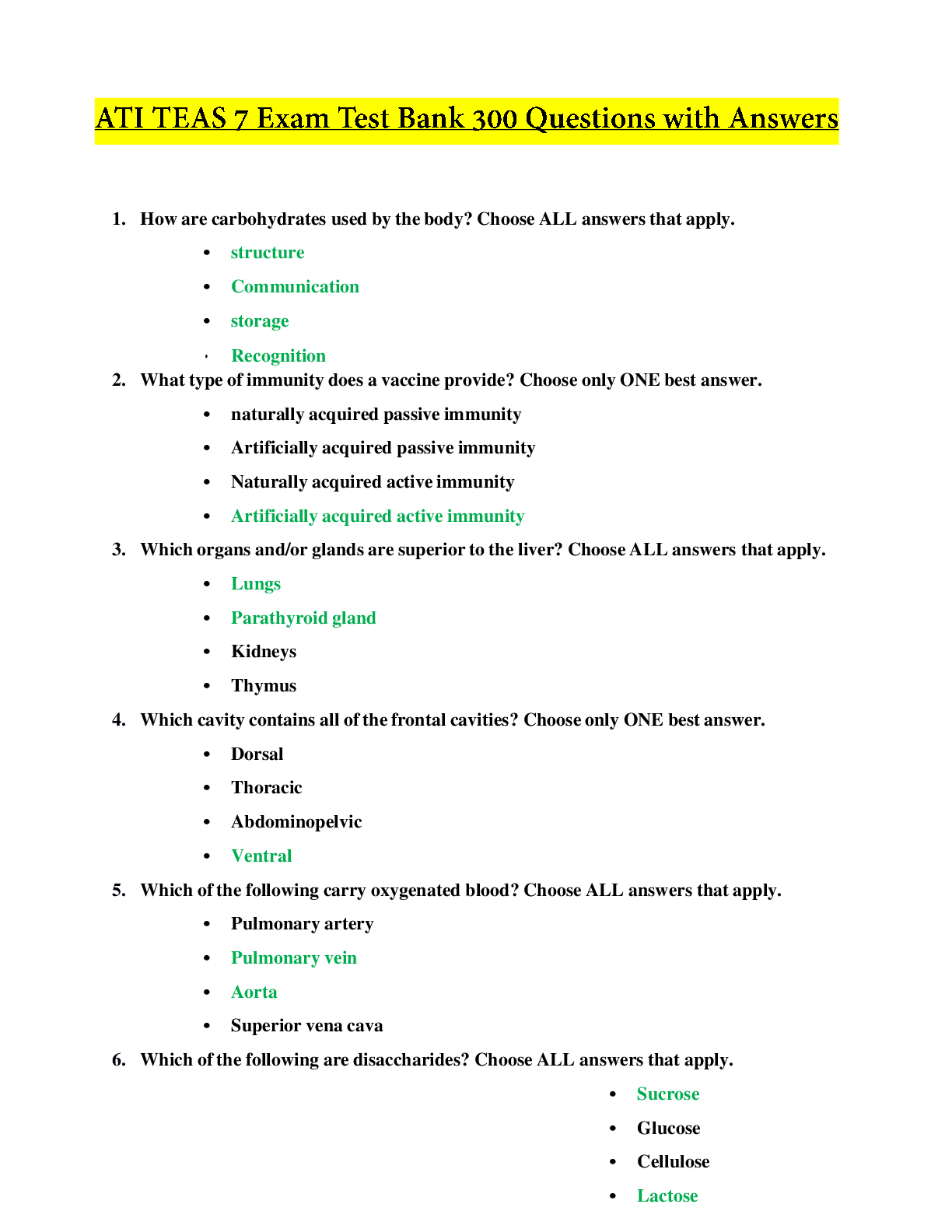

Financial Accounting > EXAMs > ACC 350 FINAL EXAM REVIEW (Questions & Answers) (All)

ACC 350 FINAL EXAM REVIEW (Questions & Answers)

Document Content and Description Below

A favorable sales volume variance in sales revenue suggests a(n) ________. A. increase in actual sales price per unit as compared to budgeted sales price B. decrease in actual fixed costs C. i ... ncrease in actual variable cost per unit as compared to expected variable cost per unit D. increase in number of actual units sold when compared to the expected number of units sold Five Seasons is a merchandiser of packed foods. The company provides the following information for the year: Sales Revenue $141,000 Cost of Goods Sold 60,000 Operating Expenses 66,000 Net Income 15,000 Number of Units Sold 23,000 How much was the unit cost per item of product sold? (Round your answer to the nearest cent.) A. $100.65 B. $6.13 C. $5.48 D. $2.61 The vertical analysis statement of Peterson, Inc. is as shown below: Peterson, Inc. Comparative Income Statement Years Ended December 31, 2017 and 2016 (In millions) 2017 Percent of Total 2016 Percent of Total Net Sales $6,355 100.0% $4,920 100.0% Cost of Goods Sold 3,370 53.0 2,200 44.7 Gross Profit 2,985 47.0 2,720 55.3 Operating Expenses: Selling Expenses 675 10.6 580 11.8 Administrative expenses 410 6.5 425 8.6 Total Operating Expenses 1,085 17.1 1,005 20.4 Operating Income 1,900 29.9 1,715 34.9 Other Revenues and (Expenses): Interest Revenue 0 0 0 0.0 Interest Expense (400) (6.3) (695) (14.1) Total Revenues and (Expenses) (400) (6.3) (695) (14.1) Income Before Income Taxes 1,500 23.6 1,020 20.7 Income Tax Expense 230 3.6 210 4.3 Net Income $1,270 20.0% $810 16.5% The 20% shown for net income in 2017 signifies that net income _______. A. is 20% of gross profit B. is 20% of net sales revenues C. increased by 20% over the previous year D. equals 20 times of the income before income tax Caty Couture sells designer shirts for $43 per shirt. It incurs monthly fixed costs of $7,000. The contribution margin ratio is calculated to be 20%. What is the breakeven point in units? A. 131 units B. 814 units C. 163 units D. 5,600 units The following details are provided by a manufacturing company: Product line Investment $1,190,000 Useful life 12 years Estimated annual net cash inflows for first year $400,000 Estimated annual net cash inflows for second year $390,000 Estimated annual net cash inflows for next ten years $490,000 Residual value $90,000 Depreciation method Straightminusline Required rate of return 12% Calculate the payback period for the investment. (Round your answer to two decimal places.) A. 2.98 years B. 2.82 years C. 1.98 years D. 2.20 years Gloria's Bakery sells three large muffins for every two small ones. A small muffin sells for $6 with a variable cost of $2. A large muffin sells for $8 with a variable cost of $2.50. What is the weighted-average contribution margin? (Round your intermediate calculations to one decimal place.) A. $4.90 per muffin B. $5.50 per muffin C. $4.00 per muffin D. $4.75 per muffin Which of the following describes the production budget? A. It provides the quantity of finished goods to be produced during a budget period. B. It aids in planning to ensure the company has adequate inventory and cash on hand. C. It helps in planning to ensure the business has adequate cash. D. It depicts the breakdown of sales on the basis of terms and conditions of collection of sales revenue. Manufacturing overhead includes all manufacturing costs, such as direct labor and direct materials. True False False The management of Vert Lawnmowers has calculated the following variances: Direct materials cost variance $11,000 U Direct materials efficiency variance 36,000 F Direct labor cost variance 17,000 F Direct labor efficiency variance 14,000 U Variable overhead cost variance 2,000 F Variable overhead efficiency variance 6,000 F Fixed overhead cost variance 3,500 F When determining the total production cost flexible budget variance, what is the total manufacturing overhead variance of the company? A. $8,000 F B. $6,000 F C. $11,500 F D. $3,500 F The net present value and internal rate of return methods are appropriate for longer-term investments because they ignore the time value of money. True False A favorable direct materials cost variance occurs when the actual direct materials cost incurred is greater than the standard direct materials cost. True False A flexible budget summarizes revenues and costs for various levels of sales volume within a relevant range. True False Glendale Brands Company uses standard costs for its manufacturing division. Standards specify 0.1 direct labor hours per unit of product. At the beginning of the year, the static budget for variable overhead costs included the following data: Production volume 6,300 units Budgeted variable overhead costs $13,500 Budgeted direct labor hours (DLHr) 630 hours At the end of the year, actual data were as follows: Production volume 4,000 units Actual variable overhead costs $15,400 Actual direct labor hours (DLHr) 495 hours What is the variable overhead efficiency variance? (Round any intermediate calculations to the nearest cent, and your final answer to the nearest dollar.) A. $2,955 U B. $2,036 U C. $2,955 F D. $2,036 F Neptune Company sold 2,200 units in November at a price of $45 per unit. The variable cost is $20 per unit. Calculate the total contribution margin. A. $99,000 B. $55,000 C. $143,000 D. $44,000 Fantabulous Products sells 2,200 kayaks per year at a price of $460 per unit. Fantabulous sells in a highly competitive market and uses target pricing. The company has $1,000,000 of assets, and the shareholders wish to make a profit of 17% on assets. Assume all products produced are sold. What is the target full product cost? A. $1,012,000 B. $842,000 C. $17,000,000 D. $1,184,040 Which of the following is used to determine how the sales revenue of a company has changed from one year to the next? A. vertical analysis of the balance sheet B. vertical analysis of the income statement C. horizontal analysis of the balance sheet D. horizontal analysis of the income statement Macaulay Roller Skates has three product--D, E, and F. The following information is available: D E F Sales revenue $80,000 $40,000 $31,000 Variable costs (40,000) (10,000) (12,000) Contribution margin $40,000 $30,000 $19,000 Fixed costs (20,000) (10,000) (25,000) Operating income (loss) $20,000 $20,000 $(6,000) The company is deciding whether to drop product line F because it has an operating loss. Assuming fixed costs are unavoidable, if Macaulay drops product line F and does not replace it, what effect will this have on operating income? A. Operating income will decrease $19,000. B. Operating income will increase $6,000. C. Operating income will increase $25,000. D. Operating income will increase $19,000. A quarterly report filed with the Securities and Exchange Commission is called a Form 10-K. True False The debt to equity ratio shows the proportion of total liabilities relative to total equity. True False Contribution margin is the difference between net sales revenue and variable costs. True False An annuity is a stream of equal cash payments made at equal time intervals. True False Smith Industries is considering replacing a machine that is presently used in its production process. Which of the following is irrelevant to the replacement decision? Old Machine Replacement Machine Original cost $55,000 $46,000 Remaining useful life in years 5 5 Current age in years 5 0 Book value $33,000 Current disposal value in cash $9,000 Future disposal value in cash (in 5 years) $0 $0 Annual cash operating costs $8,000 $4,000 Which of the information provided in the table is irrelevant to the replacement decision? A. the current disposal value of the old machine B. the annual cash operating costs C. the original cost of the old machine D. the sales price of the new machine Assume that Anna's cellphone service provider charges $6 per month and $0.4 per minute per call. If Anna's current bill is $80, how many calling minutes did Anna use? A. 200 minutes B. 185 minutes C. 220 minutes D. 170 minutes An unfavorable variance means more cost has been incurred than planned. True False The production budget is the first component of the operating budget. True False Managerial accounting reporting by a public firm is required to follow the rules of GAAP and guidelines of the Securities and Exchange Commission. True False Custom Furniture manufactures a small table and a large table. The small table sells for $800, has variable costs of $540 per table, and takes 10 direct labor hours to manufacture. The large table sells for $1,620, has variable costs of $1,000, and takes eight direct labor hours to manufacture. Calculate the contribution margin per direct labor hour for the small table. A. $54 per direct labor hour B. $260 per direct labor hour C. $26 per direct labor hour D. $62 per direct labor hour The following details are provided by Doppler Company: Initial investment $2,020,000 Discount rate 12% Yearly cash flows 1 $734,000 2 $596,000 3 $596,000 4 $596,000 5 $734,000 Present Value of $1: 10% 11% 12% 13% 1 0.909 0.901 0.893 0.885 2 0.826 0.812 0.797 0.783 3 0.751 0.731 0.712 0.693 4 0.683 0.659 0.636 0.613 5 0.621 0.593 0.567 0.543 Calculate the NPV of the project. A. $959,500 B. $330,060 C. $252,500 D. $1,015,050 Which of the following statements is true of the budgeting process? A. It is a continuous process that encourages communication. B. Managers and employees are motivated to accept the budget's goals because they enjoy having their work monitored and evaluated. C. If a company carefully plans for its future, there will be no need to make modifications during the budget period. D. It shows the actual performance of the business. South State, Inc. used $150,000 of direct materials and incurred $63,000 of direct labor costs during the year. Indirect labor amounted to $270,000, while indirect materials used totaled $52,500. Other operating costs pertaining to the factory included utilities of $133,500; maintenance of $74,880; repairs of $53,100; depreciation of $131,000; and property taxes of $74,120. There was no beginning or ending finished goods inventory, but Work-in-Process inventory began the year with a $5,600 balance and ended the year with a $7,500 balance. How much is the cost of goods manufactured? A. $13,100 B. $1,007,700 C. $1,000,200 D. $1,002,100 e-Shop, Inc. has net sales on account of $1,600,000. The average net accounts receivable are $620,000. Calculate the days' sales in receivables. (Round any intermediate calculations and your final answer to two decimal places.) A. 313.90 days B. 2.58 days C. 141.47 days D. 365.00 days The breakeven point is the point where the sales revenues are equal to the fixed costs. True False Drenning Timber Products has estimated the following amounts for its next fiscal year: Total fixed expenses $834,500 Sale price per unit 41 Variable expenses per unit 30 What will happen to the breakeven point (in units) if Drenning can reduce fixed expenses by $22,500? A. The breakeven point will decrease by 549 units. B. The breakeven point will increase by 549 units. C. The breakeven point will decrease by 750 units. D. The breakeven point will decrease by 2,046 units. The residual value is discounted as a single lump sum because it will be received only once, when the asset is sold. True False Manufacturing companies have inventory accounts, but merchandising companies do not. True False Nobula Corp. is preparing their budget for the second quarter and provides the following data: Apr May Jun Budgeted purchases of direct materials $20,000 $24,000 $23,000 Budgeted Cash Payments for Purchases of direct materials Apr May Jun 40% of previous month purchases $6,000 $8,000 $9,600 60% of current month purchases 12,000 14,400 13,800 Total cash payments $18,000 $22,400 $23,400 Assume that accounts payable pertains only to suppliers of inventory. Based on the above data, the amount of Accounts Payable that should be shown in the budgeted balance sheet as of June 30 is ________. A. $13,800 B. $9,200 C. $23,400 D. $9,600 Given the following information, determine the cost of goods sold. Direct Labor Incurred $61,000 Manufacturing Overhead Incurred 177,000 Direct Materials Used 155,000 Finished Goods Inventory, Jan. 1 198,000 Finished Goods Inventory, Dec. 31 97,500 Work-in-Process Inventory, Jan. 1 221,500 Work-in-Process Inventory, Dec. 31 109,000 A. $606,000 B. $505,500 C. $614,500 D. $295,500 Davis Naturals manufactures bulk quantities of cleaning fluids. It currently sells 1,300 containers a month at a sales price of $16 per unit. If a new fragrance is added, $18 per unit could be charged for the improved product. It would cost a total of $1,000 per month to make that alteration. Operating income would ________. A. increase by $2,600 B. increase by $1,600 C. decline by $2,600 D. decline by $1,000 Diemans Corp. has provided a part of its budget for the second quarter: Apr May Jun Cash collections $40,000 $40,000 $43,000 Cash payments: Purchases of direct materials 7,000 7,000 4,500 Operating expenses 6,000 9,000 7,000 Capital expenditures 20,000 4,000 4,600 The cash balance on April 1 is $14,000. Assume that there will be no financing transactions or costs during the quarter. Calculate the projected cash balance at the end of April. A. $41,000 B. $54,000 C. $21,000 D. $67,900 An efficiency variance measures how well the business uses its materials or human resources. True False [Show More]

Last updated: 2 years ago

Preview 1 out of 17 pages

.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$15.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Feb 06, 2023

Number of pages

17

Written in

All

Additional information

This document has been written for:

Uploaded

Feb 06, 2023

Downloads

0

Views

128

.png)

.png)

(Q&A).png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)