Accounting > SOLUTIONS MANUAL > Solutions Manual Accounting Principles 8th Canadian Edition (Volume 2) Jerry Weygandt, Donald Kieso, (All)

Solutions Manual Accounting Principles 8th Canadian Edition (Volume 2) Jerry Weygandt, Donald Kieso, Paul Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak

Document Content and Description Below

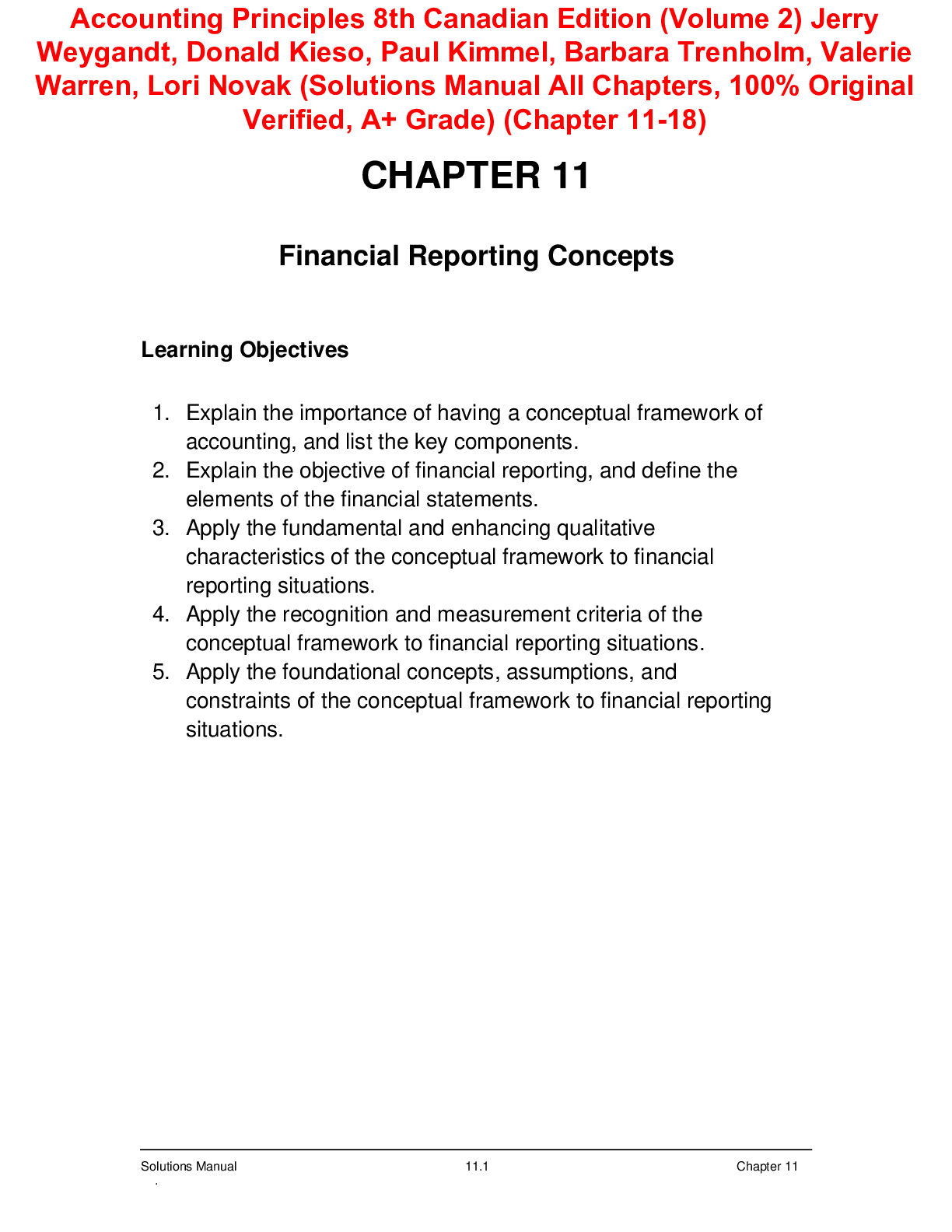

Solutions Manual Accounting Principles 8th Canadian Edition (Volume 2) Jerry Weygandt, Donald Kieso, Paul Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak-1. The conceptual framework is a coheren... t system of interrelated objectives and fundamentals that can lead to consistent standards and that prescribe the nature, function, and limits of financial accounting statements. It guides choices about what to present in financial statements, how to report economic events, and how to communicate such information. LO 1 BT: C Difficulty: S Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 2. (a) The main objective of financial reporting is to provide information that is useful for decision-making. More specifically, the conceptual framework states that the objective of general-purpose financial reporting is to provide financial information that is useful to present and potential investors, lenders, and other creditors in making decisions about a business. (b) The objective identifies the specific users to ensure that a range of possible points of view are included in fulfilling the needs of users but cannot be all things to all users. LO 2 BT: K Difficulty: S Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 3. (a) Stewardship refers to the responsibility of management to acquire and use company resources in the best way possible. (b) The objective of financial reporting is to provide users with useful financial information. Users look for information in the financial statements about a company’s ability to earn a profit and generate future cash flows. Using the financial statements helps users assess stewardship. LO 2 BT: C Difficulty: S Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 4. Under IFRS the elements of assets, liabilities, equity, revenue, and expenses are included, as they are in ASPE. Under revenues, IFRS includes gains and under expenses, IFRS includes losses. Under ASPE, gains and losses are defined in separate categories from revenues and expenses but have similar basic definitions to those under IFRS. LO 2 BT: K Difficulty: S Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition Solutions Manual . 11.8 Chapter 11 Questions (Continued) 5. The two fundamental qualitative characteristics of financial information are relevance and faithful representation. Accounting information has relevance if it makes a difference in a decision. Relevant information has predictive value or confirmatory value. Faithful representation shows the economic reality of events rather than just their legal form. Faithful representation is achieved if the information is complete, neutral, and free from material error. Complete information includes all information necessary to show the economic reality of the transaction. Accounting information is neutral if it is free from bias intended to attain a predetermined result or encourage a particular behaviour. Accounting estimates must also be based on the best available information and be reasonably accurate to be considered free from material error. LO 3 BT: K Difficulty: S Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 6. (a) The concept of materiality means that an item may be so small that failure to follow generally accepted accounting principles will not influence the decision of a reasonably careful investor or creditor. For example, the expensing of a $20 calculator would not technically be in accordance with GAAP since the calculator will probably have a useful life beyond one year. However, the cost is so insignificant that it will have no impact on users’ decisions and therefore, this GAAP deviation is not considered to be material. In addition, the cost constraint supports the expensing of the calculator. Materiality is also the criterion used in deciding whether or not an element deserves to be disclosed separately within the body of the financial statements or in the notes to the financial statements. (b) To be relevant to a financial statement user, a transaction or amount must make a difference to the user when making a decision. If an omission or misstatement does not influence a user, it is said to be immaterial or not material. Materiality is not only a matter of size, but also has to do with the nature of the omission or misstatement (for instance, illegal acts or contingent liabilities). LO 3 BT: C Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition Solutions Manual . 11.9 Chapter 11 Questions (Continued) 7. The four enhancing qualitative characteristics of financial information are comparability, verifiability, timeliness, and understandability. Accounting information about a company is most useful when it can be compared with accounting information about other companies. Comparability results when different companies use the same accounting principles. Comparability is also easier when accounting policies are used consistently by a business from one accounting period to the next. Information is verifiable if two knowledgeable and independent people would agree that it faithfully represents the economic reality. The usefulness of accounting information is enhanced when it is provided on a timely basis, when it is still highly useful for decision-making. Information in financial statements must be capable of being understood by users. Understandability is enhanced by classified, clear, and concise presentation. It is assumed that the average user has a reasonable understanding of accounting concepts and procedures, and general business and economic conditions. LO 3 BT: K Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting 8. Although the transaction’s amount might be considered immaterial to the rest of the financial statements of a business, it does not mean that the transaction should be omitted. For financial statements to be relevant, the financial information presented should be complete. The concept of materiality means that an item may be so small that failure to follow GAAP will not influence the decision of a reasonably careful investor or creditor. When dealing with the omission of a transaction, the framework discusses the decision to omit the transaction’s detail in the disclosure of separate elements in the body of the financial statement or in their notes. [Show More]

Last updated: 4 months ago

Preview 5 out of 1086 pages

Loading document previews ...

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$18.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Mar 27, 2025

Number of pages

1086

Written in

Additional information

This document has been written for:

Uploaded

Mar 27, 2025

Downloads

0

Views

16

By Jerry Weygandt, Donald Kieso, Paul Kimmel, Trenholm, Warren, Novak.png)

By Jerry Weygandt, Donald Kieso, Paul Kimmel, Trenholm, Warren, Novak.png)