Business > QUESTIONS and ANSWERS > QuickBooks Chapter 9 Questions and Answers Already Passed (All)

QuickBooks Chapter 9 Questions and Answers Already Passed

Document Content and Description Below

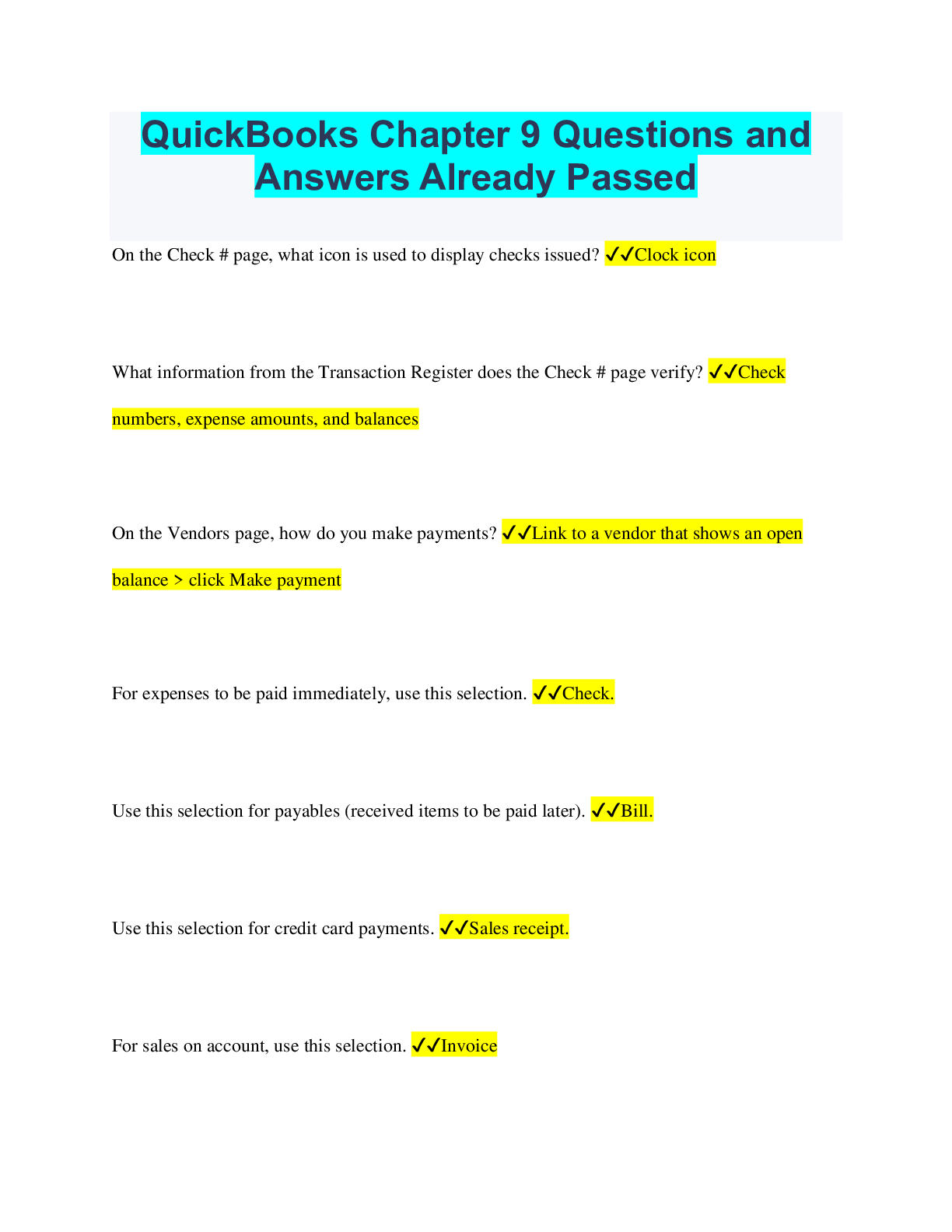

QuickBooks Chapter 9 Questions and Answers Already Passed On the Check # page, what icon is used to display checks issued? ✔✔Clock icon What information from the Transaction Register does the C ... heck # page verify? ✔✔Check numbers, expense amounts, and balances On the Vendors page, how do you make payments? ✔✔Link to a vendor that shows an open balance > click Make payment For expenses to be paid immediately, use this selection. ✔✔Check. Use this selection for payables (received items to be paid later). ✔✔Bill. Use this selection for credit card payments. ✔✔Sales receipt. For sales on account, use this selection. ✔✔Invoice What link on the Customer's page shows that customers have not paid? ✔✔Receive payment. What link on the Vendors page shows what is owed? ✔✔Make payment. The Dashboard shows the current balance for? ✔✔All of these: Profit and Loss. Bank Expenses. Invoices and Sales. What account is tracked when you create an invoice and add a sales receipt? ✔✔Inventory. What report shows how much you owe to sales tax agencies? ✔✔Sales tax liability report. How are sales taxes determined? ✔✔All of these: The amount of sales tax collected varies from state to state. Each state sets a sales tax rate. Counties, cities, and other localities can set their own rates. Some states are exempt from sales taxes. To make sure you are starting in the correct place in the data, display the: ✔✔January 1-31 Trial Balance. In Chapter 9, all transactions occur in the month of: ✔✔None of these. Credit card receipts are entered on this window: ✔✔Sales Receipt. Use this report to display the accounts receivable balance: ✔✔Accounts Receivable Aging Summary. The Dashboard displays the same Checking account balance (as of a specific date) as the: ✔✔Transaction Register. The Sales Tax rate on credit card sales is: ✔✔6.10% Payments from customers are due within: ✔✔30 days. The total amount owed to vendors is the same amount as: ✔✔Account 201, Accounts Payable. Asset values and average costs are shown on this report: ✔✔Inventory Valuation Summary. Net income is shown on the following reports: ✔✔Profit and Loss and Balance Sheet. .Refer to the transaction register for entering ATMs and checks for expenses. ✔✔true Memos include vendor payments, remittances, and customer payments. ✔✔True Use sales invoices for purchasing inventory. ✔✔False The Profit and Loss shows Cost of Goods Sold. ✔✔True The Balance Sheet's Net Income amount is also shown on the Trial Balance. ✔✔False Each credit card receipt is from the same credit card company. ✔✔False Deposit customer payments into Account 101 Checking. ✔✔True The January 31 Trial Balance shows non-zero or active accounts only. ✔✔True [Show More]

Last updated: 2 years ago

Preview 1 out of 5 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$10.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jul 12, 2023

Number of pages

5

Written in

All

Additional information

This document has been written for:

Uploaded

Jul 12, 2023

Downloads

0

Views

150