Financial Accounting > QUESTIONS & ANSWERS > ACC 3100 - Baruch College- ACC 3100 Practice Questions with Solutions. (All)

ACC 3100 - Baruch College- ACC 3100 Practice Questions with Solutions.

Document Content and Description Below

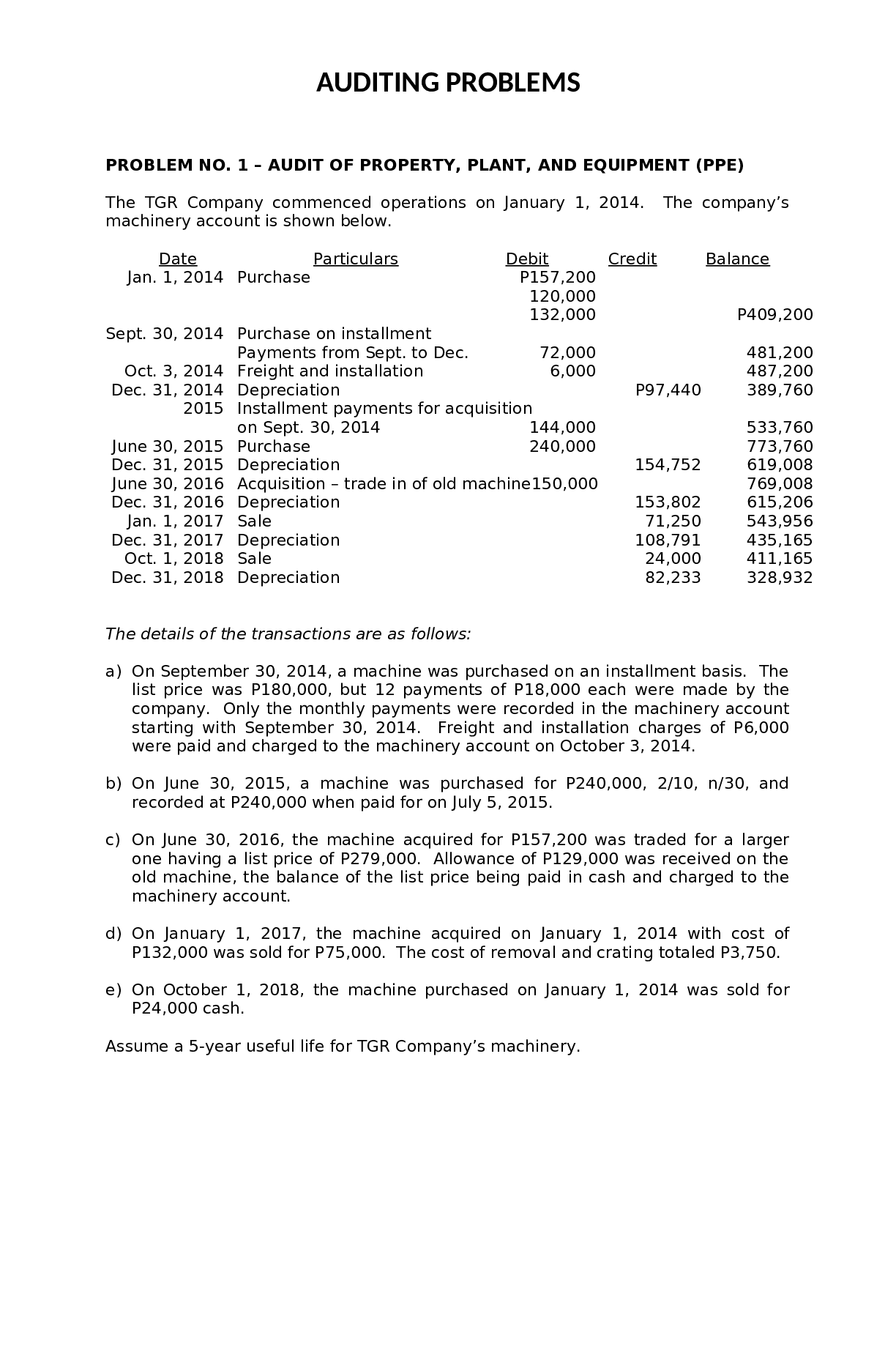

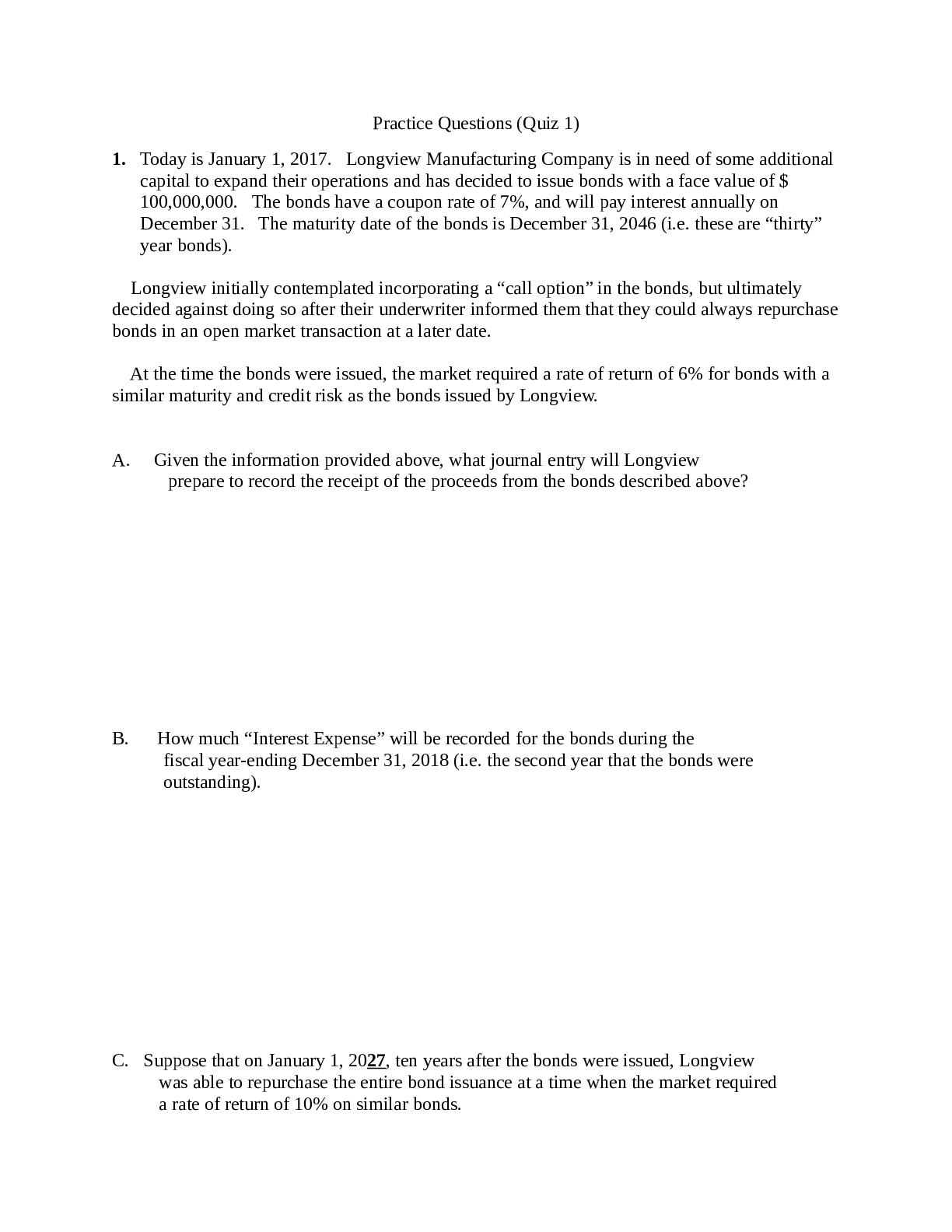

ACC 3100 - Baruch College- ACC 3100 Practice Questions with Solutions. Practice Questions (Quiz 1) 1. Today is January 1, 2017. Longview Manufacturing Company is in need of some additional capital ... to expand their operations and has decided to issue bonds with a face value of $ 100,000,000. The bonds have a coupon rate of 7%, and will pay interest annually on December 31. The maturity date of the bonds is December 31, 2046 (i.e. these are “thirty” year bonds). Longview initially contemplated incorporating a “call option” in the bonds, but ultimately decided against doing so after their underwriter informed them that they could always repurchase bonds in an open market transaction at a later date. At the time the bonds were issued, the market required a rate of return of 6% for bonds with a similar maturity and credit risk as the bonds issued by Longview. A. Given the information provided above, what journal entry will Longview prepare to record the receipt of the proceeds from the bonds described above? B. How much “Interest Expense” will be recorded for the bonds during the fiscal year-ending December 31, 2018 (i.e. the second year that the bonds were outstanding). C. Suppose that on January 1, 2027, ten years after the bonds were issued, Longview was able to repurchase the entire bond issuance at a time when the market required a rate of return of 10% on similar bonds.As a result of the repurchase, Longview would report a Pre-Tax GAIN / LOSS / NEITHER (circle one) in the amount of $ ________________ on the repurchase (fill in the blank with the correct amount or $ 0). [Show More]

Last updated: 2 years ago

Preview 1 out of 11 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$9.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Apr 08, 2023

Number of pages

11

Written in

Additional information

This document has been written for:

Uploaded

Apr 08, 2023

Downloads

0

Views

72