Financial Accounting > Final Exam Review > ACC 3100 Financial Accounting 1 - Baruch College Campus_ACC 3100 Financial Accounting 1 -Sample Fina (All)

ACC 3100 Financial Accounting 1 - Baruch College Campus_ACC 3100 Financial Accounting 1 -Sample Final Exam MCQ Plus Worked Solutions

Document Content and Description Below

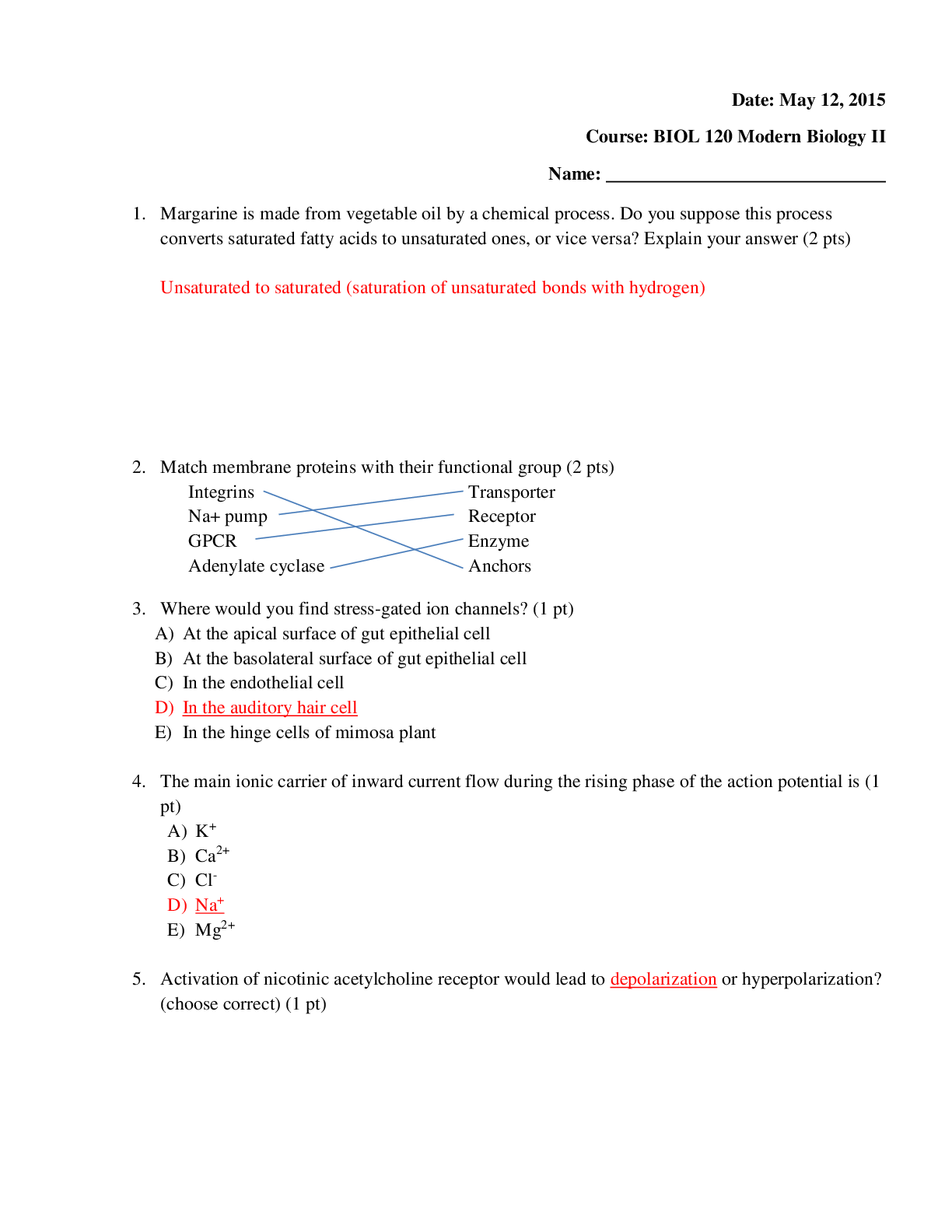

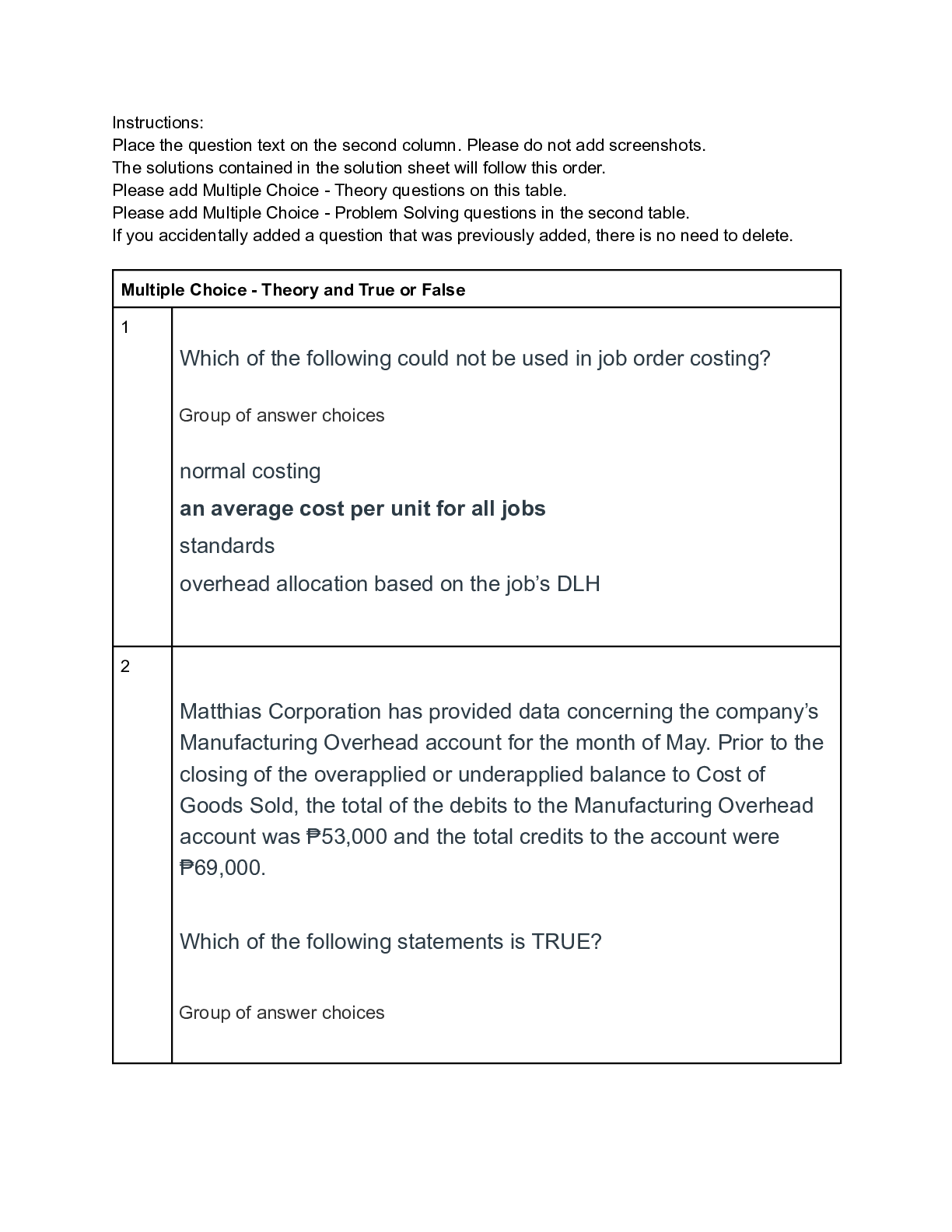

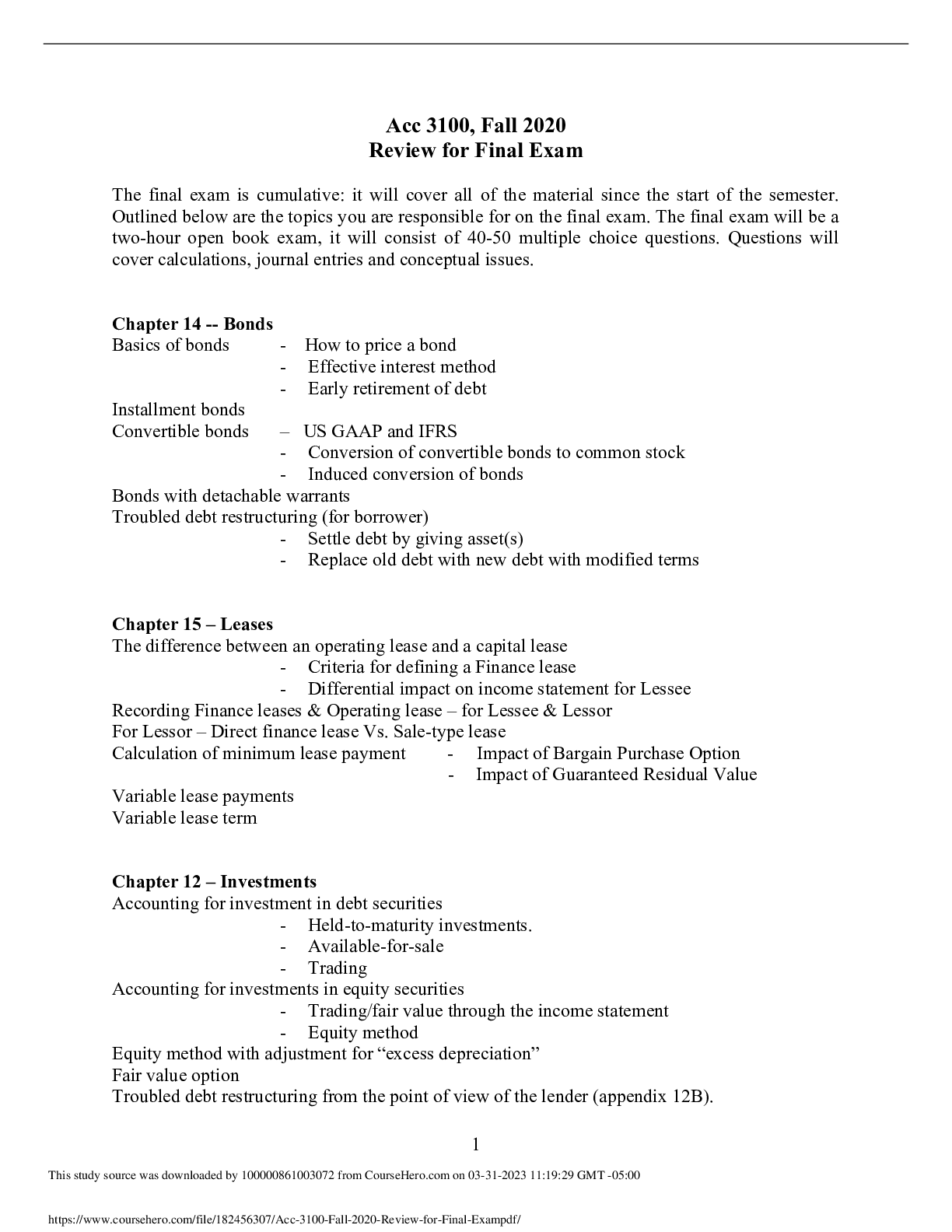

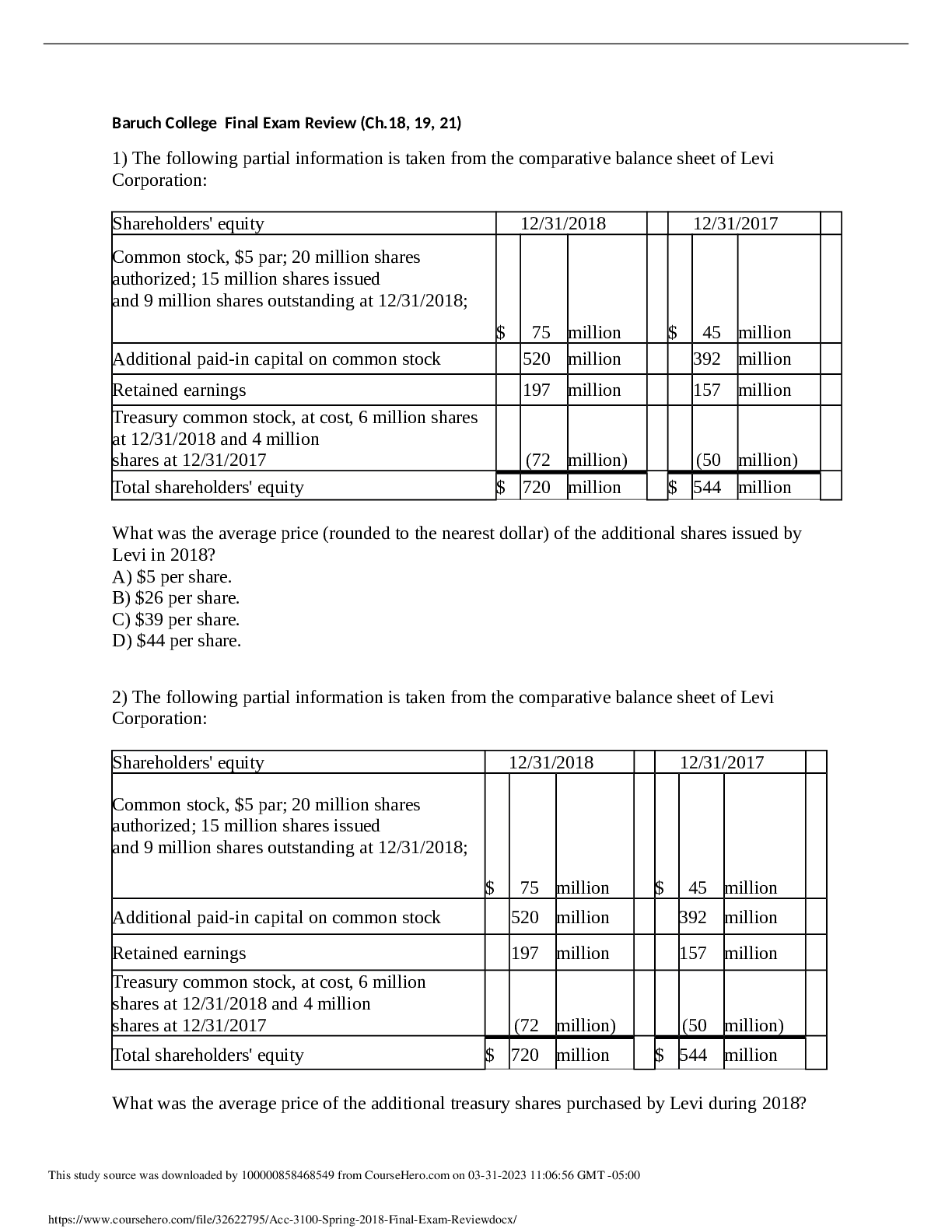

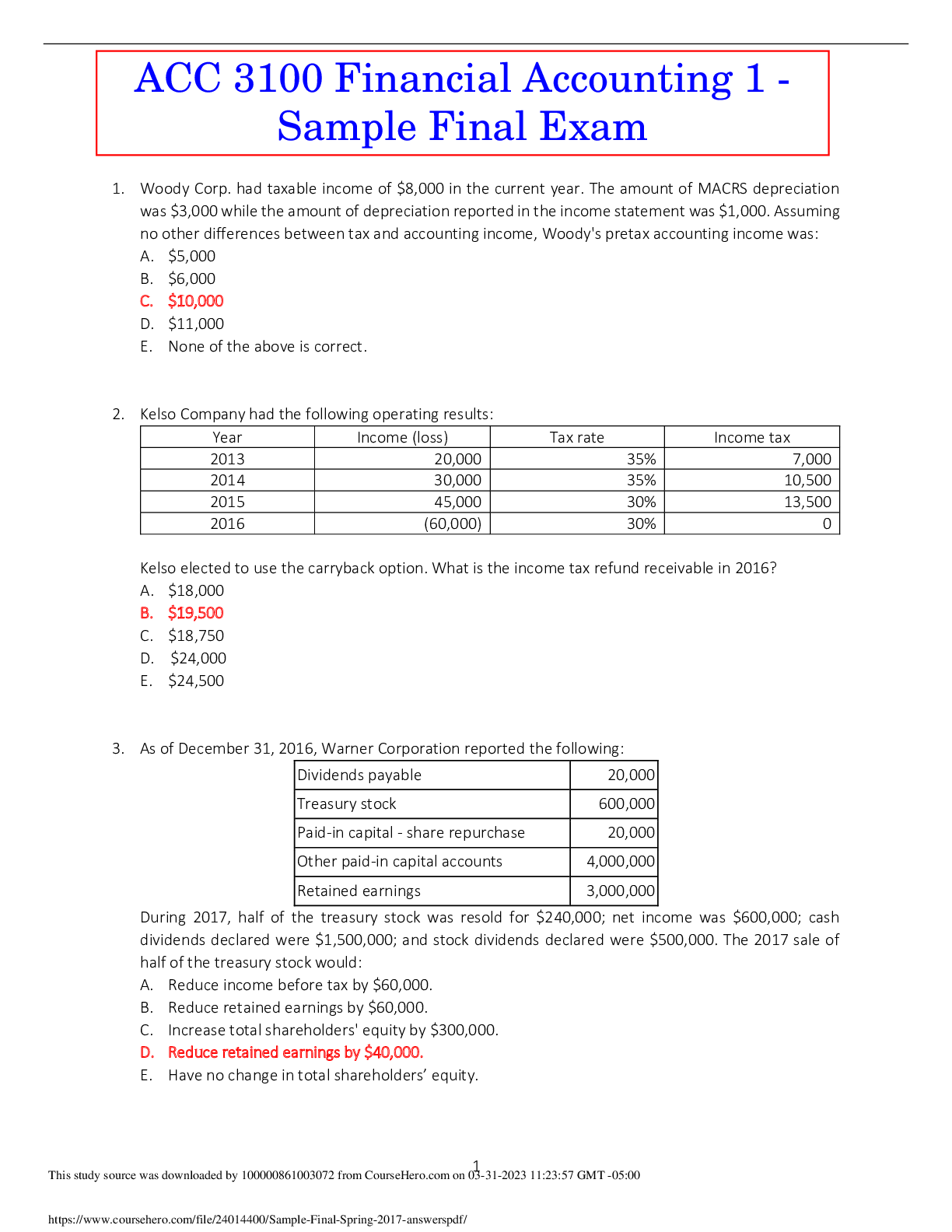

ACC 3100 Financial Accounting 1 - Baruch College Campus_ACC 3100 Financial Accounting 1 -Sample Final Exam MCQ Plus Worked Solutions Woody Corp. had taxable income of $8,000 in the current year. The ... amount of MACRS depreciation was $3,000 while the amount of depreciation reported in the income statement was $1,000. Assuming no other differences between tax and accounting income, Woody's pretax accounting income was: A. $5,000 B. $6,000 C. $10,000 D. $11,000 E. None of the above is correct. 2. Kelso Company had the following operating results: Year Income (loss) Tax rate Income tax 2013 20,000 35% 7,000 2014 30,000 35% 10,500 2015 45,000 30% 13,500 2016 (60,000) 30% 0 Kelso elected to use the carryback option. What is the income tax refund receivable in 2016? A. $18,000 B. $19,500 C. $18,750 D. $24,000 E. $24,500 3. As of December 31, 2016, Warner Corporation reported the following: Dividends payable 20,000 Treasury stock 600,000 Paid-in capital - share repurchase 20,000 Other paid-in capital accounts 4,000,000 Retained earnings 3,000,000 During 2017, half of the treasury stock was resold for $240,000; net income was $600,000; cash dividends declared were $1,500,000; and stock dividends declared were $500,000. The 2017 sale of half of the treasury stock would: A. Reduce income before tax by $60,000. B. Reduce retained earnings by $60,000. C. Increase total shareholders' equity by $300,000. D. Reduce retained earnings by $40,000. E. Have no change in total shareholders’ equity. 4. In 2014, Winn, Inc., issued $1 par value common stock for $35 per share. No other common stock transactions occurred until July 31, 2016, when Winn acquired some of the issued shares for $30 per share and retired them. Which of the following statements correctly states an effect of this acquisition and retirement? A. 2016 net income is decreased. B. Additional paid-in capital is decreased. C. 2016 net income is increased. D. Retained earnings is increased. E. Transactions on Winn’s own stock do not affect the balance sheet. [Show More]

Last updated: 2 years ago

Preview 1 out of 7 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$9.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Apr 07, 2023

Number of pages

7

Written in

Additional information

This document has been written for:

Uploaded

Apr 07, 2023

Downloads

0

Views

93