Solutions Class 1

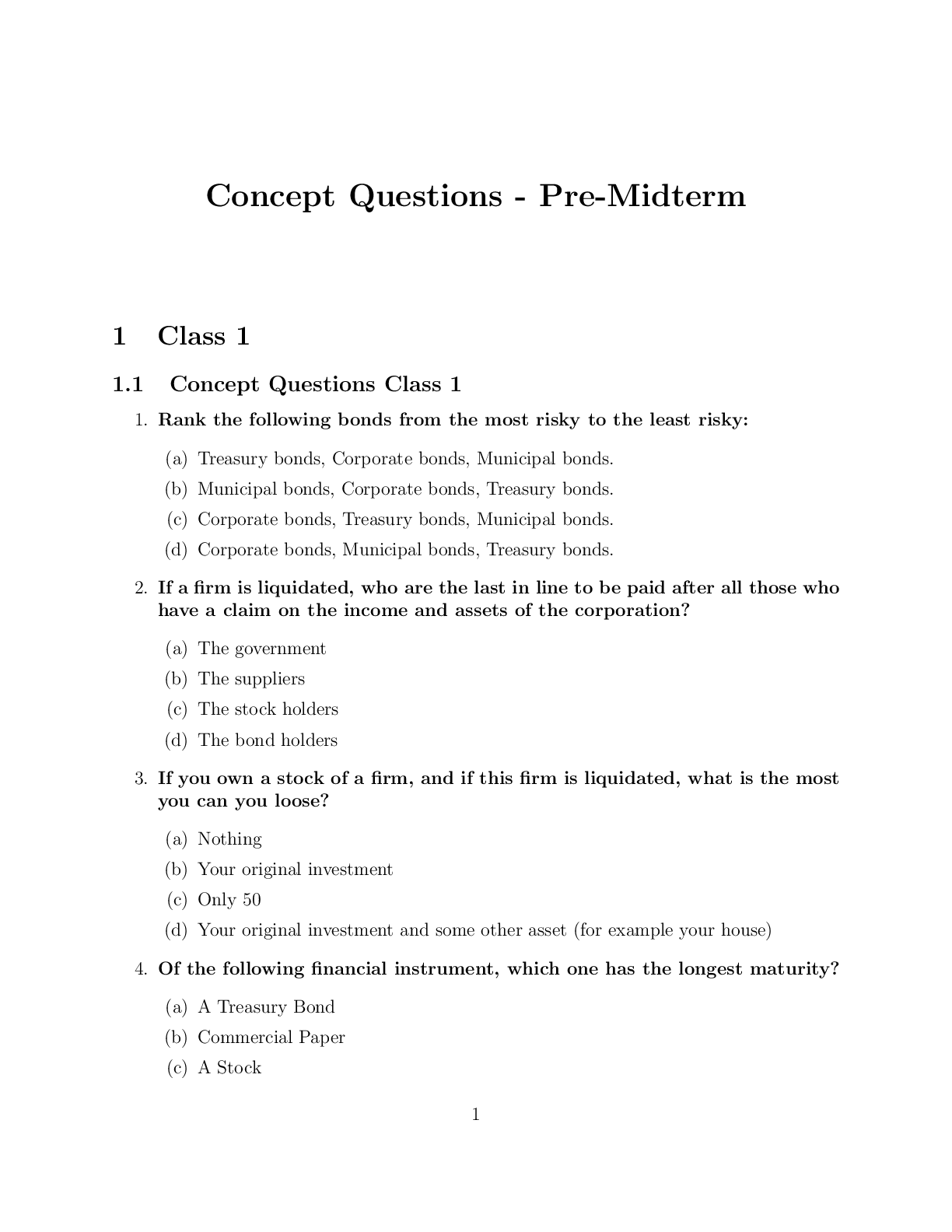

1. Rank the following bonds from the most risky to the least risky:

(a) Treasury bonds, Corporate bonds, Municipal bonds.

(b) Municipal bonds, Corporate bonds, Treasury bonds.

(c) Corporate bonds, T

...

Solutions Class 1

1. Rank the following bonds from the most risky to the least risky:

(a) Treasury bonds, Corporate bonds, Municipal bonds.

(b) Municipal bonds, Corporate bonds, Treasury bonds.

(c) Corporate bonds, Treasury bonds, Municipal bonds.

(d) Corporate bonds, Municipal bonds, Treasury bonds.

Answer: The correct answer is (d).

The difference in riskiness stems from default risk. Corporations are

most likely to default on their bond payments followed by state and

local governments. U.S. Treasury debt is very safe.

2. If a firm is liquidated, who are the last in line to be paid after all those who

have a claim on the income and assets of the corporation?

(a) The government

(b) The suppliers

(c) The stock holders

(d) The bond holders

Answer: The correct answer is (c).

Bankruptcy laws specify the following ordering: government, employees, bondholders, stockholders (preferred stock), stockholders (common

stock).

3. If you own a stock of a firm, and if this firm is liquidated, what is the most

you can you loose?

(a) Nothing

(b) Your original investment

(c) Only 50

(d) Your original investment and some other asset (for example your house)

Answer: The correct answer is (b).

The price of the security can go to zero in case the firm is liquidated.

But there is never a possibility to go after stockholders and demand them

to pay for remaining debt. All that investors can therefore lose is there

intial investment. We call that ”limited liability”.

4. Of the following financial instrument, which one has the longest maturity?

(a) A Treasury Bond

3

(b) Commercial Paper

(c) A Stock

(d) Mortgage Backed Security

Answer: The correct answer is (c).

Stocks do not have a defined maturity and hence it can be arbitrarily

long unless the firm gets liquidated. Treasury bonds have maturities in

the range of 10 to 30 years and commercial paper is short-term.

5. Which of the following is an arbitrage opportunity?

(a) Two stocks, one has expected return of 5%, the other 4%.

(b) For every $1 you deposit today, the bank offers to pay you $1 in a year if the

economy is bad and $2 in a year if the economy is good.

(c) The bank offers you a loan at 5% interest and a savings account that pays 4%

interest.

(d) The bank offers you a loan at 4% interest and a savings account that pays 5%

interest.

Answer: The correct answer is (d).

You can earn a sure profit by taking out the loan paying 4% interest and

investing in the savings account at 5% interest, earning 1% interest.

[Show More]