FIN 494 Homework 2 Solutions_2020 | FIN494 Homework 2 Solutions_Graded A

Document Content and Description Below

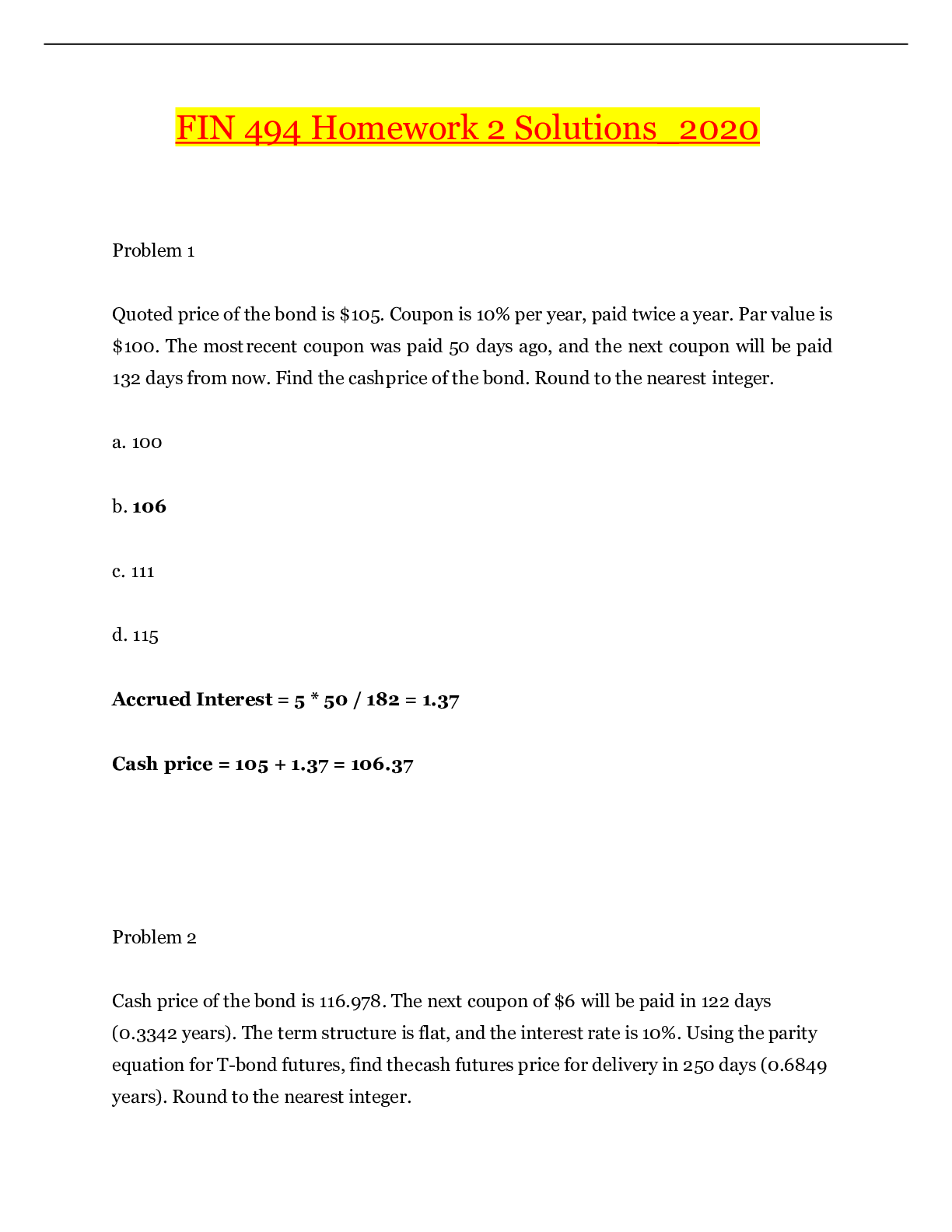

FIN 494 Homework 2 Solutions_2020 Problem 1 Quoted price of the bond is $105. Coupon is 10% per year, paid twice a year. Par value is $100. The most recent coupon was paid 50 days ago, and the n... ext coupon will be paid 132 days from now. Find the cash price of the bond. Round to the nearest integer. a. 100 b. 106 c. 111 d. 115 Accrued Interest = 5 * 50 / 182 = 1.37 Cash price = 105 + 1.37 = 106.37 Problem 2 Cash price of the bond is 116.978. The next coupon of $6 will be paid in 122 days (0.3342 years). The term structure is flat, and the interest rate is 10%. Using the parity equation for T-bond futures, find the cash futures price for delivery in 250 days (0.6849 years). Round to the nearest integer. a. 110 b. 115 c. 120 d. 125 Cash Price = (116.978 – 6*e-0.1*0.3342)*e0.1*0.6849 = 119.05 Problem 3 Cash futures price is 119.67. The bond pays coupons of $6. At the time of delivery, the most recent coupon would be paid 128 days prior to delivery, and the next coupon would be paid 55 days following delivery. Conversion factor is 1.65. Find the quoted (settlement) futures price. Round to the nearest integer. a. 65 b. 70 c. 75 d. 80 Quoted Price = (119.67 – 6 *128/183) / 1.65 = 69.98 Problem 4 A futures contract on S&P 500 with the maturity 3 months has settled at 2,510 today. The underlying index value is $2,500 now and is going to pay a $10 dividend in 3 months. The discount factor (present value of $1) is 0.997. Calculate your arbitrage profit in 3 months from the strategy in the table below (per unit of the index). Position Cash Flow, t=0 Cash Flow, in 3 months Buy S&P 500 -2,500 Borrow at the risk-free rate +2,500 Short Futures 0 Total 0 Arbitrage profit = ? a. $10 b. Zero c. 12.48 d. 15.17 Arb. Profit = (ST + 10) – 2,500 / 0.997 + (2,510 – ST) = 12.48 Problem 5 The S&P 500 futures contract has a multiplier of a. 100 b. 150 c. 200 d. 250 Problem 6 The spot exchange rate S = $0.95 US / FOREX. The U.S. interest rate is 3% per annum. The interest rate in the foreign country is 2% per annum. A futures contract for delivery of 1 million units of the foreign currency one year from today is trading now at F = $0.92 US / FOREX. Which of the following is true? An arbitrage strategy a. Doesn’t exist b. Would involve buying the futures contract and borrowing in the foreign currency c. Would involve selling the futures contract and borrowing in U.S. dollars. 0.92 < 0.95 (1.03/1.02) Problem 7 If the currency futures price is too low in the sense that F0 < S0·[(1+rUS)/(1+rFOREIGN)]T Then the arbitrage strategy would include which of the following positions? a. Sell futures b. Borrow in the U.S., convert into foreign currency, invest the foreign currency c. Borrow in the foreign currency, convert into U.S. dollars and invest in the U.S. d. None of the above Problem 8 The spot exchange rate is $0.75 US/CAD. The U.S. interest rate is 2%, the interest rate in Canada is 3%. A futures contract on 1,000,000 CAD, with one year to delivery, settles at 0.77 US/CAD. Calculate the amount of U.S. dollars that you need for the arbitrage strategy. [Show More]

Last updated: 2 years ago

Preview 1 out of 9 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$11.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Apr 16, 2021

Number of pages

9

Written in

Additional information

This document has been written for:

Uploaded

Apr 16, 2021

Downloads

0

Views

52

.png)