Finance > ANSWERS AND COMMENTARIES > Week 8_Quiz Advanced Corporate Finance | Download for quality grades | step by step solutions| (All)

Week 8_Quiz Advanced Corporate Finance | Download for quality grades | step by step solutions|

Document Content and Description Below

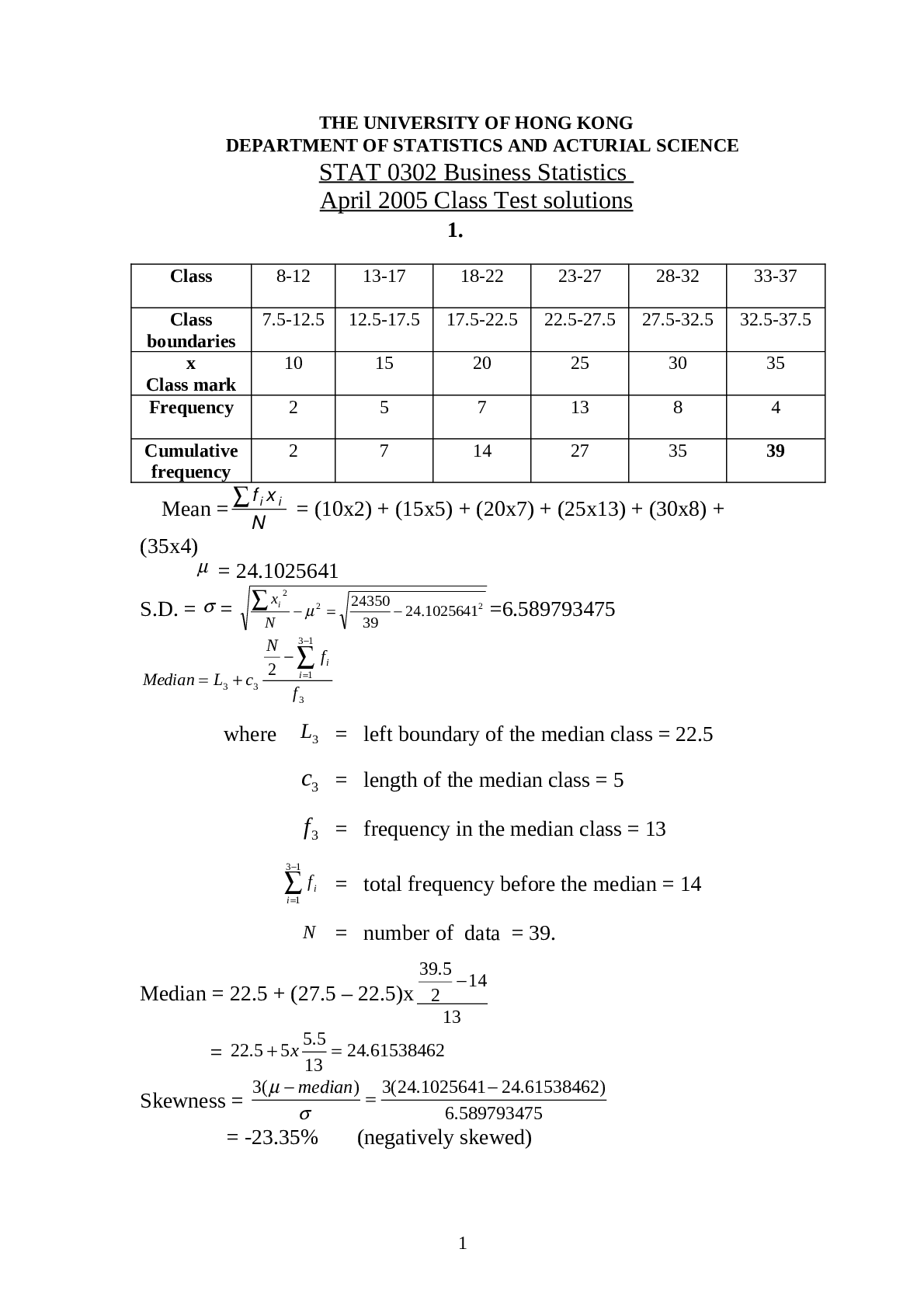

Ques 1 / 1 pts tion 6 Suppose that (1) investors expect a 4.0% rate of inflation in the future, (2) the real risk-free rate is 3.0%, (3) the market risk premium is 5.0%, (4) Talcott Inc.'s beta is ... 1.00, and (5) its realized rate of return has averaged 15.0% over the last 5 years. Calculate the required rate of return for Talcot Inc. 12.00% 12.60% 11.40% 10.29% 10.83% IP: 4.00% Real rate: 3.00% RP : 5.00% Beta: 1.00 Required return = 3% + 4% + 1.0(5%) = 12.00% M Ques 1 / 1 pts tion 7 Your mother's well-diversified portfolio has an expected return of 12.0% and a beta of 1.20. She is in the process of buying 100 shares of Safety Corp. at $10 a share and adding it to her portfolio. Safety has an expected return of 15.0% and a beta of 2.00. The total value of your current portfolio is $9,000. What will the expected return and beta on the portfolio be after the purchase of the Safety stock? rp bp 12.30%; 1.28 12.92%; 1.34 14.24%; 1.48 13.56%; 1.41 11.69%; 1.22 Old portfolio return 12.0% Old portfolio beta 1.20 New stock return 15.0% New stock beta 2.00 Percent of portfolio in new stock: 10% [Show More]

Last updated: 2 years ago

Preview 1 out of 9 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$7.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Feb 17, 2023

Number of pages

9

Written in

All

Additional information

This document has been written for:

Uploaded

Feb 17, 2023

Downloads

0

Views

90

.png)