FIN 494 Homework 3 Solutions_2020 | FIN494 Homework 3 Solutions_Graded A

Document Content and Description Below

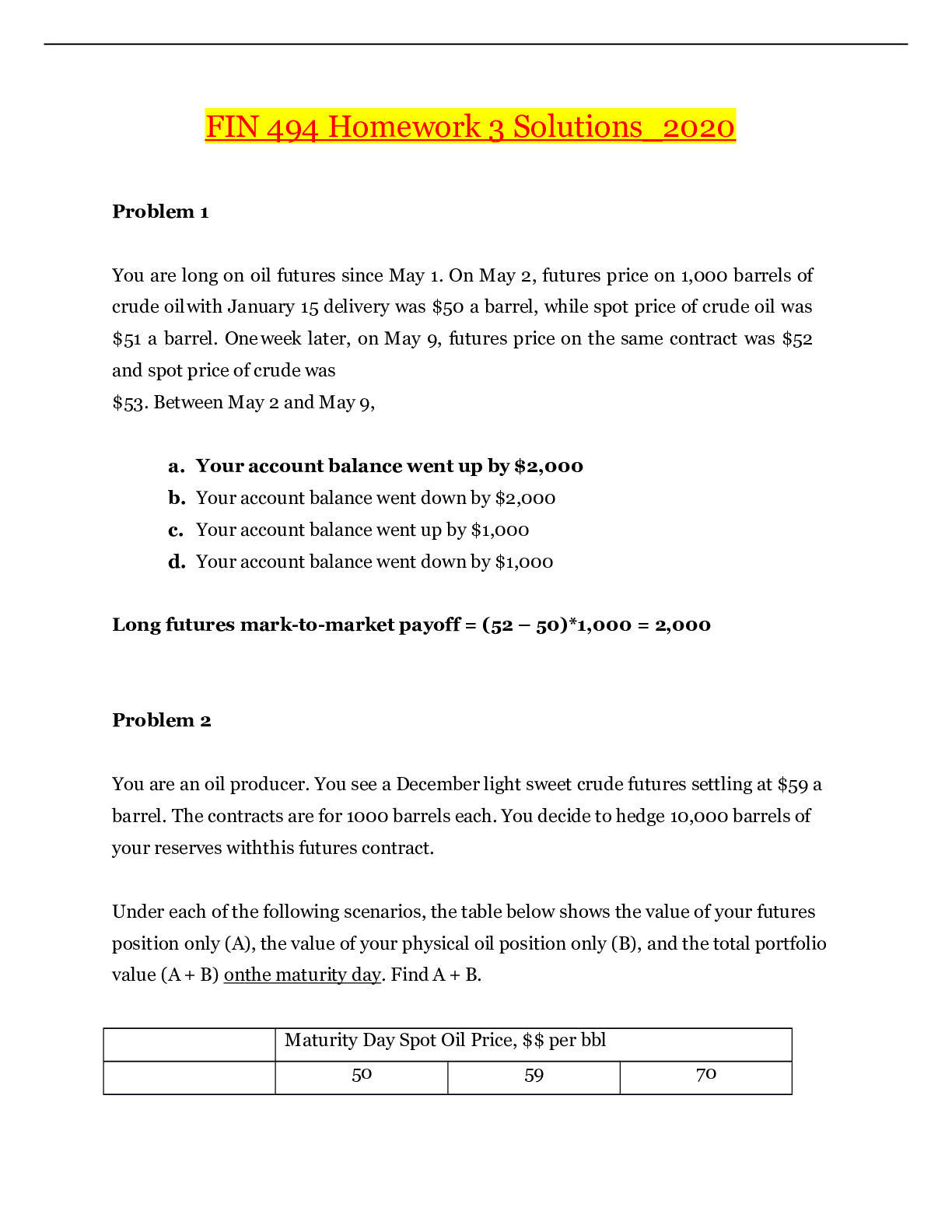

FIN 494 Homework 3 Solutions_2020 Problem 1 You are long on oil futures since May 1. On May 2, futures price on 1,000 barrels of crude oil with January 15 delivery was $50 a barrel, while spot p... rice of crude oil was $51 a barrel. One week later, on May 9, futures price on the same contract was $52 and spot price of crude was $53. Between May 2 and May 9, a. Your account balance went up by $2,000 b. Your account balance went down by $2,000 c. Your account balance went up by $1,000 d. Your account balance went down by $1,000 Long futures mark-to-market payoff = (52 – 50)*1,000 = 2,000 Problem 2 You are an oil producer. You see a December light sweet crude futures settling at $59 a barrel. The contracts are for 1000 barrels each. You decide to hedge 10,000 barrels of your reserves with this futures contract. Under each of the following scenarios, the table below shows the value of your futures position only (A), the value of your physical oil position only (B), and the total portfolio value (A + B) on the maturity day. Find A + B. Maturity Day Spot Oil Price, $$ per bbl 50 59 70 Value of your position in the futures A Value of your physical position in oil B 500,000 590,000 700,000 TOTAL A + B = ? = ? = ? a. 500,000 b. 590,000 c. 600,000 d. 690,000 Solution: Maturity Day Spot Oil Price, $$ per bbl 50 59 70 Value of your position in the futures A (59 – 50)*10,000 = 90,000 (59 – 59) = 0 (59 – 70)*10,000 = -110,000 Value of your physical position in oil B 500,000 590,000 700,000 TOTAL A + B = 590,000 = 590,000 = 590,000 Problem 3 Which of the following statements is FALSE? a. When a hedger holds her futures position until the maturity day, the hedge works thanks to the convergence property. b. If you close out your futures position prior to the contract maturity day, the hedge is not guaranteed to work. c. If you close out your futures position prior to the contract maturity day, your futures account will not be marked to market. Problem 4 A speculator who has a position in wheat futures wants the futures price of wheat to in the future. a. long; increase b. long; decrease c. short; increase d. long; stay the same Problem 5 In which case is your physical exposure short, and you need to long futures to hedge? a. You are a farmer growing soybeans b. You have international operations and receive revenues in foreign currency c. You bought a market ETF d. You are an airline and you need to purchase jet fuel for your operations Problem 6 S&P 500 is now at 2,100. Ignore interest rate (assume everything is given in PV terms). Suppose you own a $20M portfolio with a beta of 0.9. S&P 500 is expected to drop by 3% (or by 63 points, 3% ·2,100 = 63). Futures on S&P500 have a multiplier 250. If S&P500 drops by 63 points, what is the dollar change in the portfolio value? a. $600,000 increase b. $540,000 increase c. $600,000 drop d. $540,000 drop Portfolio will drop by $20,000,000 * 0.9 * 3% = $540,000 Problem 7 S&P 500 is now at 2,000. Ignore interest rate (assume everything is given in PV terms). Suppose you short a $20M portfolio with a beta of 0.8. Find the delta of your portfolio. a. 8,000 b. 10,000 [Show More]

Last updated: 2 years ago

Preview 1 out of 11 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$12.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Apr 16, 2021

Number of pages

11

Written in

Additional information

This document has been written for:

Uploaded

Apr 16, 2021

Downloads

0

Views

55

.png)