Finance > QUESTION PAPER (QP) > FNCE 4102testbank-M.I very detailed questions with multiple choices(the best required revision quest (All)

FNCE 4102testbank-M.I very detailed questions with multiple choices(the best required revision questions)

Document Content and Description Below

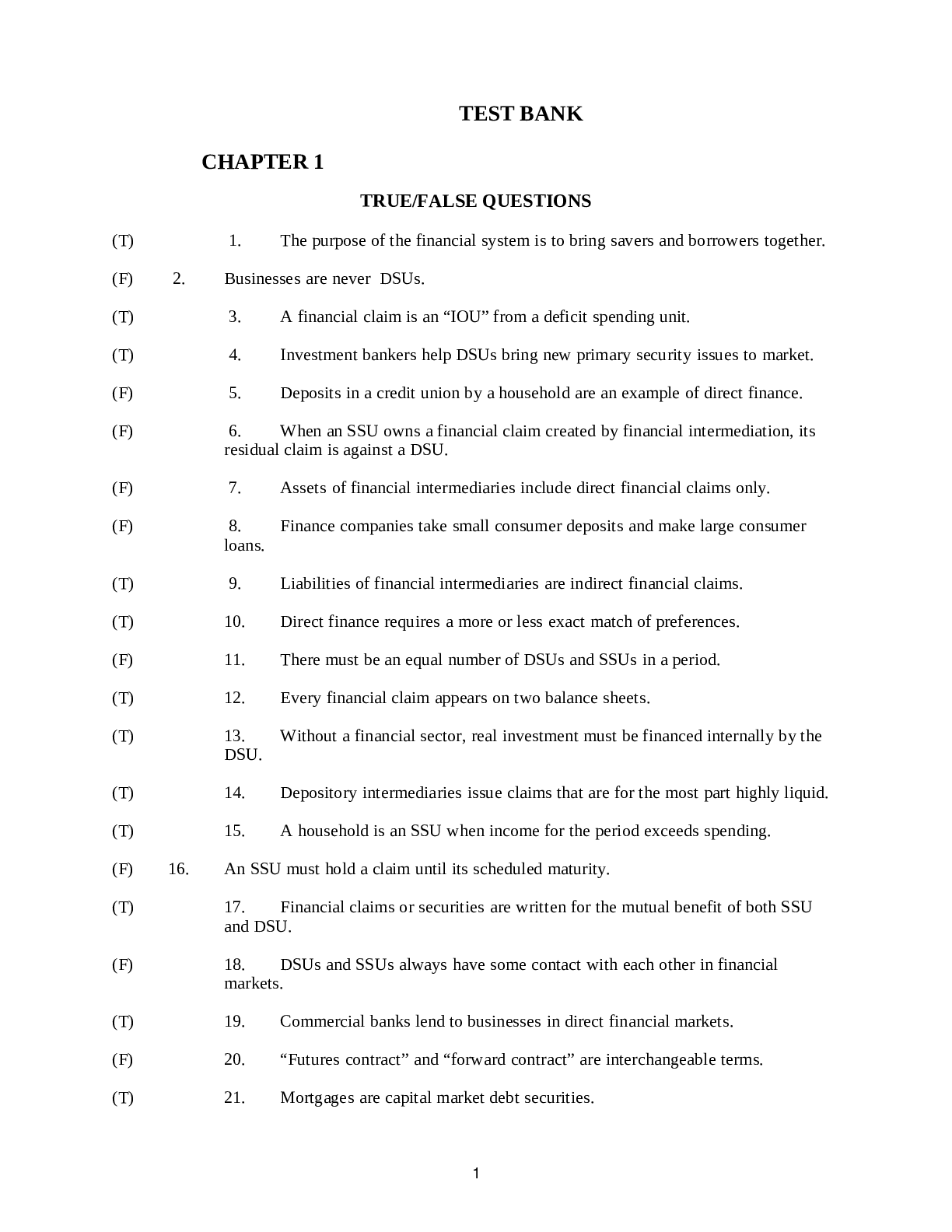

(T) 1. The purpose of the financial system is to bring savers and borrowers together. (F) 2. Businesses are never DSUs. (T) 3. A financial claim is an “IOU” from a deficit spending unit. (T) 4. ... Investment bankers help DSUs bring new primary security issues to market. (F) 5. Deposits in a credit union by a household are an example of direct finance. (F) 6. When an SSU owns a financial claim created by financial intermediation, its residual claim is against a DSU. (F) 7. Assets of financial intermediaries include direct financial claims only. (F) 8. Finance companies take small consumer deposits and make large consumer loans. (T) 9. Liabilities of financial intermediaries are indirect financial claims. (T) 10. Direct finance requires a more or less exact match of preferences. (F) 11. There must be an equal number of DSUs and SSUs in a period. (T) 12. Every financial claim appears on two balance sheets. (T) 13. Without a financial sector, real investment must be financed internally by the DSU. (T) 14. Depository intermediaries issue claims that are for the most part highly liquid. (T) 15. A household is an SSU when income for the period exceeds spending. (F) 16. An SSU must hold a claim until its scheduled maturity. (T) 17. Financial claims or securities are written for the mutual benefit of both SSU and DSU. (F) 18. DSUs and SSUs always have some contact with each other in financial markets. (T) 19. Commercial banks lend to businesses in direct financial markets. (F) 20. “Futures contract” and “forward contract” are interchangeable terms. (T) 21. Mortgages are capital market debt securities. 1 (T) 22. Households are the major source of funds to the financial system. (F) 23. Secondary markets are important because they provide funds directly to DSUs. (F) 24. Primary markets offer liquidity and ways for investors to alter the risk of their portfolios. (T) 25. The New York Stock Exchange is an example of an organized exchange. (T) 26. The money market provides liquidity; the capital market finances economic growth. (T) 27. Private placements are the simplest form of direct finance. (T) 28. Competition among financial intermediaries tends to force interest rates downward. (T) 29. Money markets have a greater variety of investors than borrowers. (F) 30. Every asset is someone else’s liability, but not every liability is someone else’s asset. (T) 31. All money market instruments are short-term debt. (T) 33. The money market is a dealer market, not an exchange, and has no specific location. (T) 34. Money market borrowers are small in number compared to money market lenders. (T) 35. The money market is a market where liquidity is bought and sold. (T) 36. Commercial banks are the major issuer and investor of money market securities. () 37. Organized exchanges are less “exclusive” than over-the-counter markets. (F) 38. Dealers bring buyer and seller together; brokers make a market. (F) 39. OTC markets are not very important any more. (T) 40. When a stock is listed on an exchange, members may trade it on the floor of the exchange. MULTIPLE CHOICE QUESTIONS (b) 1. An SSU’s a. income and expenditures for the period are equal. b. income for the period exceeds expenditures. c. expenditures for the period exceed receipts. d. spending is entirely financed by credit cards (c) 2. Which of the following is an example of indirect financing? 2 a. an SSU purchasing a financial claim from a DSU b. an SSU purchasing a financial claim from a dealer c. an SSU purchasing a financial claim from a commercial bank d. an SSU purchasing a financial claim from an underwriter (d) 3. Which of the following does not take deposits? a. commercial banks. b. savings and loan associations. c. credit unions. d. finance companies. (c) 4. When the financial system has achieved a high degree of efficiency, a. Borrowers are able to finance at the highest possible cost. b. Surplus spending units are able to receive the lowest return on their savings. c. Transaction and intermediation costs are low. d. Lenders will have a limited choice of financial investments. (c) 5. An efficient financial system a. eliminates search and transactions costs b. is a mere theoretical possibility c. promotes economic growth and social progress d. depends on high volumes of “direct” transactions (a) 6. Pension funds tend to invest in a. higher-yielding long-term securities b. money market securities exclusively c. government securities exclusively d. none of the above (d) 7. Financial institutions facilitate the flow of investment funds a. from savers to borrowers b. from SSUs to DSUs c. from the household sector to the business sector d. any of the above (d) 8. Which sector has been most consistently in a surplus budget position? a. Business b. Government c. Foreign d. Household (d) 9. Which of the following are “economic units”? a. households b. businesses c. governments d. all of the above (b) 10. Which of the following best describes the "two faces of debt" concept? a. DSUs are sometimes SSUs. b. Every financial asset is someone else’s liability. c. Intermediaries may own both direct and indirect financial assets. d. The government is unable to control its federal spending. (a) 11. A dealer offers to buy shares of IBM at $125 and sell to investors at $127. The 3 “bid” is a. $125 b. $127c. $2 d. none of the preceding (d) 12. Most financial intermediaries: a. issue direct claims and purchase direct financial assets. b. issue indirect claims and purchase indirect financial assets. c. purchase large amounts of real, tangible assets. d. purchase direct financial claims and issue indirect securities. (a) 13. Profitability of financial intermediaries derives from all of the following except a. government regulation of interest rates b. economies of scale c. ability to manage credit risk d. control of transactions costs (c) 14. Denomination intermediation is best exemplified by a. issuing insured deposits and making risky business loans. b. bringing together investors of different religions c. issuing five $3,000 CDs and making one $15,000 loan. d. promising liquidity to SSUs while investing the funds long-term (a) 15. All but one of the following is comparative advantage of financial intermediaries: a. ability to finance businesses and governments. b. ability to achieve economies of scale. c. ability to reduce transaction costs. d. ability to find confidential informa [Show More]

Last updated: 3 years ago

Preview 1 out of 164 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$8.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

May 21, 2021

Number of pages

164

Written in

All

Additional information

This document has been written for:

Uploaded

May 21, 2021

Downloads

0

Views

153

.png)