FIN 205FIN205_StudyGuide.

Document Content and Description Below

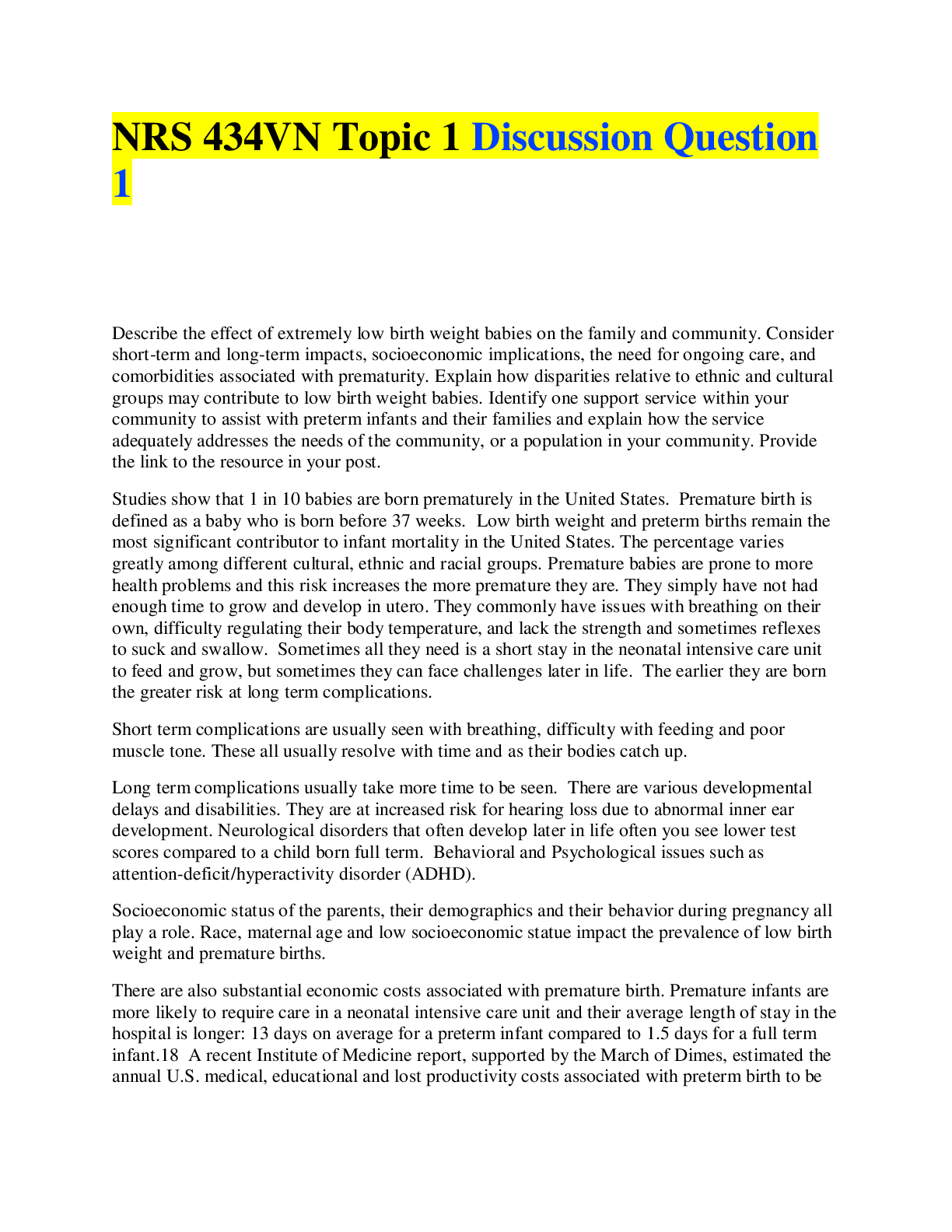

Chapter 1: Financial modelling

1.1 What is financial modelling?

In finance, one would come across all kinds of information and data related to the

company or the market. Financial modelling is a me

...

thod that utilises such information

and data to build a model to represent a real-world financial situation. It involves either

building a model from scratch or maintaining the existing models with new information.

Through the abstract numerical scenario, users can get a better understanding of how

different inputs and how changes in the inputs would influence the outcome.

1.2 Why is financial modelling important?

Financial modelling is very useful in the analysis and evaluation of a firm, a project,

a portfolio or an asset class, which will contribute to a more accurate and informed

investment or other strategic decisions, for both institutions and individuals. Basically, it is

a tool used to aid the decision-making process, by the companies in the cost estimation and

project benefit analysis, by financial analysts in the impact forecasts and event analysis,

by portfolio managers in risk management and portfolio allocations, or by investors in

company valuations and asset pricing.

Therefore, as a Finance student, the abilities and skills to perform analysis using financial

modelling are of great importance. Not only the understanding of accounting, financial

and business models and scenarios will be deepened, but also the competitive advantages

provided in the future working environment.

There are many scenarios that financial modelling can be applied to, both in accounting

and corporate finance, and in quantitative finance applications. The following are

common areas that financial modelling is generally used for:

• Financial statement analysis

• Business valuation (especially the discounted cash flow method)

• Restructuring situations (e.g. merger and acquisition)

• Valuation of assets (e.g. stocks, bonds, and option pricing)

• Raising capital and cost of capital calculations (i.e. weighted average cost of capital,

or WACC)

• Capital allocation

• Budgeting and forecasting

• Leveraged buyout (LBO)

• Risk management

1.3 Who would build financial models1?

Financial modelling is a tool that can be used by various people or organisations. The

person that builds financial models in different sectors or roles would have different foci

of financial models. Examples of professionals that build financial models are summarised

below.

• Investment banking analysts

The investment banking analysts help governments, enterprises, or institutions raise

capital and execute mergers and acquisitions. Financial modelling for business valuation

and financial statement analysis would be heavily used in investment banking.

• Equity research analysts

Equity research analysts usually conduct research on listed companies and share the

results with the clients to help with their investment or other corporate decisions. The

focus is mainly on equities.

1 Referring to the interactive career map developed by the Corporate Finance Institute (CFI) for more

details on the career path.

• Corporate development analysts

Corporate development generally involves executing corporate strategic decisions related

to its development, such as mergers, acquisitions, divestitures, and capital raising.

• Financial planning and analysis (FP&A) analysts

FP&A analysts usually sit within a corporate and are responsible for generating analysis

and information that senior management and executives would need for operational,

financial, and strategic decisions. Such roles usually possess strong accounting skills

and should be familiar with financial statement models, as well as the budgeting and

forecasting models.

• Accounting firm consultants (e.g. due diligence, transaction advisory, valuations,

etc.)

Accounting firms would provide services to prepare, review and audit financial

statements, and advise on other accounting related issues such as tax, accounting systems,

fundraising and M&A. In general, financial statement models would be significantly used

by consultants and analysts in accounting firms. Other models adopted frequently include

risk management (especially for financial due diligence) and business valuation.

• Credit analysts

Credit analysts perform credit analysis and evaluation of individuals, enterprises, or

securities, typically for banks, credit card rating agencies, investment firms, and credit

card issuing institutions.

• Risk analysts

Risk analysts are responsible for identifying potential risks associated with a business

decision or project to help avoid or reduce the risks.

• Data analysts

Data analyst is a general term that could represent any analysis using data. In the

finance realm, data analysts are in charge of data collection, consolidation, analysis, and

presentation, with the aim to generate information out of the data that can help companies

or clients make better business or investment decisions.

[Show More]

Last updated: 3 years ago

Preview 1 out of 168 pages

.png)