Finance > SOLUTIONS MANUAL > CHAPTER SOLUTIONS > Tax 3. Unit 2. Chapter 4 Chapter 4. Introduction to Corporate Income Taxation. (All)

CHAPTER SOLUTIONS > Tax 3. Unit 2. Chapter 4 Chapter 4. Introduction to Corporate Income Taxation.

Document Content and Description Below

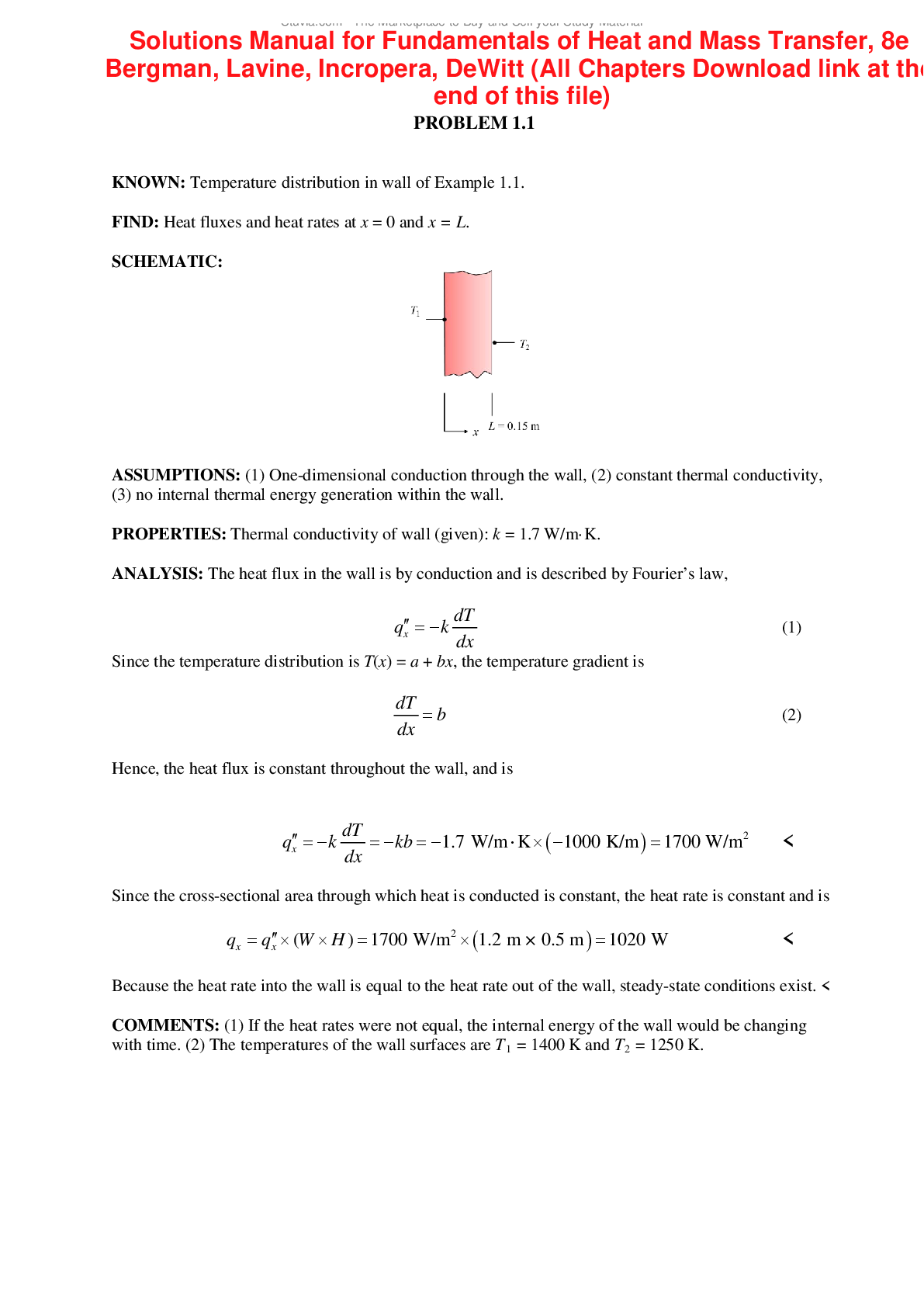

Tax 3. Unit 2. Chapter 4 Chapter 4. Introduction to Corporate Income Taxation I. Corporate Income Taxpayers Corporation -Includes partnerships, no matter how created or organized, joint-stock comp ... anies, joint accounts, associations, or insurance companies. -Excludes general professional partnerships and joint ventures or consortium formed for the purpose of undertaking construction projects or engaging in petroleum, coal, geothermal, and other energy operations pursuant to an operating consortium agreement under a service contract with the Government. II. General Classification and Taxation of Corporations Classification Within Without Tax Rate and Tax Base Domestic Corporation ✔ ✔ 20% or 25% regular corporate tax subject to Minimum Corporate Income Tax Resident Foreign ✔ ? 25% regular corporate tax subject to Minimum Corporate Income Tax Non-Resident Foreign Corporation ✔ ? 25% final tax on Philippine gross income NOTE:• Effectivity of the RCIT rates under CREATE; RR 5-2021: - For DC and RFC -Beginning July 1, 2020 -20% or 25% - For NRFC -Beginning January 1, 2021. -25% •CREATE law, which was published on March 27, 2021, took effect on April11, 2021. Although CREATE law took effect only on April 11, 2021, there are certain provisions in the law with specific effectivity dates which are earlier than April 11, 2021, such as the revised RCIT rates for DCs and RFCS as well as the revised FWT rate for NRFCS.• Illustration: A corporation with 100M assets had the following income and expenses for 2022 [Show More]

Last updated: 2 years ago

Preview 1 out of 16 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$4.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jan 18, 2023

Number of pages

16

Written in

All

Additional information

This document has been written for:

Uploaded

Jan 18, 2023

Downloads

0

Views

87