Question 1. Holcomb Industries sold a piece of machinery with a purchase value of $918,000

and accumulated depreciation of $856,800 for $80,000. They realized a gain of $18,800 on the

sale. How would this transaction a

...

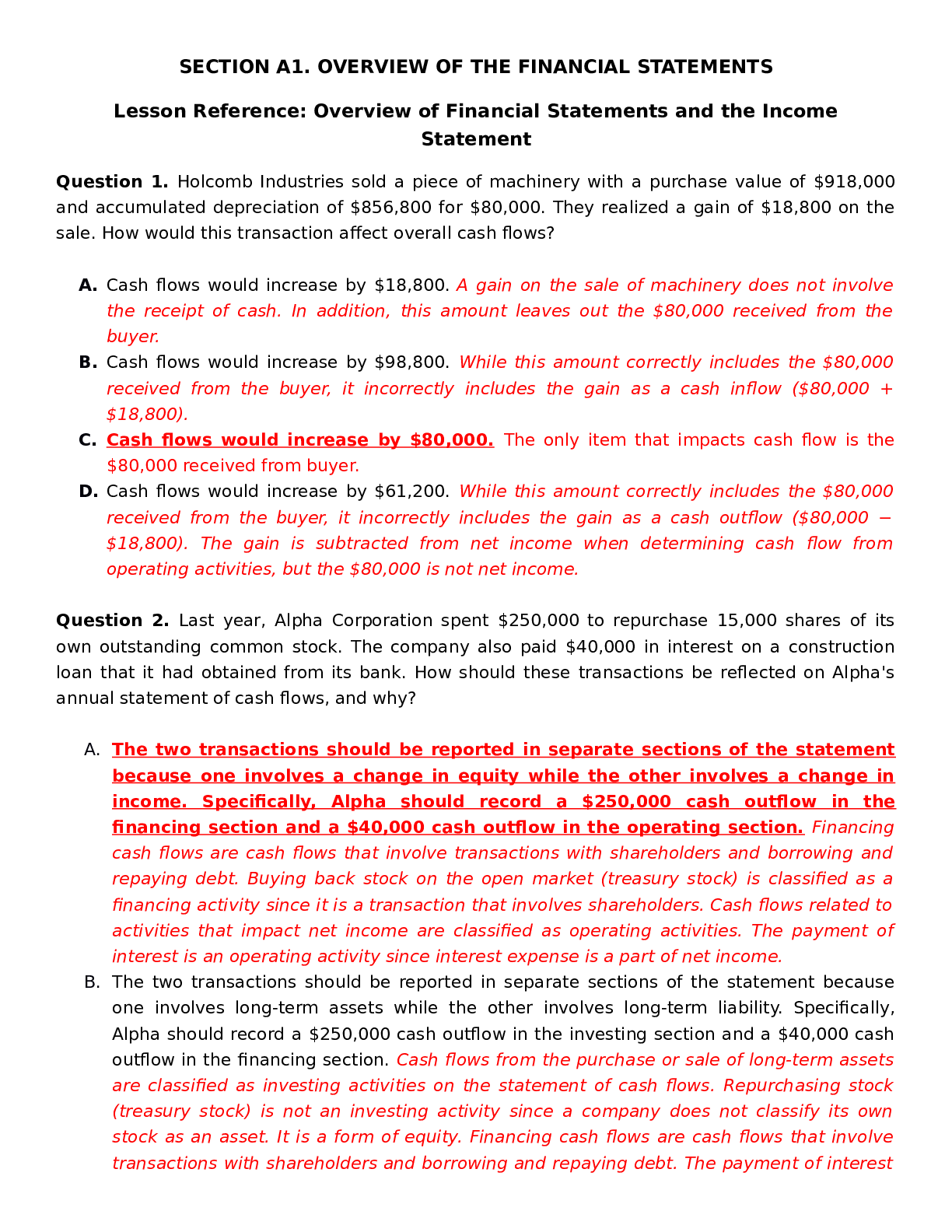

Question 1. Holcomb Industries sold a piece of machinery with a purchase value of $918,000

and accumulated depreciation of $856,800 for $80,000. They realized a gain of $18,800 on the

sale. How would this transaction affect overall cash flows?

A. Cash flows would increase by $18,800. A gain on the sale of machinery does not involve

the receipt of cash. In addition, this amount leaves out the $80,000 received from the

buyer.

B. Cash flows would increase by $98,800. While this amount correctly includes the $80,000

received from the buyer, it incorrectly includes the gain as a cash inflow ($80,000 +

$18,800).

C. Cash flows would increase by $80,000. The only item that impacts cash flow is the

$80,000 received from buyer.

D. Cash flows would increase by $61,200. While this amount correctly includes the $80,000

received from the buyer, it incorrectly includes the gain as a cash outflow ($80,000 −

$18,800). The gain is subtracted from net income when determining cash flow from

operating activities, but the $80,000 is not net income.

Question 2. Last year, Alpha Corporation spent $250,000 to repurchase 15,000 shares of its

own outstanding common stock. The company also paid $40,000 in interest on a construction

loan that it had obtained from its bank. How should these transactions be reflected on Alpha's

annual statement of cash flows, and why?

A. The two transactions should be reported in separate sections of the statement

because one involves a change in equity while the other involves a change in

income. Specifically, Alpha should record a $250,000 cash outflow in the

financing section and a $40,000 cash outflow in the operating section. Financing

cash flows are cash flows that involve transactions with shareholders and borrowing and

repaying debt. Buying back stock on the open market (treasury stock) is classified as a

financing activity since it is a transaction that involves shareholders. Cash flows related to

activities that impact net income are classified as operating activities. The payment of

interest is an operating activity since interest expense is a part of net income.

B. The two transactions should be reported in separate sections of the statement because

one involves long-term assets while the other involves long-term liability. Specifically,

Alpha should record a $250,000 cash outflow in the investing section and a $40,000 cash

outflow in the financing section. Cash flows from the purchase or sale of long-term assets

are classified as investing activities on the statement of cash flows. Repurchasing stock

(treasury stock) is not an investing activity since a company does not classify its own

stock as an asset. It is a form of equity. Financing cash flows are cash flows that involve

transactions with shareholders and borrowing and repaying debt. The payment of interest is not a financing activity. Rather, it is an operating activity since interest expense is a part

of net income. The initial borrowing and eventual repayment are financing activities, but

payment of interest is not.

C. Both transactions should be reported in the operating activities section because both

involve alterations in the company's income. Because the two transactions are unrelated,

they should be recorded separately—as a $250,000 cash outflow from the stock

repurchase and a $40,000 cash outflow from the interest payment. Cash flows related to

activities that impact net income are classified as operating activities. The payment of

interest is an operating activity since interest expense is a part of net income. However,

buying back stock does not impact net income. This means it is not an operating activity.

Because it reduces equity, it is a financing activity.

D. Both transactions should be reported in the financing activities section because both

involve long-term liability and/or equity items. Because the two transactions are unrelated,

they should be recorded separately—as a $250,000 cash outflow from the stock

repurchase and a $40,000 cash outflow from the interest payment. Financing cash flows

are cash flows that involve transactions with shareholders and borrowing and repaying

debt. Buying back stock on the open market (treasury stock) is classified as a financing

activity since it is a transaction that involves shareholders. However, the payment of

interest is not a financing activity. Rather, it is an operating activity since interest expense

is a part of net income. The initial borrowing and eventual repayment are financing

activities, but the payment of interest is not

[Show More]