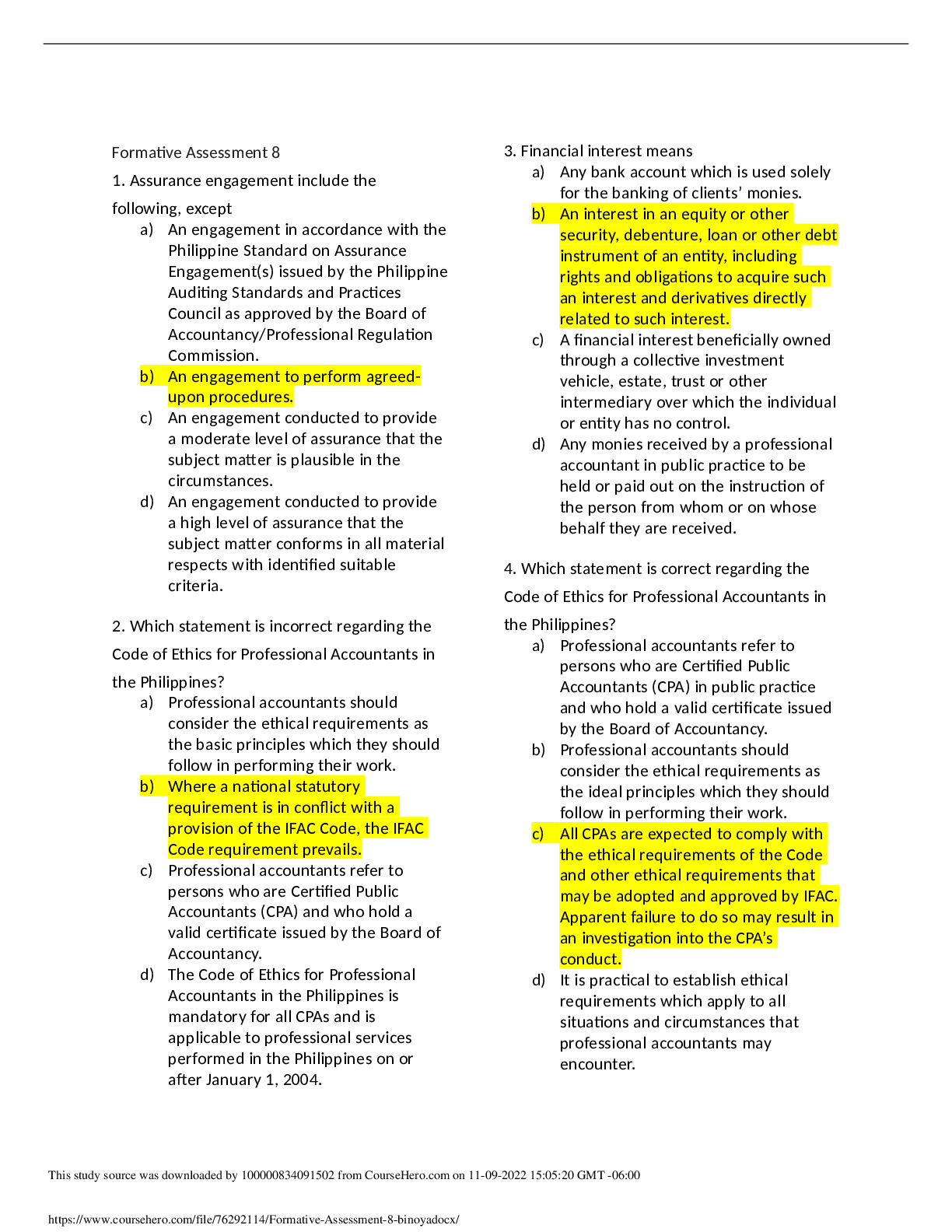

Formative Assessment 8

1. Assurance engagement include the

following, except

a) An engagement in accordance with the

Philippine Standard on Assurance

Engagement(s) issued by the Philippine

Auditing Standards and

...

Formative Assessment 8

1. Assurance engagement include the

following, except

a) An engagement in accordance with the

Philippine Standard on Assurance

Engagement(s) issued by the Philippine

Auditing Standards and Practices

Council as approved by the Board of

Accountancy/Professional Regulation

Commission.

b) An engagement to perform agreed�upon procedures.

c) An engagement conducted to provide

a moderate level of assurance that the

subject matter is plausible in the

circumstances.

d) An engagement conducted to provide

a high level of assurance that the

subject matter conforms in all material

respects with identified suitable

criteria.

2. Which statement is incorrect regarding the

Code of Ethics for Professional Accountants in

the Philippines?

a) Professional accountants should

consider the ethical requirements as

the basic principles which they should

follow in performing their work.

b) Where a national statutory

requirement is in conflict with a

provision of the IFAC Code, the IFAC

Code requirement prevails.

c) Professional accountants refer to

persons who are Certified Public

Accountants (CPA) and who hold a

valid certificate issued by the Board of

Accountancy.

d) The Code of Ethics for Professional

Accountants in the Philippines is

mandatory for all CPAs and is

applicable to professional services

performed in the Philippines on or

after January 1, 2004.

3. Financial interest means

a) Any bank account which is used solely

for the banking of clients’ monies.

b) An interest in an equity or other

security, debenture, loan or other debt

instrument of an entity, including

rights and obligations to acquire such

an interest and derivatives directly

related to such interest.

c) A financial interest beneficially owned

through a collective investment

vehicle, estate, trust or other

intermediary over which the individual

or entity has no control.

d) Any monies received by a professional

accountant in public practice to be

held or paid out on the instruction of

the person from whom or on whose

behalf they are received.

4. Which statement is correct regarding the

Code of Ethics for Pro

[Show More]