Civilizations Past and Present, Volume 2, 13th edition By Robert R. Edgar, Neil J. Hackett, George F. Jewsbury, Barbara A. Molony, Matthew S. Gordon [TEST BANK]

Accounting > Quiz > ACCT-212 Week 4 Quiz – 100% Correct Answers – Graded An A+ (All)

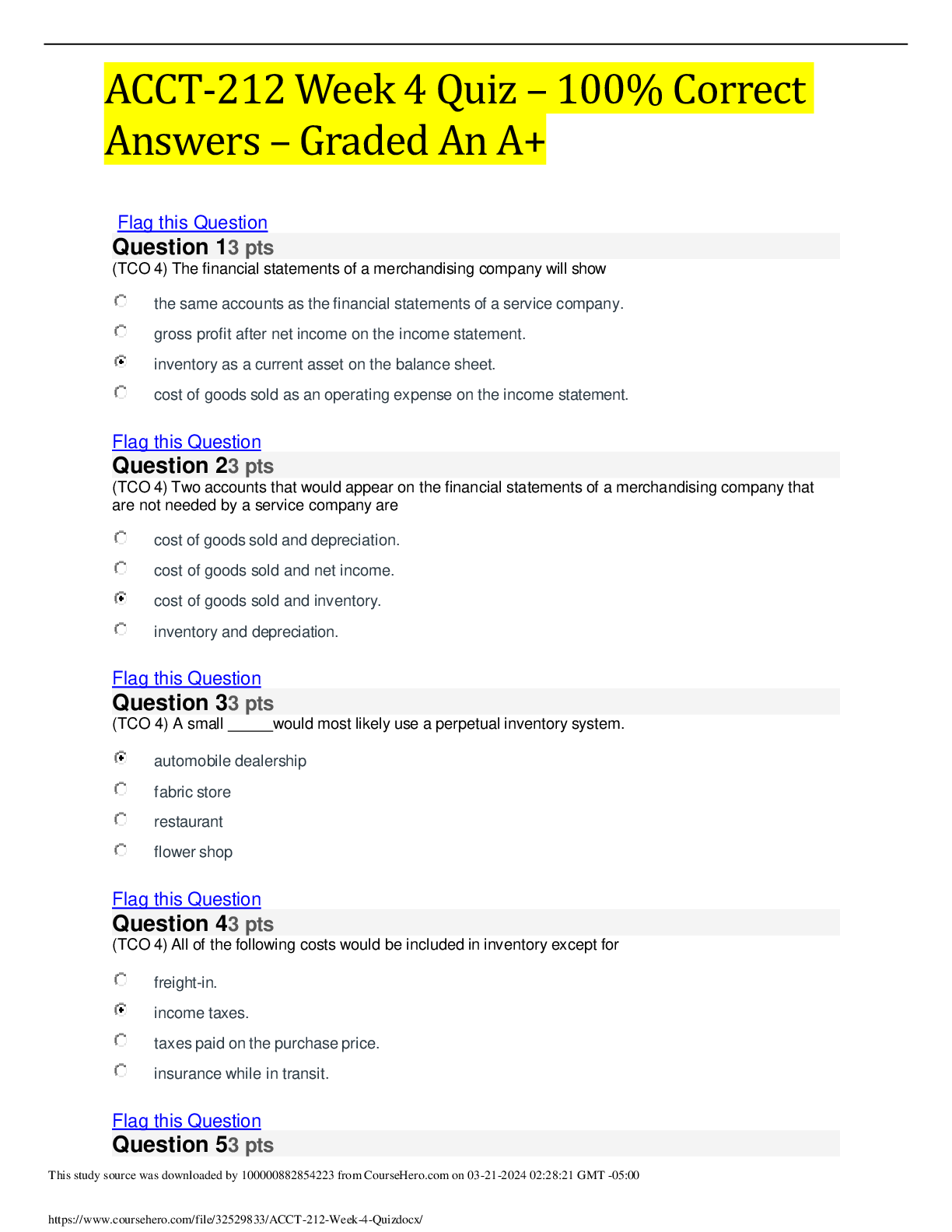

ACCT-212 Week 4 Quiz – 100% Correct Answers – Graded An A+ Flag this Question (TCO 4) The financial statements of a merchandising company will show the same accounts as the financial s ... tatements of a service company. gross profit after net income on the income statement. inventory as a current asset on the balance sheet. cost of goods sold as an operating expense on the income statement. Flag this Question (TCO 4) Two accounts that would appear on the financial statements of a merchandising company that are not needed by a service company are cost of goods sold and depreciation. cost of goods sold and net income. cost of goods sold and inventory. inventory and depreciation. Flag this Question (TCO 4) A small would most likely use a perpetual inventory system. automobile dealership fabric store restaurant flower shop Flag this Question (TCO 4) All of the following costs would be included in inventory except for freight-in. income taxes. taxes paid on the purchase price. insurance while in transit. Flag this Question (TCO 4) The specific-unit-cost method will produce the highest net income. is also known as the specific identification method. will produce the same ending inventory as the average cost method. is also known as the cost-of-goods sold model. Flag this Question (TCO 4) To determine the average cost per unit the beginning inventory is divided by the number of units available. the cost of goods available is divided by the number of units sold. the purchases for the period are divided by the number of units available. the cost of goods available is divided by the number of units available. Flag this Question (TCO 4) When comparing the results of LIFO and FIFO when inventory costs are decreasing cost of goods sold will be the lowest using FIFO. ending inventory will be the highest using FIFO. cost of goods sold will be the highest using LIFO. ending inventory will be the highest using LIFO. Flag this Question (TCO 4) The principle states that the financial statements of a business must report enough information for outsiders to make knowledgeable decisions about the business. consistency historical cost disclosure conservatism Flag this Question (TCO 4) The lower-of-cost-or-market rule requires a company to report inventories at the lower of historical cost or current sales price. historical cost or current replacement cost. current replacement cost or sales invoice price. FIFO cost or LIFO cost. Flag this Question Question 103 pts (TCO 4) The inventory turnover ratio is determined by dividing cost of goods sold by net sales. shows how many times the company sold its average level of inventory. should be high for a company that sells high-priced inventory items. will be lower for companies that have many low-priced items in their inventory . [Show More]

Last updated: 1 year ago

Preview 1 out of 4 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Can't find what you want? Try our AI powered Search

Connected school, study & course

About the document

Uploaded On

Mar 21, 2024

Number of pages

4

Written in

All

This document has been written for:

Uploaded

Mar 21, 2024

Downloads

0

Views

97

Scholarfriends.com Online Platform by Browsegrades Inc. 651N South Broad St, Middletown DE. United States.

We're available through e-mail, Twitter, Facebook, and live chat.

FAQ

Questions? Leave a message!

Copyright © Scholarfriends · High quality services·