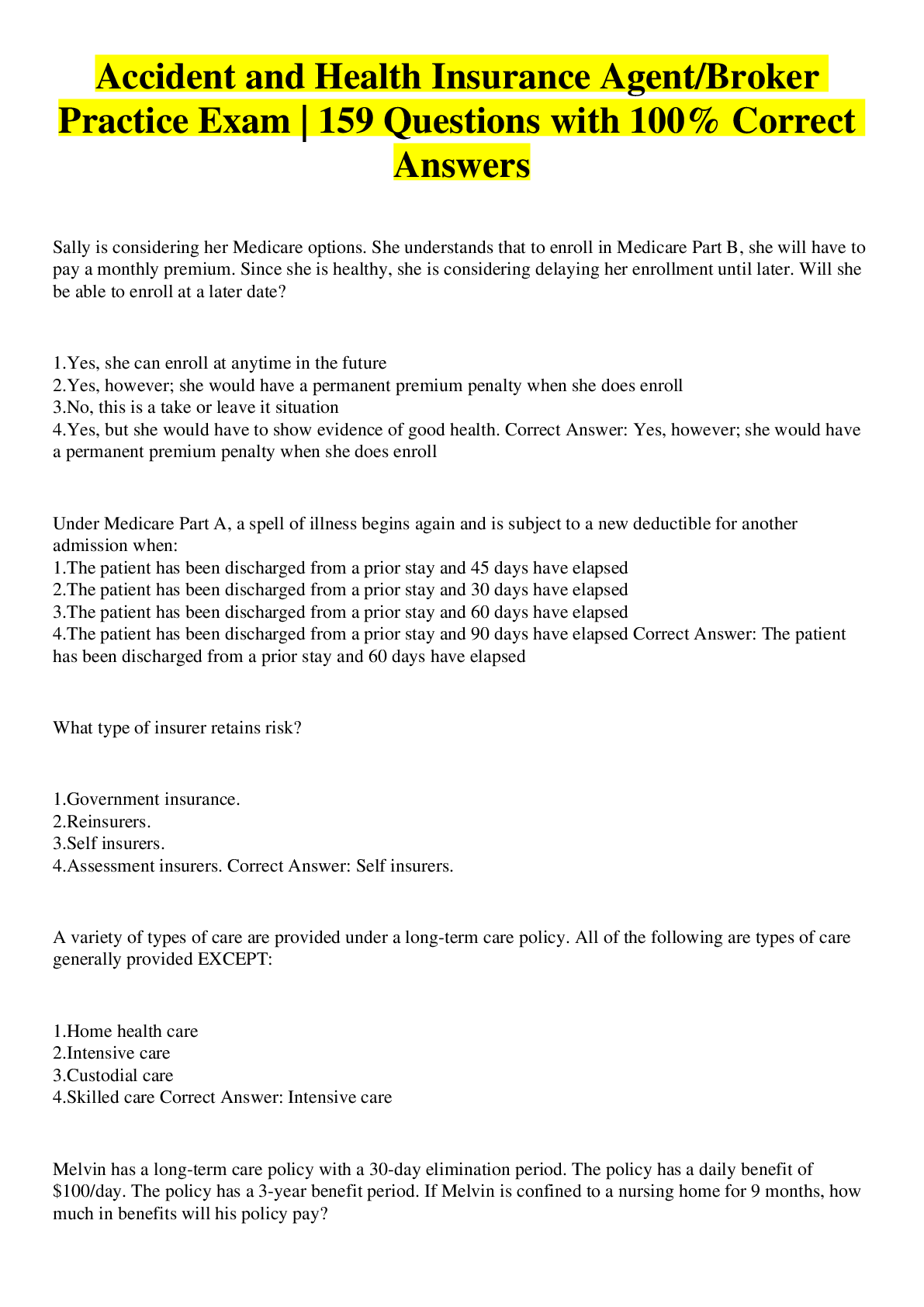

Social Sciences > QUESTIONS & ANSWERS > H1 Health and Accident Insurance 61 questions and Answers (All)

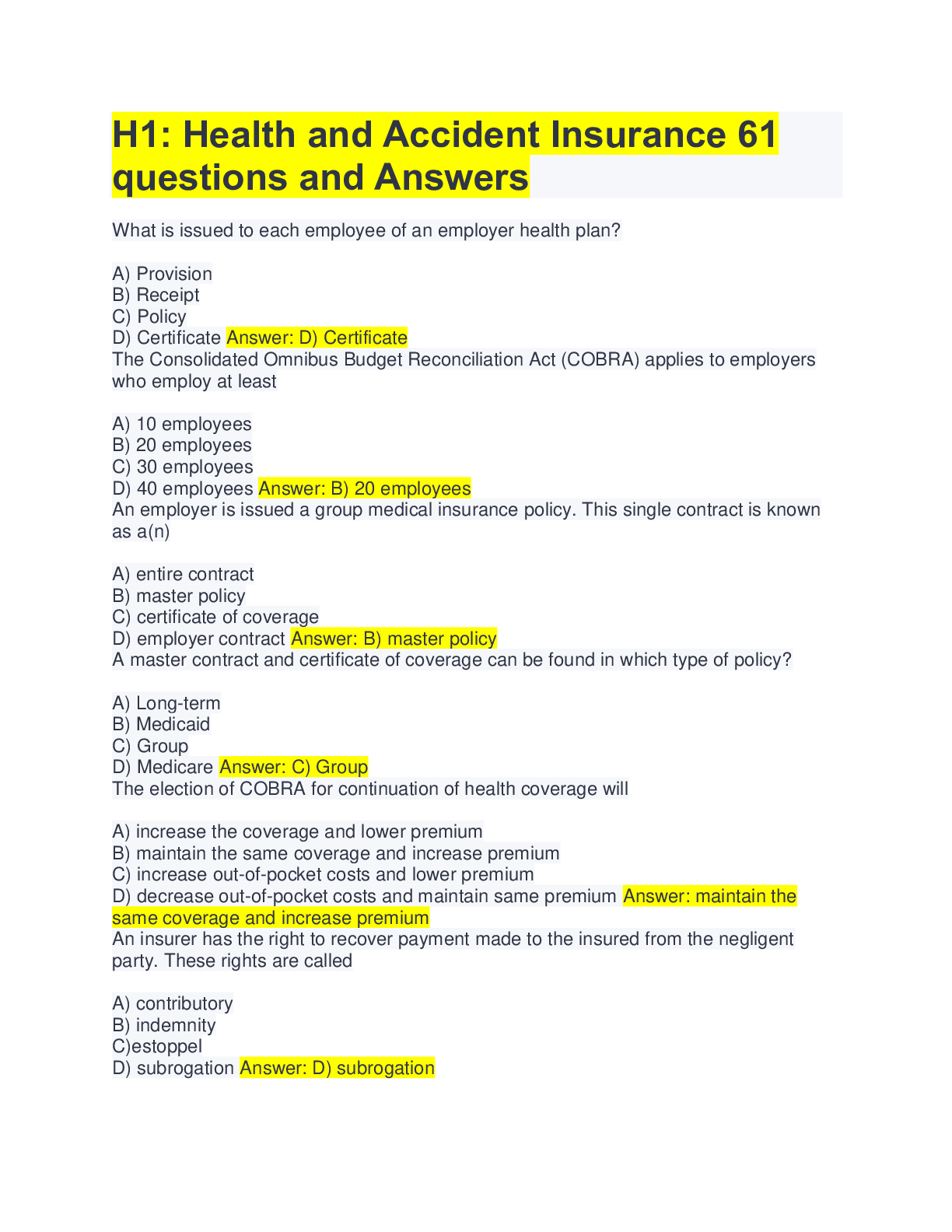

H1 Health and Accident Insurance 61 questions and Answers

Document Content and Description Below

H1: Health and Accident Insurance 61 questions and Answers What is issued to each employee of an employer health plan? A) Provision B) Receipt C) Policy D) Certificate Answer: D) Certificate Th... e Consolidated Omnibus Budget Reconciliation Act (COBRA) applies to employers who employ at least A) 10 employees B) 20 employees C) 30 employees D) 40 employees Answer: B) 20 employees An employer is issued a group medical insurance policy. This single contract is known as a(n) A) entire contract B) master policy C) certificate of coverage D) employer contract Answer: B) master policy A master contract and certificate of coverage can be found in which type of policy? A) Long-term B) Medicaid C) Group D) Medicare Answer: C) Group The election of COBRA for continuation of health coverage will A) increase the coverage and lower premium B) maintain the same coverage and increase premium C) increase out-of-pocket costs and lower premium D) decrease out-of-pocket costs and maintain same premium Answer: maintain the same coverage and increase premium An insurer has the right to recover payment made to the insured from the negligent party. These rights are called A) contributory B) indemnity C)estoppel D) subrogation Answer: D) subrogationWithout a Section 125 Plan in place, what would happen to an employee's payroll contribution to an HSA? A) It would be considered taxable income to the employee B) The employee would not be allowed to an HSA C) The employer would pay payroll tax and FICA on the contribution amount D) The employer would not be allowed to deduct the contribution from the employee's pay Answer: A) It would be considered taxable income to the employee According to the Health Insurance Portability and Accountability Act (HIPAA), when can a group health policy renewal be denied? A) There have been too many claims in the previous year B) The size of the group has increased by more than 10% C) Participation or contribution rules have been violated D) Participation or contribution rules have been changed Answer: C) Participation or contribution rules have been violated A group Disability Income plan that pays tax-free benefits to covered employees is considered A) non-contributory B) partially contributory C) group contributory D) fully contributory Answer: D) fully contributory The purpose of the Coordination of Benefits provision in group accident and health plans is to A) avoid overpayment of claims B) reduce out-of-pocket costs C) reduce adverse selection D) lower the cost of premiums Answer: A) avoid overpayment of claims Continued coverage under COBRA would be provided to all of the following EXCEPT: A) former dependent of employee no longer of dependent status B) terminated employee C) divorced spouse of employee D) a covered employee is terminated for gross misconduct Answer: D) a covered employee is terminated for gross misconduct Buy-sell plans are typically funded by which two types of insurance? A) Life insurance and disability insurance B) Annuities and disability insurance C) Modified endowment contracts and Long-term care insurance D) Life insurance and Long-term care insurance Answer: A) Life insurance and disability insurance How many employees must an employer have for a terminated employee to be eligible for COBRA? [Show More]

Last updated: 6 months ago

Preview 3 out of 10 pages

Loading document previews ...

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 1 )

by Cerlyne · 6 months ago

$9.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Aug 04, 2022

Number of pages

10

Written in

Additional information

This document has been written for:

Uploaded

Aug 04, 2022

Downloads

1

Views

408