Financial Accounting > SOLUTIONS MANUAL > SOLUTION MANUAL FOR Financial Accounting Tools for Business Decision Making, 9th Canadian Edition Pa (All)

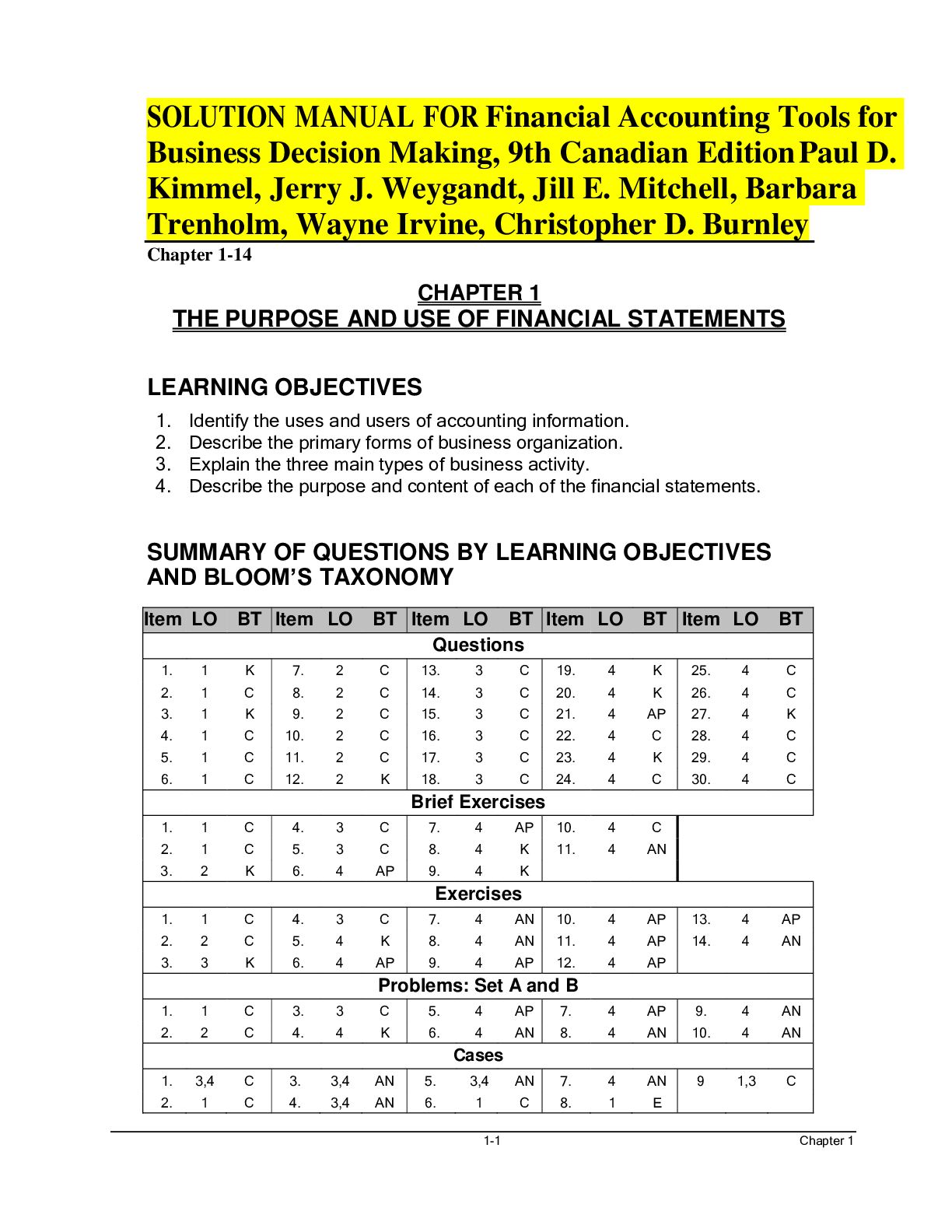

SOLUTION MANUAL FOR Financial Accounting Tools for Business Decision Making, 9th Canadian Edition Paul D. Kimmel, Jerry J. Weygandt, Jill E. Mitchell, Barbara Trenholm, Wayne Irvine, Christopher D. Burnley

Document Content and Description Below

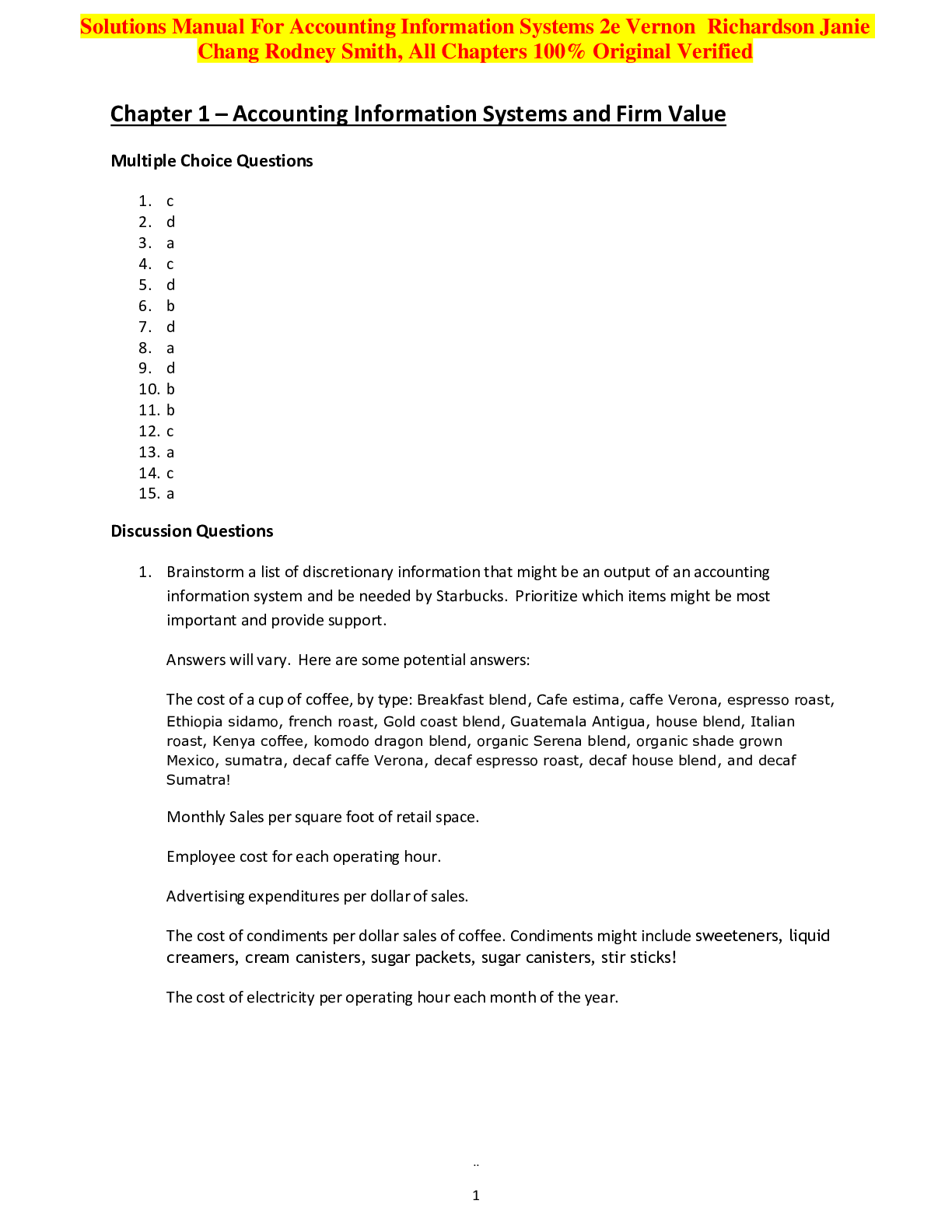

SOLUTION MANUAL FOR Financial Accounting Tools for Business Decision Making, 9th Canadian Edition Paul D. Kimmel, Jerry J. Weygandt, Jill E. Mitchell, Barbara Trenholm, Wayne Irvine, Christopher D. Bu... rnley-1. Accounting is the information system that identifies and records the economic events of an organization, and then communicates them to a wide variety of interested users. LO 1 BT: K Difficulty: S TIME: 3 min. AACSB: None CPA: cpa-t001 CM: Reporting 2. (a) Internal users of accounting information work for the company and include finance directors, marketing managers, human resource personnel, production supervisors, and company officers. Internal users have access to company information that is not available to external users. (b) Some external users may be individuals who are employees of the company but are not directly involved in managing the company. As a result, they do not have access to much information. External users of accounting information generally do not work for the company. The primary external users are investors and creditors. Other external users include labour unions, customers, the Canada Revenue Agency (CRA), and securities commissions. LO 1 BT: C Difficulty: M TIME: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 3. Internal users may want the following questions answered: Is there enough cash to purchase a new piece of equipment? What price should we sell our product for to cover costs and to maximize net income? How many employees can we afford to hire this year? Which product line is the most profitable? How much of a pay raise can the company afford to give me? External users may want the following questions answered: Is the company earning enough to give me my required return on investment? Will the company be able to repay its debts as the debts come due? Will the company stay in business long enough to service the products I buy from it? LO 1 BT: K Difficulty: M TIME: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 1-4 Chapter 1 4. Primary users of accounting information include investors and creditors. These external users need to make decisions concerning their ongoing business relationship with the company. They need to be able to assess the company‘s performance and financial health because they intend to start, continue, or discontinue having transactions with the company. Other decision makers who have specific needs for certain financial information, such as the amount of taxes paid by the company, are not considered primary users. LO 1 BT: C Difficulty: M TIME: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 5. Decision makers rely on financial statement information and expect the accounting information to have been prepared ethically. Without the expectation of ethical behaviour, the information presented in the financial statements would have no credibility for the users of the accounting information. Without credibility, financial statement information would be useless to financial statement users. LO 1 BT: C Difficulty: M TIME: 5 min. AACSB: None Ethics CPA: cpa-t001 CM: Reporting and Ethics 6. Descriptive data analytic provides information about what happened. On the other hand, predictive data analytics helps the organization look into the future and gives some visibility into what is likely to happen. Predictive data analytics is of the most use to management LO 1 BT: C Difficulty: M TIME: 5 min. AACSB: None Ethics CPA: cpa-t001 CM: Reporting and Ethics 7. (a) Proprietorship: Proprietorships are easier to form (and dissolve) than other types of business organizations. They are not taxed as separate entities; rather, the proprietor pays personal income tax on the company‘s net income. Depending on the circumstances, this may be an advantage or disadvantage. Disadvantages of a proprietorship include unlimited liability (proprietors are personally liable for all debts of the business) and difficulty in obtaining financing compared to other forms of organization. In addition, the life of the proprietorship is limited as it is dependent on the willingness and capability of the proprietor to continue operations. 1-5 Chapter 1 7. (continued) (b) Partnership: Partnerships are easier to form (and dissolve) than a corporation, although not as easy as a proprietorship. Similar to proprietorships, partnerships are not taxed as separate entities. Instead, the partners pay personal income tax on their share of income. Depending on the circumstances, this may be an advantage or disadvantage. Disadvantages of partnerships include unlimited liability (partners are jointly and severally liable for all debts of the business) and difficulty in obtaining financing compared to corporations. In addition, the life of a partnership can be limited depending on the terms of the partnership agreement and actions of the other partners. (c) Private corporation: Advantages of a private corporation include limited liability (shareholders not being personally liable for corporate debts), indefinite life, and transferability of ownership. In many cases, depending on the size of the corporation, a creditor such as a bank will ask for a personal guarantee which will void the limited liability advantage. In addition, transferability of ownership may be limited since shares are not publicly traded. Disadvantages of a private corporation include increased government regulations and paperwork. The fact that corporations are taxed as a separate legal entity may be an advantage or a disadvantage. Corporations often receive more favourable income tax treatment than other forms of business organizations. As mentioned above, depending on the size of the corporation, many of the advantages of the corporate form are not available to a small private corporation. [Show More]

Last updated: 8 months ago

Preview 5 out of 1679 pages

Loading document previews ...

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$18.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Dec 02, 2024

Number of pages

1679

Written in

Additional information

This document has been written for:

Uploaded

Dec 02, 2024

Downloads

0

Views

41

.png)

.png)