FIN 494 Exam Prepared 3_2020 | FIN494 Exam Prepared 3_Graded A

Document Content and Description Below

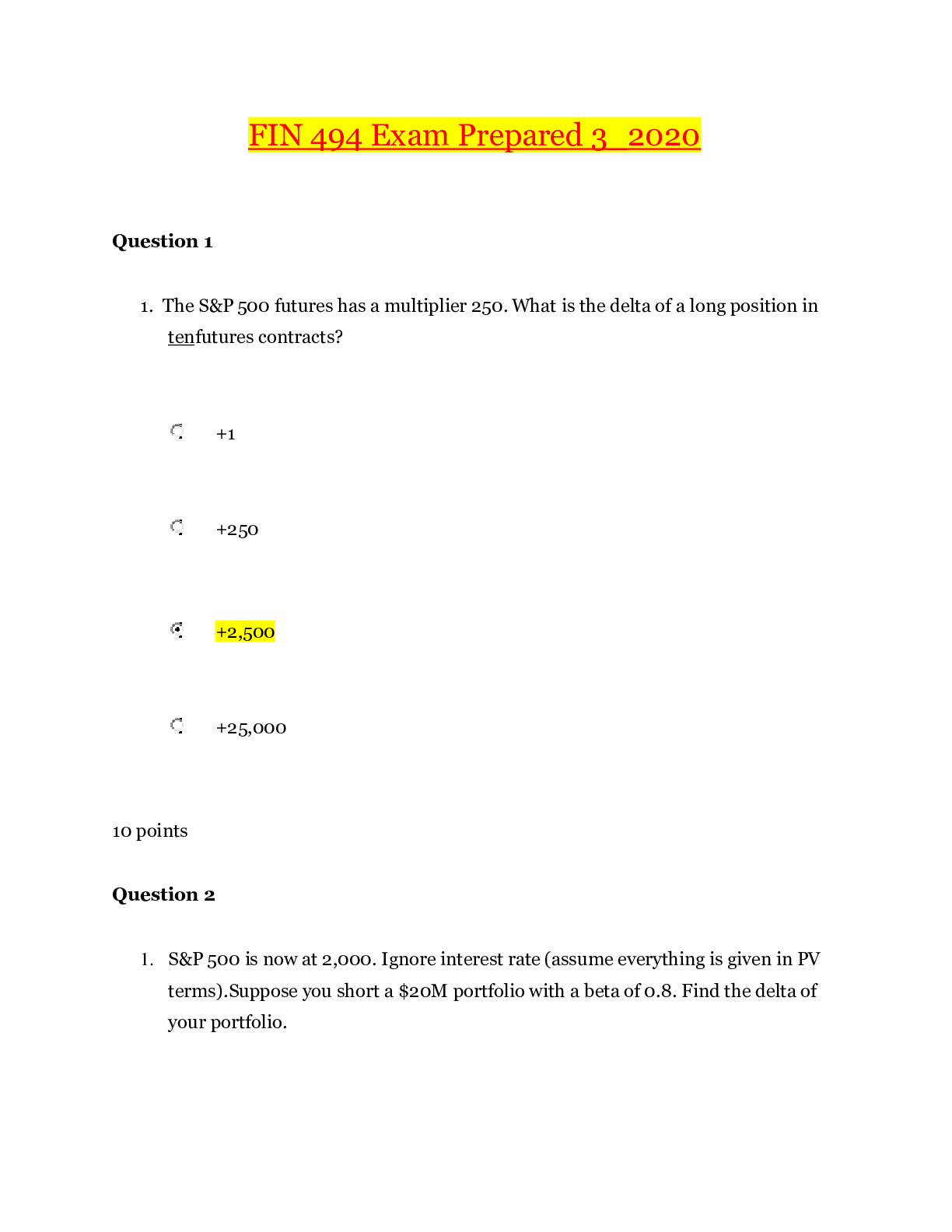

FIN 494 Exam Prepared 3_2020 Question 1 1. The S&P 500 futures has a multiplier 250. What is the delta of a long position in ten futures contracts? +1 +250 ... +2,500 +25,000 10 points Question 2 1. S&P 500 is now at 2,000. Ignore interest rate (assume everything is given in PV terms). Suppose you short a $20M portfolio with a beta of 0.8. Find the delta of your portfolio. 8,000 10,000 -8,000 10 points -10,000 -0.8*(20,000,000/2,000)= -8000 Question 3 1. A bank is short a futures contract on 1,000,000 Euro with F= $1.5 million maturing in one year. The value of this position may decline if: The Euro appreciates against the dollar The Euro depreciates against the dollar The bank faces zero risk because the futures prices is locked in 10 points The value of a short position in a futures contract will decline if the price of the underlying asset rises. In the case of a currency futures contract, the value of a short position will decline if the exchange rate of th underlying currency rises. In this case, if the $/€ exchange rate rises, the value of a short position will decline. If the $/€ exchange rate rises, it means that the € has appreciated because each € can buy a higher amount of $. Therefore, the correct option is "The Euro appreciates against the dollar" Question 4 1. You are long on oil futures since May 1. On May 2, futures price on 1,000 barrels of crude oil with January 15 delivery was $50 a barrel, while spot price of crude oil was $51 a barrel. One week later, on May 9, futures price on the same contract was $52 and spot price of crude was $53. Between May 2 and May 9, Your account balance went up by $2,000 Your account balance went down by $2,000 Your account balance went up by $1,000 Your account balance went down by $1,000 10 points Balance between May 2 and May 9 will change by profit or loss on future contract. Future contract long price on May 2= $50 per barrel Future contract closing price on May 9= $52 per barrel Profit or loss = (Sale or closing price - Long price)* units brought (52-50)*1000 =$2000 There is profit of $2000. So Account balance will up by $2000. Question 5 1. S&P 500 is now at 2,100. Ignore interest rate (assume everything is given in PV terms). Suppose you own a $20M portfolio with a beta of 0.9. S&P 500 is expected to drop by 3% (or by 63 points, 3% ·2,100 = 63). Futures on S&P500 have a multiplier 250. If S&P500 drops by 63 points, what is the dollar change in the portfolio value? $600,000 increase $540,000 increase $600,000 drop $540,000 drop 20,000,000*(3%*0.9)= 540,000 10 points Question 6 ( 틀림) 1. You own a $20M equity portfolio with a beta 0.8. S&P 500 is expected to drop by 63 points. You short S&P 500 futures to hedge. Futures contract multiplier 250. If S&P500 drops by 63 points, what is the dollar change in your futures position, per contract? Vof=(0-0.8)/1*20= 16m 15,750 gain 63,000 gain 15,750 loss 63,000 loss 10 points 16,000,000/250= Question 7 (틀림) 1. You have a utility company, buying natural gas and selling electricity. If you want to hedge both natural gas [Show More]

Last updated: 2 years ago

Preview 1 out of 19 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$13.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Apr 16, 2021

Number of pages

19

Written in

Additional information

This document has been written for:

Uploaded

Apr 16, 2021

Downloads

0

Views

38

.png)