FIN 494 Homework 4 Solutions_2020 | FIN494 Homework 4 Solutions_Graded A

Document Content and Description Below

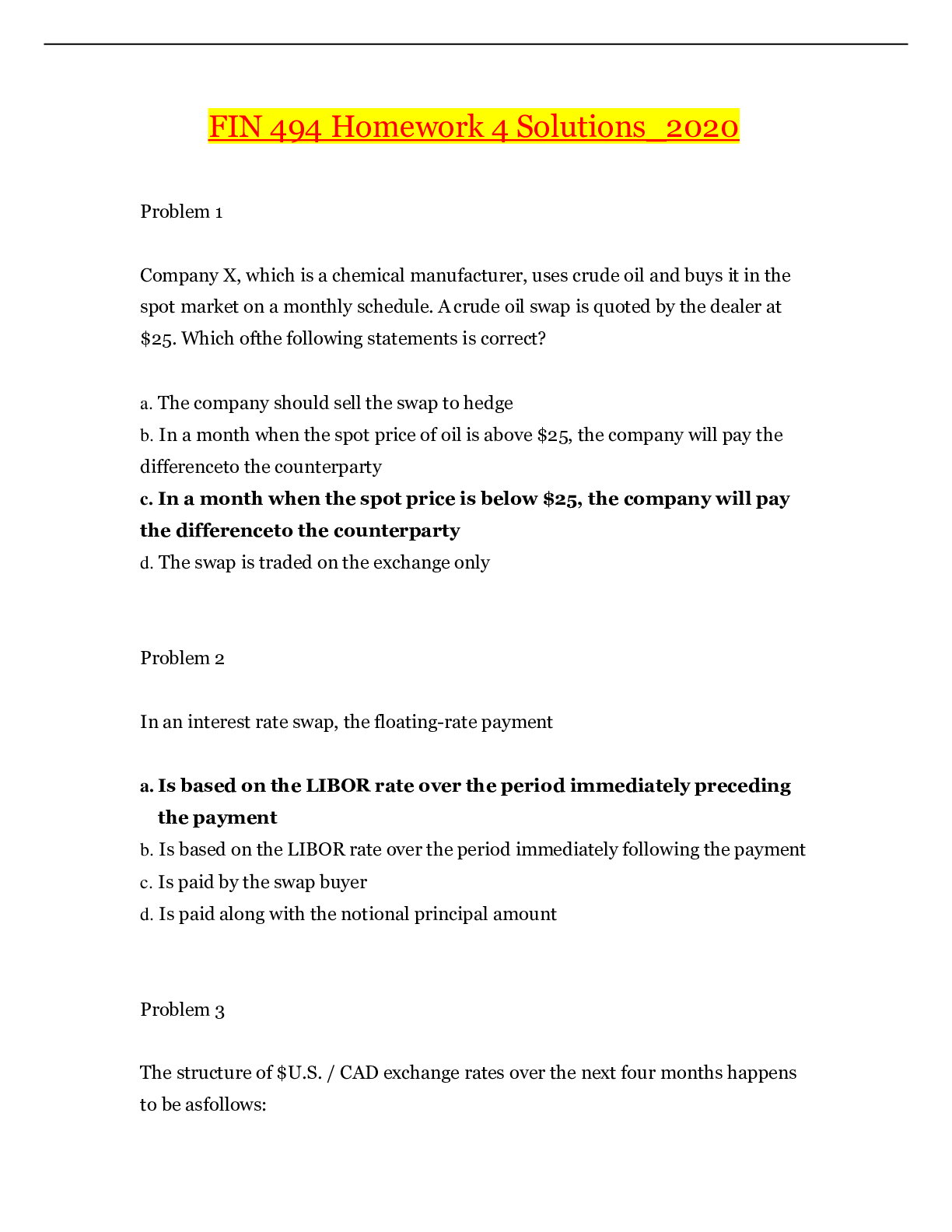

FIN 494 Homework 4 Solutions_2020 Problem 1 Company X, which is a chemical manufacturer, uses crude oil and buys it in the spot market on a monthly schedule. A crude oil swap is quoted by the de... aler at $25. Which of the following statements is correct? a. The company should sell the swap to hedge b. In a month when the spot price of oil is above $25, the company will pay the difference to the counterparty c. In a month when the spot price is below $25, the company will pay the difference to the counterparty d. The swap is traded on the exchange only Problem 2 In an interest rate swap, the floating-rate payment a. Is based on the LIBOR rate over the period immediately preceding the payment b. Is based on the LIBOR rate over the period immediately following the payment c. Is paid by the swap buyer d. Is paid along with the notional principal amount Problem 3 The structure of $U.S. / CAD exchange rates over the next four months happens to be as follows: January 0.70 February 0.75 March 0.72 April 0.68 If an exchange rate swap was quoted at $0.72 US/CAN, in which month will the seller of the swap owe money to the buyer? a. January b. February c. March d. April Problem 4 Firms A and B want to borrow $10M for 5 years. They are offered the following terms by outside creditors Fixed-Rate Market Floating-Rate Market A 10% 6-mo LIBOR +0.3% B 11.2% 6-mo LIBOR + 1.0% Difference (spread) 1.2% 0.7% Which of the following statements is correct? a. Firm A has a poorer credit rating than firm B b. The spread differential is 0.5% c. If firm A wants to pay a floating rate, it should borrow at 10% and buy a swap from B d. The information in the table is sufficient to determine the swap price Problem 5 Firms A and B have a swap agreement for the next two years with payments to be made every six months. The terms are LIBOR for 5%. The notional principal is $100M. If LIBOR term structure drops to a flat 4.5% per annum, which of the following statements is correct? a. The swap buyer will owe its counterparty $250,000 each time b. The value of the swap to the buyer will rise by $946,185 c. The buyer of the swap will face counterparty default risk d. All of the above The swap buyer will owe its counterparty (0.05 – 0.045)*100*1/2 = 0.25M each time The value of the swap to the buyer will drop by V = 250,000∗[1− 1 ] = $946,185 0.045 / 2 ( 1+0.045 /2)4 The seller of the swap will face counterparty default risk Problem 6 You have the following information on LIBOR rates: One-year spot rate s1=3% per year. Two-year spot rate s2=6%. Find the forward rate f for the second year. Round to three decimal places. a. 0.051 b. 0.081 c. 0.090 d. 0.091 f = (1 + 0.06)2/(1.03)-1 = 0.091 Problem 7 The expectations hypothesis states that a. forward rate equals the expected future short rate. [Show More]

Last updated: 2 years ago

Preview 1 out of 13 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$13.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Apr 16, 2021

Number of pages

13

Written in

Additional information

This document has been written for:

Uploaded

Apr 16, 2021

Downloads

0

Views

41

.png)