Management > Study Notes > PAD 3003John Schuyler-Risk and Decision Analysis in Projects, 2nd Edition (Cases in project and prog (All)

PAD 3003John Schuyler-Risk and Decision Analysis in Projects, 2nd Edition (Cases in project and program mana

Document Content and Description Below

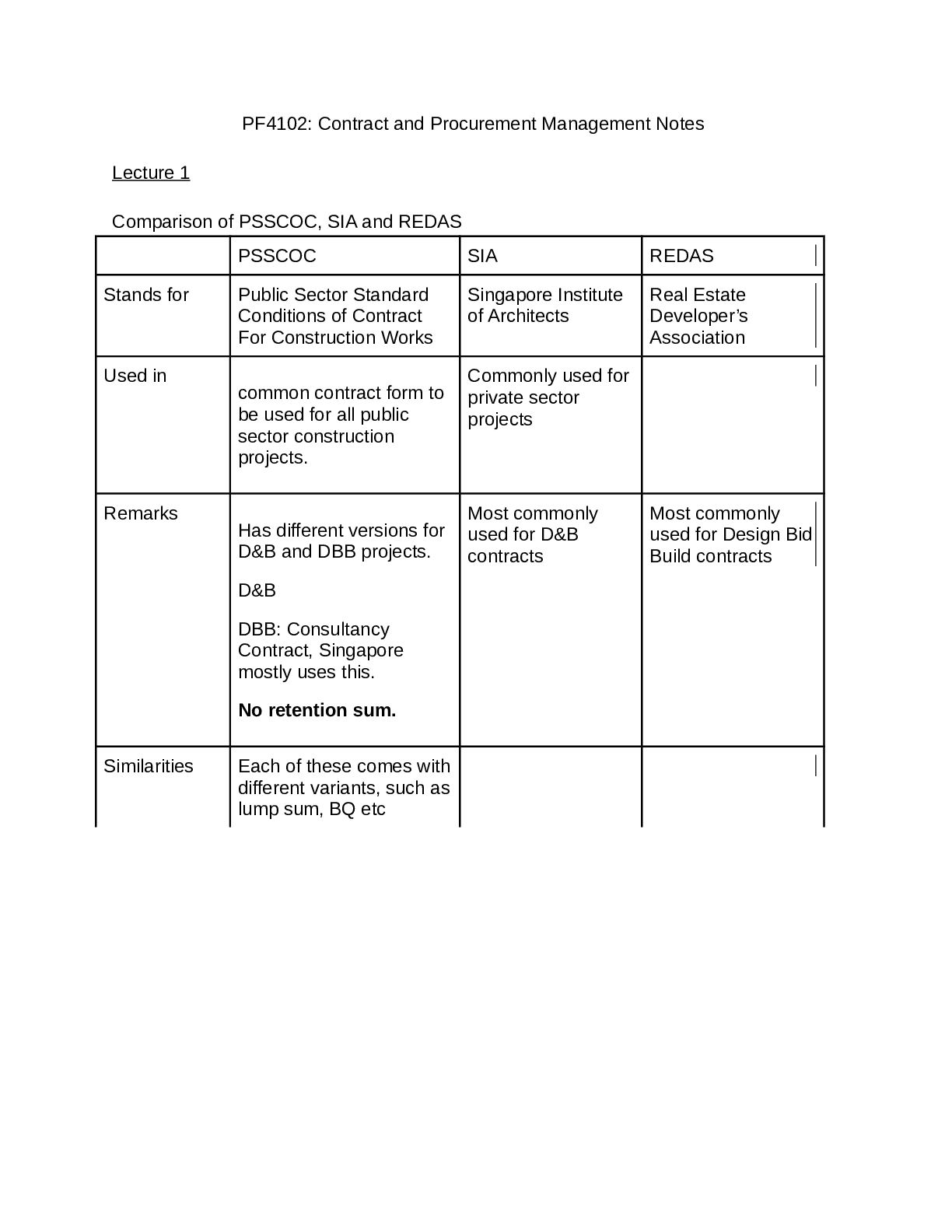

Introduction Decision analysis (DA),sometimes called risk analysis, is the discipline for helpingdecision makerschoose wisely under conditionsof uncertainty.The techniques are applicable to all typ ... es of project decisions and valuations. Committing to fund a project does not end the decision making, for decisions continue to be made throughout the project life cycle. The quality of these decisions impacts cost, schedule, and performance. This book explores the approach and principal techniquesof DA. These methods explicitly recognize uncertainties in project forecasts.This analysis technology,on the leadingedge in the1970s and earlier, is becomingmainstream practice.The methodology is proven, accessible, and-I hope you will agree-easily understood. Decision Problems Most decision problemsare about resourceallocation:Where do we put our money, time, and other resources? DA involves concepts borrowed from probability theory, statistics, psychology, finance, and operations research. The formal disciplineis called decision science, a subset of operations research (also called management science). Operations Research/Management Science Chapter 1-Risk and Decision Analysis (OR/MS or ORMS)is the broad discipline of applying quantitative methods to problems of business and other organizations. DA techniques are universal.They apply in any professional discipline and to problems in your personallife. Althoughthis book is oriented toward project managementdecisions,DA is a general problem-solving process and applies to three types of problems: Choosing between alternatives + Buy, make or build, or lease + Size or number of units of equipment to purchase @ Best use or disposition of an asset. Appraising value + Project or venture value, or elements of projects or ventures + Estimating transaction or project proceeds. Determiningthe optimal values for decision variables 0 Bid amount to maximize the value of the bid opportunity 0 Optimal capacityor configuration of a facility or equipment. All decisions seem to fall into one of these categories, and we evaluate each type in a similar manner. All we need is a way to measure value under uncertainty-the topic of Applying the DA approach requires: Capturing judgments about risks and uncertainty as probability distributions Having a single measure of value or the quality of the result Putting these together with expected value calculations. DA provides the only logical, consistentway to incorporate judgments about risks and uncertainties into an analysis. When uncertainties are significant, these techniquesare the best route toward credible project decisions. Decision science emerged as a subcategory of management science during the 1960s. Yet still, evaluation practices and decision policy remain a weak link in many organizations (seeFigure1.1).This is despite great sophistication in the technical science and engineering disciplines. The purpose of this book is to strengthen that weak link. Increasing business complexity, speed, and competition pressure us to improve decision making. People are maturing in traditional planning and evaluation practices, and dealing with uncertainty seems a logical improvement. Sophisticated decision making doesn't mean more complicated. We can solve many decision problems on the back of an envelope; however, low- and moderate-cost computer software is now available to implement the methods described in this book. Applying these techniques should lead to faster, more confident decisions. Chapter I-Risk and Decision Analysis Material Science Engineering Design Production Project Evaluation Other Engineering and Scientific Disciplines Credible Analysis Your job may involve estimating project or activity costs. How would you evaluate the quality of your estimates?Most forecast users recognize two principal, desirable characteristicsin a credible analysis: Objectivity: Over a number of projects, estimates proving neither too high nor too low on average. Unbiased. Precision: Reasonable closeness between estimates and actual valuesthat is, minimal random "noise"in the estimates. Forecast accuracy is a composite of low bias and high precision. Objectivity-lack of bias-tells us about the error of estimations compared to what actualvalues result. We demonstratelow bias by having an average forecast error of approximately zero.Precision tells us about the magnitude of the errors, and we desire small errors, of course. In competitive situations, both bias and precision are important. For most internal purposes-where we're competing against nature, for example-objectivity is more important. Applying the expected value (EV)concept enables more accurate forecasts and estimates. Understandinga few things about probability distributions will be helpful before introducing EV later in this chapter. [Show More]

Last updated: 3 years ago

Preview 1 out of 278 pages

.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$16.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Sep 01, 2021

Number of pages

278

Written in

All

Additional information

This document has been written for:

Uploaded

Sep 01, 2021

Downloads

0

Views

191

.png)