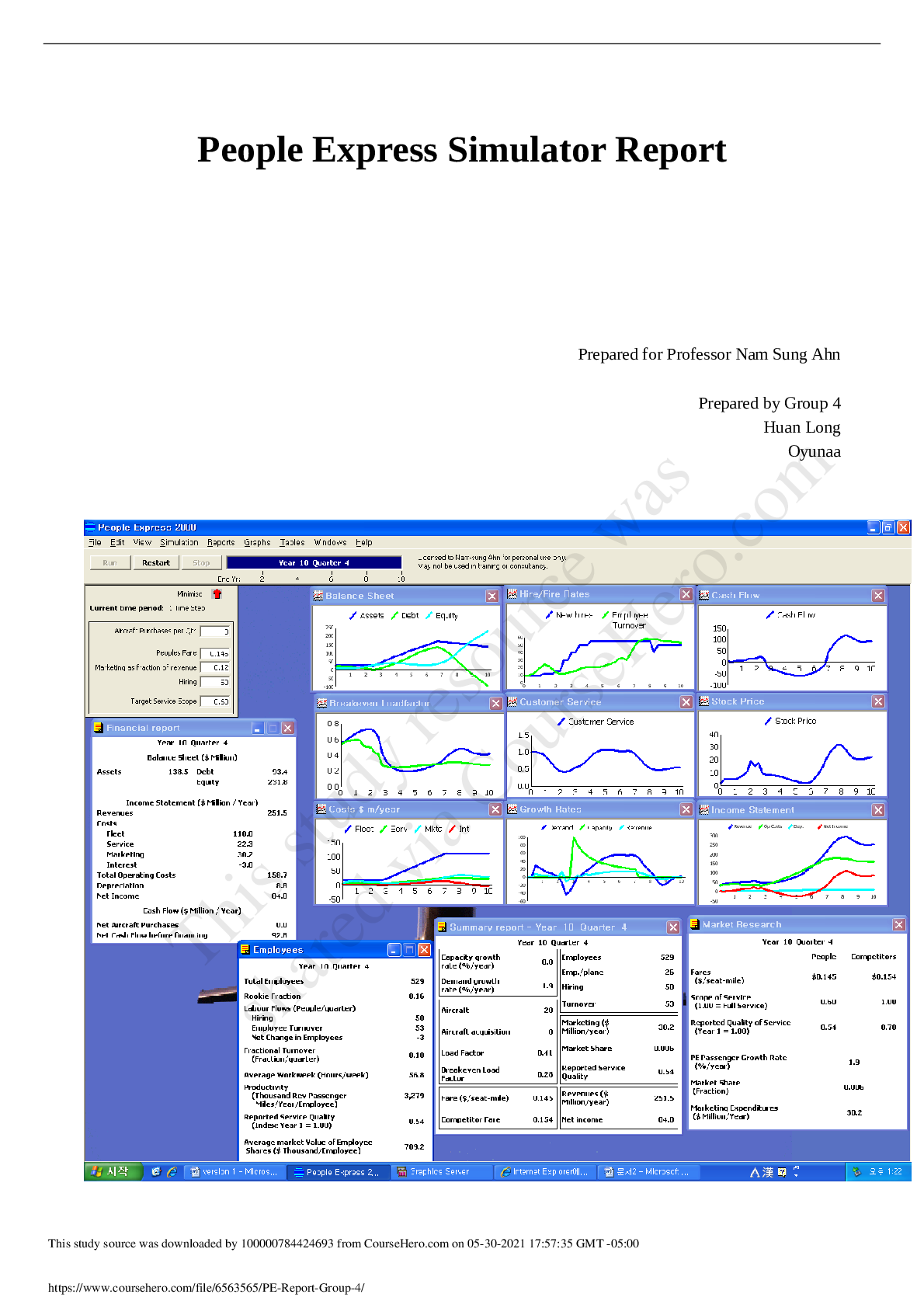

People Express Simulator Report

Prepared for Professor Nam Sung Ahn

Prepared by Group 4

Huan Long

Oyunaa

This study source was downloaded by 100000784424693 from CourseHero.com on 05-30-2021 17:57:35 GMT -05:00

htt

...

People Express Simulator Report

Prepared for Professor Nam Sung Ahn

Prepared by Group 4

Huan Long

Oyunaa

This study source was downloaded by 100000784424693 from CourseHero.com on 05-30-2021 17:57:35 GMT -05:00

https://www.coursehero.com/file/6563565/PE-Report-Group-4/

This study resource was

shared via CourseHero.comOur group began to run the simulator with only 3 aircrafts and 165 employees in People Express

(PE), after 10 years operation, now PE becomes an airline company owning 20 aircrafts and 529

employees, with $251.5 Million revenues and $84.0 Million net incomes at the 10th year. Now let’s

look in detail to see how we got here.

For each quarter of the total 10 years, we have the opportunity to make five decisions, which are

Aircraft Purchase per Qtr, People Fare, Marketing as Fraction of Revenue, Hiring, and Target Service

Scope. At the beginning of running the simulator, the Quarter 4 of Year 0, PE didn’t plan to purchase

new aircraft; priced the routes at an average of $0.09/seat-mile; spent 10% of revenues in marketing;

kept the staff constant by hiring replacements for the 9 employees who left during the last quarter;

and sticked target service scope to 0.60.

From all those preconditions, we realized that PE is a no-frill airline, with few assets (only 3

aircrafts), and low customer demand growth rate. However, because PE only owned 3 aircraft but

had 165 employees, the service quality is pretty high, up to 1.0. Thus, for the 1st Quarter of the 1st

year, we decided to increase the marketing cost by changing the Marketing as Fraction of Revenue to

0.30, to increasing the demand growth rate. Meanwhile, in order to generate more cash for future

investment, we increased the People Fares from 0.09 to 0.11, which was still much lower than the

competitors’ average of $0.16/seat-mile. However, we sticked with the initial fleet of three, and kept

the Hiring and Target Service Scope unchanged, owing to lack of cash. We kept this strategy for 5

quarters, until the end of the Quarter 1, Year 2.

Because of this strategy, PE’s stock price was constantly increasing, from $1.88/share up to near

$20/share. At the same time, the cash flow was increasing from close 0 to around $15 Million. The

cash flow came from two paths

[Show More]

.png)