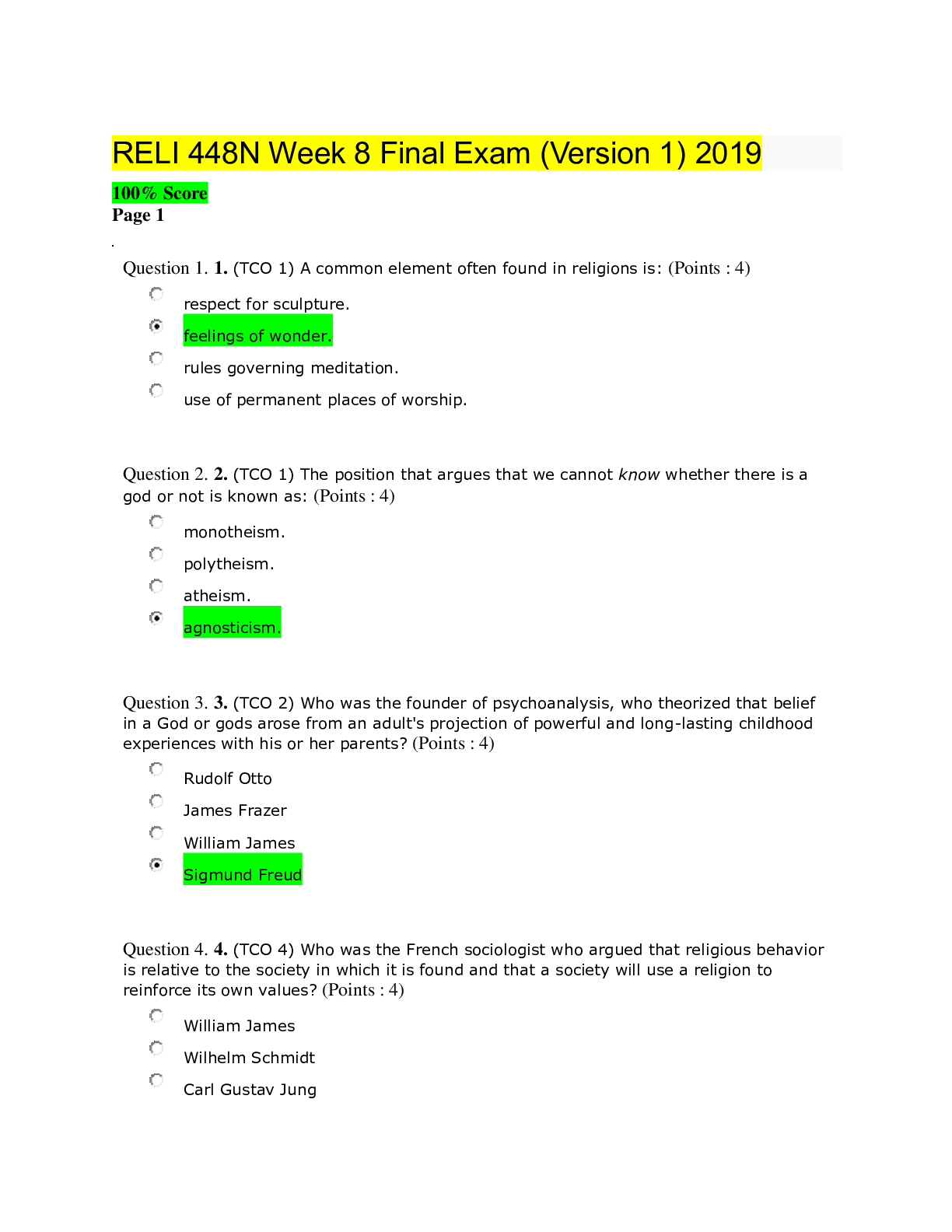

FIN 515 Final Exam (Version 3) Page 2

Document Content and Description Below

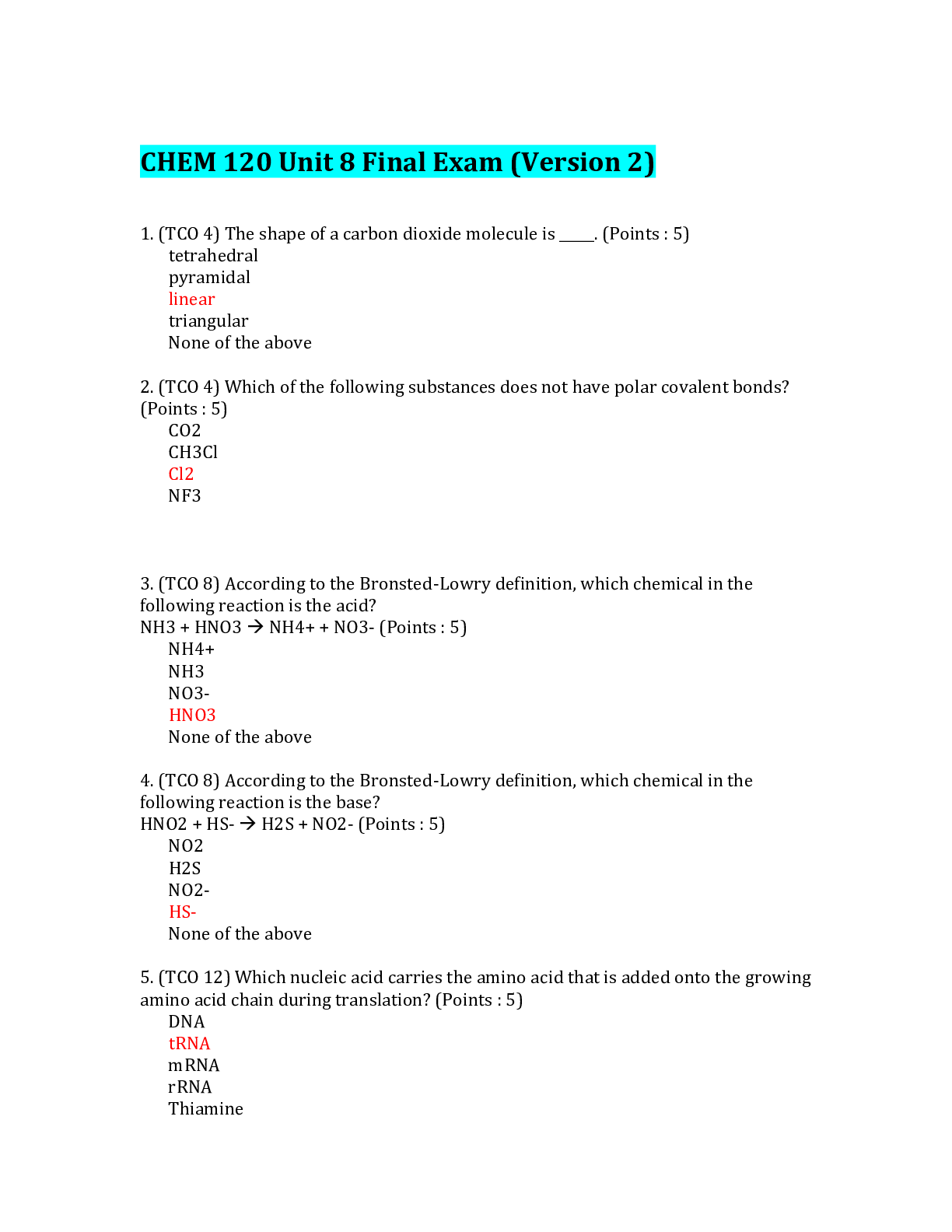

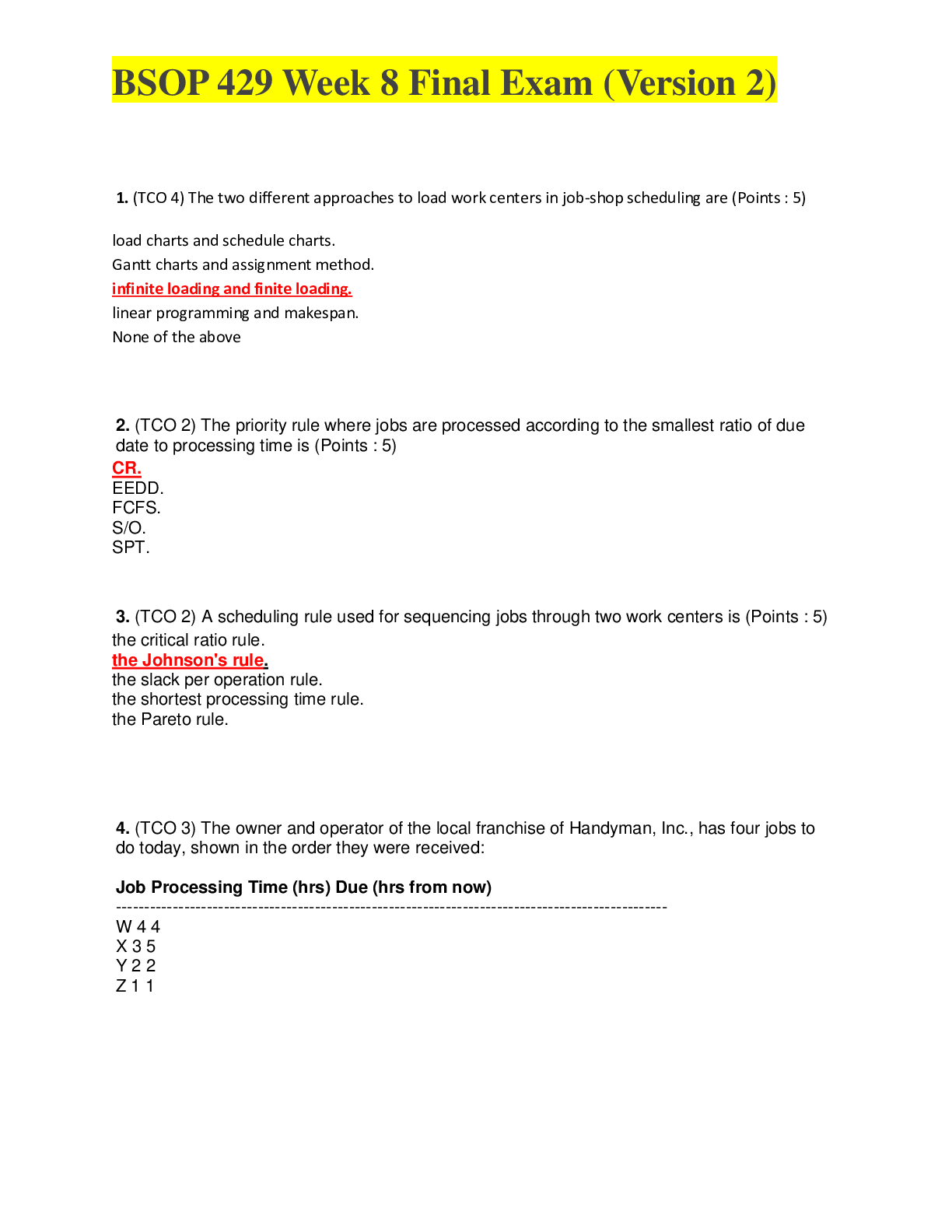

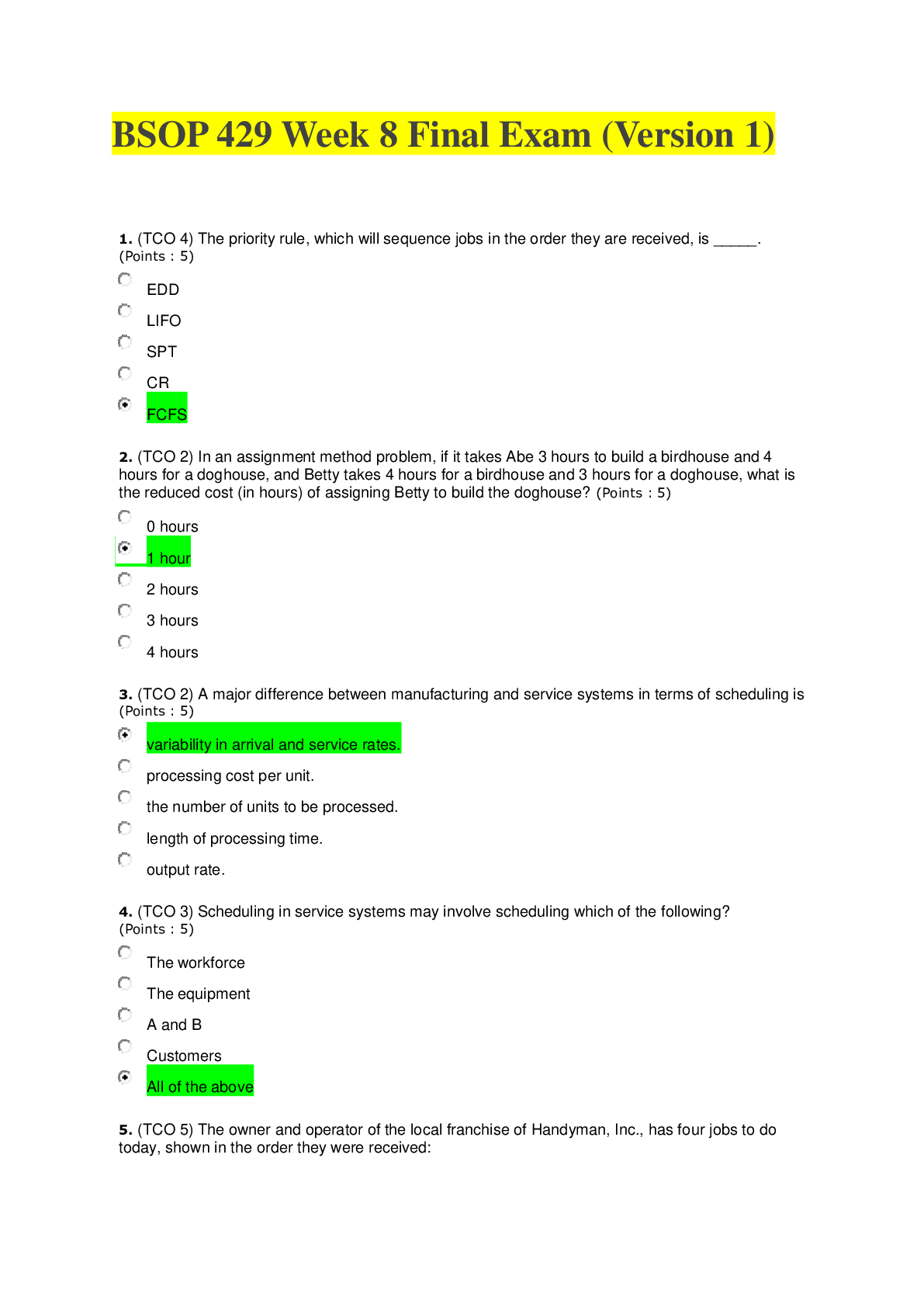

(TCO H) Zervos Inc. had the following data for 2008 (in millions). The new CFO believes (a) that an improved inventory management system could lower the average inventory by $4,000, (b) that improveme... nts in the credit department could reduce receivables by $2,000, and…….If these changes were made, by how many days would the cash conversion cycle be lowered? (TCO C) Bumpas Enterprises purchases $4,562,500 in goods per year from its sole supplier on terms of 2/15, net 50. If the firm chooses to pay on time but does not take the discount, what is the effective annual percentage cost of its nonfree trade credit? (Assume a 365-day year.) (TCO E) You were hired as a consultant to the Quigley Company, whose target capital structure is 35% debt, 10% preferred, and 55% common equity. The interest rate on new debt is 6.50%, the yield on the preferred is 6.00%, the cost of common from retained earnings is 11.25%, and the tax rate is 40%. The firm will not be issuing any new common stock. What is Quigley’s WACC? (TCO B) A company forecasts the free cash flows (in millions) shown below. The weighted average cost of capital is 13%, and the FCFs are expected to continue growing at a 5% rate after Year 3. Assuming that the ROIC is expected to remain constant in Year 3 and beyond, what is the Year 0 value of operations, in millions? (TCO G) Based on the corporate valuation model, Hunsader’s value of operations is $300 million. The balance sheet shows $20 million of short-term investments that are unrelated to operations, $50 million of …….10 million shares of stock outstanding. What is the best estimate of the stock’s price per share? [Show More]

Last updated: 2 years ago

Preview 1 out of 14 pages

.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$15.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Aug 24, 2021

Number of pages

14

Written in

Additional information

This document has been written for:

Uploaded

Aug 24, 2021

Downloads

0

Views

34

.png)

.png)

.png)