finc 5310 final exam | Download for quality grades | 100% solved exam|

Document Content and Description Below

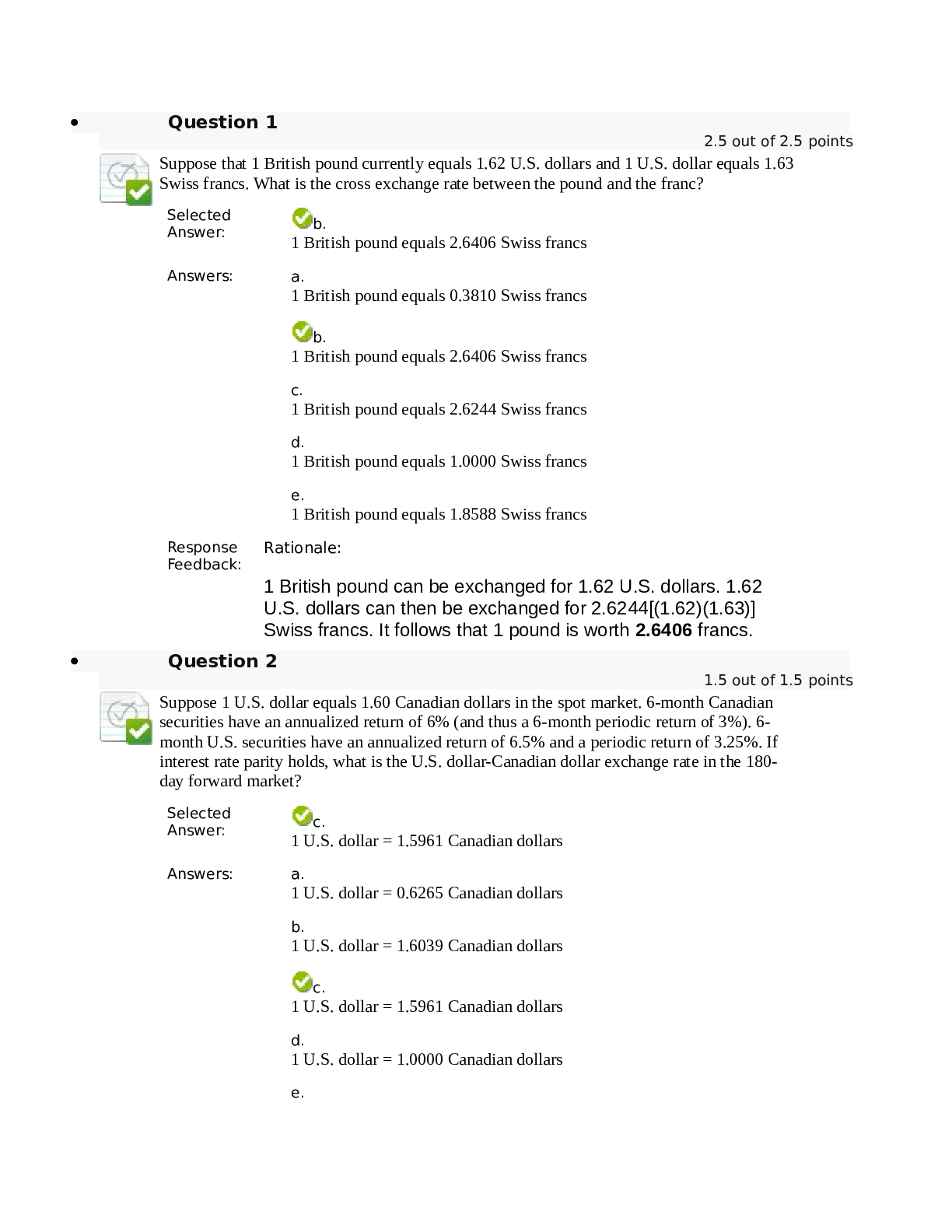

Question 1 2.5 out of 2.5 points Suppose that 1 British pound currently equals 1.62 U.S. dollars and 1 U.S. dollar equals 1.63 Swiss francs. What is the cross exchange rate between the pound and th ... e franc? Selected Answer: b. 1 British pound equals 2.6406 Swiss francs Answers: a. 1 British pound equals 0.3810 Swiss francs b. 1 British pound equals 2.6406 Swiss francs c. 1 British pound equals 2.6244 Swiss francs d. 1 British pound equals 1.0000 Swiss francs e. 1 British pound equals 1.8588 Swiss francs Response Feedback: Rationale: 1 British pound can be exchanged for 1.62 U.S. dollars. 1.62 U.S. dollars can then be exchanged for 2.6244[(1.62)(1.63)] Swiss francs. It follows that 1 pound is worth 2.6406 francs. Question 2 1.5 out of 1.5 points Suppose 1 U.S. dollar equals 1.60 Canadian dollars in the spot market. 6-month Canadian securities have an annualized return of 6% (and thus a 6-month periodic return of 3%). 6- month U.S. securities have an annualized return of 6.5% and a periodic return of 3.25%. If interest rate parity holds, what is the U.S. dollar-Canadian dollar exchange rate in the 180- day forward market? Selected Answer: c. 1 U.S. dollar = 1.5961 Canadian dollars Answers: a. 1 U.S. dollar = 0.6265 Canadian dollars b. 1 U.S. dollar = 1.6039 Canadian dollars c. 1 U.S. dollar = 1.5961 Canadian dollars d. 1 U.S. dollar = 1.0000 Canadian dollars e. 1 U.S. dollar = 0.6235 Canadian dollars Response Feedback : Rationale: From the interest rate parity formula it follows that ft = (eo)(1 + rh)/(1 + rf) = (0.6250 U.S. dollars/Canadian dollar) (1.0325)/(1.03) = 0.6265 U.S. dollars/Canadian dollar, or 1.5961 Canadian dollars per U.S. dollar. Another way to think of this is $1 invested today in the United States yields $1.0325 six months from now. Alternatively, investors could put their money in Canadian securities. In this case, the investor would exchange $1 today for 1.6 Canadian dollars. This money could be invested in Canada and after 6 months this investment would be worth 1.6480 Canadian dollars[(1.6)(1.03)]. At a forward exchange rate of 1 U.S. dollar equals 1.5961 Canadian dollars, 1.6480 Canadian dollars would be worth $1.0325 in the U.S. Since the 2 investments produce the same return, interest rate parity holds. Question 3 2.5 out of 2.5 points Chapter 7 of the Bankruptcy Act is designed to do which of the following? [Show More]

Last updated: 2 years ago

Preview 1 out of 23 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$13.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Feb 17, 2023

Number of pages

23

Written in

All

Additional information

This document has been written for:

Uploaded

Feb 17, 2023

Downloads

0

Views

130