Business > TEST BANKS > Solution Manual for McGraw Hill's Taxation of Individuals and Business Entities, 2024 Edition, 15th (All)

Solution Manual for McGraw Hill's Taxation of Individuals and Business Entities, 2024 Edition, 15th Edition

Document Content and Description Below

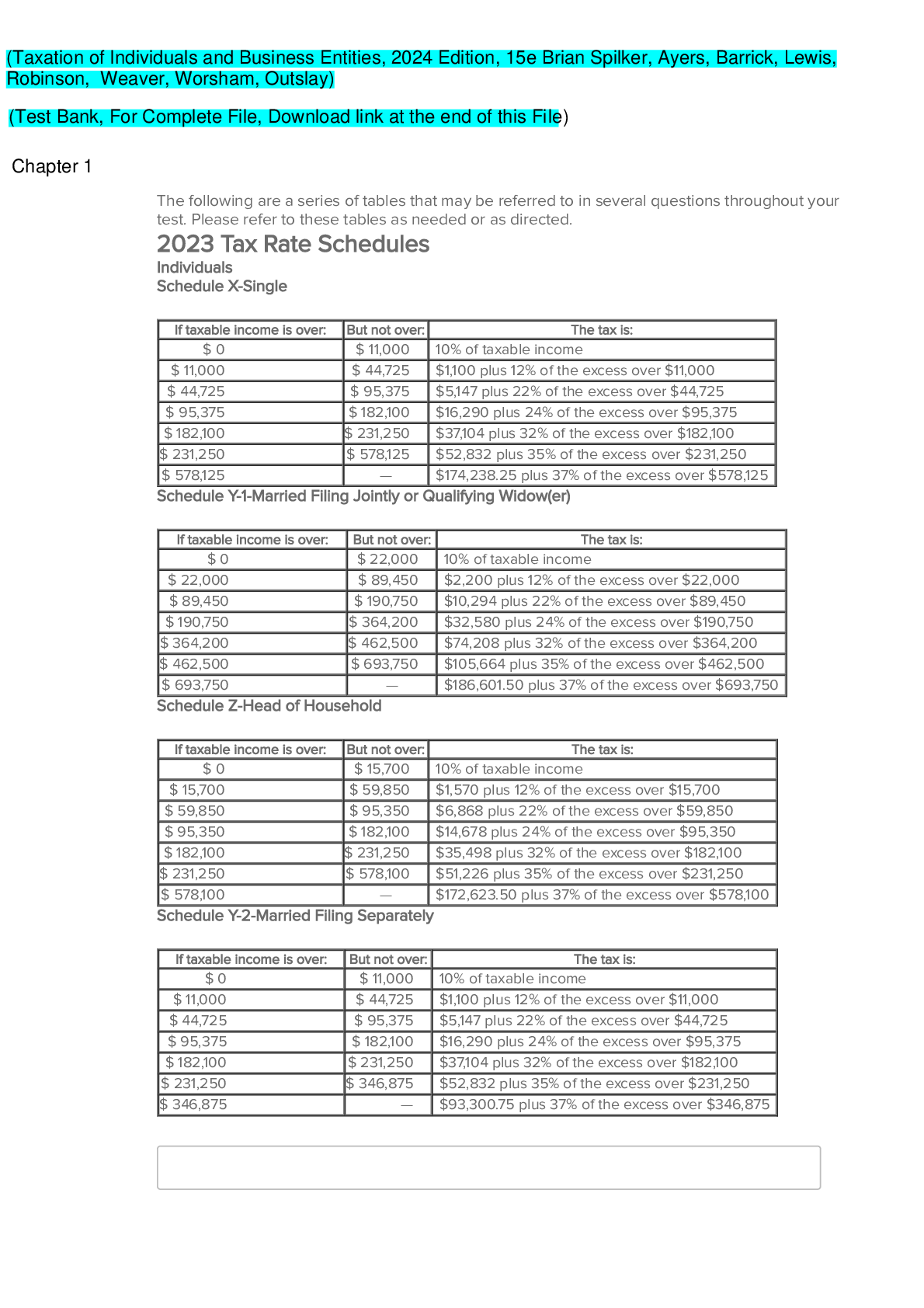

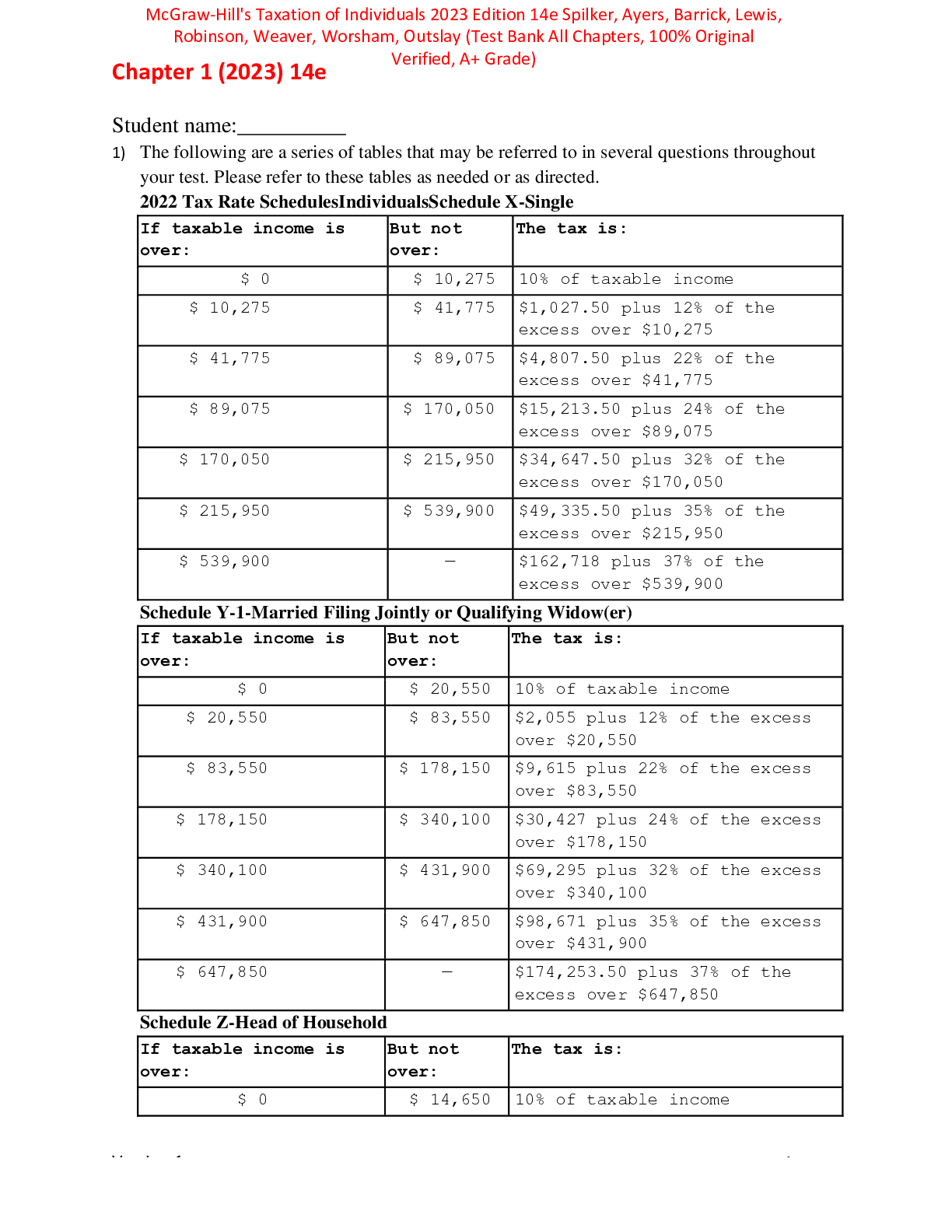

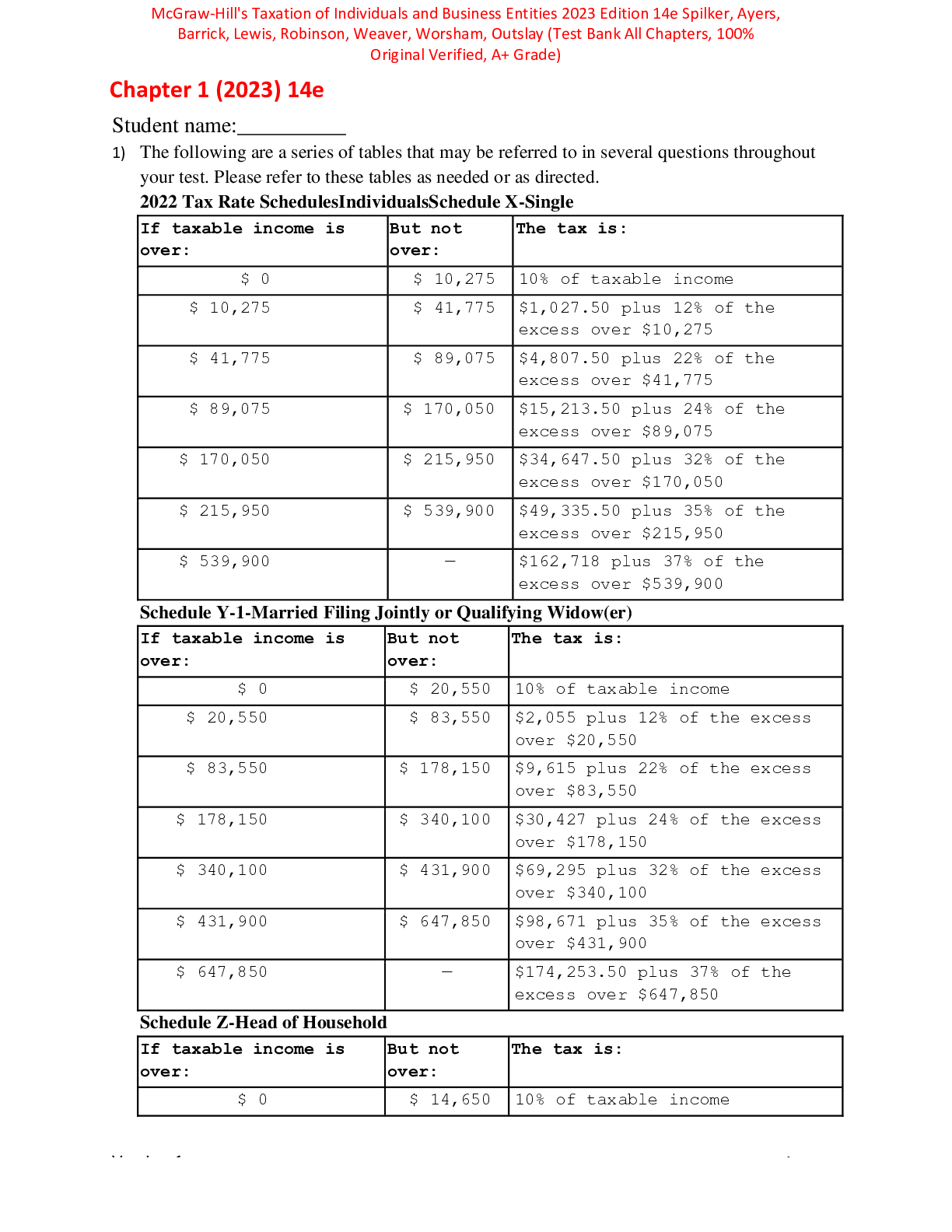

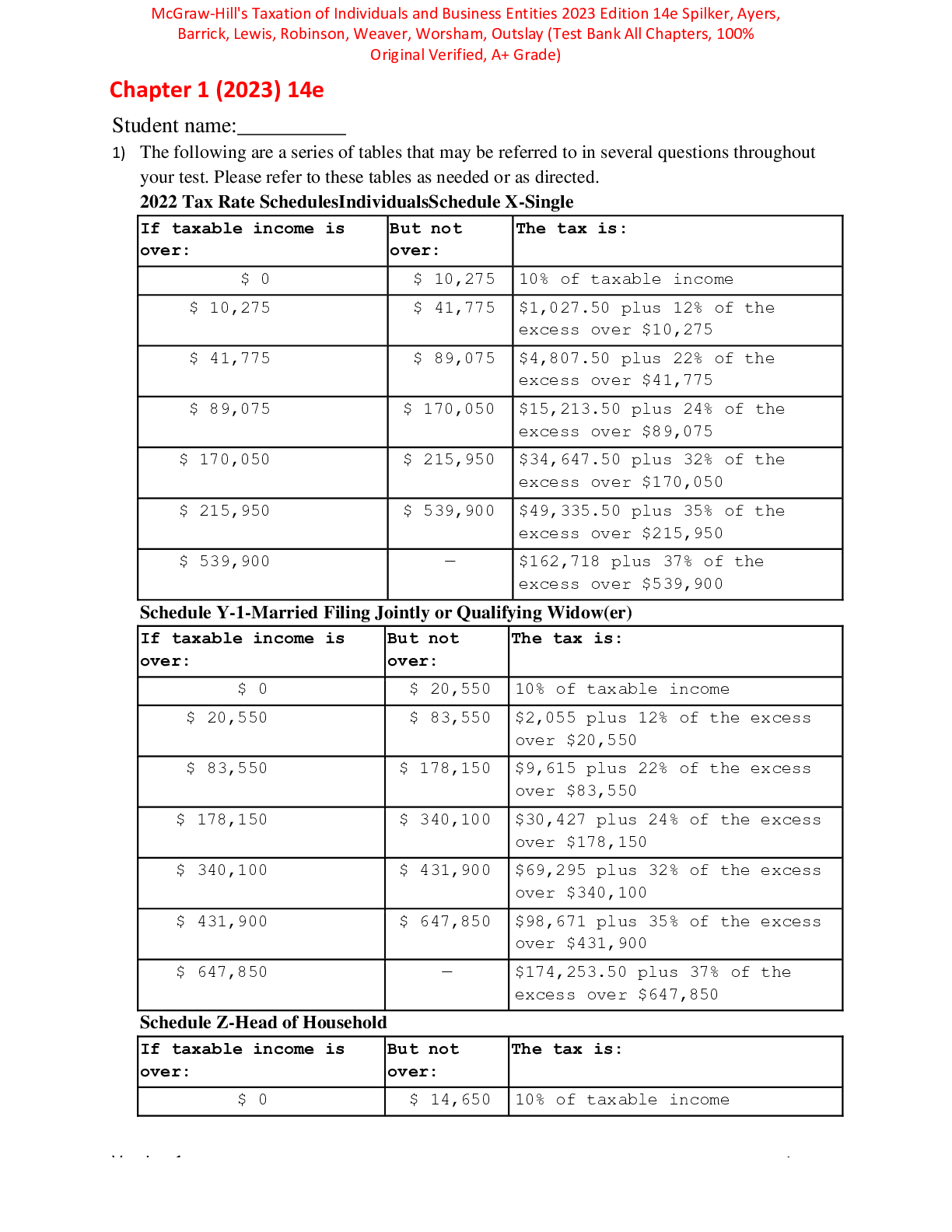

SOLUTION MANUAL FOR McGraw Hill's Taxation of Individuals and Business Entities, 2024 Edition, 15th Edition Chapter 1-25 Chapter 1 An Introduction to Tax SOLUTIONS MANUAL Discussion Questions ... (1) [LO 1] Jessica’s friend Zachary once stated that he couldn’t understand why someone would take a tax course. Why is this a rather naïve view? Taxes are a part of everyday life and have a financial effect on many of the major personal decisions that individuals face (e.g., investment decisions, evaluating alternative job offers, saving for education expenses, gift or estate planning, etc.). (2) [LO 1] What are some aspects of business that require knowledge of taxation? What are some aspects of personal finance that require knowledge of taxation? Taxes play an important role in fundamental business decisions such as the following: • What organizational form should a business use? • Where should the business locate? • How should business acquisitions be structured? • How should the business compensate employees? • What is the appropriate mix of debt and equity for the business? • Should the business rent or own its equipment and property? • How should the business distribute profits to its owners? One must consider all transaction costs (including taxes) to evaluate the merits of a transaction. Common personal financial decisions that taxes influence include: choosing Stuvia.com - The Marketplace to Buy and Sell your Study Material Downloaded by: Nursestars | joymbugua08@gmail.com Distribution of this document is illegal Want to earn $1.236 extra per year? Stuvia.com - The Marketplace to Buy and Sell your Study Material investments, retirement planning, choosing to rent or buy a home, evaluating alternative job offers, saving for education expenses, and doing gift or estate planning. (3) [LO 1] Describe some ways in which taxes affect the political process in the United States. © McGraw Hill LLC. All rights reserved. No reproduction or distribution without the prior written consent of McGraw Hill L [Show More]

Last updated: 7 months ago

Preview 5 out of 1243 pages

Loading document previews ...

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$32.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Dec 05, 2024

Number of pages

1243

Written in

Additional information

This document has been written for:

Uploaded

Dec 05, 2024

Downloads

0

Views

29