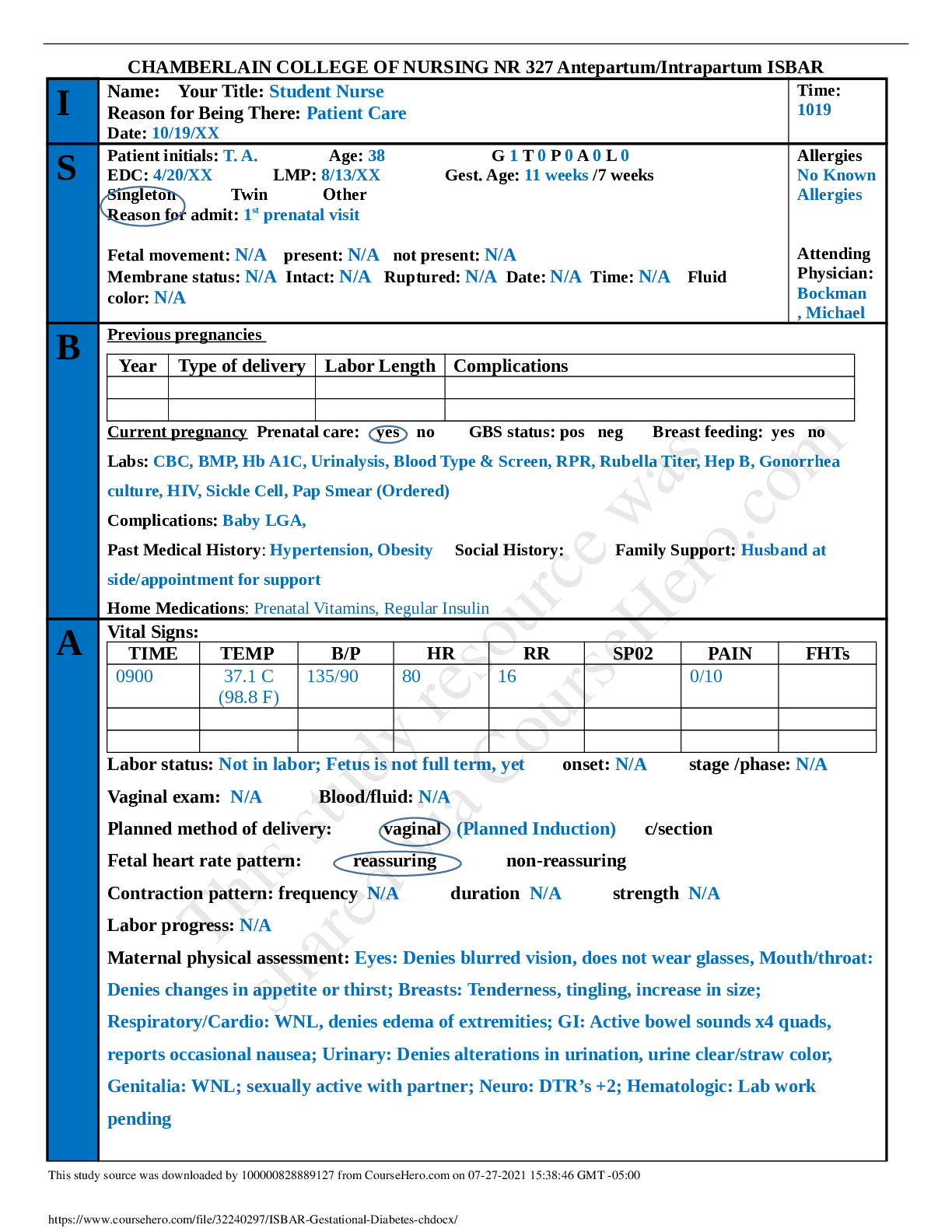

ISBAR_Gestational Diabetes

$ 9.5

E book Bioelectronics and Medical Devices Applications and Technology 1st Edition by Garima Srivastava Manju Khari

$ 29

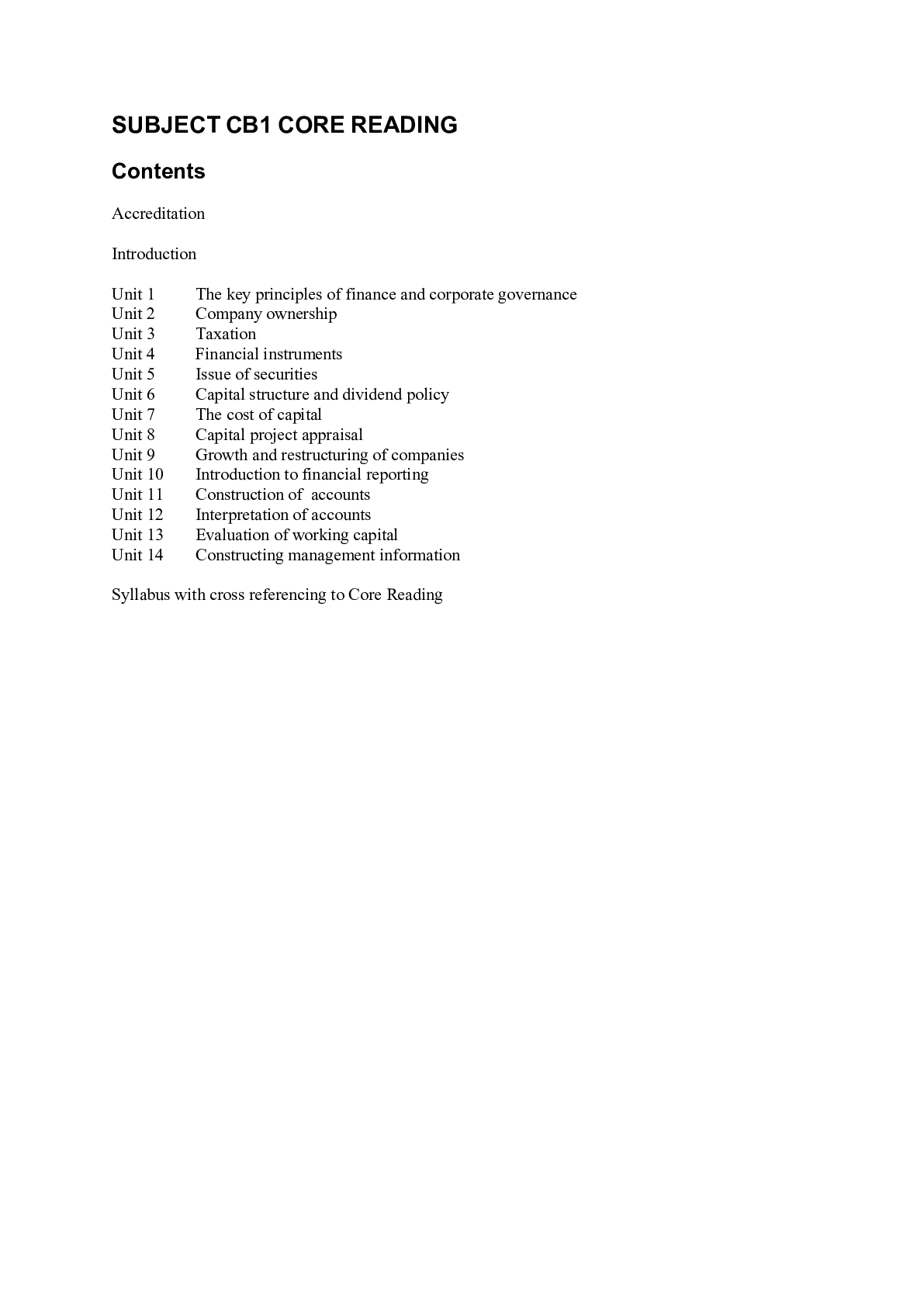

CB1_Core_Reading_IFoA_2020_Final

$ 14

Comprehensive shadow health assessment notes

$ 11

ebook Data-Driven Science and Engineering: Machine Learning, Dynamical Systems, and Control 2nd Edition By Steven L. Brunton, J. Nathan Kutz

$ 29

NURS 6560 FINAL EXAM

$ 9.5

NR 547 Midterm Study Guide

$ 15

test bank for Language culture and communication 7th edition by bonvillain, All Chapters Included ·

$ 15

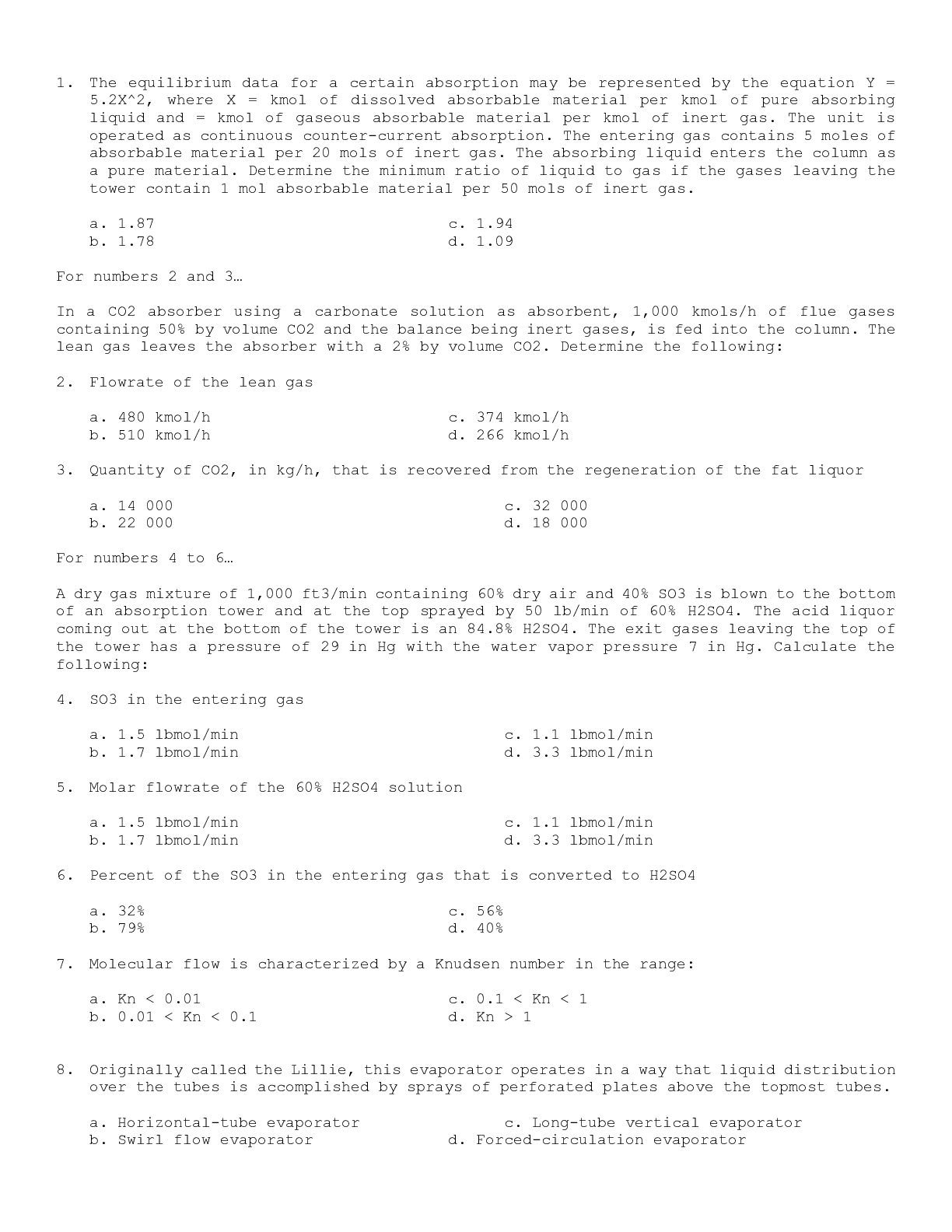

Day_2__200_items. | Download for quality grades |

$ 10

eBook Water and Wastewater Engineering Technology 1st Edition By Subhash Verma

$ 30

ATI RN COMPREHENSIVE EXIT EXAM STUDY GUIDE FOR EXAM PREPARATION

$ 14.5

SEC 571 Week 8 Final Exam - Graded An A+

$ 8

HESI A2 MATH FILES-CHRISJAY FILES

$ 20

NR 599 Midterm Review( Complete Solution Rated A)

$ 17

ATI PN COMPREHENSIVE PREDICTOR FORMB 2020 STUDYGUIDE

$ 11

Test Bank For College Physics, 11th Edition By Raymond Serway, Chris Vuille

$ 26

eBook Biotechnology for Toxicity Remediation and Environmental Sustainability 1st Edition By K. M. Gothandam, Ramachandran Srinivasan, Shivendu Ranjan, Nandita Dasgupta

$ 30

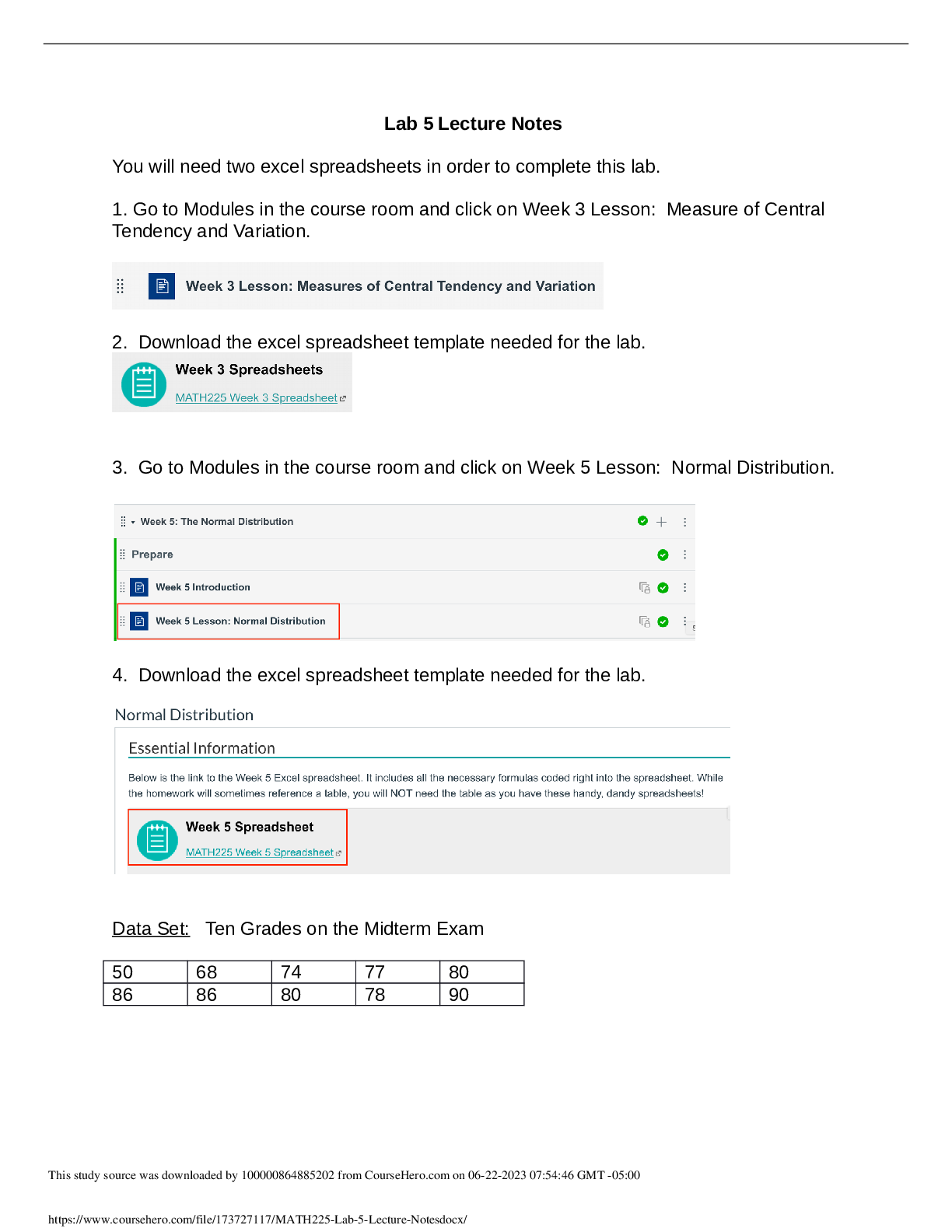

MATH225 Lab 5 Lecture Notes

$ 10

.png)

Milestone Chapter 04 Assessment and Care of Patients with Pain (Concepts for Interprofessional Collaborative Care College Test Bank)

$ 12

COLL 101 Sophia learning_College_Readiness_Test_1 {2020} - University of Phoenix | COLL101 Sophia learning_College_Readiness_Test_1 {2020}

$ 10.5

Assignment IX.6 Codominance New.

$ 14.5

Medication Aide TEST

$ 10

UNIV 104 learnsmart assignment week 1 self assessment Liberty University answers