Financial Accounting > QUESTIONS & ANSWERS > VALUATION OF INVENTORIES: A COST-BASIS APPROACH DHCC FINAL EXAM 2 (All)

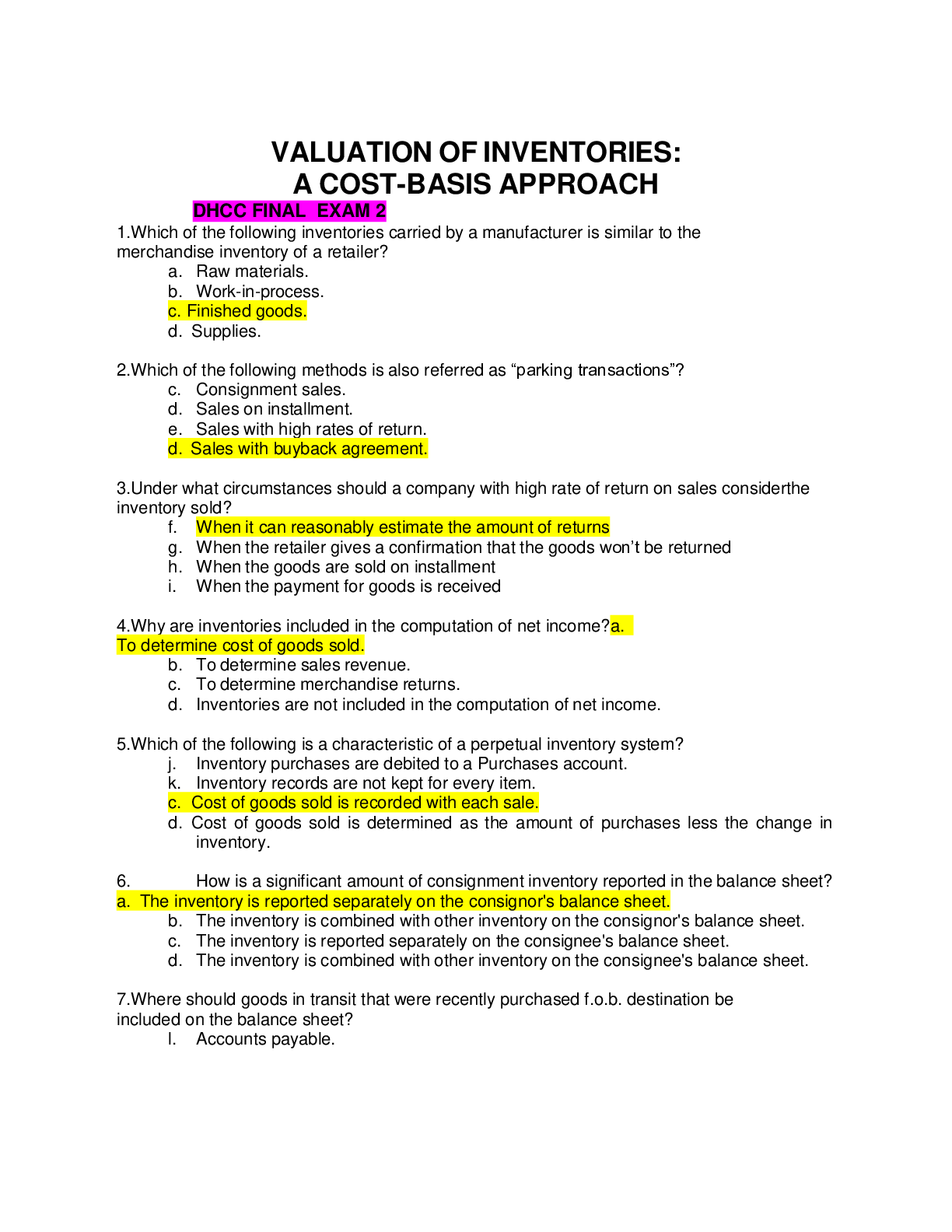

VALUATION OF INVENTORIES: A COST-BASIS APPROACH DHCC FINAL EXAM 2

Document Content and Description Below

VALUATION OF INVENTORIES: A COST-BASIS APPROACH DHCC FINAL EXAM 2 1.Which of the following inventories carried by a manufacturer is similar to the merchandise inventory of a retailer? a. Raw mat... erials. b. Work-in-process. c. Finished goods. d. Supplies. 2.Which of the following methods is also referred as “parking transactions”? c. Consignment sales. d. Sales on installment. e. Sales with high rates of return. d. Sales with buyback agreement. 3.Under what circumstances should a company with high rate of return on sales considerthe inventory sold? f. When it can reasonably estimate the amount of returns g. When the retailer gives a confirmation that the goods won’t be returned h. When the goods are sold on installment i. When the payment for goods is received 4.Why are inventories included in the computation of net income?a. To determine cost of goods sold. b. To determine sales revenue. c. To determine merchandise returns. d. Inventories are not included in the computation of net income. 5.Which of the following is a characteristic of a perpetual inventory system? j. Inventory purchases are debited to a Purchases account. k. Inventory records are not kept for every item. c. Cost of goods sold is recorded with each sale. d. Cost of goods sold is determined as the amount of purchases less the change in inventory. 6. How is a significant amount of consignment inventory reported in the balance sheet? a. The inventory is reported separately on the consignor's balance sheet. b. The inventory is combined with other inventory on the consignor's balance sheet. c. The inventory is reported separately on the consignee's balance sheet. d. The inventory is combined with other inventory on the consignee's balance sheet. 7.Where should goods in transit that were recently purchased f.o.b. destination be included on the balance sheet? l. Accounts payable.m. Inventory. n. Equipment. o. Not on the balance sheet. 8.If a company uses the periodic inventory system, what is the impact on net income of including goods in transit f.o.b. shipping point in purchases, but not ending inventory? p. Overstate net income. b. Understate net income. c. No effect on net income. d. Not sufficient information to determine effect on net income. 10.If a company uses the periodic inventory system, what is the impact on the current ratioof including goods in transit f.o.b. shipping point in purchases, but not ending inventory? q. Overstate the current ratio. b. Understate the current ratio. c. No effect on the current ratio. d. Not sufficient information to determine effect on the current ratio. 11.What is consigned inventory? r. Goods that are shipped, but title transfers to the receiver. s. Goods that are sold, but payment is not required until the goods are sold. c. Goods that are shipped, but title remains with the shipper. d. Goods that have been segregated for shipment to a customer. 22. When using a perpetual inventory system, a. no Purchases account is used. b. a Cost of Goods Sold account is used. c. two entries are required to record a sale. d. All of these answer choices are correct. 23. Goods in transit which are shipped f.o.b. shipping point should be a. included in the inventory of the seller. b. included in the inventory of the buyer. c. included in the inventory of the shipping company. d. None of these answer choices are correct. 24. Goods in transit which are shipped f.o.b. destination should be a. included in the inventory of the seller. b. included in the inventory of the buyer. c. included in the inventory of the shipping company. d. none of these answers are correct. 25. Which of the following items should be included in a company's inventory at the balance sheet date? a. Goods in transit which were purchased f.o.b. destination. b. Goods received from another company for sale on consignment. c. Goods sold to a customer which are being held for the customer to call for at his or her convenience. d. None of these answer choices are correct. Use the following information for questions 35 and 36.During 2014 Carne Corporation transferred inventory to Nolan Corporation and agreed to repurchase the merchandise early in 2015. Nolan then used the inventory as collateral to borrow from Norwalk Bank, remitting the proceeds to Carne. In 2015 when Carne repurchased the inventory, Nolan used the proceeds to repay its bank loan. 26. This transaction is known as a(n) a. consignment. b. installment sale. c. assignment for the benefit of creditors. d. product financing arrangement. 27. On whose books should the cost of the inventory appear at the December 31, 2014 balance sheet date? a. Carne Corporation b. Nolan Corporation c. Norwalk Bank d. Nolan Corporation, with Carne making appropriate note disclosure of the transaction 28. Goods on consignment are a. included in the consignee's inventory. b. included in the consignor’s inventory. c. included in the consignee’s revenue. d. included in both the consignee’s and the consignor’s inventory. S38. Valuation of inventories requires the determination of all of the following except a. the costs to be included in inventory. b. the physical goods to be included in inventory. c. the cost of goods held on consignment from other companies. d. the cost flow assumption to be adopted. P39. The accountant for the Pryor Sales Company is preparing the income statement for 2014 and the balance sheet at December 31, 2014. Pryor uses the periodic inventory system. The January 1, 2014 merchandise inventory balance will appear a. only as an asset on the balance sheet. b. only in the cost of goods sold section of the income statement. c. as a deduction in the cost of goods sold section of the income statement and as a current asset on the balance sheet. d. as an addition in the cost of goods sold section of the income statement and as a current asset on the balance sheet. P40. If the beginning inventory for 2014 is overstated, the effects of this error on cost of goods sold for 2014, net income for 2014, and assets at December 31, 2015, respectively, are a. overstatement, understatement, overstatement. b. overstatement, understatement, no effect. c. understatement, overstatement, overstatement. d. understatement, overstatement, no effect. S41. The failure to record a purchase of merchandise on account even though the goods are properly included in the physical inventory results in a. an overstatement of assets and net income. b. an understatement of assets and net income. [Show More]

Last updated: 2 years ago

Preview 1 out of 20 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$10.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jul 06, 2021

Number of pages

20

Written in

Additional information

This document has been written for:

Uploaded

Jul 06, 2021

Downloads

0

Views

57

answers.png)