Finance > AQA QUESTION and MARK SCHEMES > Georgia State University ( FINANCE FI3300 ) Updated Finance for A+ (All)

Georgia State University ( FINANCE FI3300 ) Updated Finance for A+

Document Content and Description Below

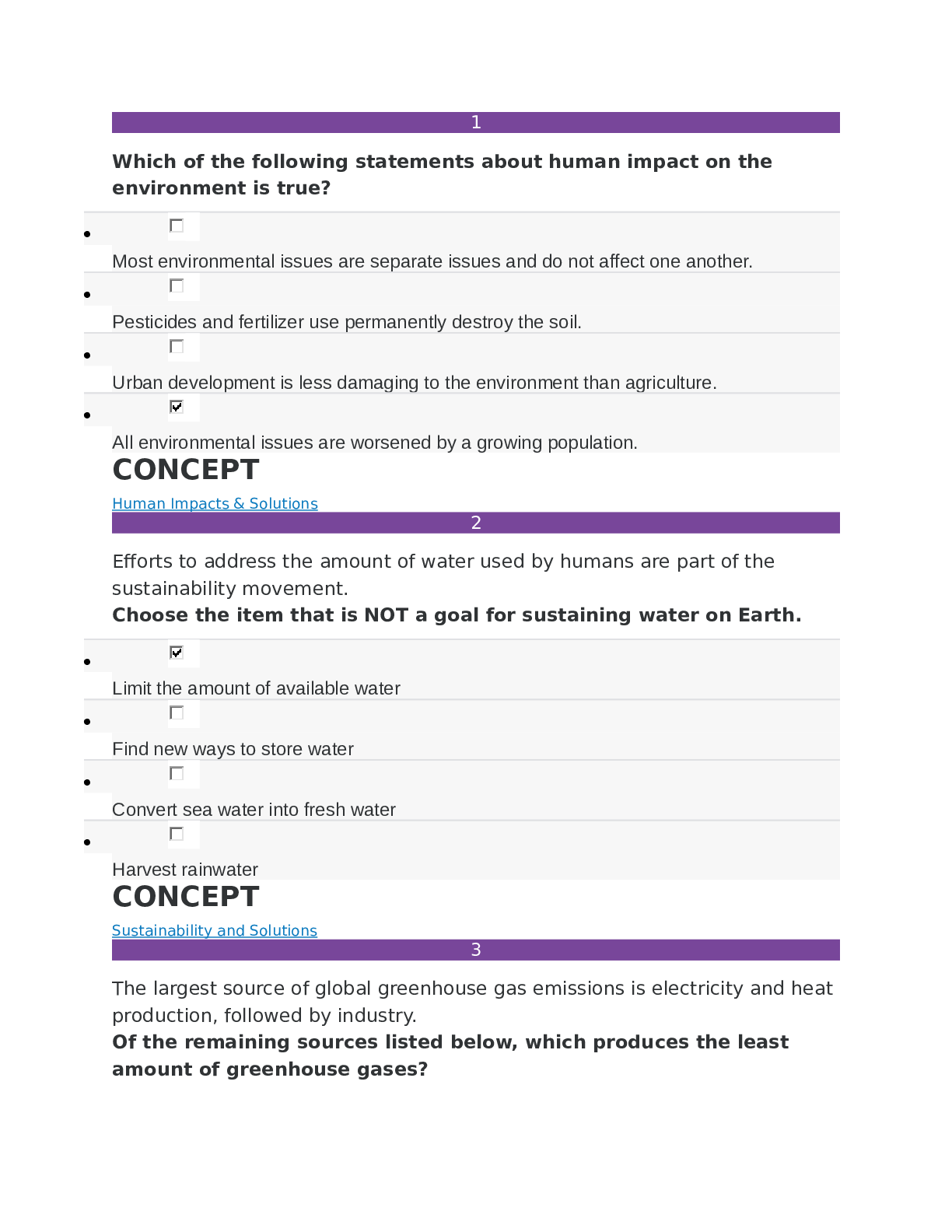

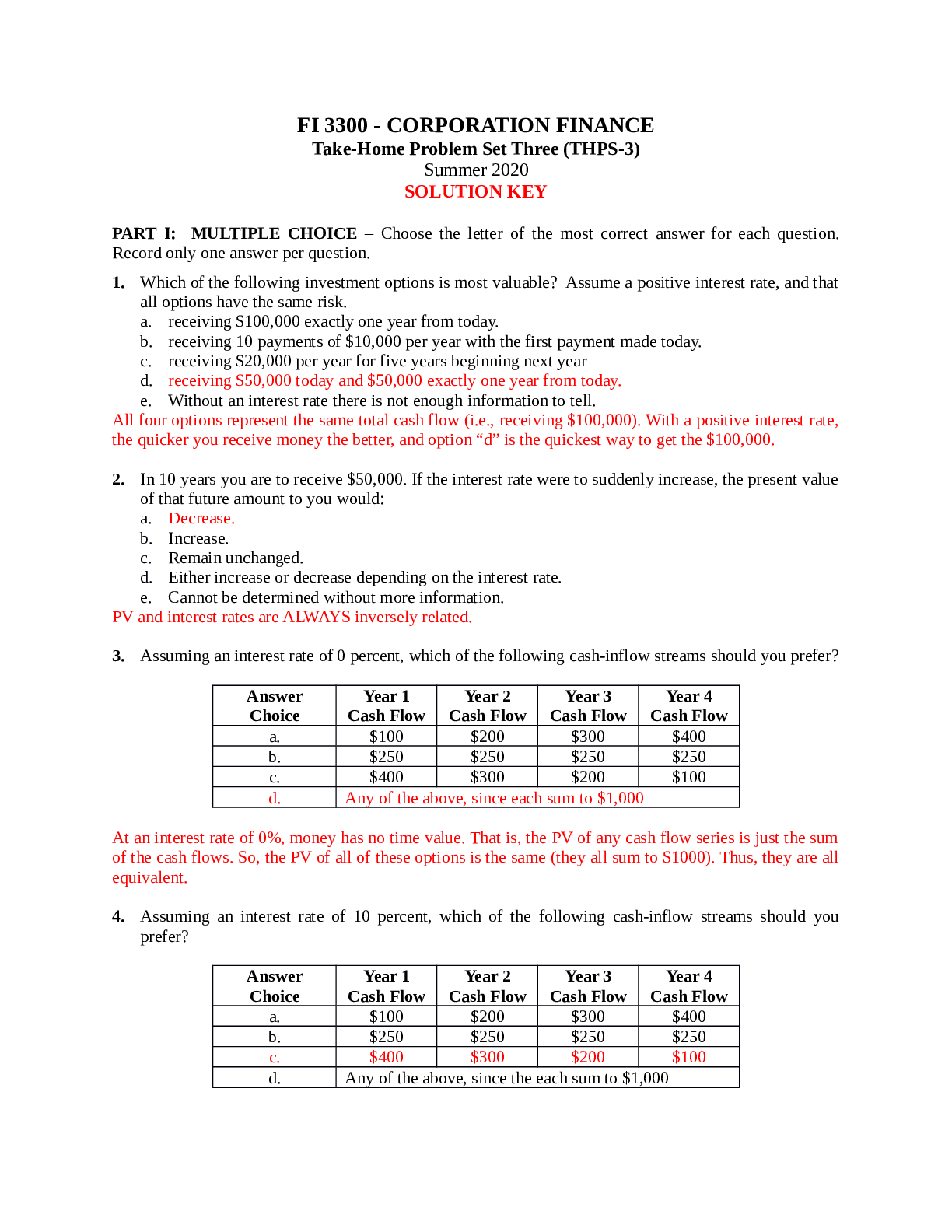

PART I: MULTIPLE CHOICE – Choose the letter of the most correct answer for each question. Record only one answer per question. 1. Which of the following investment options is most valuable? Assume... a positive interest rate, and that all options have the same risk. a. receiving $100,000 exactly one year from today. b. receiving 10 payments of $10,000 per year with the first payment made today. c. receiving $20,000 per year for five years beginning next year d. receiving $50,000 today and $50,000 exactly one year from today. e. Without an interest rate there is not enough information to tell. All four options represent the same total cash flow (i.e., receiving $100,000). With a positive interest rate, the quicker you receive money the better, and option “d” is the quickest way to get the $100,000. 2. In 10 years you are to receive $50,000. If the interest rate were to suddenly increase, the present value of that future amount to you would: a. Decrease. b. Increase. c. Remain unchanged. d. Either increase or decrease depending on the interest rate. e. Cannot be determined without more information. PV and interest rates are ALWAYS inversely related. 3. Assuming an interest rate of 0 percent, which of the following cash-inflow streams should you prefer? Answer Choice Year 1 Cash Flow Year 2 Cash Flow Year 3 Cash Flow Year 4 Cash Flow a. $100 $200 $300 $400 b. $250 $250 $250 $250 c. $400 $300 $200 $100 d. Any of the above, since each sum to $1,000 At an interest rate of 0%, money has no time value. That is, the PV of any cash flow series is just the sum of the cash flows. So, the PV of all of these options is the same (they all sum to $1000). Thus, they are all equivalent. 4. Assuming an interest rate of 10 percent, which of the following cash-inflow streams should you prefer? Answer Choice Year 1 Cash Flow Year 2 Cash Flow Year 3 Cash Flow Year 4 Cash Flow a. $100 $200 $300 $400 b. $250 $250 $250 $250 c. $400 $300 $200 $100 d. Any of the above, since the each sum to $1,000 All four options represent the same total cash flow (i.e., receiving $1000). With a positive interest rate, the quicker you receive money the better. Option “c” represents the quickest way to get the $1000 amount [Show More]

Last updated: 2 years ago

Preview 1 out of 11 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$5.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Oct 30, 2022

Number of pages

11

Written in

Additional information

This document has been written for:

Uploaded

Oct 30, 2022

Downloads

0

Views

74