Financial Accounting > STUDY GUIDE > Ch 5-In Class Ex - Grant MacEwan University ACCT 315 (All)

Ch 5-In Class Ex - Grant MacEwan University ACCT 315

Document Content and Description Below

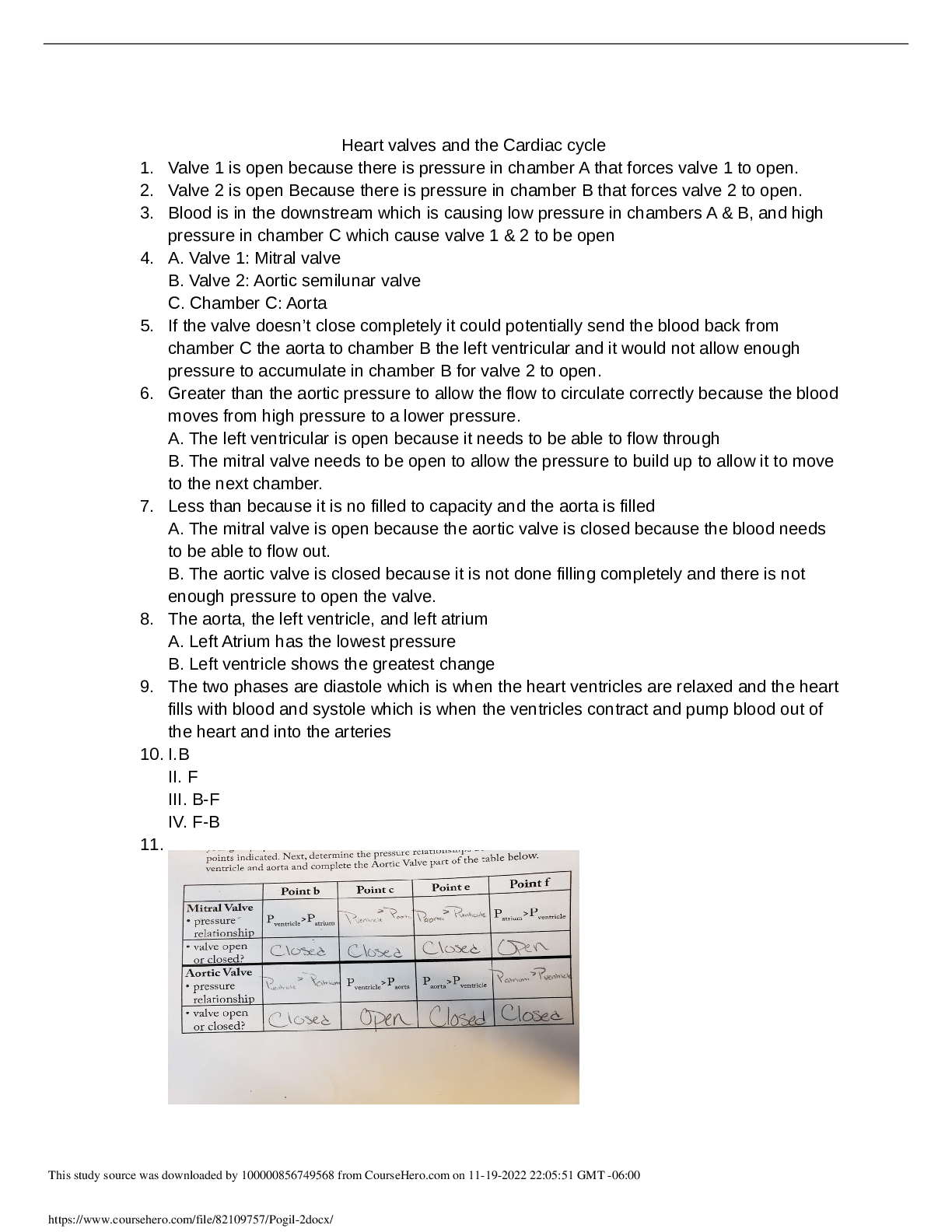

Ch 5-In Class Ex E5-10 (Current Assets Section of Statement of Financial Position) (LO 4, 5, 6 ) Selected accounts follow of Aramis Limited at December 31, 2014: Finished Goods Inventory 52,000 $ ... Cost of Goods Sold $2,100,000 Unearned Revenue 90,000 Notes Receivable 40,000 Bank Overdraft 8,000 Accounts Receivable 161,000 Equipment 253,000 Raw Materials 187,000 Work-in-Process Inventory 34,000 Supplies Expense 60,000 Cash, R.M. Bank 50,000 Allowance for Doubtful Accounts 12,000 FV-NI Investments 31,000 Intangible Assets—Trade Names 18,000 Interest Payable 36,000 Contributed Surplus 88,000 Restricted Cash (for Plant Expansion) 50,000 Common Shares 22,000 The following additional information is available: 1. Inventory is valued at lower of cost and net realizable value using FIFO. 2. Equipment is recorded at cost. Accumulated depreciation, calculated on a straight-line basis, is $50,600. 3. The fair value—net income investments have a fair value of $29,000. 4. The notes receivable are due April 30, 2015, with interest receivable every April 30. The notes bear interest at 6%. (Hint: Accrue interest due on December 31, 2014.) 5. The allowance for doubtful accounts applies to the accounts receivable. Accounts receivable of $50,000 are pledged as collateral on a bank loan. 6. Intangible Assets—Trade Names are recorded net of accumulated amortization of $14,000. Instructions (a) Prepare the current assets section of Aramis Limited's statement of financial position as at December 31, 2014, with appropriate disclosures. (b) Outline the other ways or methods that can be used to disclose the details that are required for the financial statement elements in part (a). Solution to EXERCISE 5-10 (a) Current assets Cash $ 92,000* Less cash restricted for plant expansion (50,000) $42,000 FV - NI investments 29,000 Accounts receivable (of which $50,000 is pledged as collateral on a bank loan) 161,00 0 Less allowance for doubtful accounts (12,000) 149,000 Notes receivable 40,000 Interest receivable ** 1,600 Inventory at lower of FIFO cost and net realizable value Finished goods 52,000 Work-in-process 34,000 Raw materials 187,000 273,000 Total current assets $534,600 *An acceptable alternative is to report cash at $42,000 and report the cash restricted for plant expansion in the non-current investments section of the statement of financial position. ($50,000 + $50,000 – $8,000) ** [($40,000 X 6%) X 8/12] EXERCISE 5-10 (Continued) (b) An alternative to the presentation of the details (for example of the three categories of inventory) as shown above is to provide disclosure in a table within the notes to the financial statements. This provides a more condensed format of the statement of financial position. This allows easier comparisons of balances, especially when presented on a comparative basis. References to the notes containing the detail would be added to the captions appearing on the face of the statement of financial position as a cross-reference. A second possible alternative to the presentation of information is parenthetical disclosure on the face of the statement of financial position. Although not a required disclosure, the balance of accounts receivable could be presented: “net of allowance for doubtful accounts of $12,000.” E5-11 (Preparation of Statement of Financial Position) (LO 4, 8 ) Zezulka Corporation's statement of financial position at the end of 2013 included the following items: Current assets $1,105,000 Current liabilities $1,020,000 Land 30,000 Bonds payable 1,100,000 Building 1,120,000 Common shares 180,000 Equipment 320,000 Retained earnings 174,000 Accumulated depreciation— building (130,000) Total $2,474,000 Accumulated depreciation— equipment (11,000) Intangible assets—patents 40,000 Total $2,474,000 The following information is available for 2014: 1. Net income was $391,000. 2. Equipment (cost of $20,000 and accumulated depreciation of $8,000) was sold for $10,000. 3. Depreciation expense was $4,000 on the building and $9,000 on equipment. 4. Patent amortization expense was $3,000. 5. Current assets other than cash increased by $229,000. Current liabilities increased by $213,000. 6. An addition to the building was completed at a cost of $31,000. 7. A fair value—OCI investment in shares was purchased for $20,500 at the end of the year. 8. Bonds payable of $75,000 were issued. 9. Cash dividends of $180,000 were declared and paid. Dividends paid are treated as financing activities. Instructions (a) Prepare a statement of financial position as at December 31, 2014. (Hint: You may need to adjust the December 31, 2014 amount of current assets to ensure it balances.) (b) Prepare a statement of cash flows for the year ended December 31, 2014. Solution to EXERCISE 5-11 (a) Zezulka Corporation Statement of Financial Position December 31, 2014 Assets Current assets $1,580,500a FV – OCI Investments 20,500 Property, plant, and equipment Land $ 30,000 Building ($1,120,000 + $31,000) [Show More]

Last updated: 3 years ago

Preview 1 out of 12 pages

.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$7.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Dec 01, 2022

Number of pages

12

Written in

All

Additional information

This document has been written for:

Uploaded

Dec 01, 2022

Downloads

0

Views

159

.png)

.png)