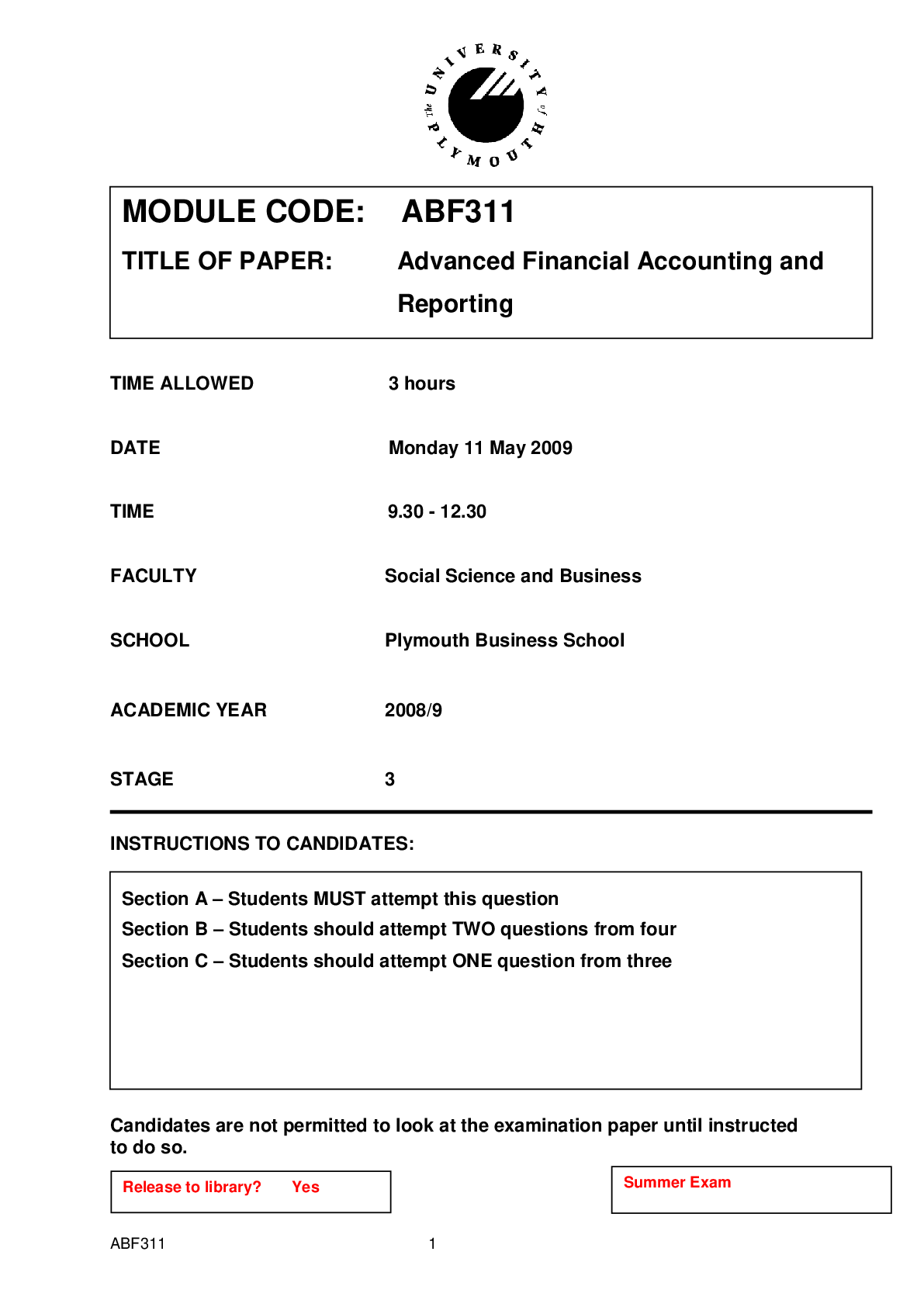

Financial Accounting > QUESTION PAPER (QP) > MODULE CODE: ABF 203 TITLE OF PAPER: Financial Accounting and Reporting. REVISION QUESTIONS (All)

MODULE CODE: ABF 203 TITLE OF PAPER: Financial Accounting and Reporting. REVISION QUESTIONS

Document Content and Description Below

SECTION A (60 MARKS) QUESTION 1 [30 MARKS] Below are a set of simplified financial statements (Income Statement, Balance Sheet and Notes to the Accounts) of the Redrow Group plc. “Redrow is one ... of the UK's leading residential and mixed use property developers. We aim to be the developer of choice for customers, colleagues, land owners, suppliers, subcontractors and investors. We have a reputation for imaginative design, build quality and customer service. We have the skills to complete a wide range of developments from large greenfield sites to complex brownfield regeneration schemes” Extract from Redrow plc‟s website „About Redrow‟ page http://www.redrow.co.uk/cms/company/about REDROW PLC CONSOLIDATED INCOME STATEMENT 12 months ended 30 June 2008 ADDITIONAL INFORMATION 1. The group made an operating profit before exceptional items of £120.5million. The exceptional item related to a cost reduction programme of £259.4million. 2. The group paid a total dividend of 15.6 pence per share for the year ended 30 June 2007 (comprising interim and final dividends paid and proposed) compared to a dividend of 9.3 pence per share for the year ended 30 June 2008 (being the interim dividend paid on 2 May 2008, the company does not propose making a final dividend payment this year). 3. The share price at 30 June 2007 was 510.5 pence per share and at 30 June 2008 was 142.5 pence per share. Notes to the Accounts Exceptional Charge “The reduced activity levels and the related impact on selling prices being experienced in the market have led to a significant adjustment to values in the land market. We have prudently reviewed the net realisable value of land and work-inprogress in the balance sheet on phases of sites currently in development together with the value of land not in development. This detailed review has resulted in an exceptional charge of £259.4m relating to the provision against the carrying value of the Group‟s land and work-in-progress. This represents an appropriate platform from which the Group can move forward in the current market conditions.” Extract from the „Redrow plc Annual Report and Accounts 2008‟ p.7 http://www.shareholder.com/visitors/DynamicDoc/document.cfm?CompanyID=REDR OW&documentID=2390&PIN=21185254&resizeThree=no&Scale=100&Keyword=typ e%20keyword%20here&Pag Work in progress includes £13.7m (2007: £9.8m) in respect of part exchange properties. An exceptional net realisable value provision was recognised in the year in the sum of £259.4m. This represented a £223.4m provision against land and a £36.0m provision against work in progress. 15. Trade and Other Payables Requirement a) Calculate appropriate ratios to allow you to comment on the company‟s position and performance. (10 marks) b) Prepare a report for the stakeholders of the company, which includes an analysis and commentary on the position and performance of Redrow plc for the year ended 30 June 2008. (20 marks) Orion plc acquired 80% of the equity share capital of Draco Ltd at a cost of £15.6 million when the revenue reserves of Draco were £6 million. Orion plc acquired 40% of the ordinary share capital of Cassiopeia plc at a cost of £10.4 million when the revenue reserves of Cassiopeia were £9 million. The following information relates to Orion plc and its related companies as at 31 March 2009. Dividend payable refers to the proposed ordinary dividend for the year. No provision has yet been made in the books of Orion for the dividends receivable from Draco. Orion sold goods to Draco at a price of £6 million. These goods had cost Orion £4 million. Half of these goods were still in the inventory of Draco at 31 March 2009. Draco had a balance of £1.5 million owing to Orion included in trade payables at 31t March 2009 which agreed with Orion‟s records of receivables. There is no evidence of any impairment in the value of goodwill Premier Cruises is a private limited liability company that operates a single cruise ship. The ship was acquired on 1 January 2000. Details of the original cost of the ship‟s components and their estimated useful lives are: component original cost (£million) depreciation basis ship‟s fabric (hull, decks etc) 300 25 years straight-line propulsion system 100 useful life of 40,000 hours cabins and entertainment area fittings 150 12 years straight-line At 31 December 2007 no further capital expenditure had been incurred on the ship. Ship‟s Fabric In the year ended 31 December 2008 the ship‟s fabric was repainted at a cost of £20 million. Propulsion System n the year ended 31 December 2008 the ship‟s fabric was repainted at a cost of £20 million. Propulsion System In the year ended 31 December 2007 the ship had experienced a high level of engine trouble which had cost the company considerable lost revenue and compensation costs. The measured expired life of the propulsion system at 31 December 2007 was 30,000 hours. Due to the unreliability of the engines, a decision was taken in early January 2008 to replace the whole of the propulsion system at a cost of £140 million. The expected life of the new propulsion system was 50,000 hours and in the year ended 31 December 2008 the ship had used its engines for 5,000 hours. Cabins and entertainment areas and fittings At the same time as the propulsion system replacement, the company took the opportunity to do a limited upgrade to the cabin and entertainment facilities at a cost of £60 million. After the upgrade of the cabin and entertainment area fittings it was estimated that their remaining life was five years (from the date of the upgrade). For the purpose of calculating depreciation, all the work on the ship can be assumed to have been completed on 1 January 2008. All residual values can be taken as nil. Requirement (a) Calculate the carrying amount of Premier Cruises‟s cruise ship at 31t December 2007 and 2008. Your answer should explain the treatment of each item. [Show More]

Last updated: 3 years ago

Preview 1 out of 12 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$2.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Oct 25, 2019

Number of pages

12

Written in

All

Additional information

This document has been written for:

Uploaded

Oct 25, 2019

Downloads

0

Views

203