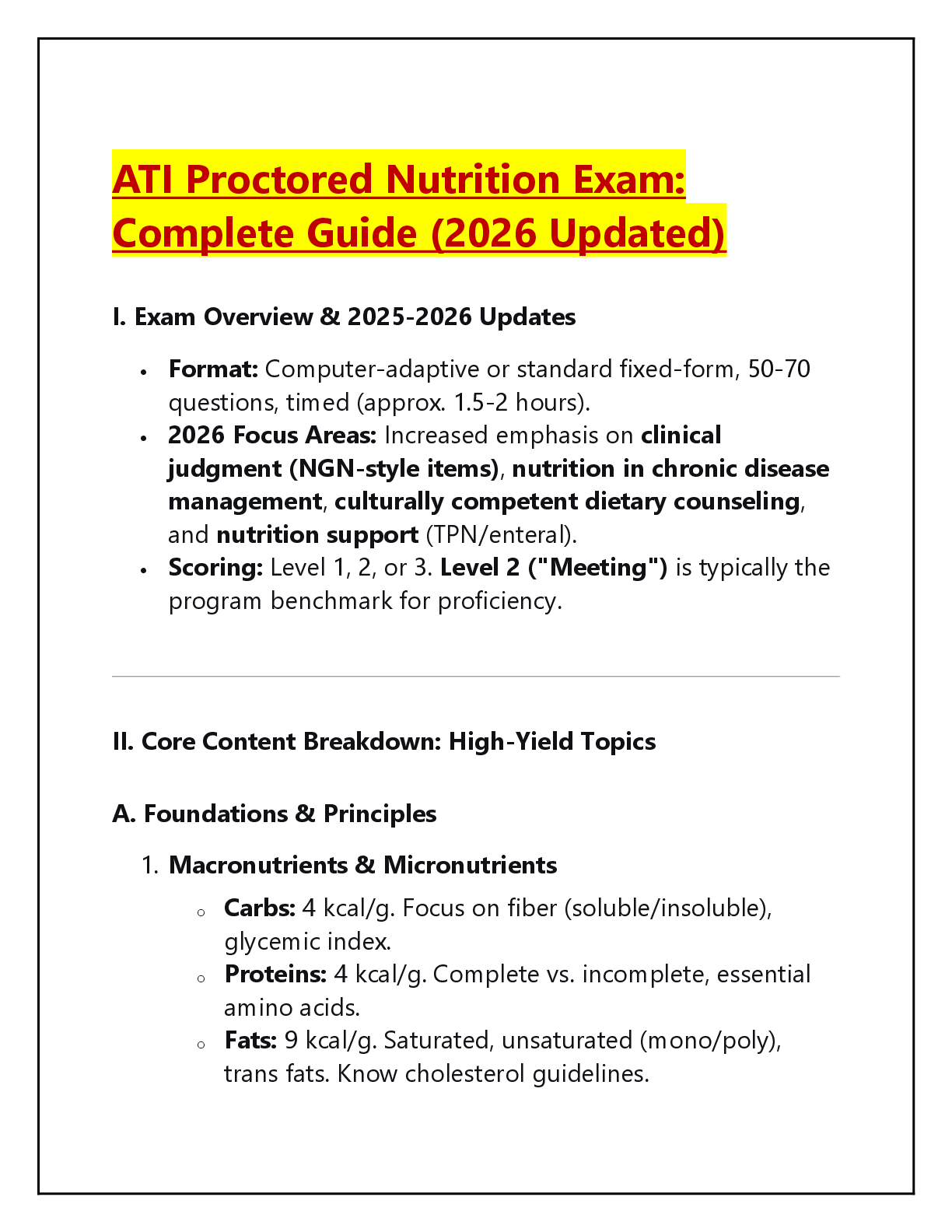

P 9–2: Allington Screen Plant

The Allington Screen Plant of Allington Windows manufactures new and replacement screens.

The plant produces more than 500 different screen sizes and offers four different aluminium

frame

...

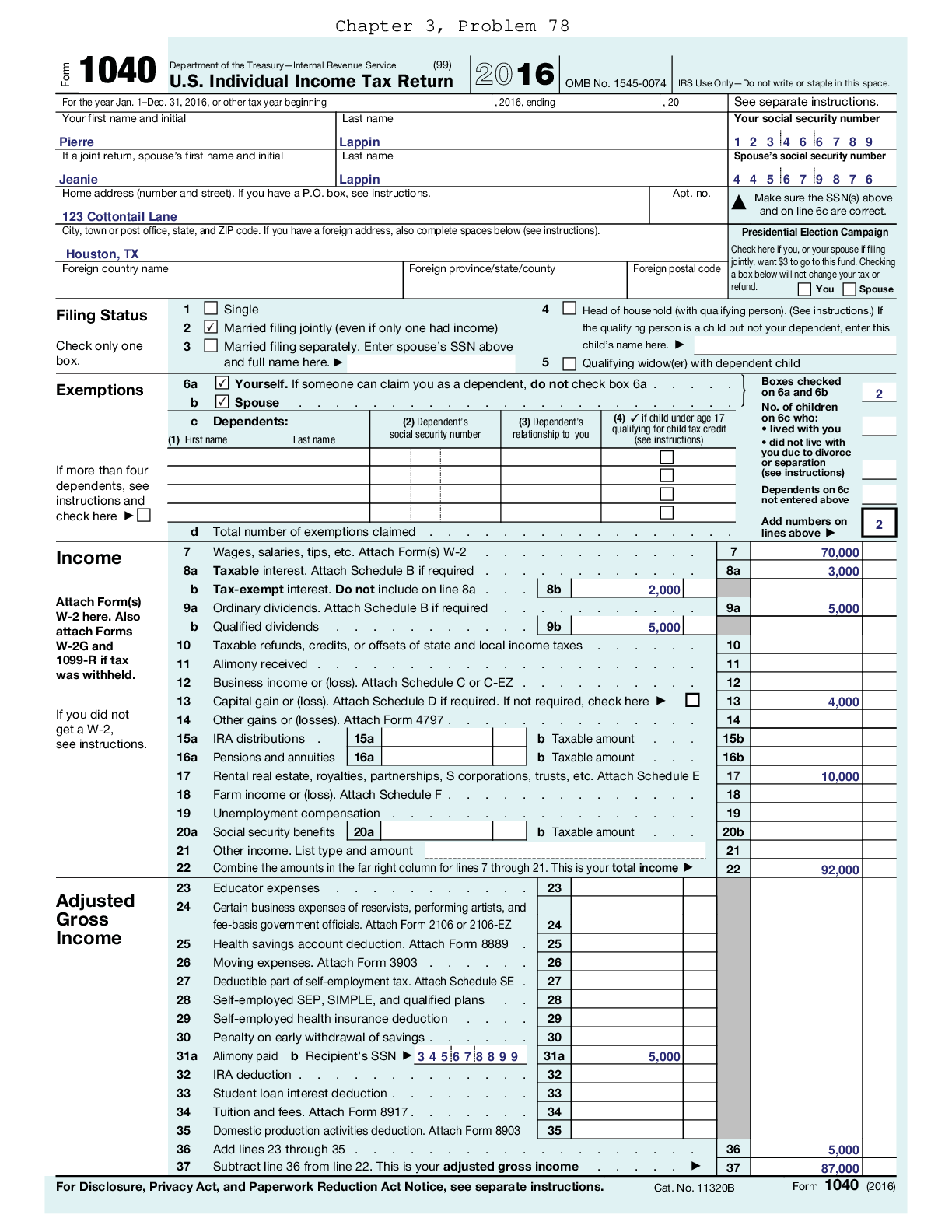

P 9–2: Allington Screen Plant

The Allington Screen Plant of Allington Windows manufactures new and replacement screens.

The plant produces more than 500 different screen sizes and offers four different aluminium

frame colours. Plant overhead is absorbed to each screen produced using the square inches of the

screen as the allocation base. (For example, a screen with dimensions 20 7 __ 32 width × 38

21 __ 32 height has 781.581 square inches.) The single plantwide overhead rate, estimated

before the year begins, is based on a flexible budget (budgeted fixed overhead plus budgeted

variable overhead) divided by budgeted volume. Volume is measured in square inches of the

screens produced. The following table summarizes operations for the year:

Required:

Calculate the budgeted volume amount (in screen square inches) Allington Screen Plant used in

computing the plantwide overhead rate for the year.

Solution:

Below is the table of calculations. The budgeted overhead is the addition of actual and over

applied overheads as actual overheads are less than the applied overheads.

S.no Details Amount

a Over absorbed overhead $7,97,759

b Actual overhead incurred $4,287,482

c=a+b Budgeted total overhead $5,085,241

d Budgeted fixed overhead $3,594,240

e=c-d Budgeted variable overhead $1,491,001

f Budgeted variable overhead $0.01

g=e/f Budgeted volume amount (in sq.in) $149,100,100

P 10–1: Federal Mixing

Federal Mixing (FM) is a division of Federal Chemicals, a large diversified chemical company.

FM provides mixing services for both outside customers and other Federal divisions. FM buys or

receives liquid chemicals and combines and packages them according to the customer’s

specifications. FM computes its divisional net income on both a fully absorbed and variable

costing basis. For the year just ending, it reported

This study source was downloaded by 100000825931745 from CourseHero.com on 05-14-2021 17:38:57 GMT -05:00

https://www.coursehero.com/file/33037810/Team-1-Roster-Week-6-Assignmentdocx/

This study resource was

shared via CourseHero.com

Week-6 Assignment Problems

Overhead is assigned to products using machine hours. There is no finished goods inventory at

FM, only work-in-process (WIP) inventory. As soon as a product is completed, it is shipped to

the customer. The beginning inventory based on absorption costing was valued at $6.3 million

and contained 70,000 machine hours. The ending WIP inventory based on absorption costing was

valued at $9.9 million and contained 90,000 machine hours.

Required:

Write a short nontechnical note to senior management explaining why variable costing and

absorption costing net income amounts differ.

Variable costing will allow us to write off all the (fixed) manufacturing costs to the income that

we become subject to during that particular year.

Now, Absorption costing distributes those fixed overhead costs between the units present in our

inventory and the units that are sold, and it is based on the machine hours utilized/required.

In Absorption costing we have total income that is more than that under variable costing by the

amount of $ 1,200,000.

This clearly states that the inventory we have under absorption costing is more by the amount of

$1.2 million.

This study source was downloaded by 100000825931745 from CourseHero.com on 05-14-2021 17:38:57 GMT -05:00

https://www.coursehero.com/file/33037810/Team-1-Roster-Week-6-Assignmentdocx/

This study resource was

shared via CourseHero.com

Week-6 Assignment Problems

At the end of our work in progress inventory, it contains 20,000 more hours of machine work

than what we had when we started the inventory i.e. ending machine hours- beginning machine

hours

90,000-70,000 = 20,000

So, when we calculate the fixed overhead rates, we have $60/ machine hour. ($1.2 mil/20,000)

As we assign overhead to products by machine hours and the beginning inventory based on

absorption costing was valued at $6.3 million at 70,000 machine hours and the ending WIP

inventory by the same costing was valued at 9.9 million at 90,000 machine hours, we have a

difference of $ 1.2 million between the variable costing and absorption costing.

P 10–10: Medford Mug Company

The Medford Mug Company is an old-line maker of ceramic coffee mugs. It imprints company

logos and other sayings on mugs for both commercial and wholesale markets. The firm has the

capacity to produce 50 million mugs per year, but the recession has cut production and sales in

the current year to 15 million mugs. The accompanying table shows the operating statement fo

[Show More]

.png)

.png)

.png)

.png)

.png)

.png)

.png)

V1-V2.png)