Financial Accounting > QUESTIONS & ANSWERS > Practice EXAM 3 Questions Chapters 10 and 11 Problems and Solutions (All)

Practice EXAM 3 Questions Chapters 10 and 11 Problems and Solutions

Document Content and Description Below

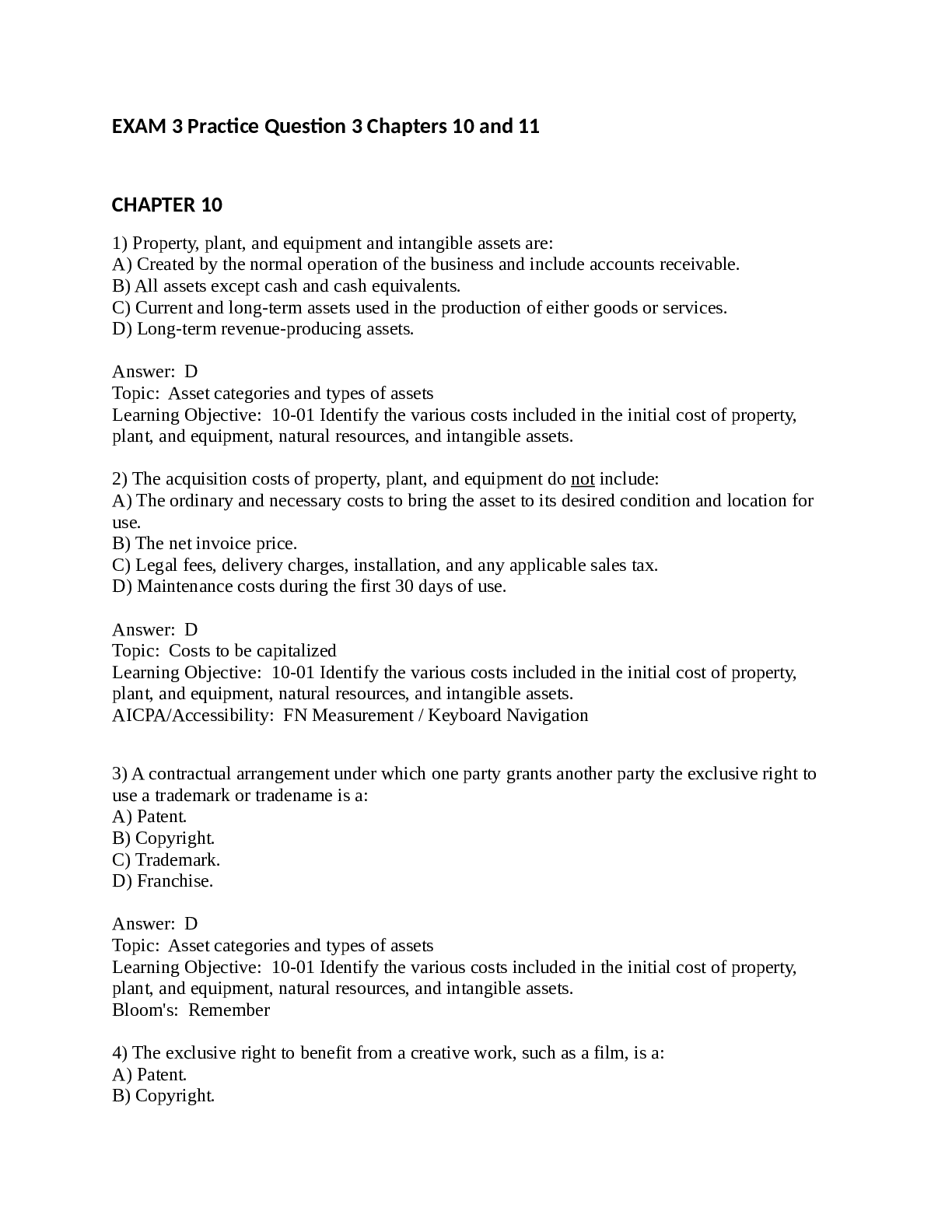

CHAPTER 10 1) Property, plant, and equipment and intangible assets are: A) Created by the normal operation of the business and include accounts receivable. B) All assets except cash and cash equiva ... lents. C) Current and long-term assets used in the production of either goods or services. D) Long-term revenue-producing assets. Answer: D Topic: Asset categories and types of assets Learning Objective: 10-01 Identify the various costs included in the initial cost of property, plant, and equipment, natural resources, and intangible assets. 2) The acquisition costs of property, plant, and equipment do not include: A) The ordinary and necessary costs to bring the asset to its desired condition and location for use. B) The net invoice price. C) Legal fees, delivery charges, installation, and any applicable sales tax. D) Maintenance costs during the first 30 days of use. Answer: D Topic: Costs to be capitalized Learning Objective: 10-01 Identify the various costs included in the initial cost of property, plant, and equipment, natural resources, and intangible assets. AICPA/Accessibility: FN Measurement / Keyboard Navigation 3) A contractual arrangement under which one party grants another party the exclusive right to use a trademark or tradename is a: A) Patent. B) Copyright. C) Trademark. D) Franchise. Answer: D Topic: Asset categories and types of assets Learning Objective: 10-01 Identify the various costs included in the initial cost of property, plant, and equipment, natural resources, and intangible assets. Bloom's: Remember 4) The exclusive right to benefit from a creative work, such as a film, is a: A) Patent. B) Copyright. C) Trademark. D) Franchise. Answer: B Topic: Asset categories and types of assets Learning Objective: 10-01 Identify the various costs included in the initial cost of property, plant, and equipment, natural resources, and intangible assets. Bloom's: Remember 5) The exclusive right to display a symbol of product identification is a: A) Patent. B) Copyright. C) Trademark. D) Franchise. Answer: C Topic: Asset categories and types of assets Learning Objective: 10-01 Identify the various costs included in the initial cost of property, plant, and equipment, natural resources, and intangible assets. Bloom's: Remember 6) The capitalized cost of land excludes: A) The purchase price of the land. B) Title insurance paid at the time of purchase. C) Real estate commissions associated with the sale. D) Property taxes for the first year owned. Answer: D Topic: Costs to be capitalized Learning Objective: 10-01 Identify the various costs included in the initial cost of property, plant, and equipment, natural resources, and intangible assets. 7) On March 1, 2021, Shipley Resources entered into an agreement with the state of Alaska to obtain the rights to operate a mineral mine for $6 million. The mine is expected to produce 100,000 tons of mineral. As part of the agreement, Shipley agrees to restore the land to its original condition after mining operations are completed in approximately five years. Management has provided the following possible outflows for the restoration costs that will occur five years from now: (PV of $1, PVA of $1) (Use appropriate factor(s) from the tables provided.) Cash Outflow Probability $ 300,000 25% 400,000 50% 500,000 25% Shipley's credit-adjusted risk-free interest rate is 10%. During 2021, Shipley extracted 18,000 tons of ore from the mine. How much accretion expense will the company record in its income statement for the 2021 fiscal year? A) $30,326. B) $20,697. C) $24,837. D) $27,294. Answer: B Explanation: $ 300,000 × 25% = $ 75,000 400,000 × 50% = 200,000 500,000 × 25% = 125,000 $ 400,000 × 0.62092* = $248,368 (*Present value of $1, n = 5, i = 10%) 2021 accretion expense: $248,368 × 0.10 × 10/12 = $20,697 Topic: Costs to be capitalized Learning Objective: 10-01 Identify the various costs included in the initial cost of property, plant, and equipment, natural resources, and intangible assets. 8) A company purchased a piece of equipment by paying $5,000 cash. A shipping cost of $400 to get the equipment to its factory was also incurred. The fair value of the equipment was $7,000 at the time of the purchase. For what amount should the company record the equipment? A) $5,000. B) $5,400. C) $7,000. D) $7,400. Answer: B Explanation: $5,000 + $400 = $5,400. Topic: Costs to be capitalized Learning Objective: 10-01 Identify the various costs included in the initial cost of property, plant, and equipment, natural resources, and intangible assets. 9) A company purchased a commercial dishwasher by paying cash of $8,000. The company incurred $600 transportation costs, $500 installation fees, and $300 annual insurance on the equipment. For what amount will the company record the dishwasher? A) $8,600. B) $8,000. C) $9,100. D) $9,400. Answer: C Explanation: $8,000 + $600 + $500 = $9,100. The annual insurance on the equipment of $300 should be recorded as insurance expense over the first year of coverage. Topic: Costs to be capitalized Learning Objective: 10-01 Identify the various costs included in the initial cost of property, plant, and equipment, natural resources, and intangible assets. 10) Grab Manufacturing Co. purchased a 10-ton draw press at a cost of $180,000 with terms of 5/15, n/45. Payment was made within the discount period. Shipping costs were $4,600, which included $200 for insurance in transit. Installation costs totaled $12,000, which included $4,000 for taking out a section of a wall and rebuilding it because the press was too large for the doorway. The capitalized cost of the 10-ton draw press is: A) $171,000. B) $183,600. C) $187,600. D) $185,760. Answer: C Explanation: Purchase price ($180,000 × 95%) $ 171,000 Shipping costs 4,600 Installation costs 12,000 Total cost of equipment $ 187,600 Difficulty: 3 Hard Topic: Costs to be capitalized Learning Objective: 10-01 Identify the various costs included in the initial cost of property, plant, and equipment, natural resources, and intangible assets. 11) The balance sheet of Cattleman's Steakhouse shows assets of $86,400 and liabilities of $15,000. The fair value of the assets is $90,000 and the fair value of its liabilities is $15,000. Longhorn paid Cattleman's $95,000 to acquire all of its assets and liabilities. Longhorn should record goodwill on this purchase of: A) $3,600. B) $5,000. C) $20,000. D) $23,600. Answer: C Explanation: Purchase price $ 95,000 Less: Fair value of net assets: Assets $ 90,000 Less: Liabilities assumed 15,000 (75,000) Goodwill $ 20,000 [Show More]

Last updated: 3 years ago

Preview 1 out of 36 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$9.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Aug 20, 2021

Number of pages

36

Written in

All

Additional information

This document has been written for:

Uploaded

Aug 20, 2021

Downloads

0

Views

107