History > CASE STUDY > Transocean and the History of Tax Inversions (All)

Transocean and the History of Tax Inversions

Document Content and Description Below

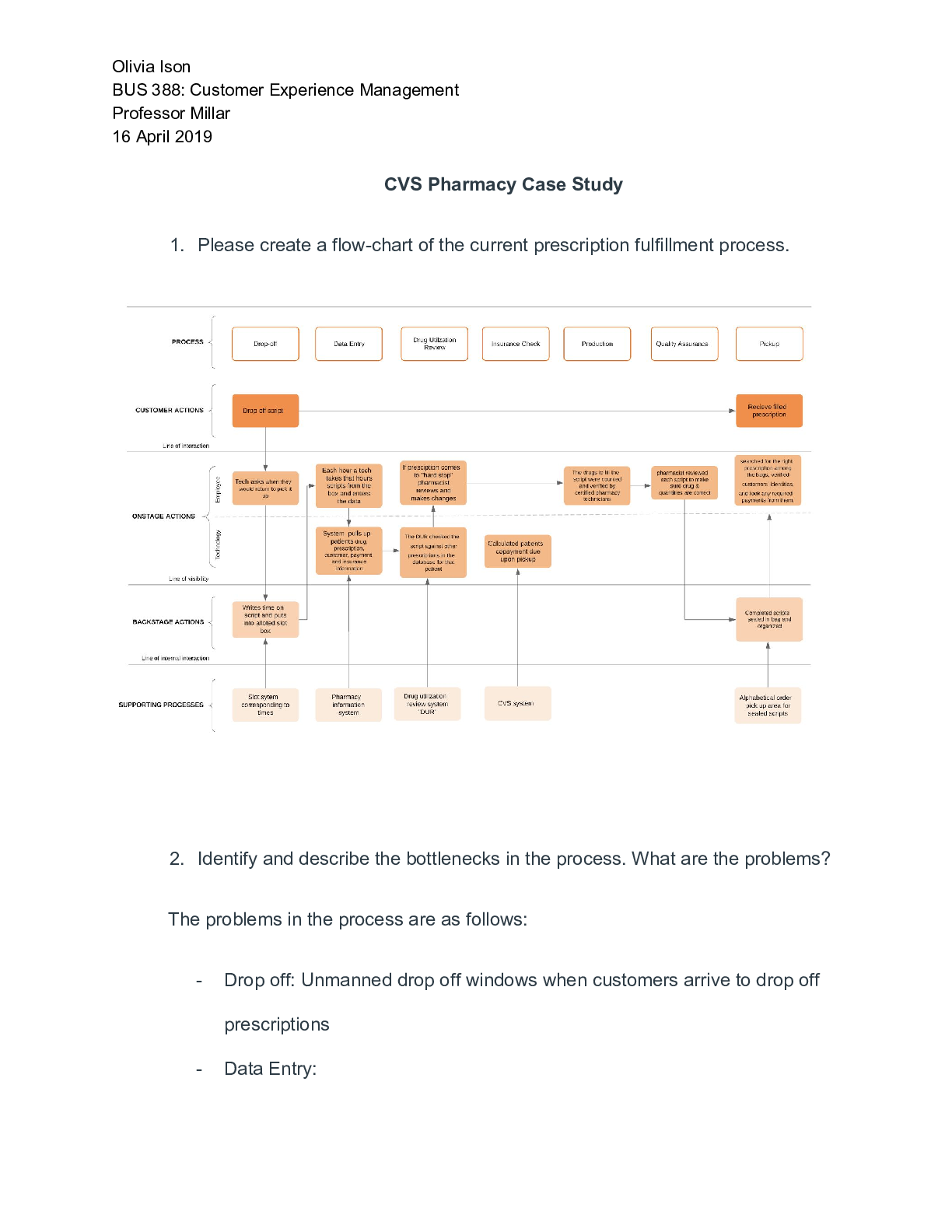

Transocean and the History of Tax Inversions Abstract Significant media and political attention has focused on tax inversions by U.S. multinational corporations, and the U.S. government has taken s ... everal actions to limit inversion activity. Transocean was one of the earliest companies to complete a tax inversion. Students use this transaction to understand the structure of the U.S. tax code and the reasons that companies complete a tax inversion. Students also learn about the structure of inversion transactions and how they have changed over time as the U.S. government has attempted to limit these transactions. Students also assess the tax and economic impacts of these transactions to make policy recommendations. Transocean and the History of Tax Inversions INTRODUCTION Inversion transactions have increasingly been in the news and the subject of political debate in recent years. Although a comparatively small number of inversion transactions have been completed, the increasing size and frequency of these transactions has made them a political target. When properly structured, inversions are legal transactions. However, critics argue that inversions result in significant loss of tax revenue to the U.S. federal government during a time of large budget deficits. Proponents argue that inversions are a response to high U.S. corporate tax rates. In one of the earliest examples of an inversion to reduce a U.S. multinational company’s tax rate, in 1999 Transocean, Ltd. moved its place of incorporation from the United States (U.S.) to the Cayman Islands.1 In a tax inversion transaction, a U.S. company reorganizes its structure so that the parent of a group of companies is a foreign corporation, rather than a U.S. corporation (Marpelles and Gravelle 2014). Several other companies in the oil field services industries quickly followed with their own inversions. These early inversions were usually so-called “naked inversions” that were paper transactions that did not involve any change in operations, and were accomplished by creating a corporate parent in a tax haven, usually Bermuda or the Cayman Islands. Politicians and others were critical of these tax inversions because of their potential negative impact on the U.S. tax base, and because they seemed unpatriotic during the period immediately following the September 11, 2001 terrorist attacks. 1 Although not a household name, Transocean entered the public eye as owner of the Deepwater Horizon oil rig operated by BP that exploded in 2010 and leaked millions of barrels of oil into the Gulf of Mexico. 1 In response, in 2003 the U.S. congress passed Internal Revenue Code (IRC) Section 7874 to restrict corporate inversions. IRC Section 7874 indicated the U.S. would tax an inverted entity as a domestic corporation if the same shareholders held 80 percent or more of the firm’s stock before and after the inversion (Webber 2011). Although IRC Section 7874 did not prohibit inversions, it did slow the practice by effectively preventing paper inversions in tax havens such as Bermuda and the Cayman Islands. Howev [Show More]

Last updated: 3 years ago

Preview 1 out of 17 pages

.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$7.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Nov 26, 2022

Number of pages

17

Written in

All

Additional information

This document has been written for:

Uploaded

Nov 26, 2022

Downloads

0

Views

94

.png)

.png)

.png)