From: Michael Carpenter (50234209)

To: Excellent Course Instructor – Michael Opara

Subject: National Motor Company – ACCT 525 Summer 2 Project

In its efforts to improve operational efficiency and increase profitabilit

...

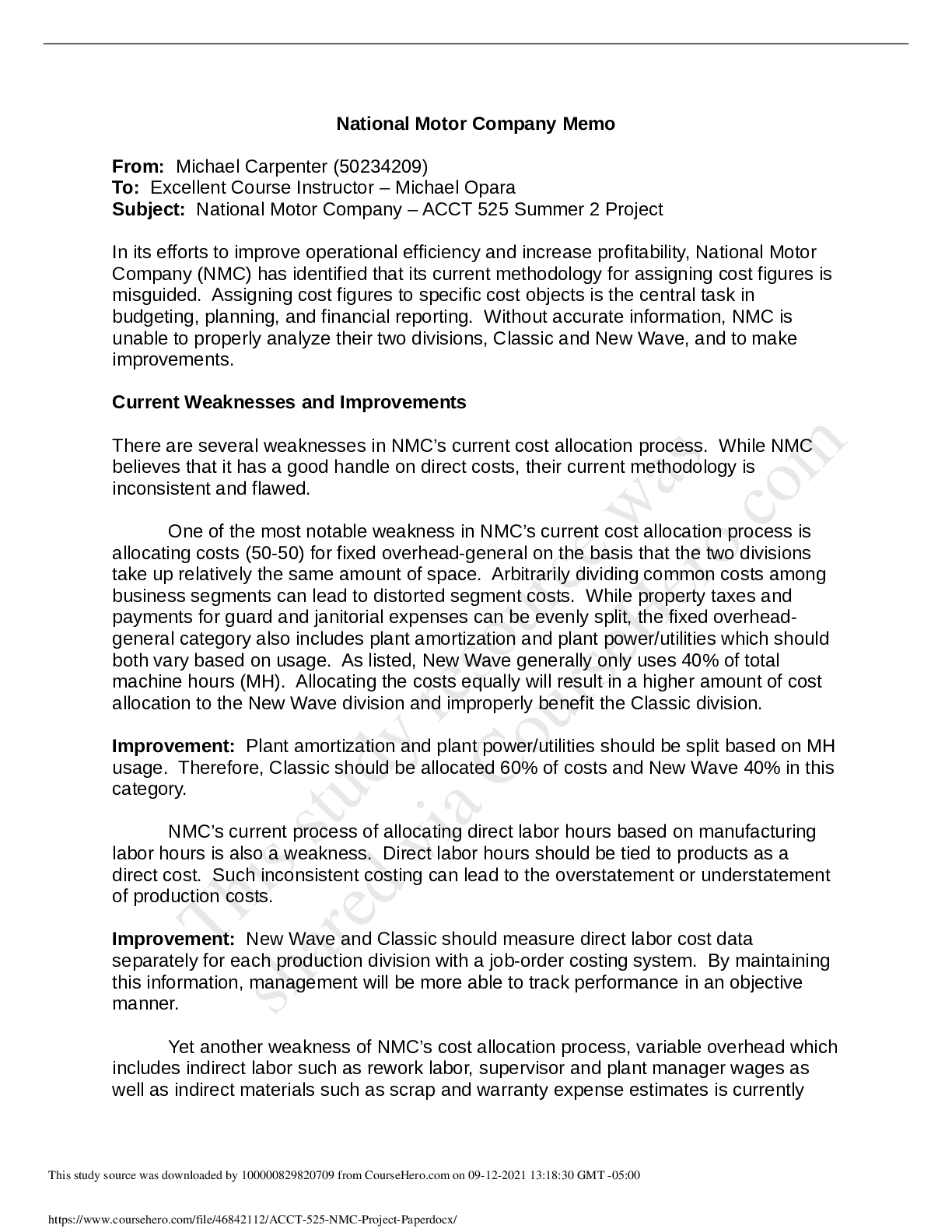

From: Michael Carpenter (50234209)

To: Excellent Course Instructor – Michael Opara

Subject: National Motor Company – ACCT 525 Summer 2 Project

In its efforts to improve operational efficiency and increase profitability, National Motor

Company (NMC) has identified that its current methodology for assigning cost figures is

misguided. Assigning cost figures to specific cost objects is the central task in

budgeting, planning, and financial reporting. Without accurate information, NMC is

unable to properly analyze their two divisions, Classic and New Wave, and to make

improvements.

Current Weaknesses and Improvements

There are several weaknesses in NMC’s current cost allocation process. While NMC

believes that it has a good handle on direct costs, their current methodology is

inconsistent and flawed.

One of the most notable weakness in NMC’s current cost allocation process is

allocating costs (50-50) for fixed overhead-general on the basis that the two divisions

take up relatively the same amount of space. Arbitrarily dividing common costs among

business segments can lead to distorted segment costs. While property taxes and

payments for guard and janitorial expenses can be evenly split, the fixed overheadgeneral

category also includes plant amortization and plant power/utilities which should

both vary based on usage. As listed, New Wave generally only uses 40% of total

machine hours (MH). Allocating the costs equally will result in a higher amount of cost

allocation to the New Wave division and improperly benefit the Classic division.

Improvement: Plant amortization and plant power/utilities should be split based on MH

usage. Therefore, Classic should be allocated 60% of costs and New Wave 40% in this

category.

NMC’s current process of allocating direct labor hours based on manufacturing

labor hours is also a weakness. Direct labor hours should be tied to products as a

direct cost. Such inconsistent costing can lead to the overstatement or understatement

of production costs.

Improvement: New Wave and Classic should measure direct labor cost data

separately for each production division with a job-order costing system. By maintaining

this information, management will be more able to track performance in an objective

manner.

Yet another weakness of NMC’s cost allocation process, variable overhead which

includes indirect labor such as rework labor, supervisor and plant manager wages as

well as indirect materials such as scrap and warranty expense estimates is currently

[Show More]