CMA Part 1 – Financial Reporting, Planning, Performance, and Control

CMA Part 1 – Financial Reporting, Planning, Performance, and Control

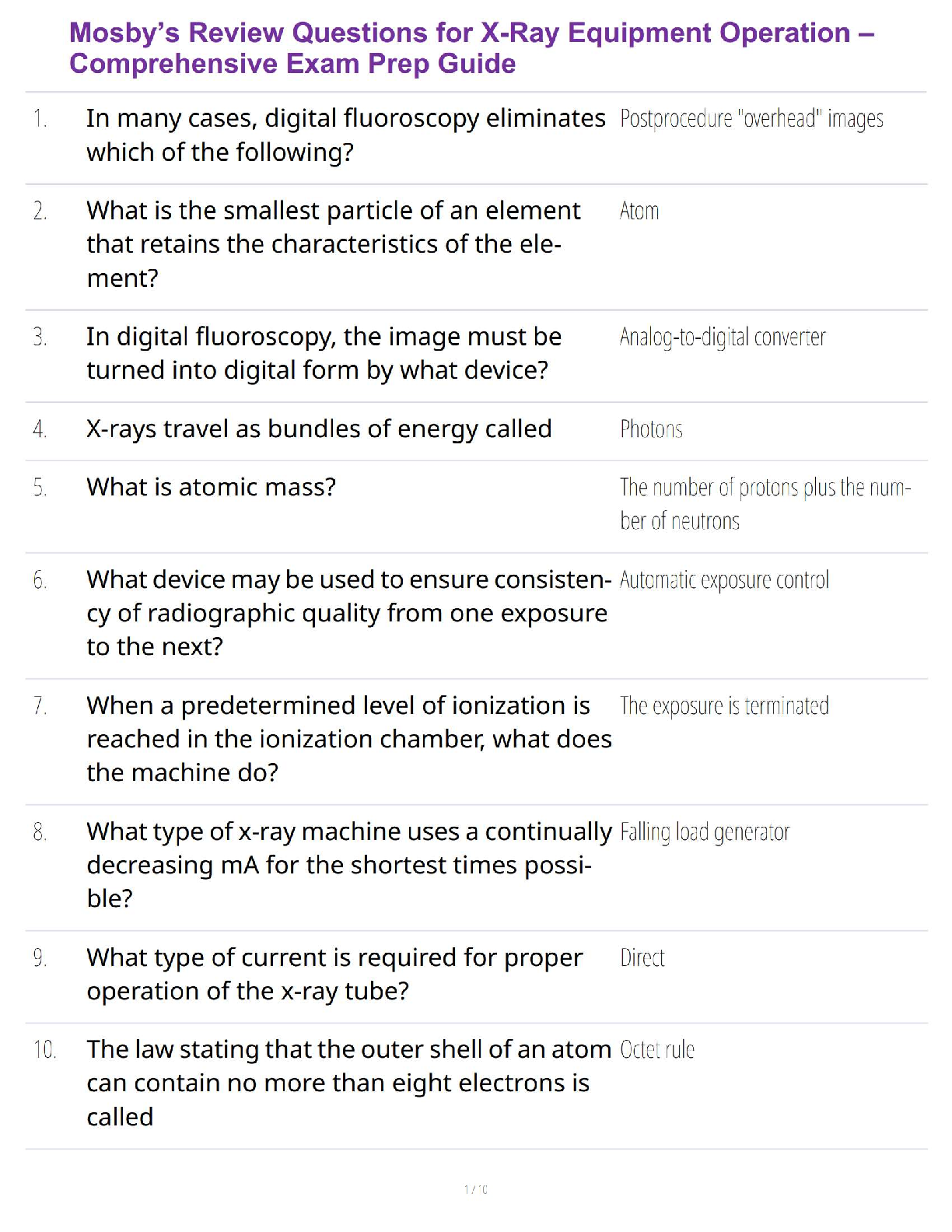

Examination Practice Questions

Section A: External Financial Reporting Decision

...

CMA Part 1 – Financial Reporting, Planning, Performance, and Control

CMA Part 1 – Financial Reporting, Planning, Performance, and Control

Examination Practice Questions

Section A: External Financial Reporting Decisions

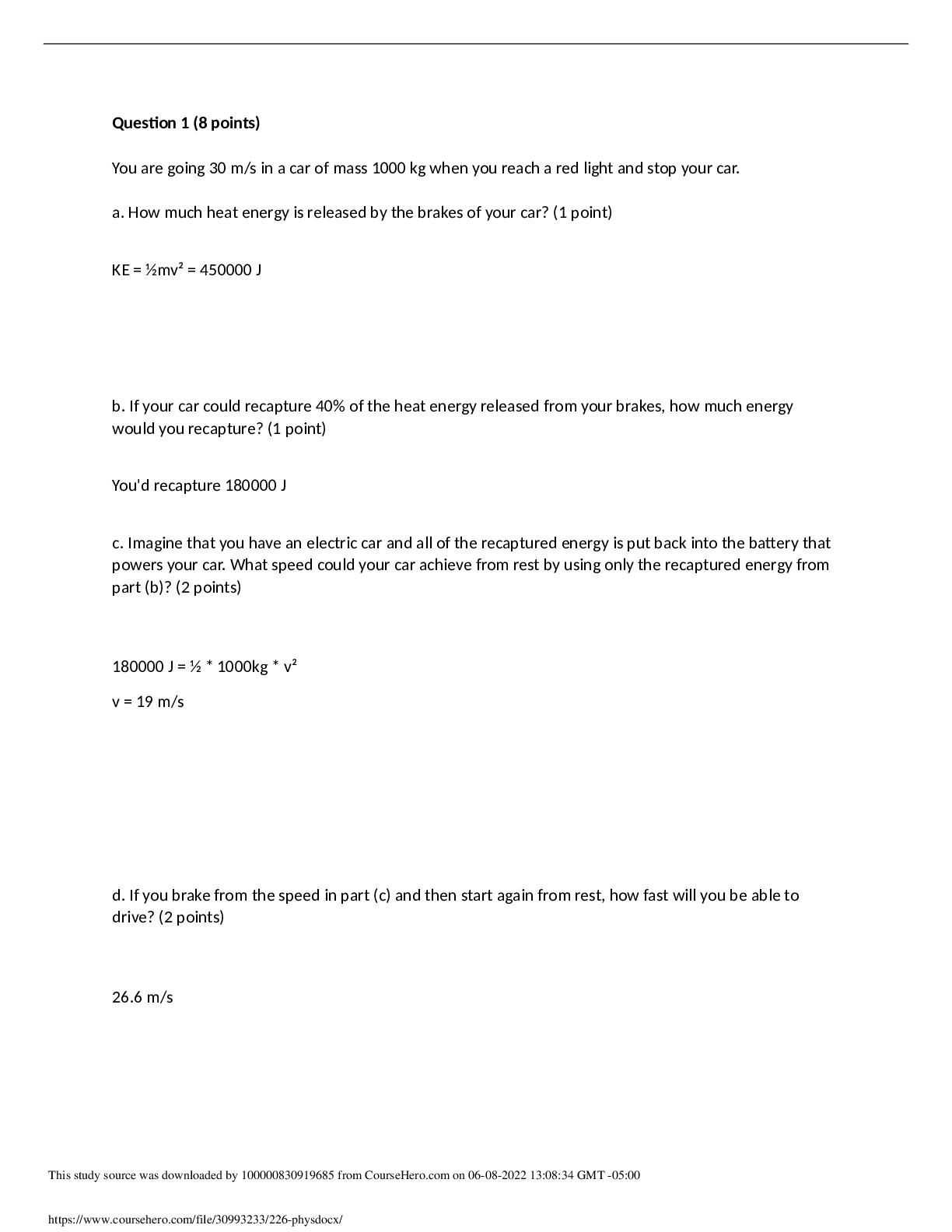

1. CSO: 1A1a LOS: 1A1a

The financial statements included in the annual report to the shareholders are least useful to which

one of the following?

a. Stockbrokers.

b. Bankers preparing to lend money.

c. Competing businesses.

d. Managers in charge of operating activities.

2. CSO: 1A1d LOS: 1A1e

Which one of the following would result in a decrease to cash flow in the indirect method of

preparing a statement of cash flows?

a. Amortization expense.

b. Decrease in income taxes payable.

c. Proceeds from the issuance of common stock.

d. Decrease in inventories.

3. CSO: 1A1c LOS: 1A1b

The statement of shareholders’ equity shows a

a. reconciliation of the beginning and ending balances in shareholders’ equity accounts.

b. listing of all shareholders’ equity accounts and their corresponding dollar amounts.

c. computation of the number of shares outstanding used for earnings per share calculations.

d. reconciliation of the beginning and ending balances in the Retained Earnings account.

4. CSO: 1A1d LOS: 1A1b

When using the statement of cash flows to evaluate a company’s continuing solvency, the most

important factor to consider is the cash

a. balance at the end of the period.

b. flows from (used for) operating activities.

c. flows from (used for) investing activities.

d. flows from (used for) financing activities.4

5. CSO: 1A1a LOS: 1A1b

A statement of financial position provides a basis for all of the following except

a. computing rates of return.

b. evaluating capital structure.

c. assessing liquidity and financial flexibility.

d. determining profitability and assessing past performance.

6. CSO: 1A1b LOS: 1A1b

The financial statement that provides a summary of the firm’s operations for a period of time is the

a. income statement.

b. statement of financial position.

c. statement of shareholders’ equity.

d. statement of retained earnings.

7. CSO: 1A1b LOS: 1A1e

Bertram Company had a balance of $100,000 in Retained Earnings at the beginning of the year and

$125,000 at the end of the year. Net income for this time period was $40,000. Bertram’s Statement

of Financial Position indicated that Dividends Payable had decreased by $5,000 throughout the year,

despite the fact that both cash dividends and a stock dividend were declared. The amount of the

stock dividend was $8,000. When preparing its Statement of Cash Flows for the year, Bertram

should show Cash Paid for Dividends as

a. $20,000.

b. $15,000.

c. $12,000.

d. $5,000.

8. CSO: 1A1b LOS: 1A1c

All of the following are elements of an income statement except

a. expenses.

b. shareholders’ equity.

c. gains and losses.

d. revenue.5

9. CSO: 1A1d LOS: 1A1c

Dividends paid to company shareholders would be shown on the statement of cash flows as

a. operating cash inflows.

b. operating cash outflows.

c. cash flows from investing activities.

d. cash flows from financing activities.

10. CSO: 1A1d LOS: 1A1c

All of the following are classifications on the statement of cash flows except

a. operating activities.

b. equity activities.

c. investing activities.

d. financing activities.

11. CSO: 1A1d LOS: 1A1c

The sale of available-for-sale securities should be accounted for on the statement of cash flows as

a(n)

a. operating activity.

b. investing activity.

c. financing activity.

d. noncash investing and financing activity.

12. CSO: 1A1d LOS: 1A1c

A statement of cash flows prepared using the indirect method would have cash activities listed in

which one of the following orders?

a. Financing, investing, operating.

b. Investing, financing, operating.

c. Operating, financing, investing.

d. Operating, investing, financing.

13. CSO: 1A1d LOS: 1A1e

Kelli Company acquired land by assuming a mortgage for the full acquisition cost. This transaction

should be disclosed on Kelli’s Statement of Cash Flows as a(n)

a. financing activity.

b. investing activity.

c. operating activity.

d. noncash financing and investing activity.6

14. CSO: 1A1d LOS: 1A1e

Which one of the following should be classified as an operating activity on the statement of cash

flows?

a. A decrease in accounts payable during the year.

b. An increase in cash resulting from the issuance of previously authorized common stock.

c. The purchase of additional equipment needed for current production.

d. The payment of a cash dividend from money arising from current operations.

15. CSO: 1A1a LOS: 1A1d

All of the following are limitations to the information provided on the statement of financial position

except the

a. quality of the earnings reported for the enterprise.

b. judgments and estimates used regarding the collectability, salability, and longevity of assets.

c. omission of items that are of financial value to the business such as the worth of the

employees.

d. lack of current valuation for most assets and liabilities.

16. CSO: 1A1d LOS: 1A1c

The most commonly used method for calculating and reporting a company’s net cash flow from

operating activities on its statement of cash flows is the

a. direct method.

b. indirect method.

c. single-step method.

d. multiple-step method.

17. CSO: 1A1d LOS: 1A1c

The presentation of the major classes of operating cash receipts (such as receipts from customers)

less the major classes of operating cash disbursements (such as cash paid for merchandise) is best

described as the

a. direct method of calculating net cash provided or used by operating activities.

b. cash method of determining income in conformity with generally accepted accounting

principles.

c. format of the statement of cash flows.

d. indirect method of calculating net cash provided or used by operating activities.7

18. CSO: 1A1a LOS: 1A1e

When a fixed asset is sold for less than book value, which one of the following will decrease?

a. Total current assets.

b. Current ratio.

c. Net profit.

d. Net working capital.

19. CSO: 1A1a LOS: 1A1e

Stanford Company leased some special-purpose equipment from Vincent Inc. under a long-term

lease that was treated as an operating lease by Stanford. After the financial statements for the year

had been issued, it was discovered that the lease should have been treated as a capital lease by

Stanford. All of the following measures relating to Stanford would be affected by this discovery

except the

a. debt/equity ratio.

b. accounts receivable turnover.

c. fixed asset turnover.

d. net income percentage.

20. CSO: 1A1d LOS: 1A1h

Larry Mitchell, Bailey Company’s controller, is gathering data for the Statement of Cash Flows for

the most recent year end. Mitchell is planning to use the indirect method to prepare this statement,

and has made the following list of cash inflows for the period.

• Net income of $100,000.

• Securities purchased for investment purposes with an original cost of $100,000 sold for

$125,000.

• Proceeds from the issuance of additional company stock totaling $10,000.

The correct amount to be shown as net cash provided by operating activities is

a. $100,000.

b. $135,000.

c. $225,000.

d. $235,000.

21. CSO: 1A1d LOS: 1A1e

During the year, Deltech Inc. acquired a long-term productive asset for $5,000 and also borrowed

$10,000 from a local bank. These transactions should be reported on Deltech’s Statement of Cash

Flows as

a. Outflows for Investing Activities, $5,000; Inflows from Financial Activities, $10,000.

b. Inflows from Investing Activities, $10,000; Outflows for Financing Activities, $5,000.

c. Outflows for Operating Activities, $5,000; Inflows from Financing Activities, $10,000.

d. Outflows for Financing Activities, $5,000; Inflows from Investing Activities, $10,000.8

22. CSO: 1A1d LOS: 1A1e

Atwater Company has recorded the following payments for the current period.

Purchase Trillium stock $300,000

Dividends paid to Atwater shareholders 200,000

Repurchase of Atwater Company stock 400,000

The amount to be shown in the Investing Activities Section of Atwater’s Cash Flow Statement

should be

a. $300,000.

b. $500,000.

c. $700,000.

d. $900,000.

23. CSO: 1A1d LOS: 1A1e

Carlson Company has the following payments recorded for the current period.

Dividends paid to Carlson shareholders $150,000

Interest paid on bank loan 250,000

Purchase of equipment 350,000

The total amount of the above items to be shown in the Operating Activities Section of Carlson’s

Cash Flow Statement should be

a. $150,000.

b. $250,000.

c. $350,000.

d. $750,000.

24. CSO: 1A1d LOS: 1A1e

Barber Company has recorded the following payments for the current period.

Interest paid on bank loan $300,000

Dividends paid to Barber shareholders 200,000

Repurchase of Barber Company stock 400,000

The amount to be shown in the Financing Activities Section of Barber’s Cash Flow Statement

should be

a. $300,000.

b. $500,000.

c. $600,000.

d. $900,000.9

25. CSO: 1A1d LOS: 1A1e

Selected financial information for Kristina Company for the year just ended is shown below.

Net income $2,000,000

Increase in accounts receivable 300,000

Decrease in inventory 100,000

Increase in accounts payable 200,000

Depreciation expense 400,000

Gain on the sale of available-for-sale securities 700,000

Cash received from the issue of common stock 800,000

Cash paid for dividends 80,000

Cash paid for the acquisition of land 1,500,000

Cash received from the sale of available-for-sale 2,800,000

securities

Kristina’s cash flow from financing activities for the year is

a. $(80,000).

b. $720,000.

c. $800,000.

d. $3,520,000.

[Show More]