Strategy Midterm Study Guide

Lecture 1:

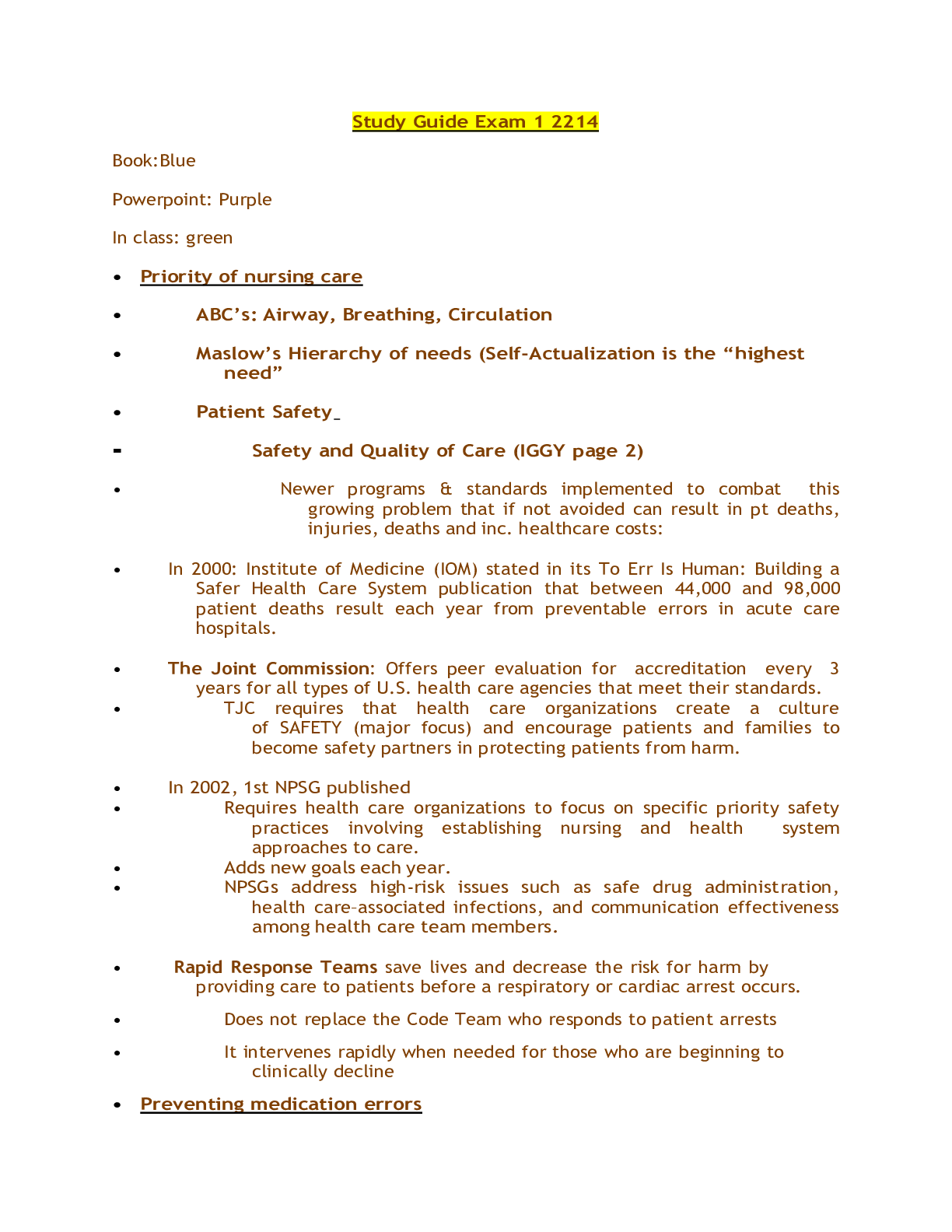

Focus on strategy rather than management or tactics

Lesson from Taxi/Coffee Case

o No mater how “hard working” some employees are, they will find it hard

to make profits b

...

Strategy Midterm Study Guide

Lecture 1:

Focus on strategy rather than management or tactics

Lesson from Taxi/Coffee Case

o No mater how “hard working” some employees are, they will find it hard

to make profits because their industries are extremely competitive

o Industry affiliation has a substantial impact on firm profitability

Supermarkets have historically low profits

Pharmaceutical companies have high profits result of economies

of those industries

Lesson from Soccer/Zappos Case

o Demonstrate the impact of Strategy at the firm level within a difficult

competitive environment

Within a particular competitive environment (or industry),

Strategy can affect a firm’s performance relative to its rivals

An effective Strategy requires trade-offs

Porterian View:

Operational Effectiveness – refers to the extent to which a firm performs similar

activities better than rivals (or “at least as good”)

o The important sources of differences in profits

o Productivity frontier shifts outward as new inputs, technologies, and

management approaches become available

o Constant improvement in OE is necessary to stay ahead of the

competition

o Necessary but not sufficient for long-run competitive advantag

Strategy – refers to performing different activities from those of rivals or

performing them in a different way

o Chose the right configuration of activities incentives, systems

o Make the right trade-offs

o Rests on unique activities

Ultimately, Porter believes that firms can achieve competitive advantage only if

they have both operational effectiveness and superior strategy

What is Strategy: Exists as a field of research and practice

o In practice the goal is to enable organizations to achieve the greatest

organizational performance

o In research the goal is to understand what are the determinants of

long-term organizational performance

Lecture 2:

Strategic Activities Map – a picture that identifies the key activities of a firm and

identifies the linkages between them (via lines)

Different industries have different profitability ROE good to compare firms in the same industry

ROS how well is a company getting from its sales (good for retail)

ROE good for comparing firms with the same capital structure

How does Grant/Jordan define Strategy

“Strategy is not a detailed plan or program of instructions; it is a unifying theme

that gives a coherence and direction to the actions and decisions of an individual

or an organization”

using your internal resources and capabilities to deal with its external

environment

Corporate choosing industry/business

Business Unit how you’ll win

Mintzberg

it is incomplete to consider strategy to be something that can simply be designed

(analyzed); instead it is important to recognize that strategy emerges & changes

over time, regardless of how carefully it is planned

Lecture 4:

Five Forces

o Helps us understand whether an industry’s incumbents are likely to earn

high/low economic profits

o To help understand trends and events on average industry profitability

o To help us make recommendations to firms on how to improve

Monopoly

o Monopolists facet he industry demand curve

o They choose prices equal to marginal revenue to maximize profits

o Good for company profits but bad for consumers because they have to

pay higher prices and get lower quality

Oligopolists

o Exist when there are only a few firms in an industry

o An industry with 3-6 firms is probably an oligopoly

The more firms the industry has, the less likely it is an oligopoly

C4, C5, C6 combined market share of top 4, 5, 6 firms

respectively

If they are all together above 80% concentration, then oligopoly!

Industr

y – define the

industry

based on similar products that have

common suppliers and buyers

Two Dimensions

The power of Buyers/Suppliers/Industry Rivalry determines who gets the

profits that the industry could potentially generate

o If supplier/buyers

Are very price sensitive

Have high bargaining power

can squeeze profits out of the industry

The Threat of Entry and Threat of Substitutes determine whether the industry

value chain can generate any profits at all

o Compare price-value ratio of the industry’s products vs. those of

alternative products if alternative products have similar price-value

ratio, power of substitutes is high

Switching costs – costs that customers must bear when they try to switch from

one product to another

Rivalry Among

Existing

Competitors

Supplier Power Buyer Power

Threat of

New Entrants

Threat of

Substitutes

Determinants of Buyer Power

• Bargaining leverage

• Buyer concentration vs.

industry

• Buyer volume

• Buyer switching costs

• Price/total purchases

• Product differences

• Brand identity

Determinants of

Substitution Threat

• Relative price

performance of

substitutes

• Switching costs

• Buyer propensity to

substitute

Determinants of Supplier Power

• Dominated by few companies

• Differentiation of product (inputs) causes

high switching costs

• Few substitute inputs

• Supplier concentration

• Importance of volume to supplier

• Cost relative to total purchases in the

industry

• Threat of forward integration relative to

threat of backward integration by firms in

the industry

Entry Barriers

• Economies of scale

• Proprietary product

differences

• Brand identity

• Capital requirements

• Access to distribution

• Government policy

• Expected retaliation

Rivalry Determinants

• Industry growth

• Demand conditions

(overcapacity)

• Exit barriers (corporate

stakes, high fixed costs)

• Product differences

• Brand identity

• Concentration and balance Economies of scale – when average costs decline as output increases

o Economies of scale arise when size matters big firms = much lower

average costs

Suppose our Five Forces Analysis suggested that our firm competed in a

Favorable Industry

o We would expect that data shows a positive industry influence

Industry average Profits > Economic wide average Profits

Compare firms five Forces to industry’s Five Forces

[Show More]