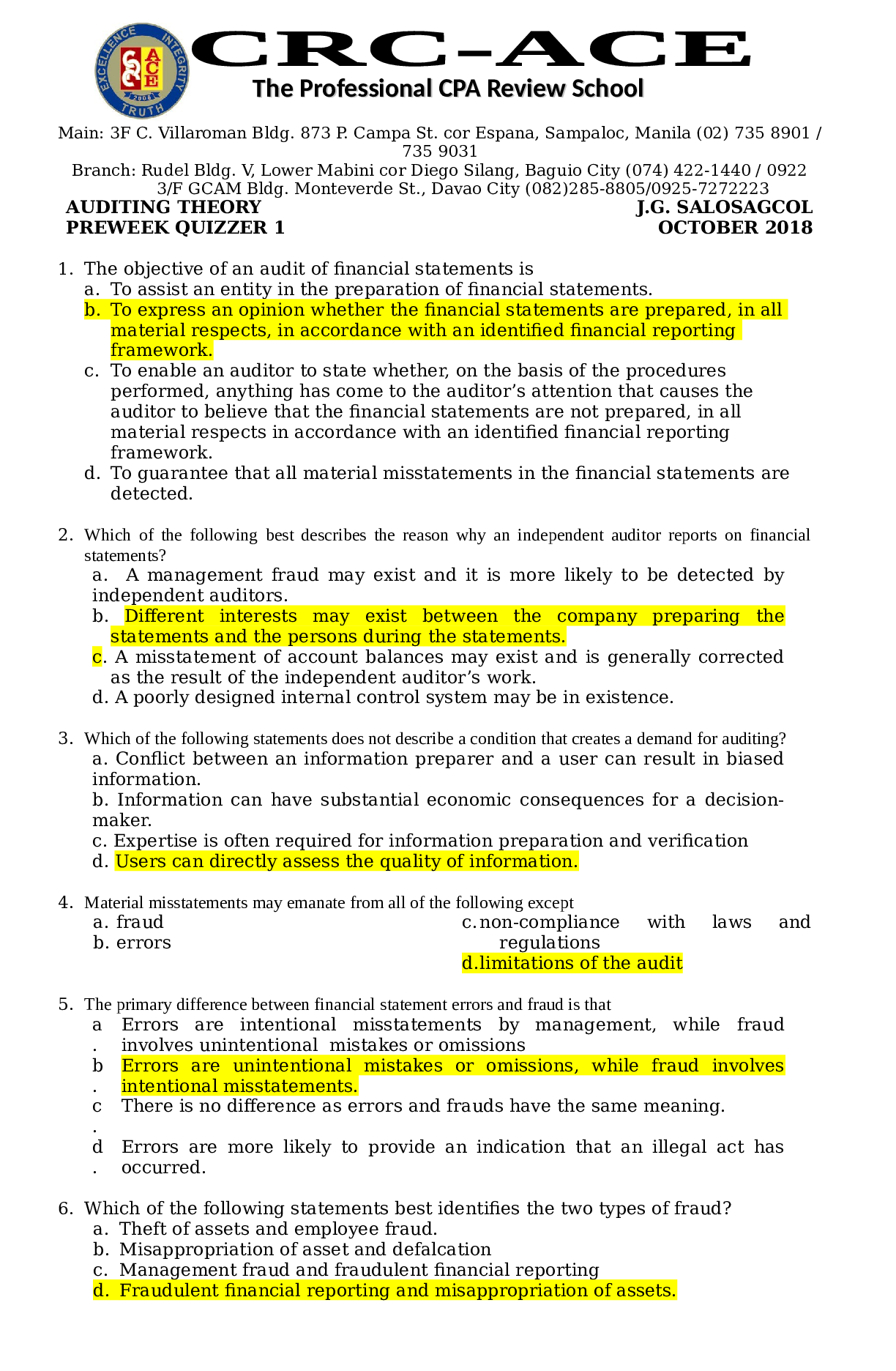

AUDITING THEORY

PREWEEK QUIZZER 1

J.G. SALOSAGCOL

OCTOBER 2018

1. The objective of an audit of financial statements is

a. To assist an entity in the preparation of financial statements.

b. To express an opinion whe

...

AUDITING THEORY

PREWEEK QUIZZER 1

J.G. SALOSAGCOL

OCTOBER 2018

1. The objective of an audit of financial statements is

a. To assist an entity in the preparation of financial statements.

b. To express an opinion whether the financial statements are prepared, in all

material respects, in accordance with an identified financial reporting

framework.

c. To enable an auditor to state whether, on the basis of the procedures

performed, anything has come to the auditor’s attention that causes the

auditor to believe that the financial statements are not prepared, in all

material respects in accordance with an identified financial reporting

framework.

d. To guarantee that all material misstatements in the financial statements are

detected.

2. Which of the following best describes the reason why an independent auditor reports on financial

statements?

a. A management fraud may exist and it is more likely to be detected by

independent auditors.

b. Different interests may exist between the company preparing the

statements and the persons during the statements.

c. A misstatement of account balances may exist and is generally corrected

as the result of the independent auditor’s work.

d. A poorly designed internal control system may be in existence.

3. Which of the following statements does not describe a condition that creates a demand for auditing?

a. Conflict between an information preparer and a user can result in biased

information.

b. Information can have substantial economic consequences for a decisionmaker.

c. Expertise is often required for information preparation and verification

d. Users can directly assess the quality of information.

4. Material misstatements may emanate from all of the following except

a. fraud

b. errors

c.non-compliance with laws and

regulations

d.limitations of the audit

5. The primary difference between financial statement errors and fraud is that

a

.

Errors are intentional misstatements by management, while fraud

involves unintentional mistakes or omissions

b

.

Errors are unintentional mistakes or omissions, while fraud involves

intentional misstatements.

c

.

There is no difference as errors and frauds have the same meaning.

d

.

Errors are more likely to provide an indication that an illegal act has

occurred.

6. Which of the following statements best identifies the two types of fraud?

a. Theft of assets and employee fraud.

b. Misappropriation of asset and defalcation

c. Management fraud and fraudulent financial reporting

d. Fraudulent financial reporting and misappropriation of assets.

The Professional CPA Review School

Main: 3F C. Villaroman Bldg. 873 P. Campa St. cor Espana, Sampaloc, Manila (02) 735 8901 /

735 9031

Branch: Rudel Bldg. V, Lower Mabini cor Diego Silang, Baguio City (074) 422-1440 / 0922

3/F GCAM Bldg. Monteverde St., Davao City (082)285-8805/0925-7272223

CRC-ACE/AT Preweek October 2018 Batch Page

2 of 17

7. Which of the following is not an example of fraud?

a.misappropriation of assets. c. Misinterpretation of facts

b. Recording transactions without substance. d. Omission of the effects of

transactions

8. Which of the following would be considered a fraud?

a. mistakes in the application of accounting principles

b. clerical mistakes in the accounting data underlying the financial statements

c. misappropriation of an asset or groups of assets

d. misinterpretations of facts that existed when the financial statements were

prepared

9. Fraudulent financial reporting is often called

a. management fraud. b. theft of assets. c. defalcation. d.

employee fraud.

10. When is the auditor responsible for detecting fraud?

a.When the fraud did not result from collusion.

b.When third parties are likely to rely on the client’s financial statements.

c.When the client’s system of internal control is judged by the auditor to be

inadequate.

d.When the application of PSA would have uncovered the fraud.

11. With respect to errors and fraud, the auditor should plan to

a.Search for errors that would have a material effect and for fraud that would

have either material or immaterial effect on the financial statements.

b.Search for fraud that would have a material effect and for errors that would

have either material or immaterial effect on the financial statements.

c.Search for errors or fraud that would have a material effect on the financial

statements.

d.Discover errors or fraud that have either material or immaterial effect on the

financial statements.

12. With respect to errors and fraud, which of the following should be part of an

auditor’s planning of the audit engagement?

a. planning to search for errors or fraud that would have a material or

immaterial effect on the financial statements

b. planning to discover errors or fraud that are either material or immaterial

c. planning to discover errors or fraud that are immaterial

d. planning to consider factors affecting the risk of material misstatement both

at the financial statement and the account balance level

13. The auditor is most likely to presume that a high-risk of a defalcation exists if

a.The client is a multinational company that does business in numerous foreign

countries.

b.The client does business with several related parties.

c.Inadequate segregation of duties places an employee in a position to

perpetrate and conceal thefts.

d.Inadequate employee training results in lengthy EDP exception reports each

month.

14. Because an examination in accordance with PSA is influenced by the possibility

of material errors, the auditor should conduct the examination with an attitude

of

a. Professional responsiveness c. Objective judgment

b. Conservative advocacy d. Professional skepticism

15. According to PSA 250, noncompliance refers to

a.intentional acts of one or more individuals which result in misstatement in

financial statements

CRC-ACE/AT Preweek October 2018 Batch Page

3 of 17

b.unintentional mistakes in the financial statements

c.personal misconduct by the entity’s management or employees

d.acts of omission or commission by the client which are contrary to prevailing

laws and regulations

16. In making a decision to accept or continue with a client, the auditor should

consider:

a b c d

Its competence YES YES YES YES

Its own independence YES NO YES NO

Its ability to service the client properly YES YES YES NO

The integrity of the client’s management YES YES NO YES

17. When an independent auditor is approached to perform an audit for the

first time, he or she should make inquiries of the predecessor auditor. Inquiries

are necessary because the predecessor may be able to provide the successor

with information that will assist the successor in determining whether

a. the predecessor’s work should be used

b. the company rotates auditors

c. in the predecessor’s opinion, control risk is low

d. the engagement should be accepted

18. When one auditor succeeds another, the successor auditor should request

the

a.Client to instruct its attorney to send a letter of audit inquiry concerning the

status of the prior year’s litigation, claims, and assessments.

b.Predecessor auditor to submit a list of internal accounting control weaknesses

that have not been corrected.

c.Client to authorize the predecessor auditor to allow a review of the

predecessor auditor’s working papers.

d.Predecessor auditor to update the prior year’s report to the date of the

change of auditors.

19. Which of the following should an auditor obtain from the predecessor

auditor prior to accepting an audit engage

[Show More]

.png)

.png)