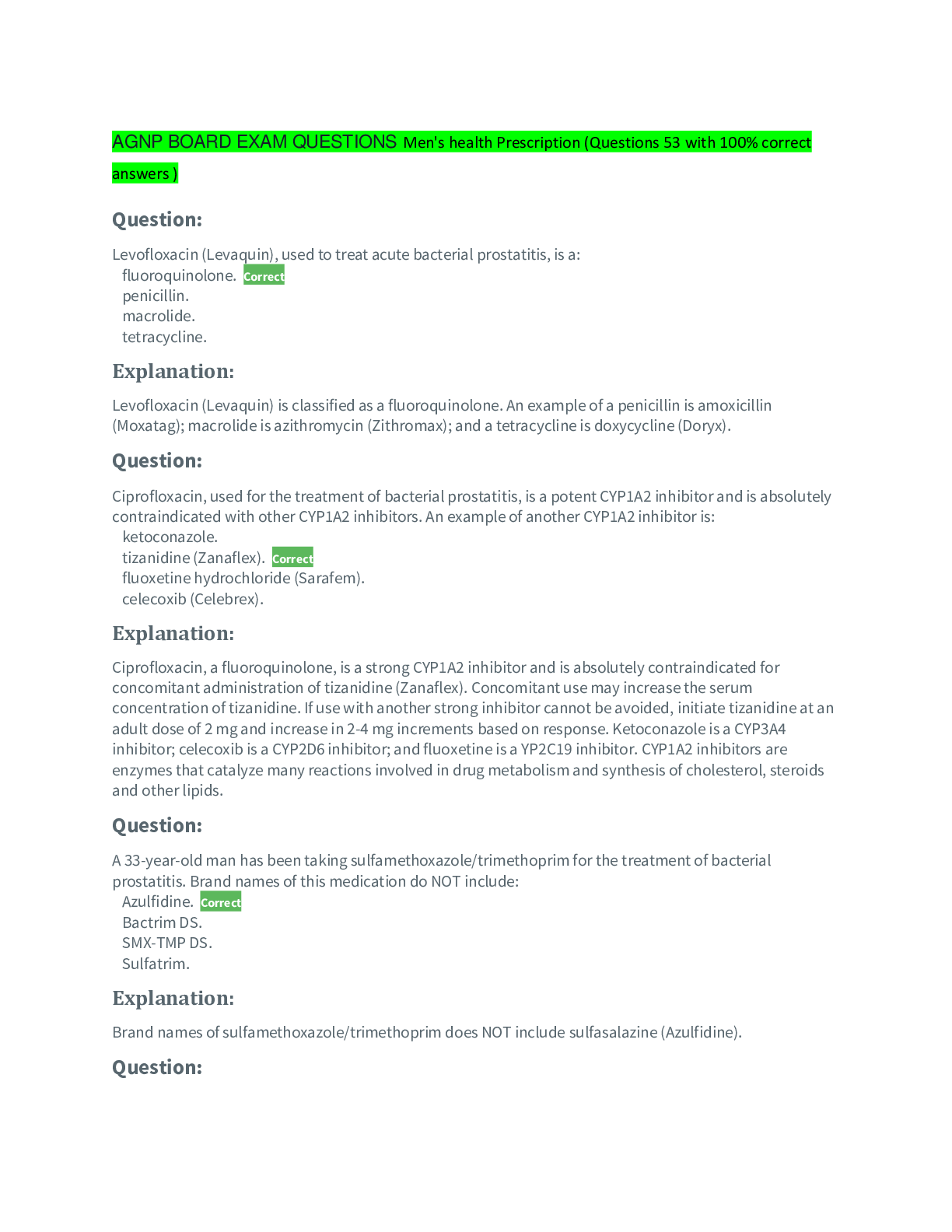

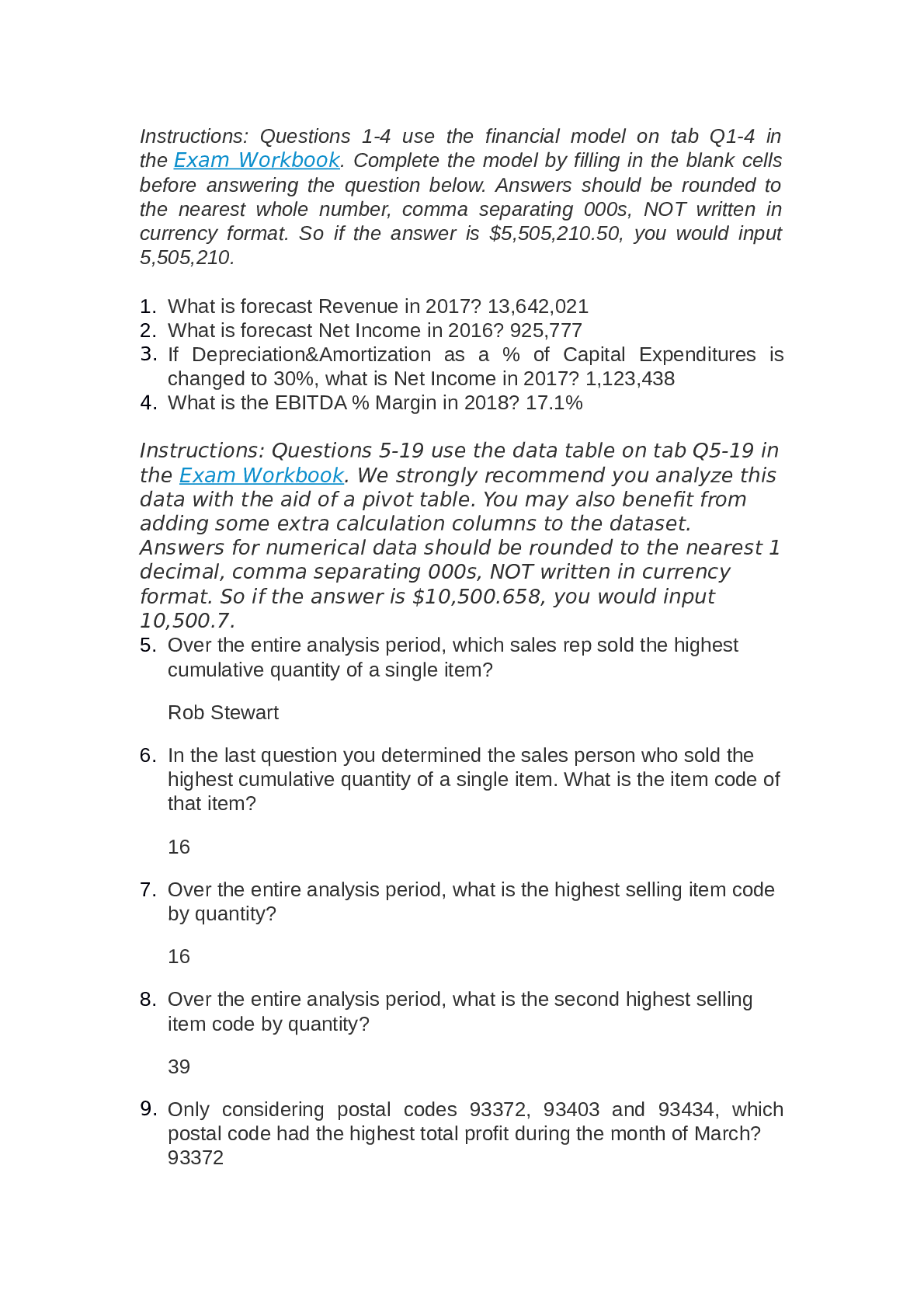

Wesleyan UniversityBUSINESS 121NDDC - Exam ( WITH 100% CORRECT ANSWERS )

Document Content and Description Below

THEORY OF ACCOUNTS 1. Which of the following is the most likely item to result in a deferred tax asset? (a) using straight line depreciation for the books and accelerated depreciation for tax (b) ... prepayment of insurance (c) rent received in advance (d) point of sale revenue recognition for the books and cost recovery method of revenue recognition for tax C 2. In annuity payments, the amount of interest which is included in each of the equal periodical payments is: (a) increasing. (c) equal. (b) decreasing. (d) not determinable. B 3. An investor purchased a bond as a long-term investment on January 2. The investor’s carrying value at the end of the first year would be highest if the bonds was purchased at a: (a) discount and amortized by the straight-line method. (b) discount and amortized by the effective interest method. (c) premium and amortized by the straight-line method. (d) premium and amortized by the effective interest method. D 4. Statement 1 A bond is a contract of debt whereby one party called the investor borrows funds from another party called the issuer of bonds. Statement 2 Convertible bonds are bonds issued whereby another party promises to make payment if the borrower fails to do so. A B C D STATEMENT 1 TRUE TRUE FALSE FALSE STATEMENT 2 TRUE FALSE FALSE TRUE C 5. Statement 1 Discount on bonds payable is treated as outright gain but amortized over the life of the bonds by charging it to interest expense. Statement 2 The common practice is to consider bond issue costs as a deferred charge and therefore classified as other noncurrent asset. A B C D STATEMENT 1 TRUE TRUE FALSE FALSE STATEMENT 2 TRUE FALSE FALSE TRUE D 6. Statement 1 Bonds issued with common stock warrants outstanding should be separated because two securities are actually sold. It is therefore necessary that the sales price from the sale of bonds should be allocated between the bonds and the warrants on the basis of market value. Statement 2 When convertible bonds are originally issued, the proceeds from the issuance should be identified with the bonds only. Thus, the convertible bonds should be accounted for solely as debt. Thus, the difference between the proceeds from issuance and the face value of the bonds is treated as discount or premium on bonds payable. A B C D STATEMENT 1 TRUE TRUE FALSE FALSE STATEMENT 2 TRUE FALSE FALSE TRUE A 7. Borrowing costs include: (a) Interest on short-term and long-term borrowings (b) Amortization of discounts or premiums relating to borrowings (c) Finance charges in respect of finance leases (d) Exchange differences arising from foreign currency borrowings to the extent that they are regarded as an adjustment to interest costs [Show More]

Last updated: 2 years ago

Preview 1 out of 31 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$11.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jun 12, 2021

Number of pages

31

Written in

Additional information

This document has been written for:

Uploaded

Jun 12, 2021

Downloads

0

Views

58

.png)

.png)

.png)

.png)