Economics > STUDY GUIDE > Why Do Financial Crises Occur and Why Are They So Damaging to the Economy (All)

Why Do Financial Crises Occur and Why Are They So Damaging to the Economy

Document Content and Description Below

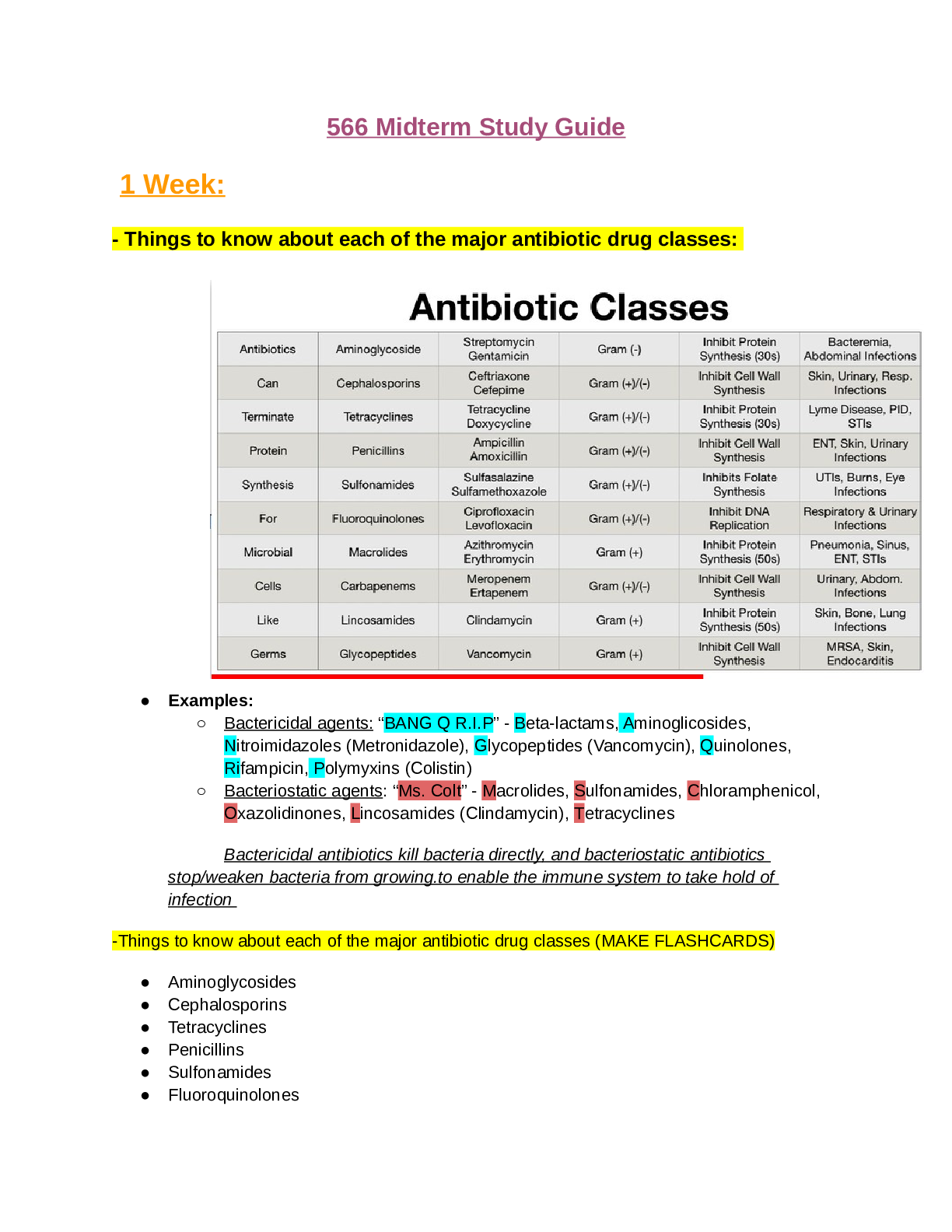

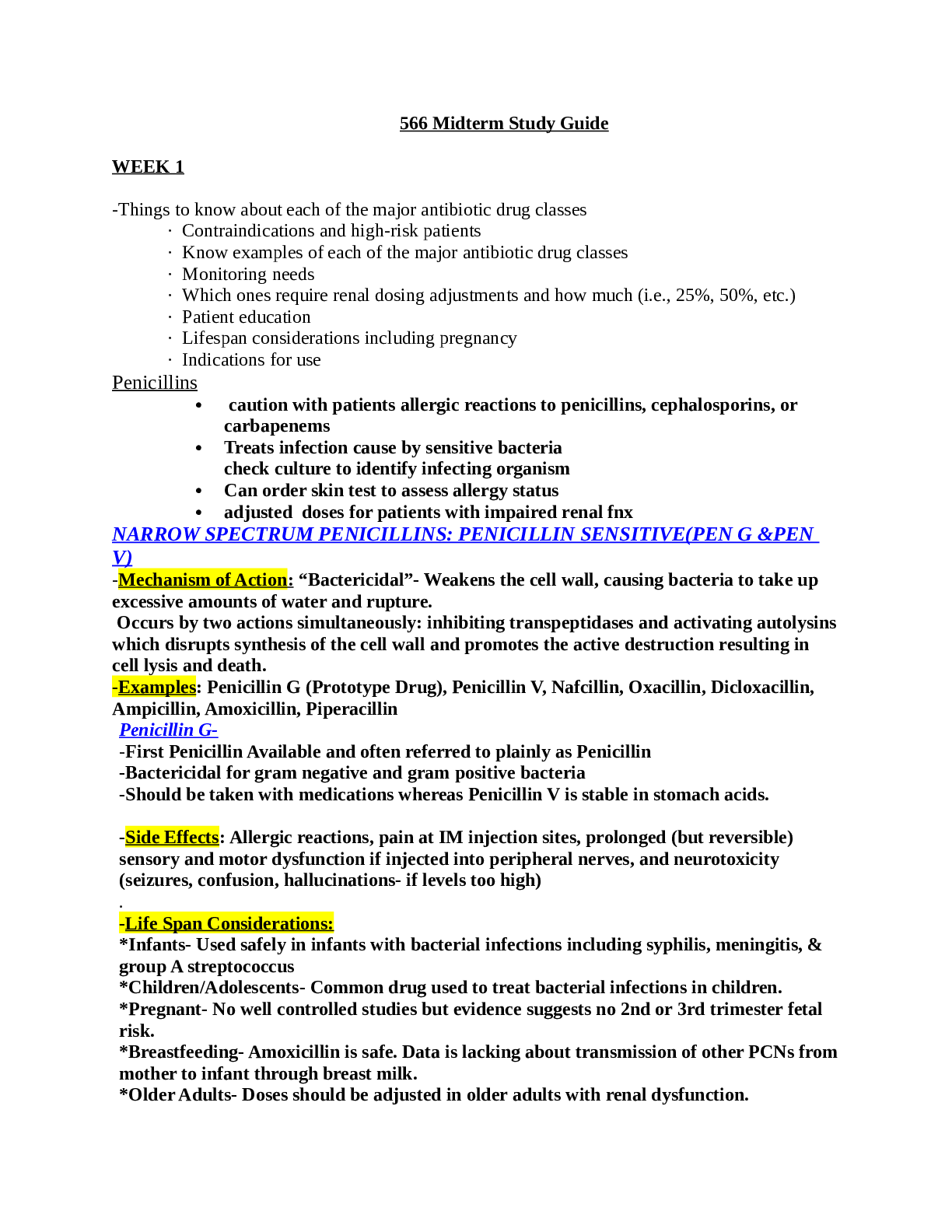

Asymmetric Information and Financial Crises We established in Chapter 7 that a fully functioning financial system is critical to a robust economy. The financial system performs the essential functio... n of channeling funds to individuals or businesses with productive investment opportunities. If capital goes to the wrong uses or does not flow at all, the economy will operate inefficiently or go into an economic downturn. Agency Theory and the Definition of a Financial Crisis The analysis of how asymmetric information problems can generate adverse selection and moral hazard problems is called agency theory in the academic finance literature. Agency theory provides the basis for defining a financial crisis. A financial crisis occurs when an increase in asymmetric information from a disruption in the financial system prevents the financial system from channeling funds efficiently from savers to households and firms with productive investment opportunities. Dynamics of Financial Crises in Advanced Economies Now that we understand what a financial crisis is, we can explore the dynamics of financial crises in advanced economies such as the United States, that is, how these financial crises unfold over time. As earth shaking and headline grabbing as the most recent financial crisis was, it was only one of a number of financial crises in U.S. history. These experiences have helped economists uncover insights on presentday economic turmoil. Financial crises in the United States have progressed in two and sometimes three stages. To help you understand how these crises have unfolded, refer to Figure 8.1, a diagram that traces out the stages and sequence of events in advanced economies. Stage One: Initiation of Financial Crisis Financial crises can begin in several ways: mismanagement of financial liberalization or innovation, asset price booms and busts, or a general increase in uncertainty caused by failures of major financial institutions. Mismanagement of Financial Liberalization or Innovation The seeds of a financial crisis are often sown when countries engage in financial liberalization, the elimination of restrictions on financial markets and institutions, or the introduction of new types of loans or other financial [Show More]

Last updated: 2 years ago

Preview 1 out of 28 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$9.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Aug 07, 2021

Number of pages

28

Written in

Additional information

This document has been written for:

Uploaded

Aug 07, 2021

Downloads

0

Views

151

.png)

(1).png)