Accounting > SOLUTIONS MANUAL > Solutions Manual For Accounting for Decision Making and Control, 9e Jerold L. Zimmerman (All)

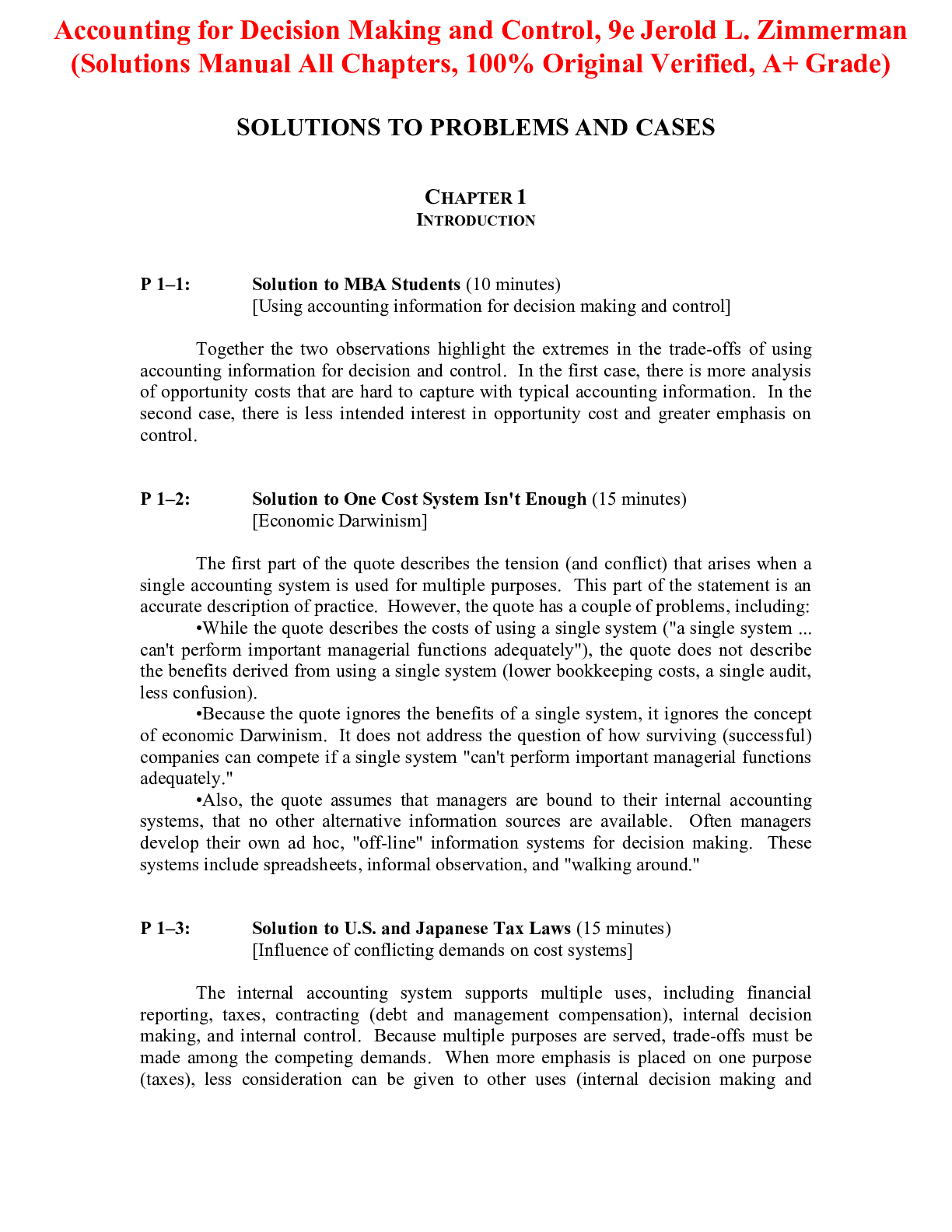

Solutions Manual For Accounting for Decision Making and Control, 9e Jerold L. Zimmerman

Document Content and Description Below

Solutions Manual For Accounting for Decision Making and Control, 9e Jerold L. Zimmerman-Together the two observations highlight the extremes in the trade-offs of using accounting information for deci... sion and control. In the first case, there is more analysis of opportunity costs that are hard to capture with typical accounting information. In the second case, there is less intended interest in opportunity cost and greater emphasis on control. P 1–2: Solution to One Cost System Isn't Enough (15 minutes) [Economic Darwinism] The first part of the quote describes the tension (and conflict) that arises when a single accounting system is used for multiple purposes. This part of the statement is an accurate description of practice. However, the quote has a couple of problems, including: •While the quote describes the costs of using a single system ("a single system ... can't perform important managerial functions adequately"), the quote does not describe the benefits derived from using a single system (lower bookkeeping costs, a single audit, less confusion). •Because the quote ignores the benefits of a single system, it ignores the concept of economic Darwinism. It does not address the question of how surviving (successful) companies can compete if a single system "can't perform important managerial functions adequately." •Also, the quote assumes that managers are bound to their internal accounting systems, that no other alternative information sources are available. Often managers develop their own ad hoc, "off-line" information systems for decision making. These systems include spreadsheets, informal observation, and "walking around." P 1–3: Solution to U.S. and Japanese Tax Laws (15 minutes) [Influence of conflicting demands on cost systems] The internal accounting system supports multiple uses, including financial reporting, taxes, contracting (debt and management compensation), internal decision making, and internal control. Because multiple purposes are served, trade-offs must be made among the competing demands. When more emphasis is placed on one purpose (taxes), less consideration can be given to other uses (internal decision making and control). By linking taxes to external reporting, Japanese firms’ financial reports will be based on accounting procedures that give more weight to tax considerations. In the U.S., companies can keep two sets of books, one for taxes and the other for financial reporting. Thus, in the U.S., there is more of a decoupling of taxes and everything else. Except for the additional bookkeeping costs of producing the two separate sets of reports, tax considerations are predicted to have less influence on the choice of internal (and thus external) accounting procedures in the U.S. than in Japan. The question is raised as to why firms use the same accounting procedures for internal reports as they do for external reports. Or for that matter, why do tax laws and external financial reporting considerations have any effect on internal accounting procedures? Why don’t firms maintain multiple sets of accounts, one for each purpose (e.g., financial reporting, internal decision making, and internal control)? Clearly there are additional bookkeeping costs for maintaining multiple sets of accounts. But also, there are confusion costs and, in many instances, firms explicitly link senior executive compensation to externally reported financial statements. Such explicit linkage of executive pay to externally reported net income presumably exists to control agency costs between management and shareholders. Once senior management performance and rewards are linked to external reports, the internal reporting system will become linked to the external reports and basically less consideration will be given to choosing accounting procedures that aid in internal decision making and internal control. In Japan, the firm’s accounting systems are less likely to be used for internal uses (decision making and control) than in the U.S. Because they cannot rely as much on their accounting systems for internal uses (because more weight is placed on using accounting procedures to reduce taxes), Japanese managers are more likely to use non-accountingbased systems for internal decision making and control. [Show More]

Last updated: 3 months ago

Preview 5 out of 434 pages

Loading document previews ...

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$16.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Mar 27, 2025

Number of pages

434

Written in

Additional information

This document has been written for:

Uploaded

Mar 27, 2025

Downloads

0

Views

12

.png)