Financial Accounting > Final Exam Review > ACC 3100 Final Exam Baruch College, CUNY _Q&A (All)

ACC 3100 Final Exam Baruch College, CUNY _Q&A

Document Content and Description Below

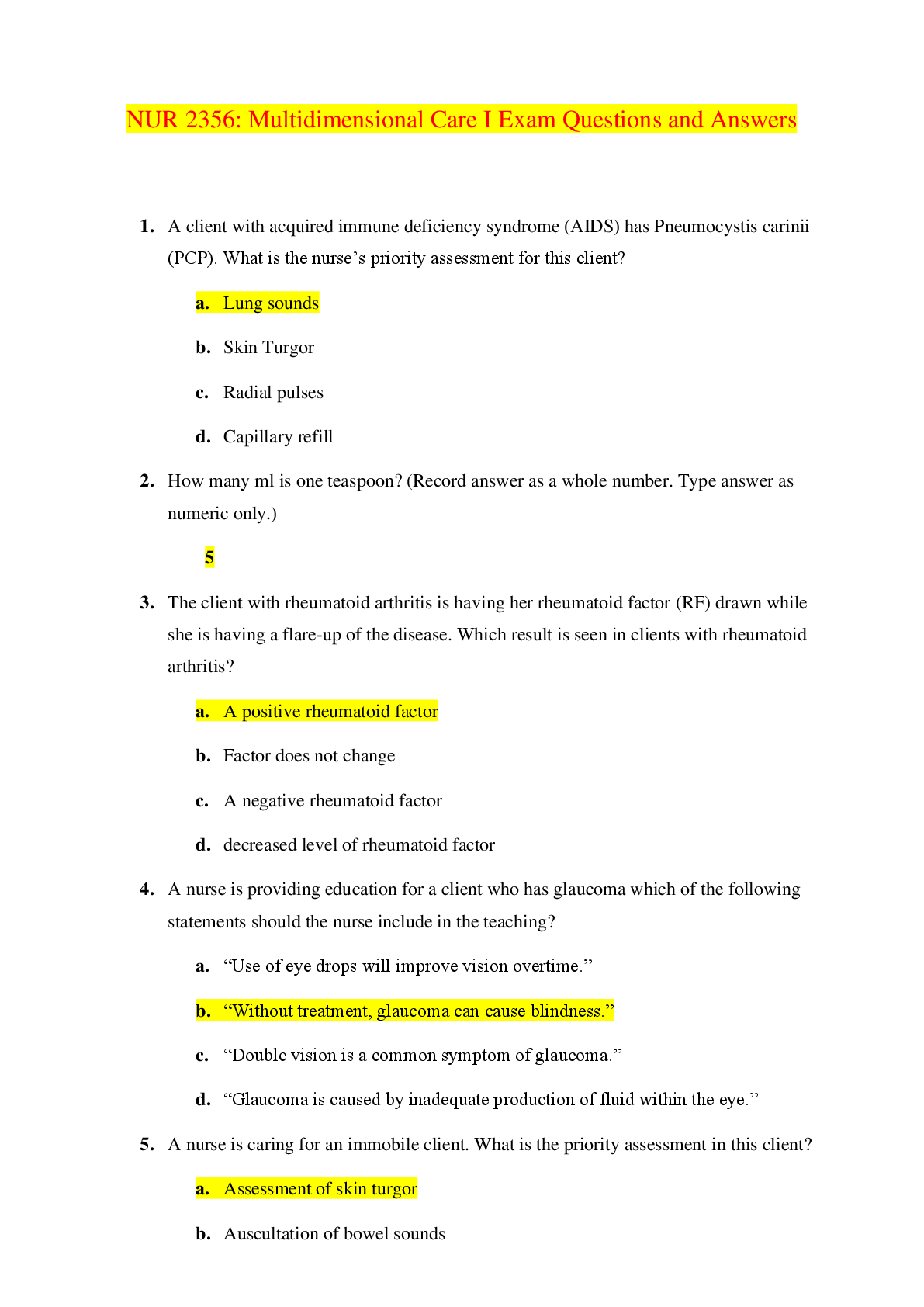

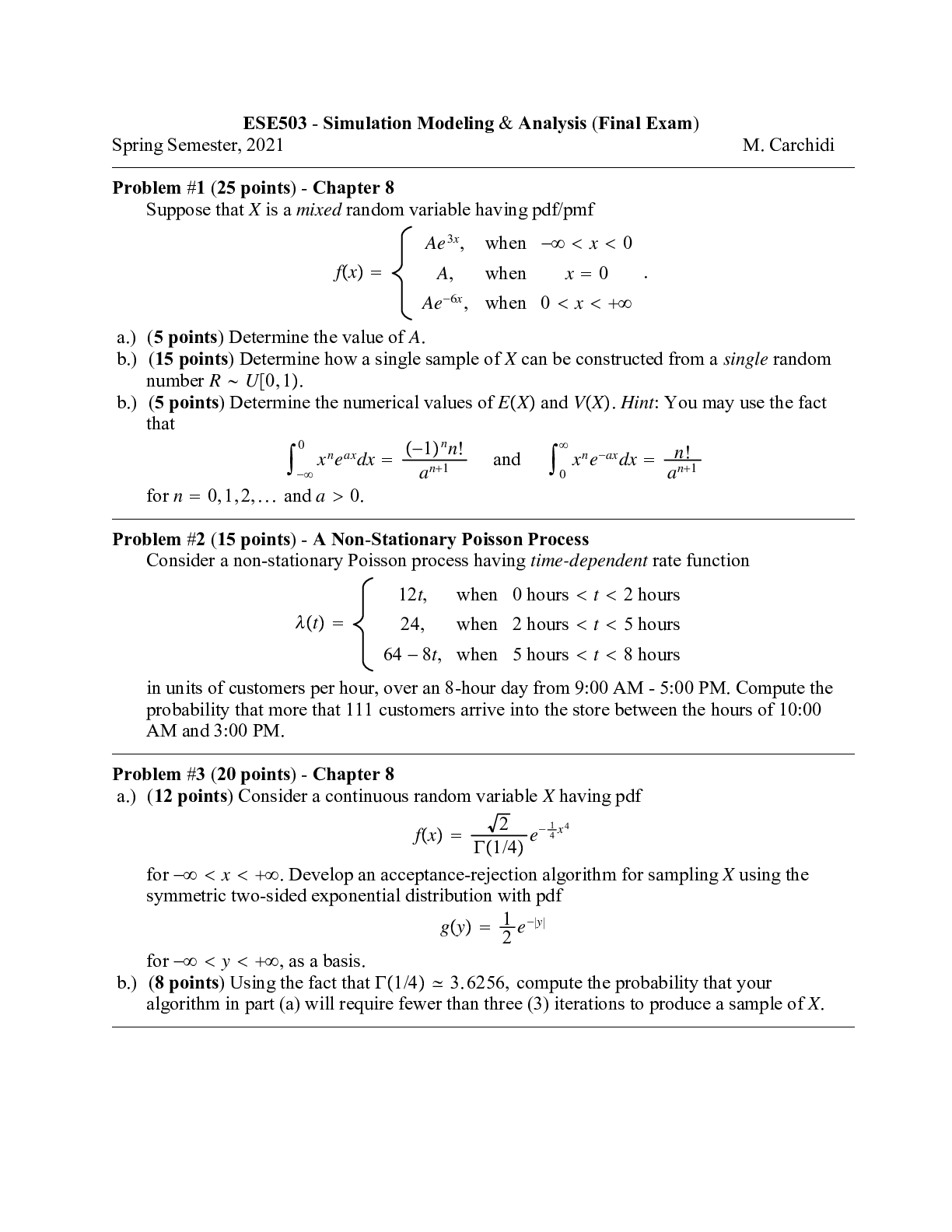

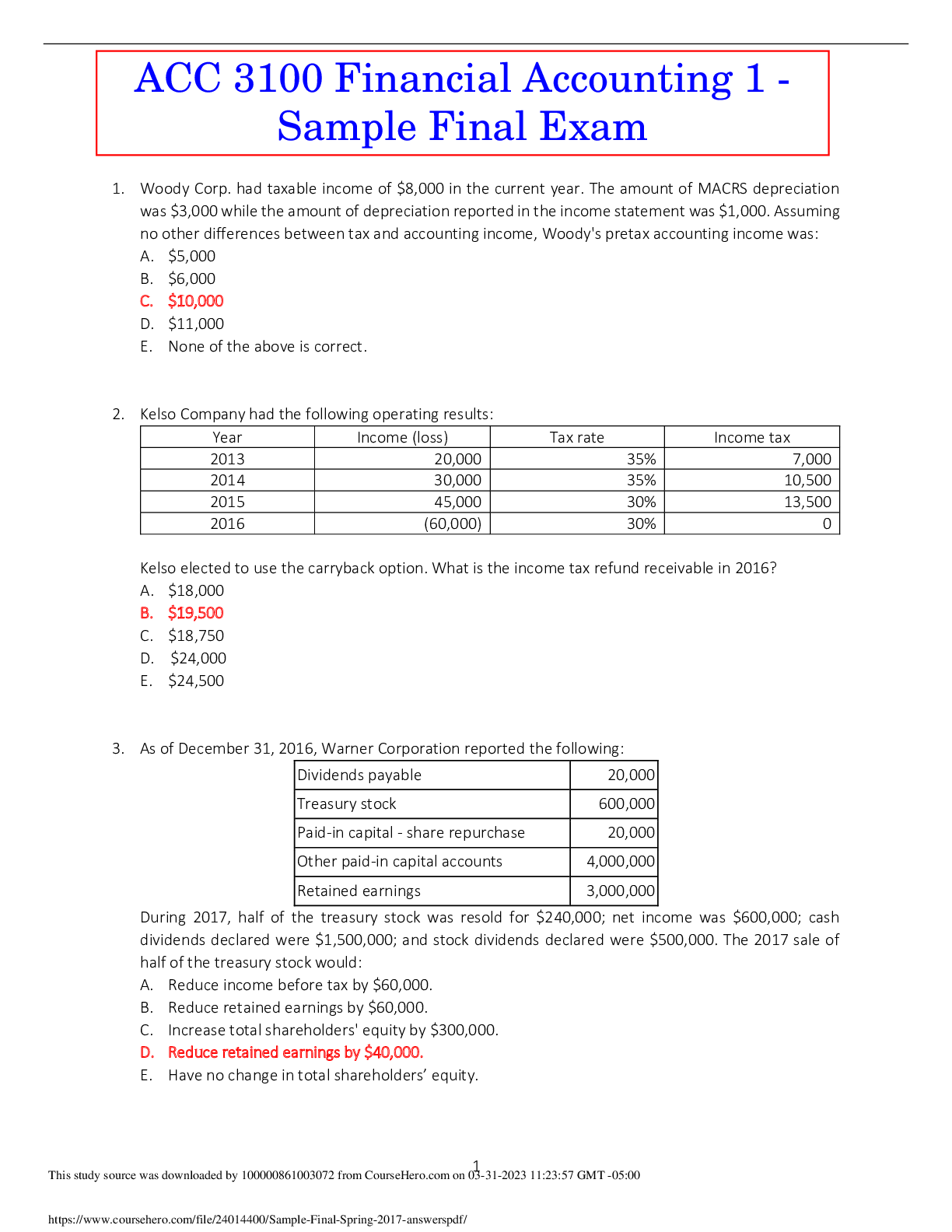

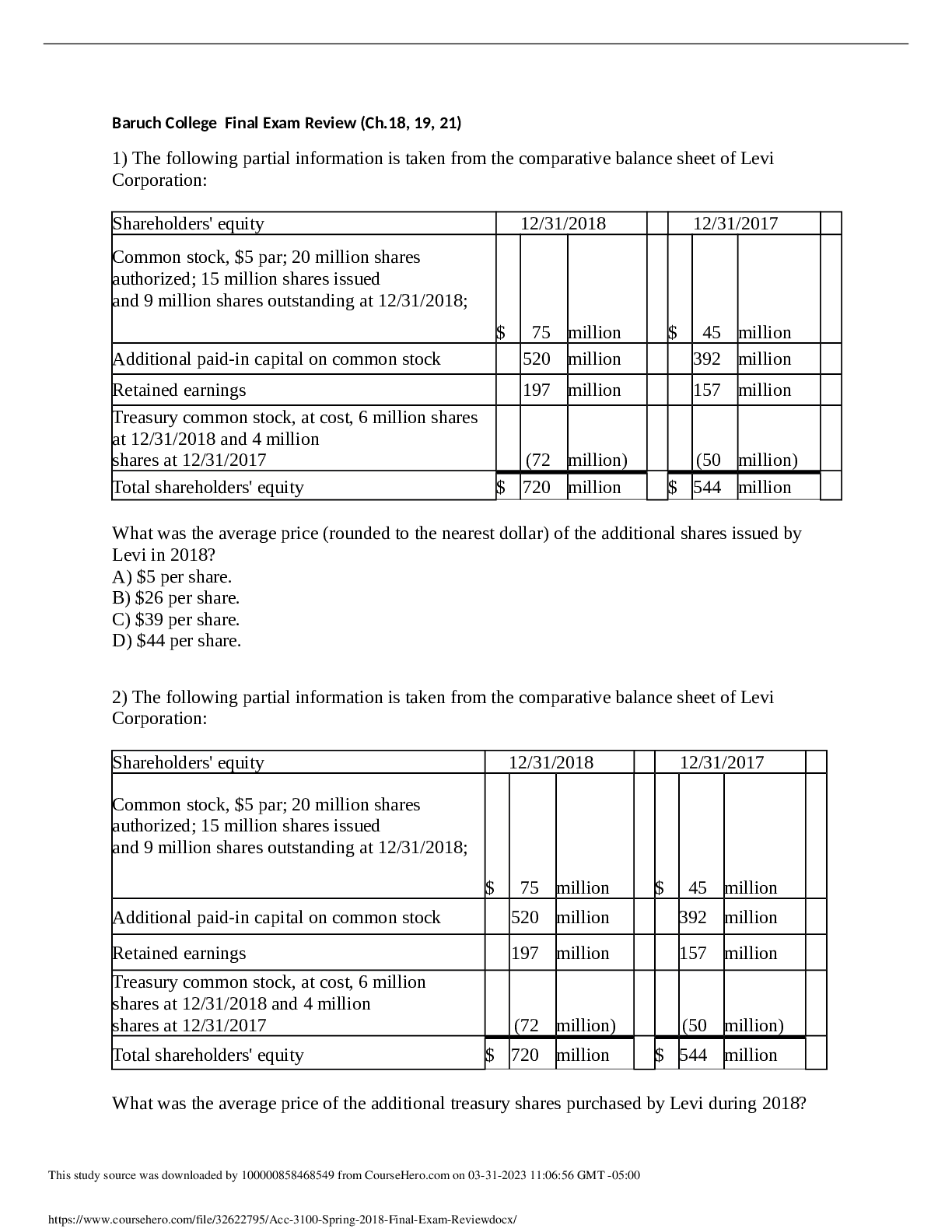

ACC 3100 Final Exam Baruch College, CUNY _Q&A 1. On January 1, 2021, D Corp. granted an employee an option to purchase 8,500 shares of D's $3 par common stock at $21 per share. The options became exe ... rcisable on December 31, 2022, after the employee completed two years of service. The option was exercised on January 10, 2023. The market prices of D's stock were as follows: January 1, 2021, $33; December 31, 2022, $51; and January 10, 2023, $46. An option pricing model estimated the value of the options at $8 each on the grant date. For 2021, D should recognize compensation expense of: $34,000 The total compensation is $68,000, the option model price of $8 each times the number of options, 8,500. Since the service period is two years, the compensation expense for 2021 is $34,000 ($68,000 ÷ 2 years). 2. Pastore Inc. granted options for 1 million shares of its $1 par common stock at the beginning of the current year. The exercise price is $37 per share, which was also the market value of the stock on the grant date. The fair value of the options was estimated at $6.50 per option. If the options have a vesting period of five years, what would be the balance in "Paid-in Capital—Stock Options" three years after the grant date? Answer: $3.9 million 1 million × $6.50 × 3/5 = $3.9 million. 3. Wall Drugs offered an incentive stock option plan to its employees. On January 1, 2021, options were granted for 75,000 $1 par common shares. The exercise price equals the $5 market price of the common stock on the grant date. The options cannot be exercised before January 1, 2024 and expire December 31, 2025. Each option has a fair value of $1 based on an option pricing model. Which is the correct entry to record compensation expense for the year 2021? Answer: $25,000 (75,000 × $1) ÷ 3 = $25,000 [Show More]

Last updated: 2 years ago

Preview 1 out of 11 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$13.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Apr 07, 2023

Number of pages

11

Written in

All

Additional information

This document has been written for:

Uploaded

Apr 07, 2023

Downloads

0

Views

121

JN21.png)