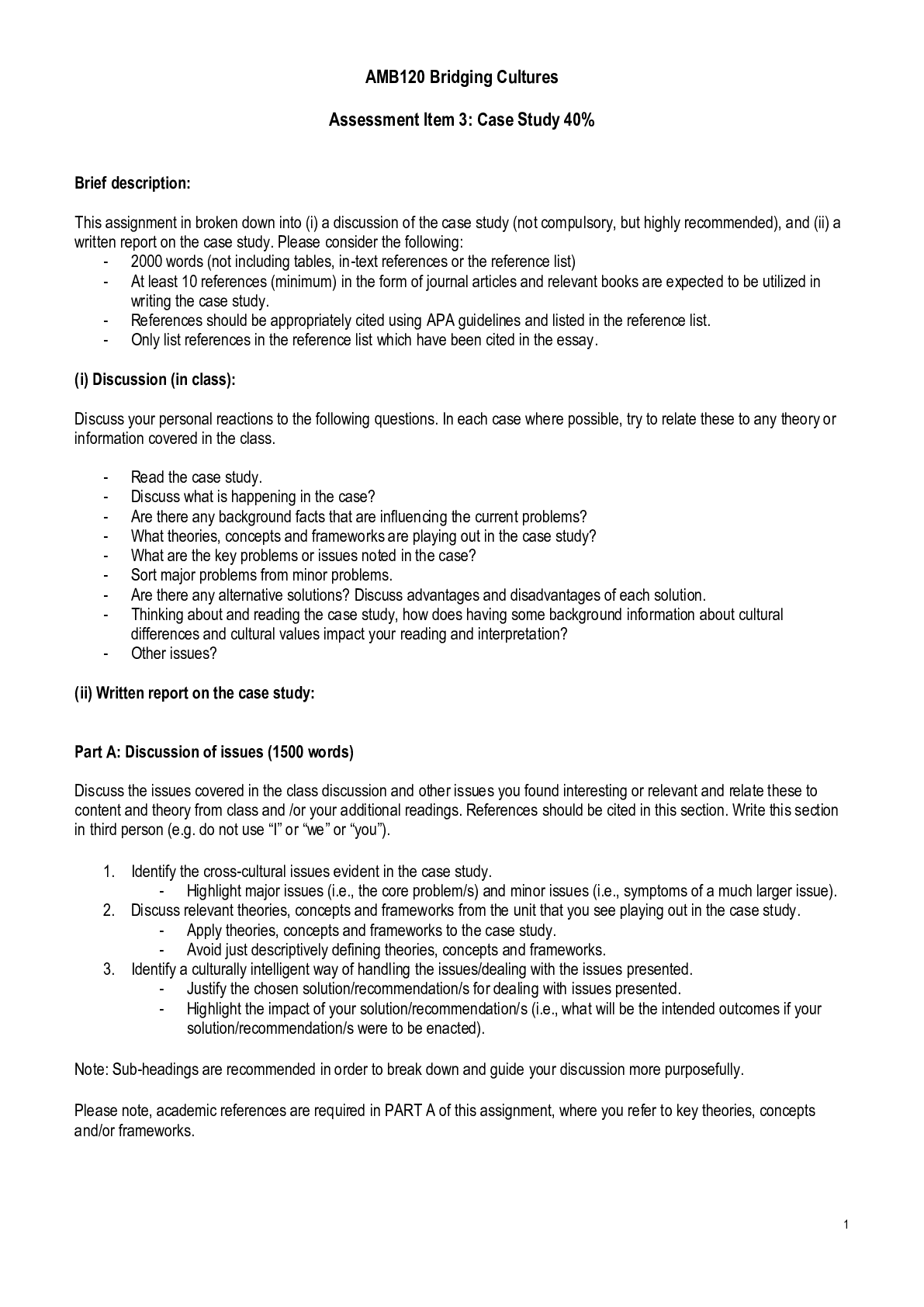

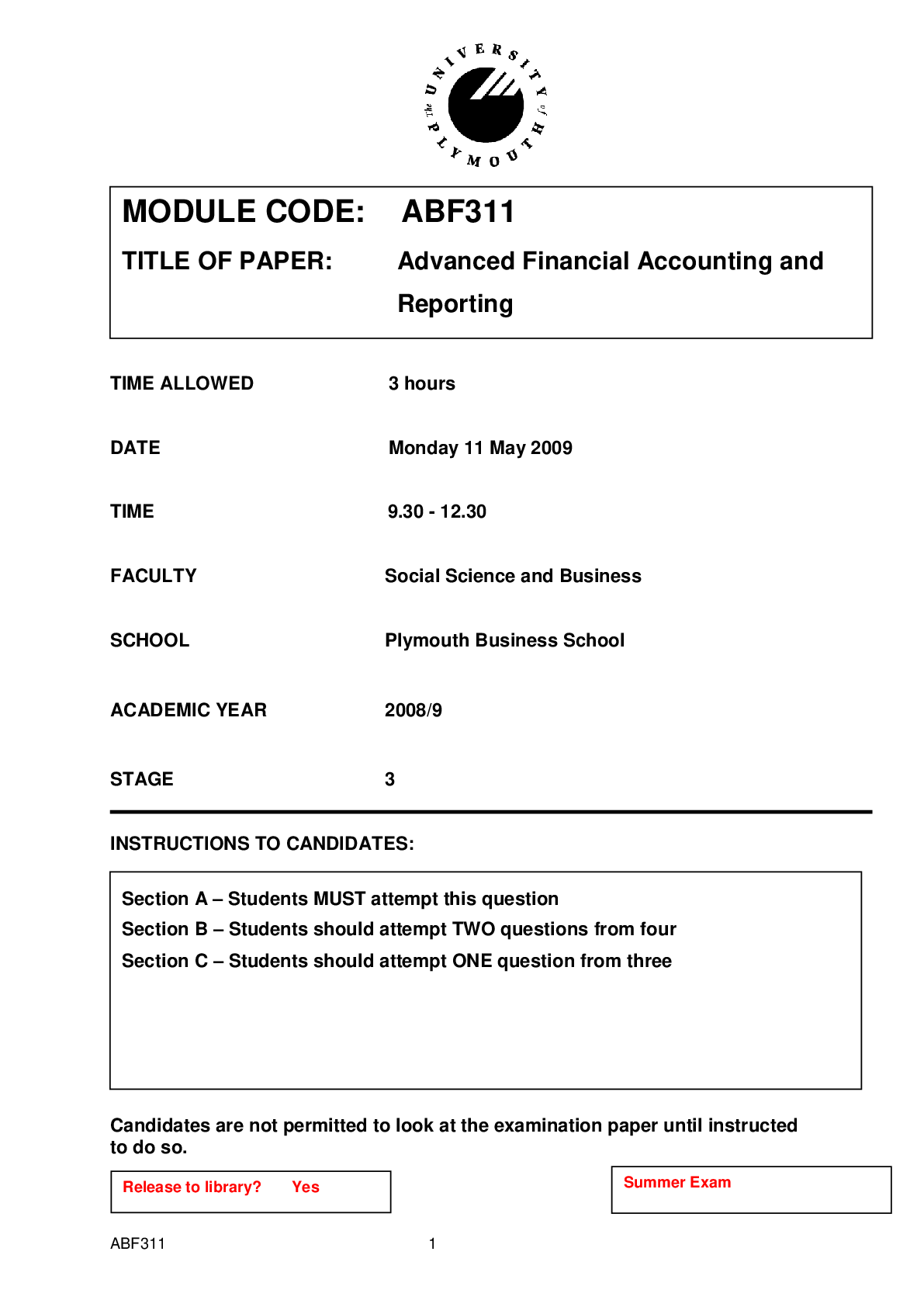

Financial Accounting > QUESTION PAPER (QP) > MODULE CODE: ABF207 TITLE OF PAPER: Taxation. REVISION QUESTIONS (All)

MODULE CODE: ABF207 TITLE OF PAPER: Taxation. REVISION QUESTIONS

Document Content and Description Below

Question 1 - 30 marks Stacey is 55 years old and has provided you with the following information in order to complete her tax return for the year ended 5 April 2009. 1. She is the sales director of ... Ballie Limited and has an annual salary of £60,000. PAYE deducted £5,000. 2. She receives the following benefits: (a) Company car, diesel engine emissions 180g/km. The list price of the car is £32,000. (b) All fuel for the car is paid for by the company. Stacey contributes £10 per week towards her private fuel. (c) Stacey has use of her company laptop for private purposes. The laptop cost the company £2,000 when it was first made available to Stacey. 3. Stacey’s company pays 5% of her salary into the company pension scheme on her behalf. Stacey contributes 2% of her salary to this scheme. 4. Stacey received the following other income during the year: £ Dividends from shares in Ballie Ltd 2,250 Interest on Building Society account 120 Interest on an ISA 220 5. Stacey owns a furnished house which she rents out. a) In 2008/9 she rented the property for £500 per month. b) The property was empty for three months in between tenancies which gave Stacey an opportunity to refurbish the kitchen and redecorate. c) She spent £2,500 on new kitchen units and £1,000 on the redecoration. d) The general expenses for running the property came to £3,400 – all allowable. e) Stacey wishes to claim the wear and tear allowance. (She paid £800 in rates on the property and this is included in the expenses figure given). f) Stacey has property losses brought forward of £500 from a previous period. 6. Stacey made a donation to charity, under the gift aid scheme of £900. Task Calculate Stacey’s income tax payable for the year ended 5 April 2009. Question 2 - 15 Marks Grace Manning has made several capital transactions during 2008/9. 1. Painting Grace bought a painting on 15 January 2000 for £3,000. She sold it on 28 February 2009 for £8,200. The advertising costs were £150. 2. Holiday cottage Grace bought a holiday cottage (for her own personal use) on 31 March 1982 for £60,000. On 20 August 1999 she had the cottage extended at a cost of £20,000. She sold the cottage on 30 September 2008 for £250,000. Agents’ fees and legal fees on the sale were £4,000. 3. Antique grandfather clock Grace bought the clock in December 1999 for £1,000 and sold it to a friend in December 2008 for £2,000. Its actual value in December 2005 was £5,000. 4. Set of antique chairs Grace bought a set of six chairs for £12,000 in July 1995. She sold four of the chairs in July 2008 for £24,000. The remaining two chairs were valued at £16,000 on the date of the sale. Grace has capital losses brought forward of £3,000. Calculate Grace’s capital gains tax liability for the year ended 5 April 2009 Peter Andrews commenced trading on 1 October 2007. His first set of accounts was made up to 30 September 2008 and accounts will be made up for each 12 month period following. Peter’s tax adjusted profits before capital allowances for the year to 30 September 2008 were £45,000. During the year ended 30 September 2008 Peter acquired the following assets for use in his business: (a) Calculate the capital allowances for the first two periods of account. (10 marks) (b) Assuming that Peter’s tax adjusted profits before capital allowances for the year ended 30 September 2009 will be £48,000, calculate the taxable trading profits for the first three years of assessment. State the overlap profits and how these can be relieved. [Show More]

Last updated: 3 years ago

Preview 1 out of 9 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$2.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Oct 25, 2019

Number of pages

9

Written in

All

Additional information

This document has been written for:

Uploaded

Oct 25, 2019

Downloads

0

Views

195