Financial Accounting > EXAM > ACC-350 Quiz 2 [Chapter 21] (Q&A Review) (All)

ACC-350 Quiz 2 [Chapter 21] (Q&A Review)

Document Content and Description Below

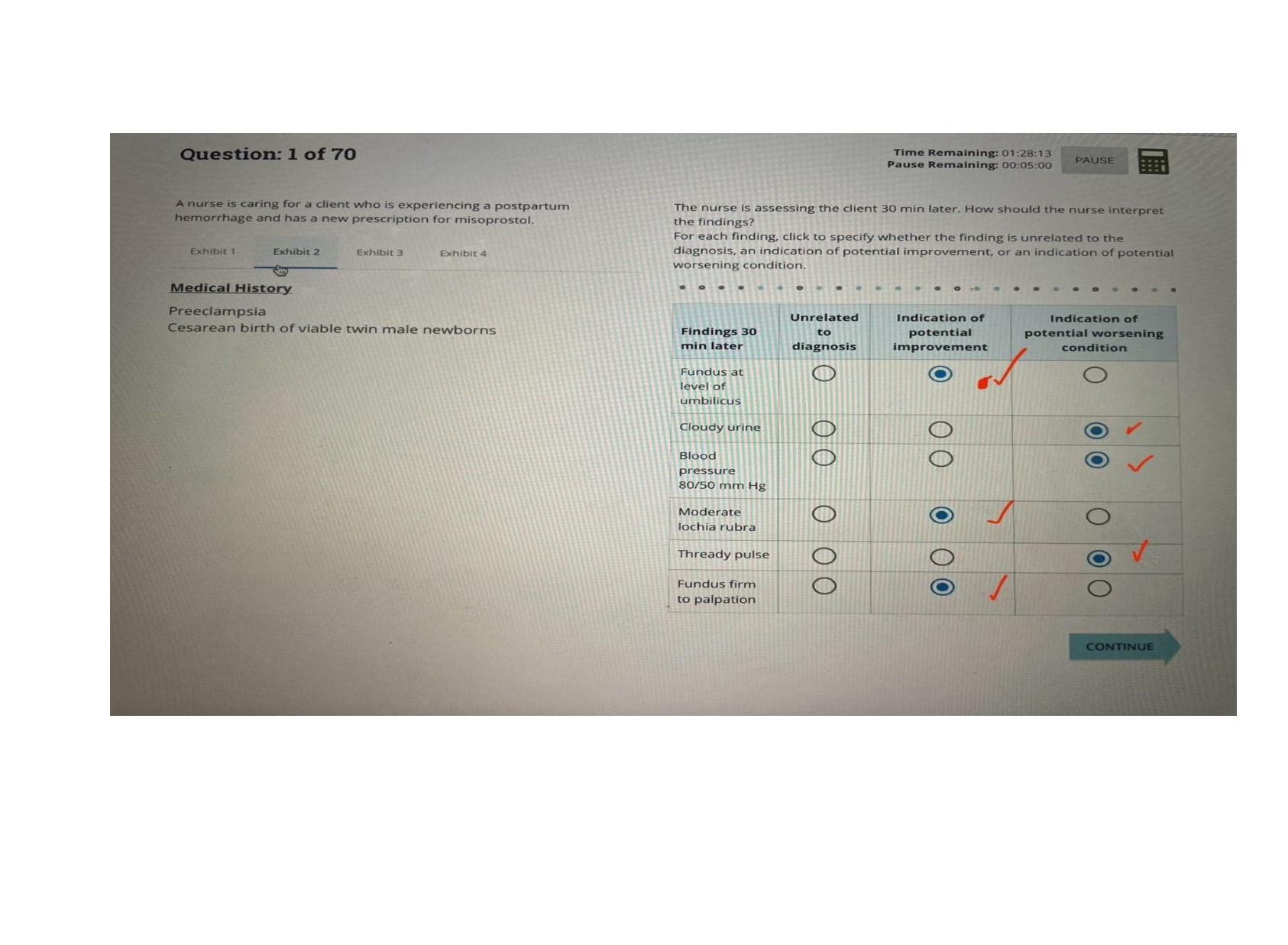

Zhou Company is facing a $7 increase in the variable cost of producing one of its products for the upcoming year. Because of this situation, the sales manager has made a proposal to increase the selli ... ng price of the product while increasing the advertising budget at the same time. The price increase will lower sales volume, but the other changes may help the company maintain its profit margins. Zhou has provided the following information regarding the current year results and the proposal made by the sales manager: Current Year Proposal Unit sale 30,000 20,000 Sales price per unit $52 $58 Variable cost per unit $34 $41 Fixed cost $78,000 $96,000 Relative to the current year, the sales manager's proposal will ________. A. decrease the unit breakeven point Your answer is not correct. B. decrease operating income by $218,000 C. increase contribution margin by $60,000 D. decrease operating income by $158,000 Zest Soda, a local convenience store, sells soft drinks. It sells two large drinks for every small drink. A large drink sells for $1.70 with a variable cost of $0.40. A small drink sells for $1.10 with a variable cost of $0.30. What is the weighted average contribution margin? (Round your intermediate calculations and final answer to two decimal places.) A. $0.40 per drink B. $3.40 per drink C. $1.70 per drink D. $1.13 per drink Which of the following appears as a line item in a contribution margin income statement? A. Gross profit B. Cost of goods sold C. Selling and administrative expenses D. Operating income Lacey sells hand-knit scarves at the flea market. Each scarf sells for $50. Lacey pays $30 to rent a vending space for one day. The variable costs are $15 per scarf. What total revenue amount does she need to earn to break even? A. $93 B. $100 C. $45 D. $43 Operating leverage predicts the effects fixed costs have on changes in operating income when ________. A. there are no sales returns B. variable costs change C. production is discontinued D. sales volume changes Molina Company has provided the following information: Sales $779,000 Variable expenses 508,000 Fixed expenses 213,000 Which of the following statements is true, if the sales volume increases by 10%? A. Contribution margin will increase by $77,900. B. Fixed expenses will increase by $21,300. C. Operating income will increase by $5,800. D. Operating income will increase by $27,100. Schmidt Company sells glass vases at a wholesale price of $3 per unit. The variable cost of manufacture is $1.75 per unit. The fixed costs are $18,000 per month. Schmidt sold 5,500 units during this month. Calculate Schmidt's operating income (loss) for this month. A. $11,125 B. $(11,125) C. $(18,000) D. $9,625 Kumar produces large decorative tiles used in home decor. The tiles sell for $700 and the fixed monthly operating costs are as follows: Rent and utilities $1,100 Management salaries 2,500 Other expenses 530 Kumar's accountant told him about contribution margin ratios and he understood clearly that for every dollar of sales, $0.70 went to cover his fixed costs, and that anything past that point was pure profit. Kumar is planning to increase the selling price to $760. What impact will the increase in selling price have on the contribution margin ratio? A. It will stay the same. B. It will go down from 79% to 72%. C. It will go up from 70% to 72%. D. It will go up from 70% to 79%. Neptune Company sold 2,300 units in November at a price of $35 per unit. The variable cost is $25 per unit. Calculate the total contribution margin. A. $80,500 B. $138,000 C. $57,500 D. $23,000 Which of the following statements is true of the behavior of total fixed costs, within the relevant range? A. They will decrease as production increases. B. They will decrease as production decreases. C. They will remain the same as production levels change. D. They will increase as production decreases. Haywood Company has fixed costs of $36,000 per month. Highest production volume during the year was in January when 120,000 units were produced, 85,000 units were sold, and total costs of $670,000 were incurred. In June, the company produced only 55,000 units. What was the total cost incurred in June? (Round any intermediate calculations to the nearest cent and your final answer to the nearest dollar.) A. $484,800 B. $670,000 C. $433,529 D. $326,400 An increase in selling price per unit increases the number of units required to break even. True False From the graph given below, identify the fixed costs line. A. AD B. AE C. AC D. OB Johar Company provides the following information about its product: Targeted operating income: $60,000 Selling price per unit: 10 Variable cost per unit: 1.50 Total fixed costs: 130,000 What is the contribution margin ratio? Round your answer to the nearest whole percent. A. 15% B. 118% C. 100% D. 85% If the variable cost per unit decreases, the total number of units required to breakeven will increase. True False Brevard Company sells two productslong dash—A and B. Product A is sold for $26 per unit and has a variable cost per unit of $16. Product B is sold for $34 per unit and has a unit variable cost of $21. Total fixed costs for the company are $50,000. Brevard Company typically sells three units of Product A for every unit of Product B. What is the breakeven point in total units? A. 4,651 units B. 1,163 units C. 2,326 units D. 3,489 units Crystal Pools, Inc. has provided the following information for the year. Units produced: 13,000 units Sales price: $200 per unit Direct materials: $50 per unit Direct labor: $45 per unit Variable manufacturing overhead: $65 per unit Fixed manufacturing overhead: $440,000 per year Variable selling and administration costs: $60 per unit Fixed selling and administration costs: $250,000 per year What is the unit product cost using absorption costing? A. $160 B. $155 C. $95 D. $194 Which of the following is considered a period cost under variable costing but not under absorption costing? A. variable manufacturing costs B. fixed manufacturing overhead C. fixed selling and administrative costs D. variable selling and administrative costs Contribution margin is calculated by deducting ________ from sales revenue. A. total product costs B. total selling and administrative costs C. total fixed costs D. total variable costs The phone bill for Laurel Accounting consists of both fixed and variable costs. Refer to the four month data below and apply the high-low method to answer the question. (Round your calculation to two decimal places.) Minutes Total Bill May: 500 $3,000 June: 240 $2,690 July: 160 $2,625 August: 330 $2,800 What is the variable cost per minute? A. $0.59 B. $1.10 C. $0.91 D. $0.53 [Show More]

Last updated: 2 years ago

Preview 1 out of 8 pages

![Preview image of ACC-350 Quiz 2 [Chapter 21] (Q&A Review) document](https://scholarfriends.com/storage/ACC-350 Quiz 2 [Chapter 21] (Q&A Review).png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$13.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Feb 06, 2023

Number of pages

8

Written in

All

Additional information

This document has been written for:

Uploaded

Feb 06, 2023

Downloads

0

Views

44

.png)

.png)

(Q&A).png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)