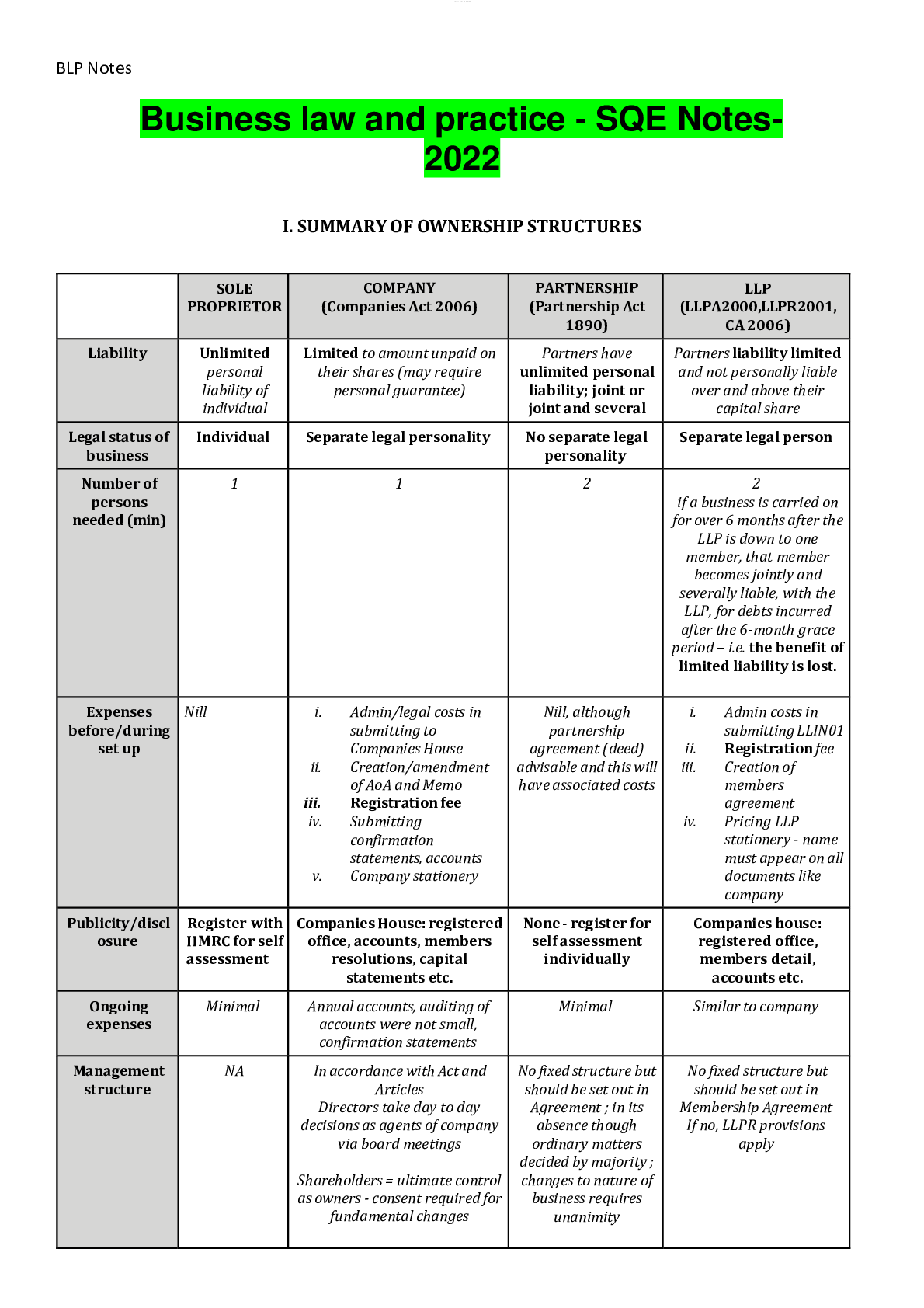

I. SUMMARY OF OWNERSHIP STRUCTURES

SOLE

PROPRIETOR

COMPANY

(Companies Act 2006)

PARTNERSHIP

(Partnership Act

1890)

LLP

(LLPA2000,LLPR2001,

CA 2006)

Liability Unlimited

personal

liability of

individual

Limi

...

I. SUMMARY OF OWNERSHIP STRUCTURES

SOLE

PROPRIETOR

COMPANY

(Companies Act 2006)

PARTNERSHIP

(Partnership Act

1890)

LLP

(LLPA2000,LLPR2001,

CA 2006)

Liability Unlimited

personal

liability of

individual

Limited to amount unpaid on

their shares (may require

personal guarantee)

Partners have

unlimited personal

liability; joint or

joint and several

Partners liability limited

and not personally liable

over and above their

capital share

Legal status of

business

Individual Separate legal personality No separate legal

personality

Separate legal person

Number of

persons

needed (min)

1 1 2 2

if a business is carried on

for over 6 months after the

LLP is down to one

member, that member

becomes jointly and

severally liable, with the

LLP, for debts incurred

after the 6-month grace

period – i.e. the benefit of

limited liability is lost.

Expenses

before/during

set up

Nill i. Admin/legal costs in

submitting to

Companies House

ii. Creation/amendment

of AoA and Memo

iii. Registration fee

iv. Submitting

confirmation

statements, accounts

v. Company stationery

Nill, although

partnership

agreement (deed)

advisable and this will

have associated costs

i. Admin costs in

submitting LLIN01

ii. Registration fee

iii. Creation of

members

agreement

iv. Pricing LLP

stationery - name

must appear on all

documents like

company

Publicity/discl

osure

Register with

HMRC for self

assessment

Companies House: registered

office, accounts, members

resolutions, capital

statements etc.

None - register for

self assessment

individually

Companies house:

registered office,

members detail,

accounts etc.

Ongoing

expenses

Minimal Annual accounts, auditing of

accounts were not small,

confirmation statements

Minimal Similar to company

Management

structure

NA In accordance with Act and

Articles

Directors take day to day

decisions as agents of company

via board meetings

Shareholders = ultimate control

as owners - consent required for

fundamental changes

No fixed structure but

should be set out in

Agreement ; in its

absence though

ordinary matters

decided by majority ;

changes to nature of

business requires

unanimity

No fixed structure but

should be set out in

Membership Agreement

If no, LLPR provisions

applylOMoARcPSD|12263423

BLP Notes

Downloaded by Anna Maina (

[email protected])

Financing

methods

Personal loans Variety of loans; floating

charges; share issuances

Personal guarantee will remove

benefit of ltd liability

Limited to persoanal

loans

Broader range of options

available, incl loans and

charges over assets; no

share issuancelOMoARcPSD|12263423

BLP Notes

Downloaded by Anna Maina (

[email protected])

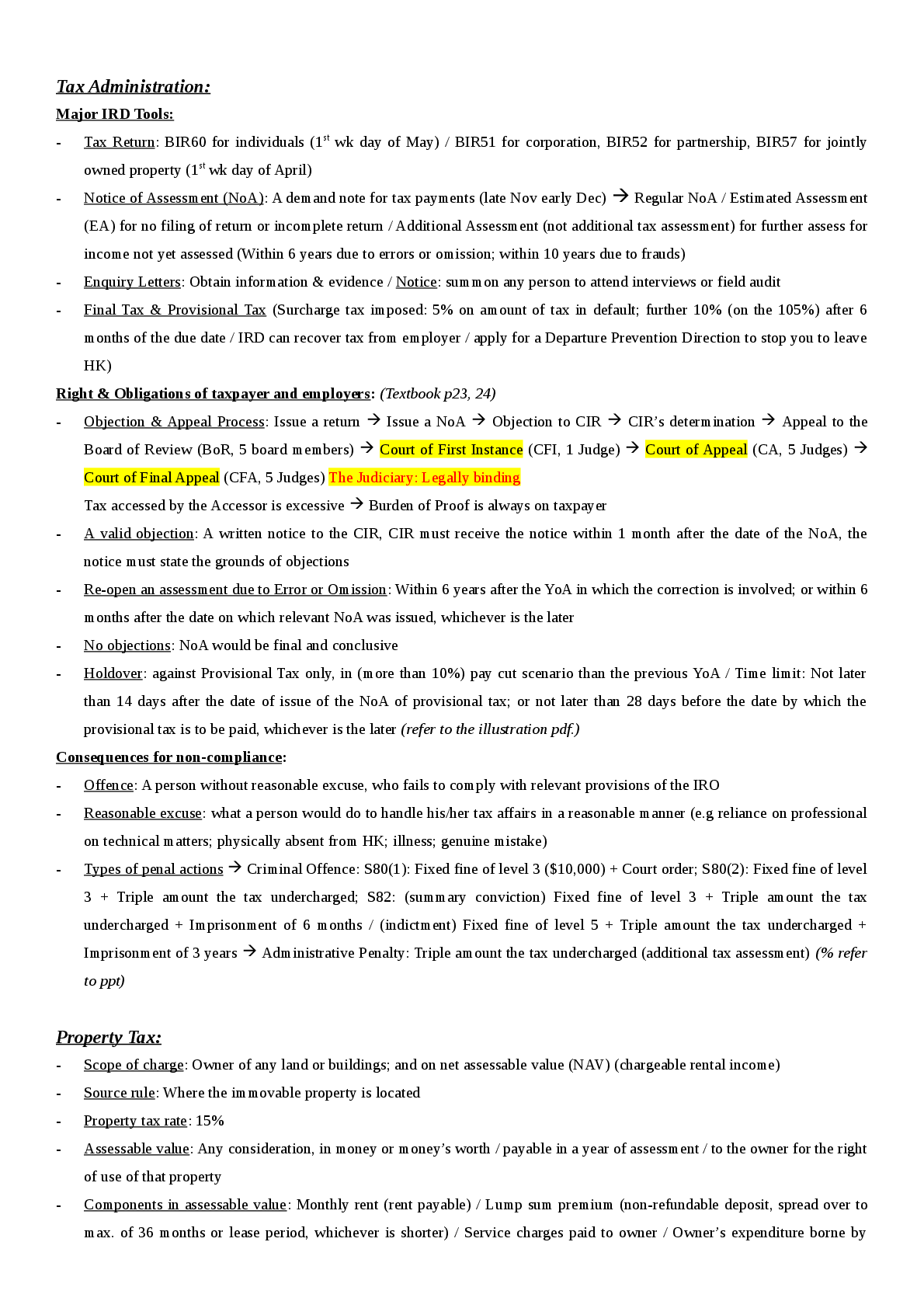

TAX CONSIDERATIONS

Tradi

ng

profit

s

Income tax charged

on the individual

level, regardless of

whether profits kept

in the business.

Corporation Tax paid on

gross profits.

Profits can be retained in the

business or used to pay

directors fees or dividends to

shareholders.

Dividends paid out of net

profits offset National

Insurance liability.

Income tax charged on the

partners’ level, regardless of

whether profits kept in

business or distributed to the

partners. Partners are taxed in

accordance with their profit

share entitlement

Similar treatment to a

general partnership.

Income tax charged on the

partners’ level, regardless

of whether profits kept in

business or distributed to

the partners. Partners are

taxed in accordance with

their profit share

entitlement

Capita

l

gains

Tax free personal

allowance.

No shares so no

double charging.

Company pays Corporation

Tax on sale of a capital asset

(chargeable gain).

Value of shares will also

increase to reflect profit –

increase in capital value of

shares is also subject to CGT

– double tax.

Tax free personal allowance.

No shares so no double

charging.

Tax free personal

allowance.

No shares so no double

charging.

No tax free allowance.

Inheri

tance

Tax

50% inheritance tax

business property

relief.

100% business property

relief.

50% inheritance tax business

property relief.

50% inheritance tax

business property relief